Go Green with hassle free eStatements

Enjoy the convenience of viewing and downloading up to 7 years of eStatement via Online Banking or SC Mobile app anytime, anywhere. Switch to eStatement now and save not only the planet, but your time and HKD10 per month Paper Statement fee too!

How to subscribe and view eStatements?

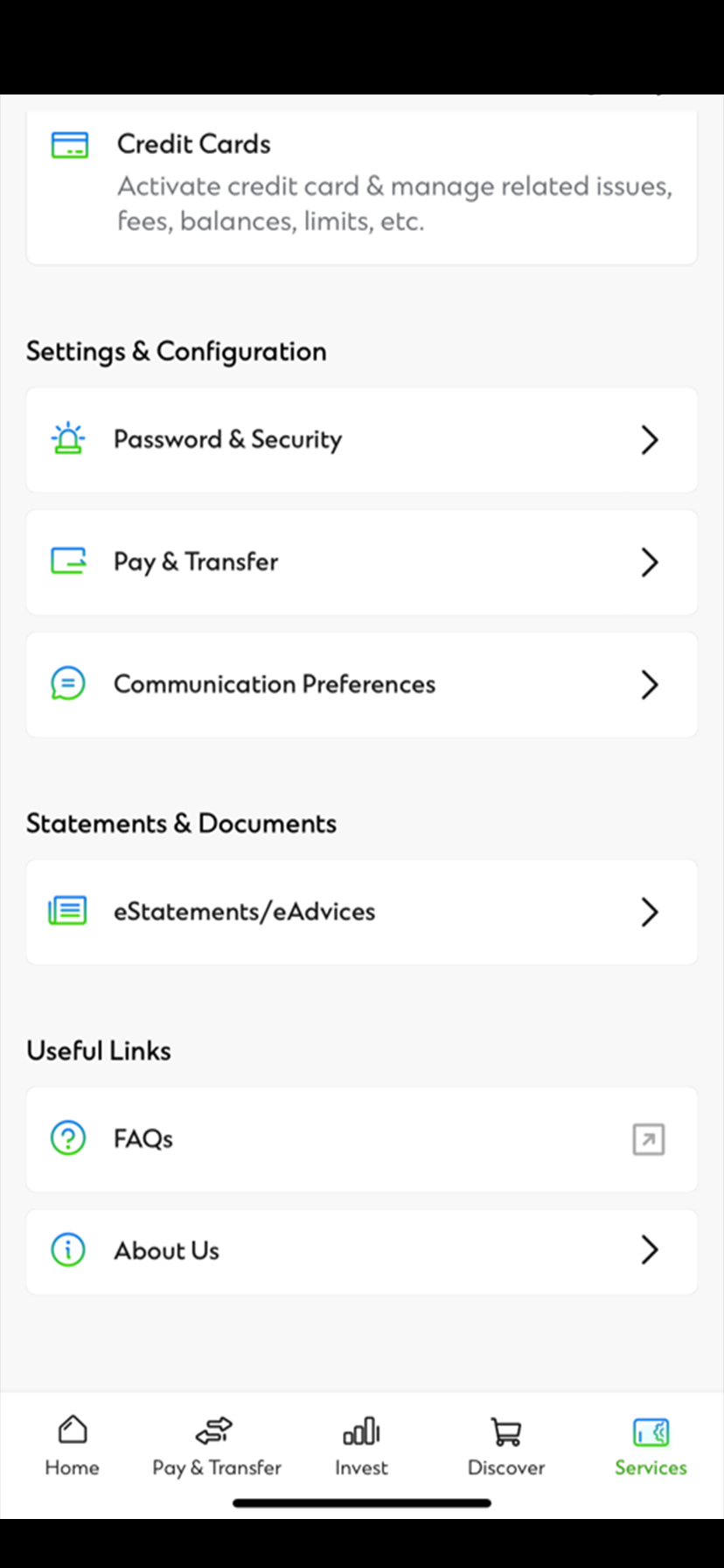

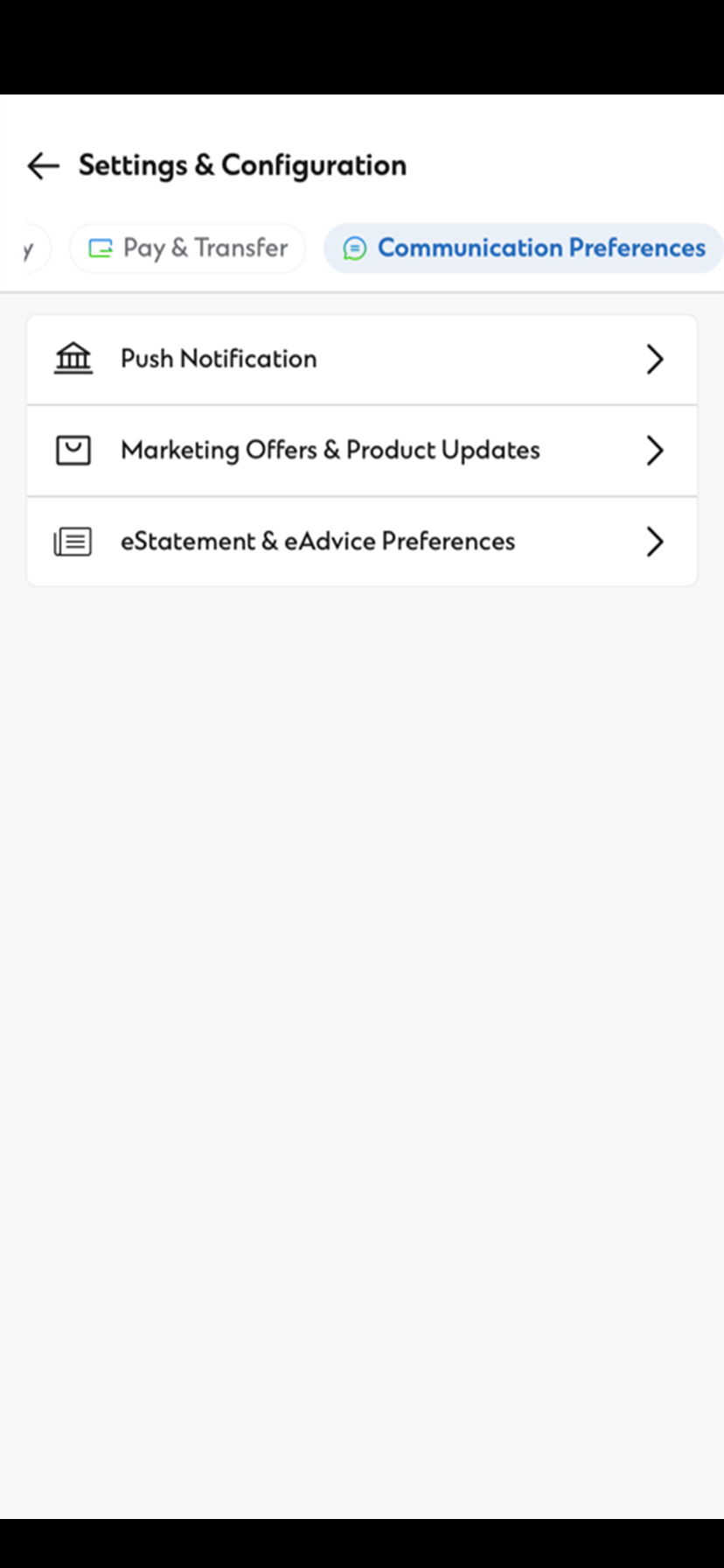

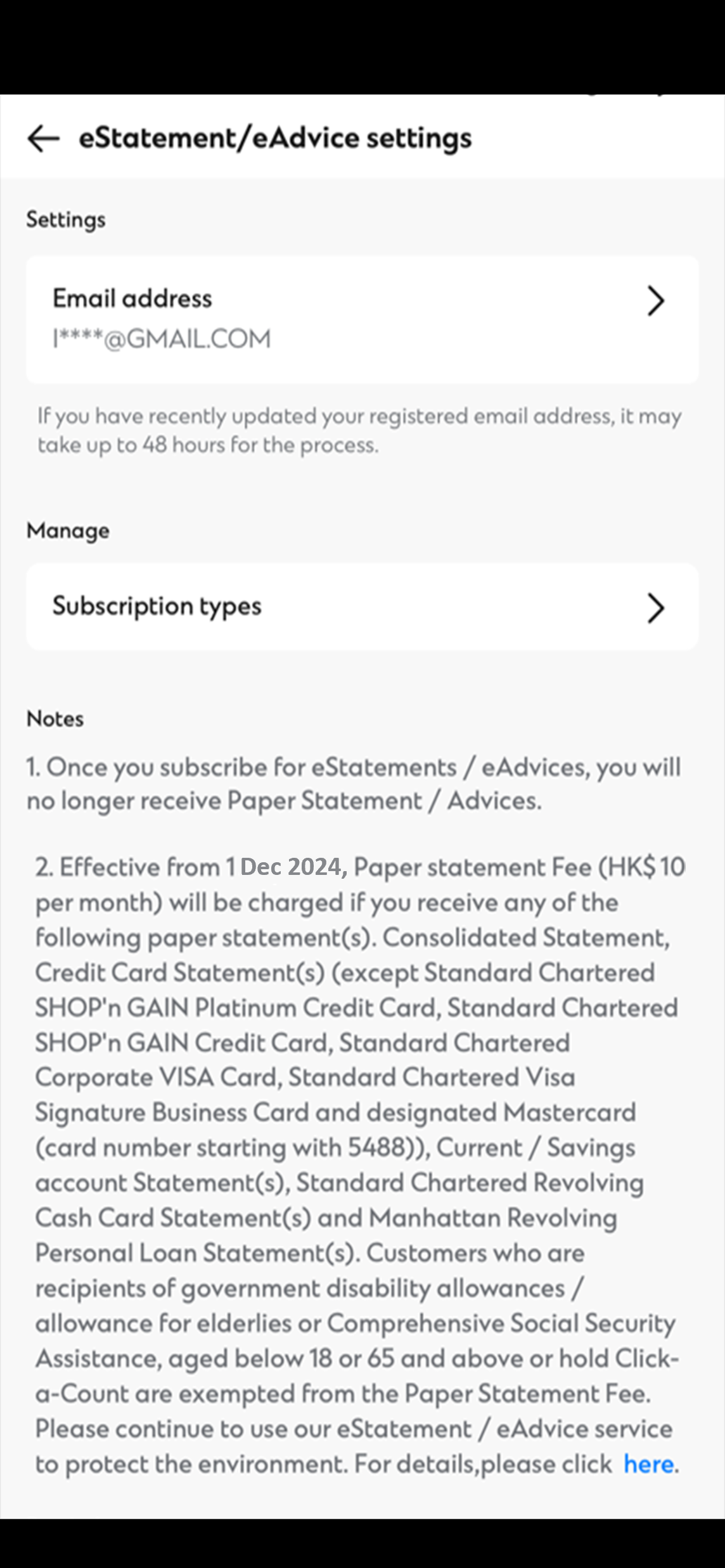

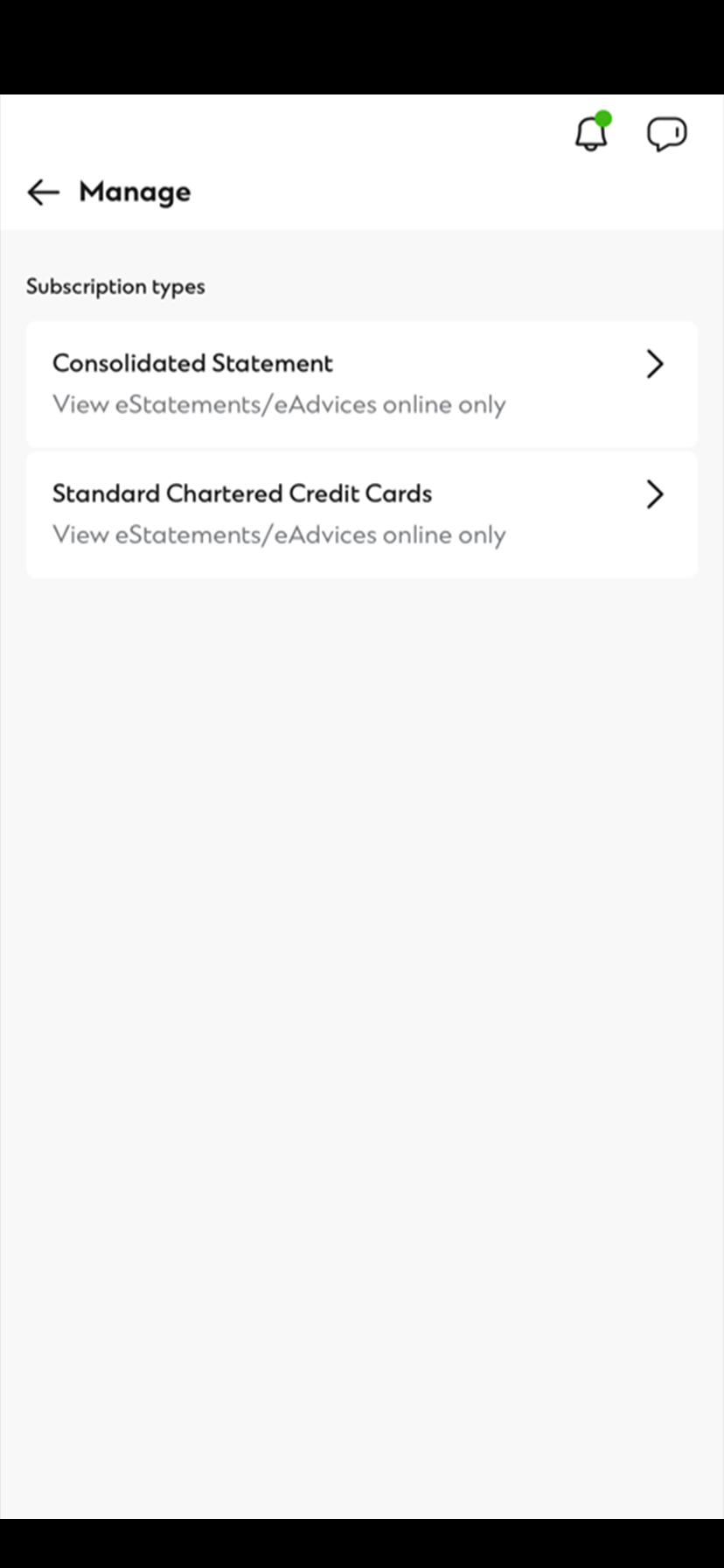

- SC Mobile App

- Online Banking

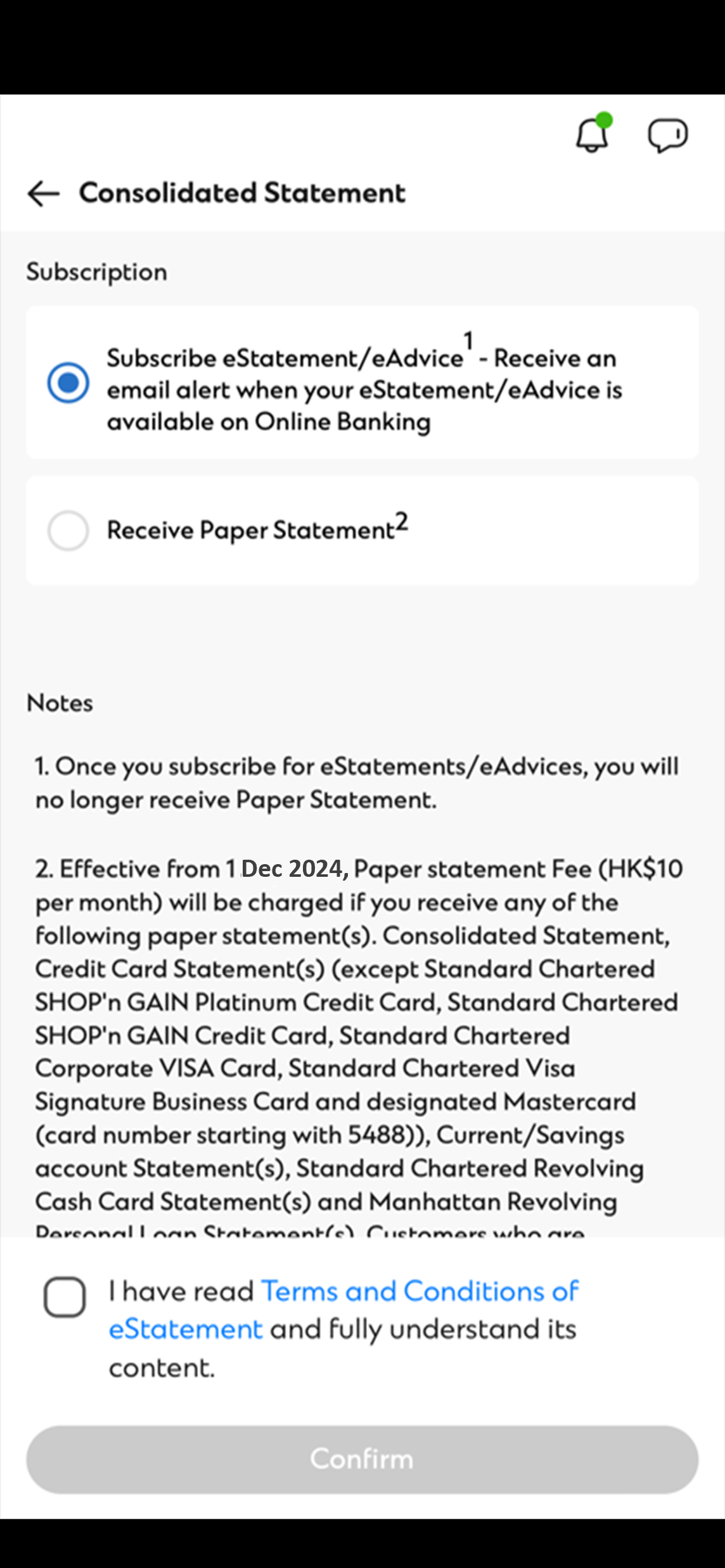

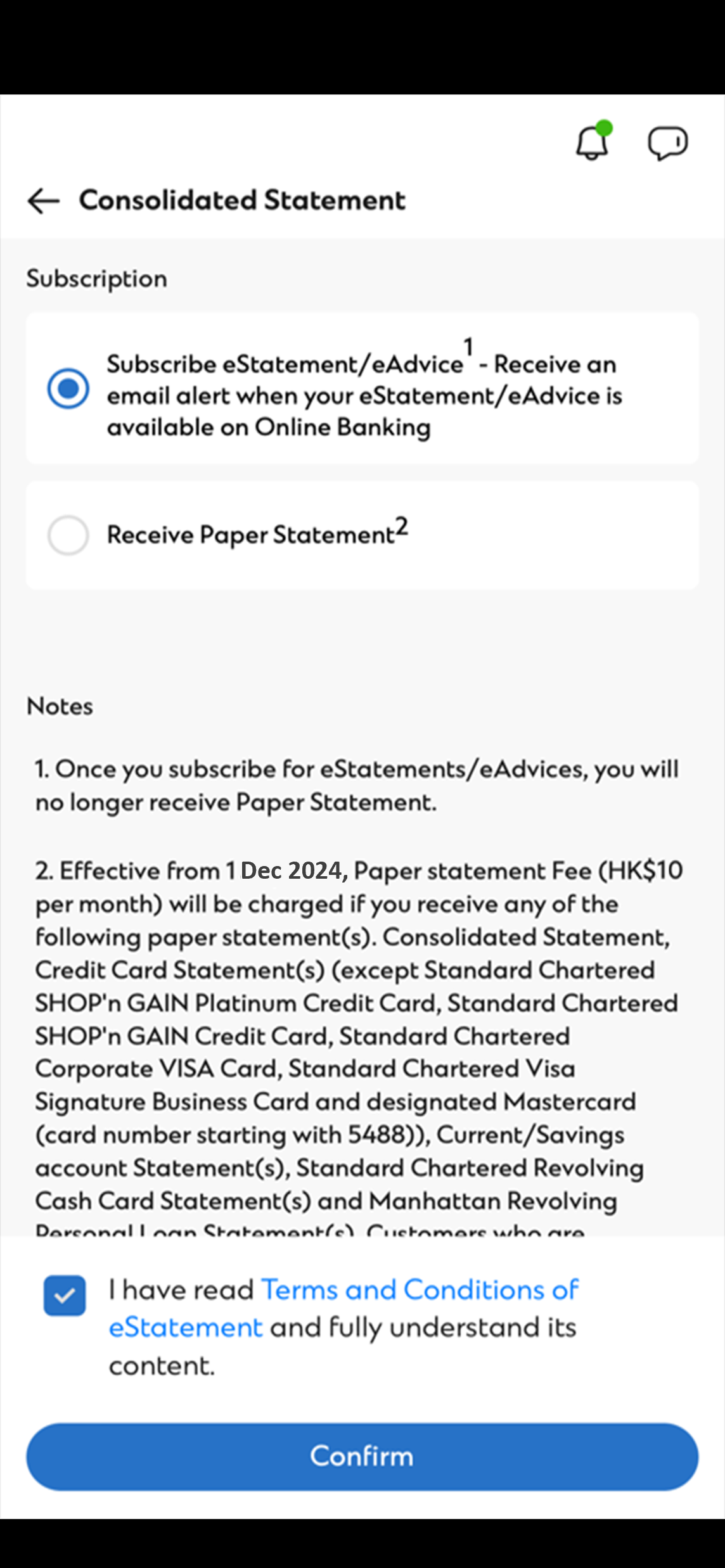

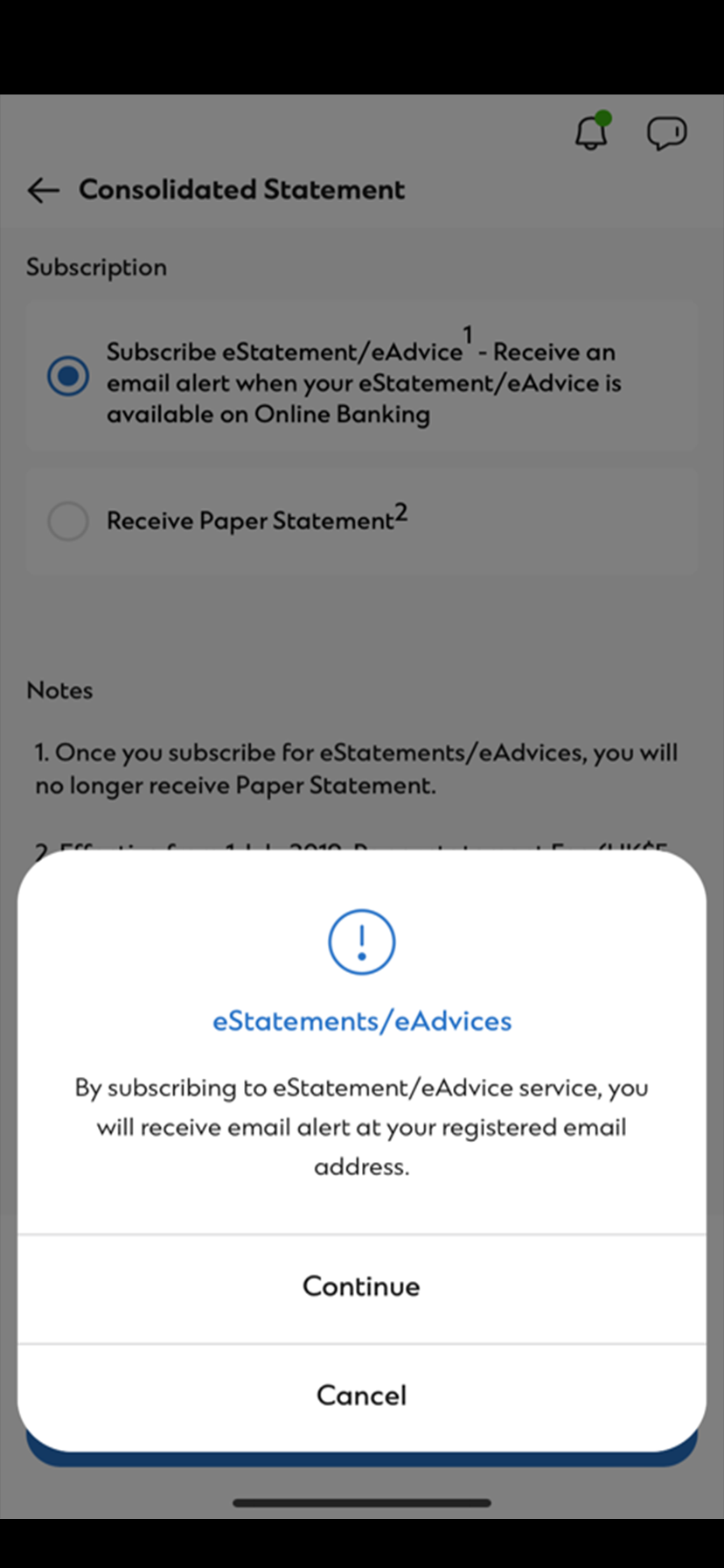

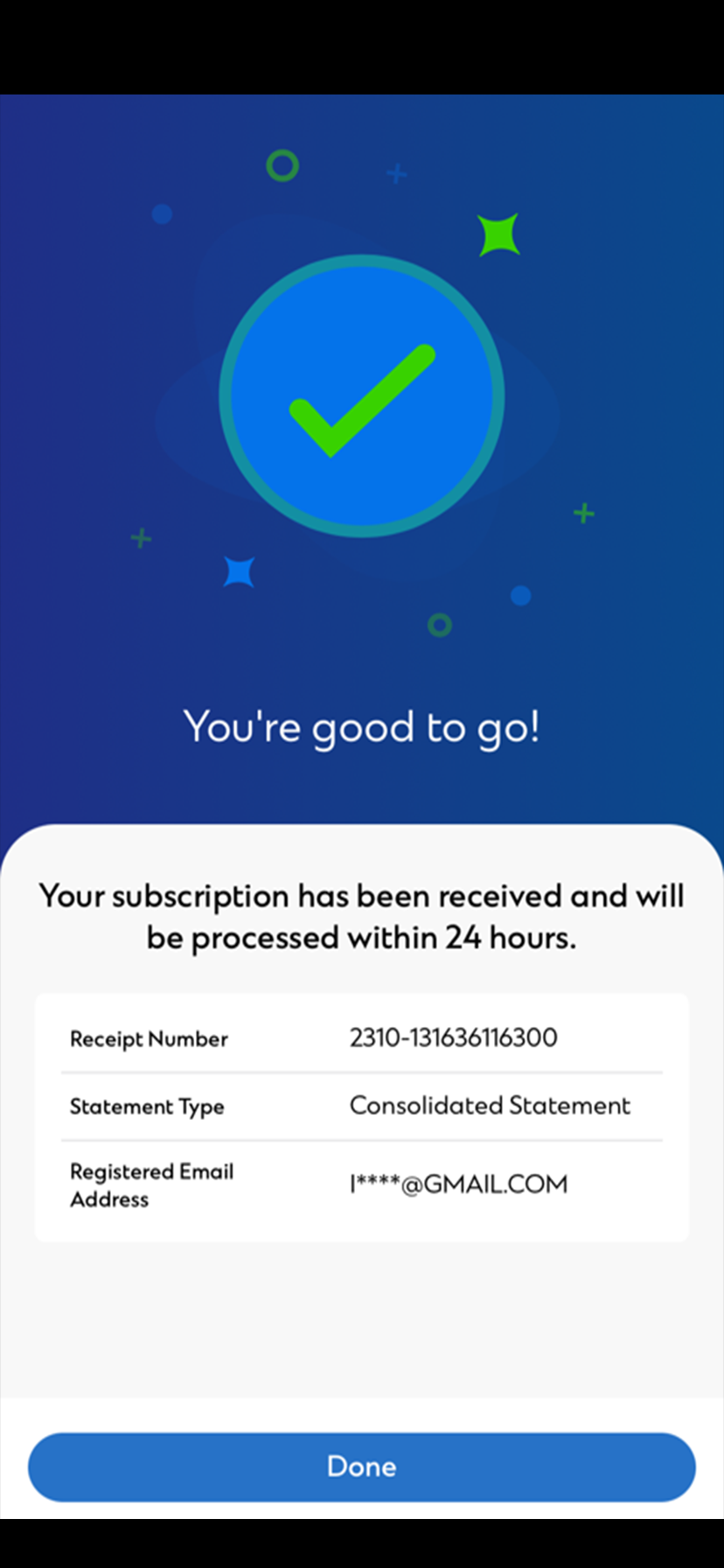

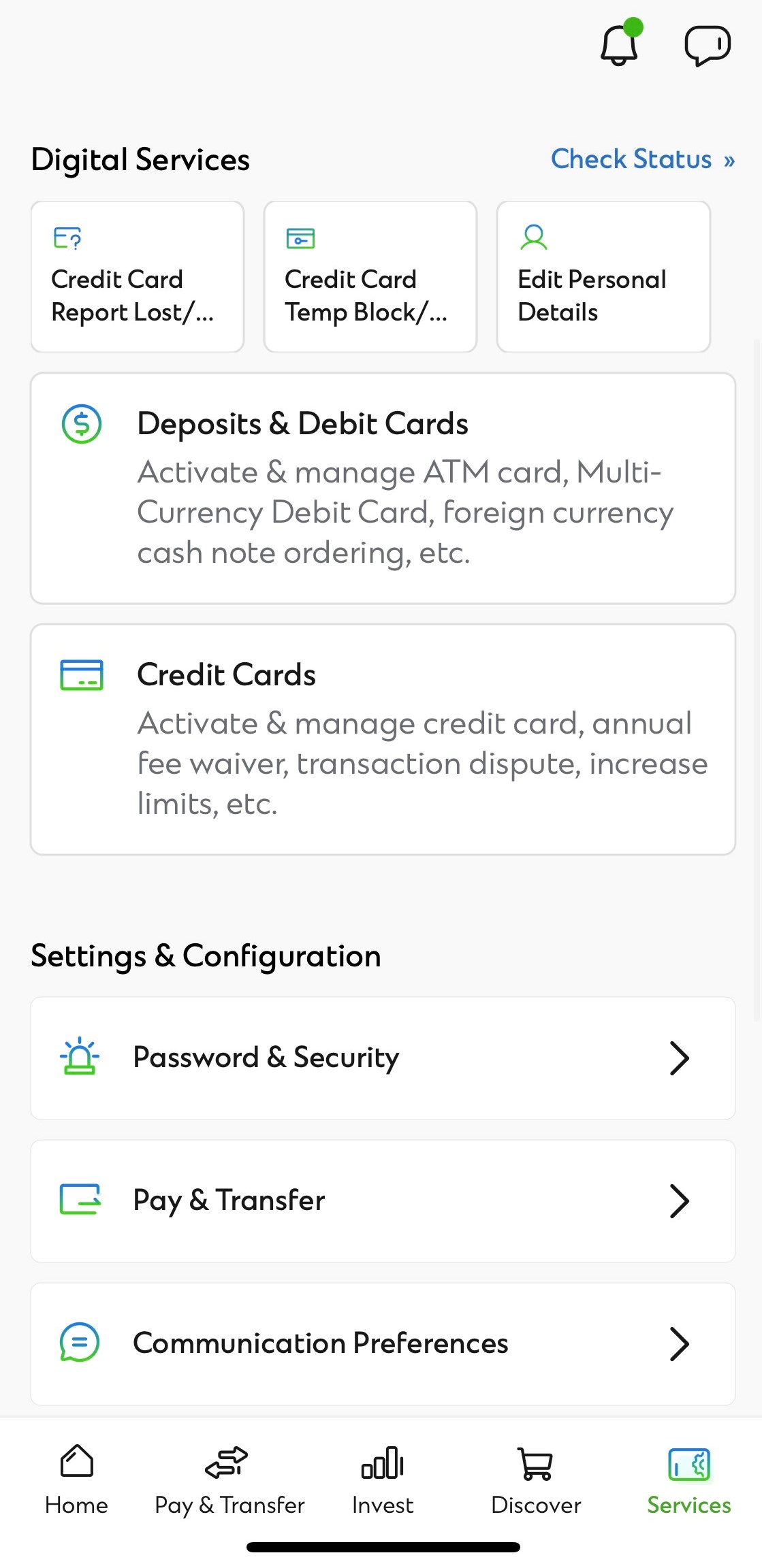

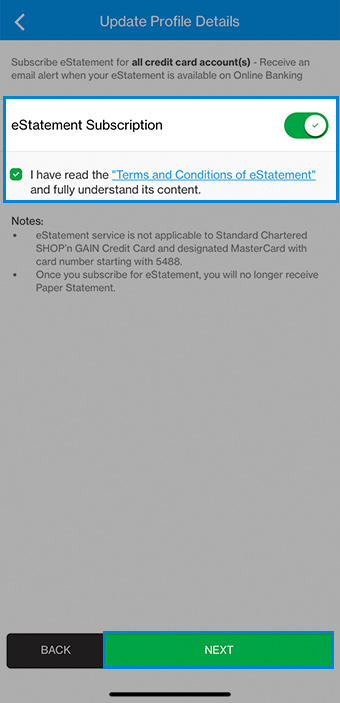

Subscribe and view eStatements on SC Mobile App

Subscribe and view eStatements on SC Mobile App

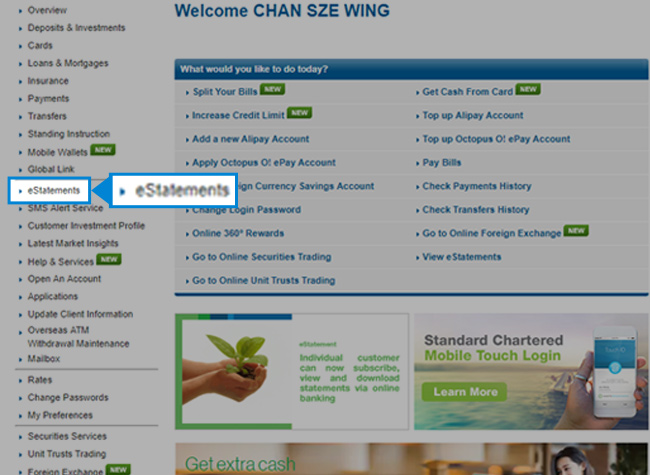

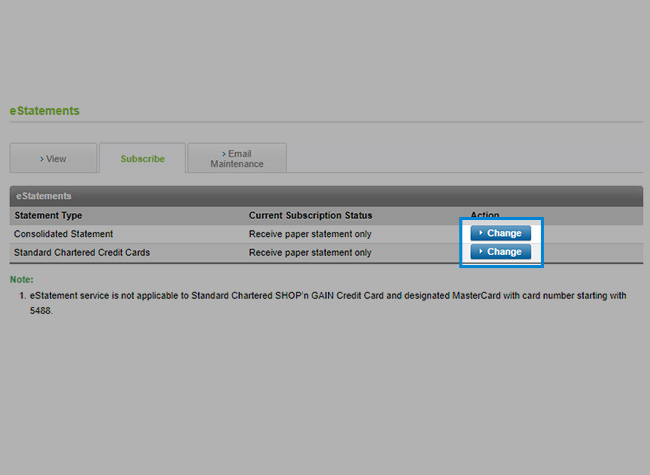

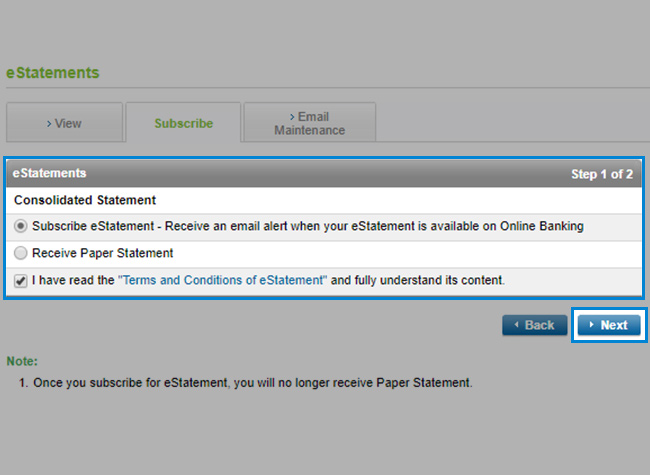

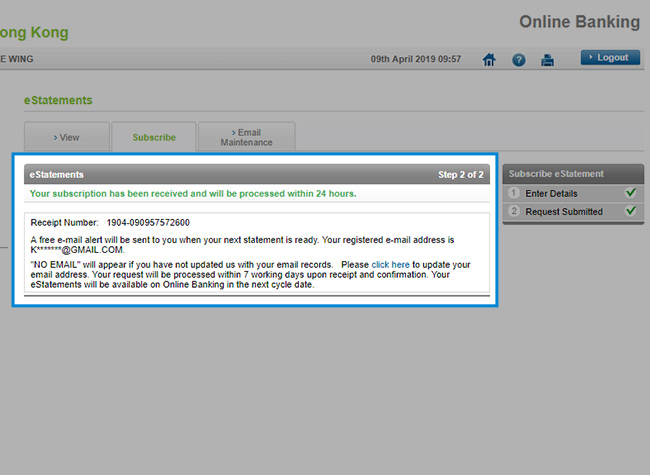

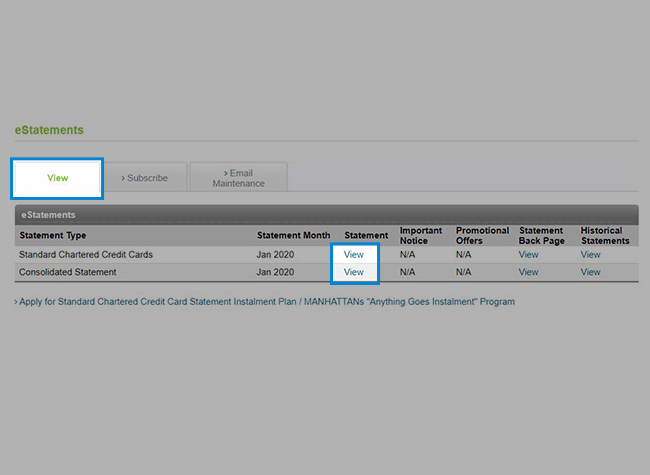

Subscribe and view eStatements on Online Banking

Subscribe and view eStatements on Online Banking

- SC Mobile App

- Online Banking

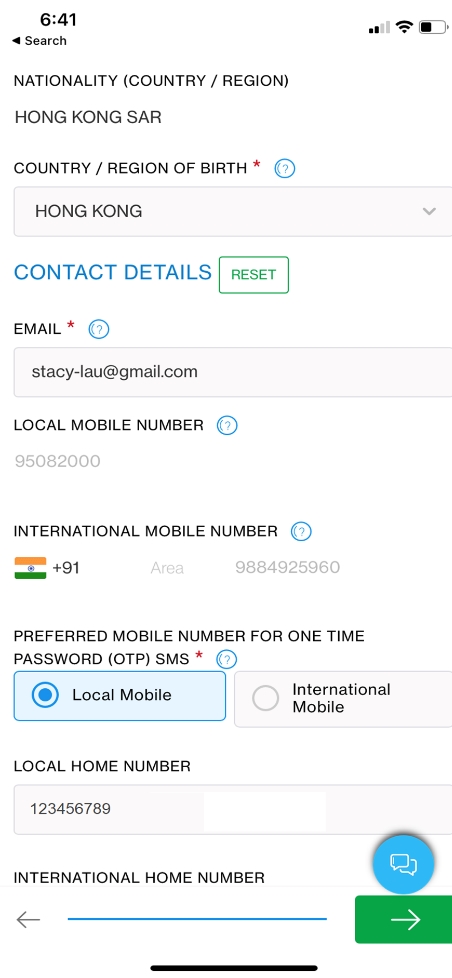

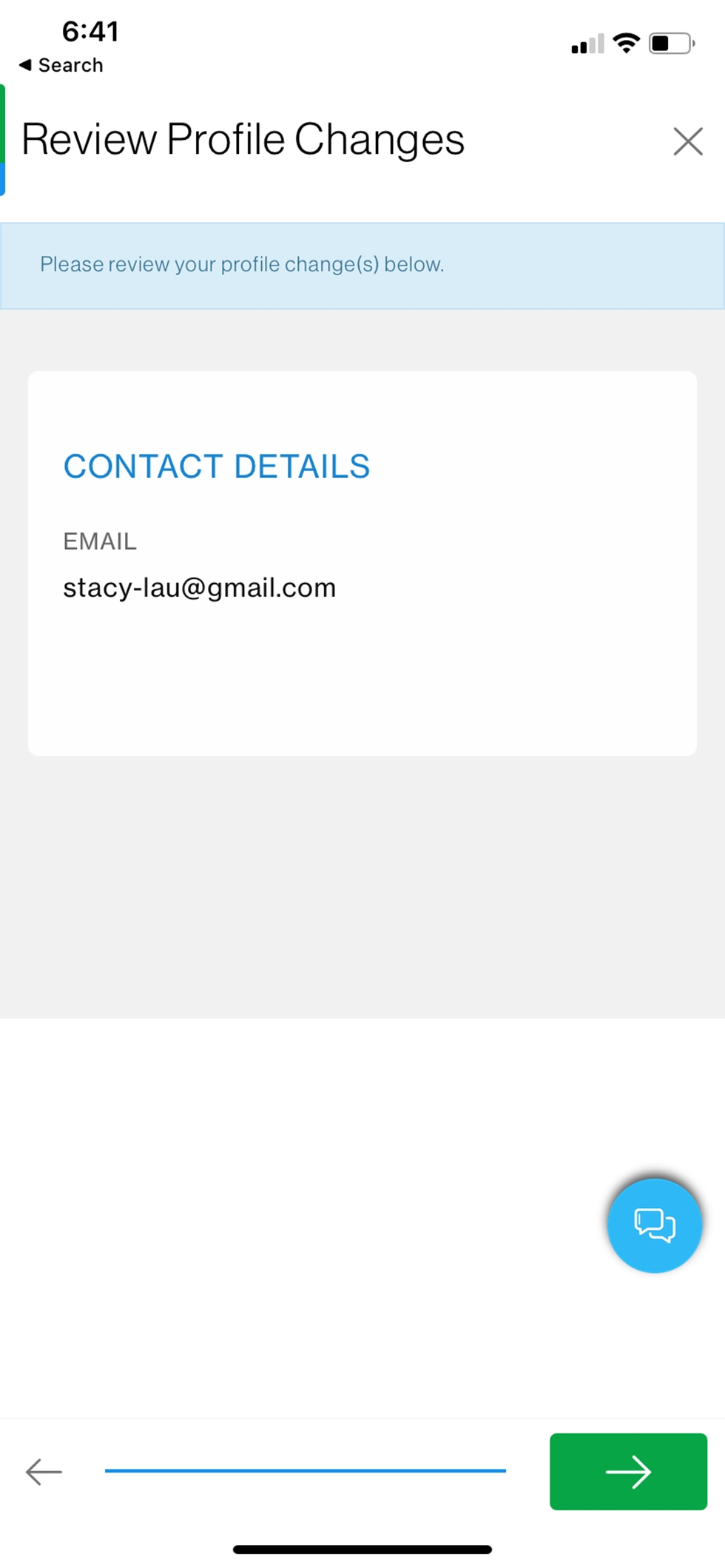

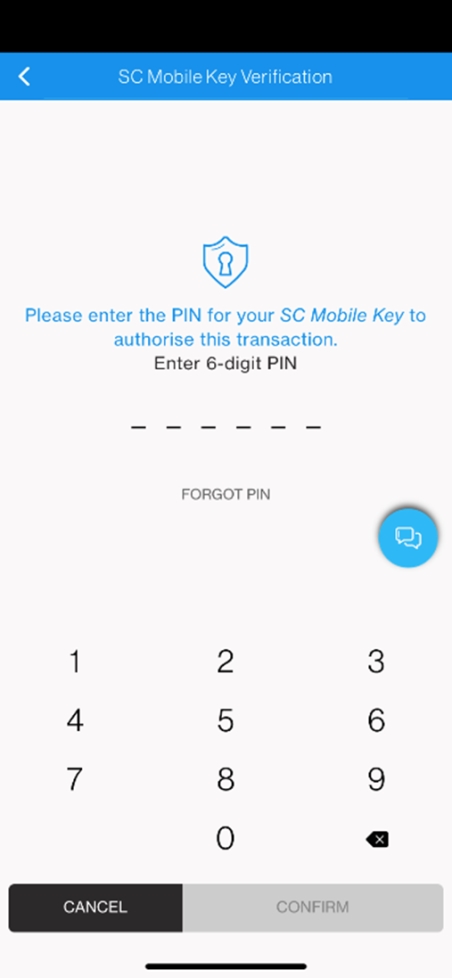

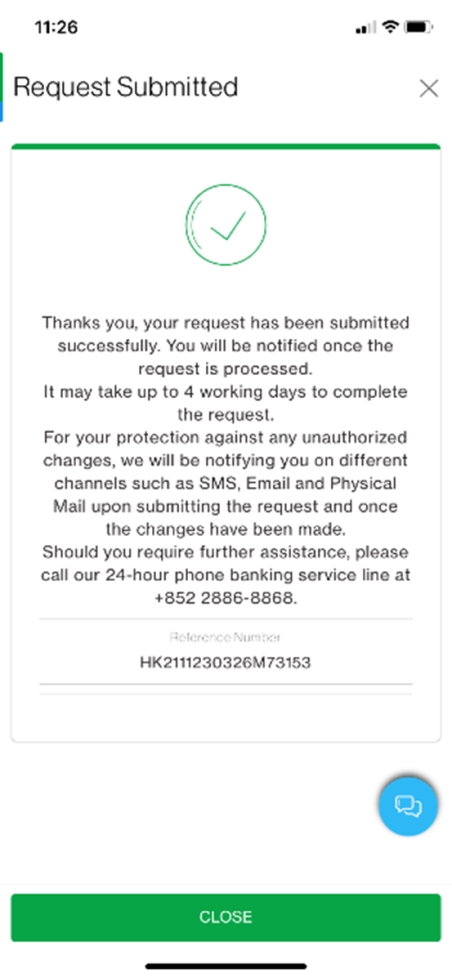

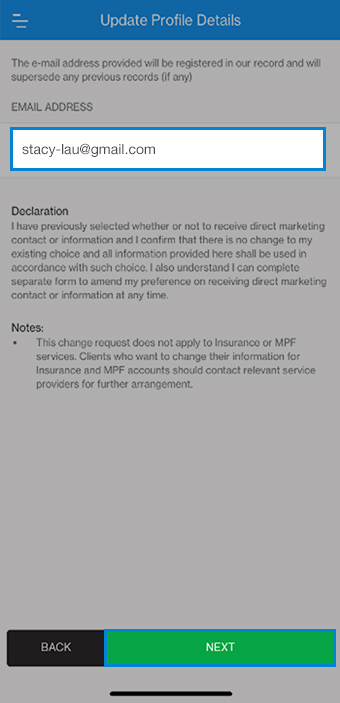

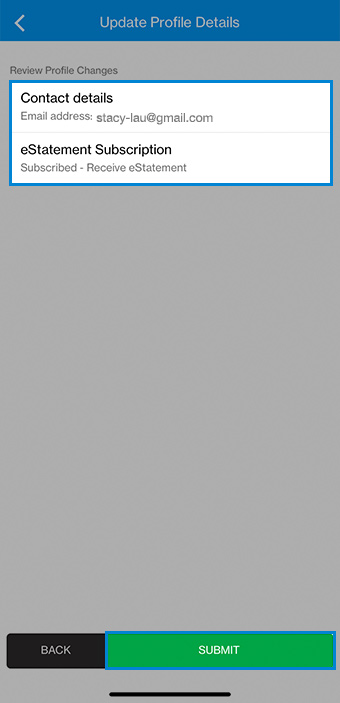

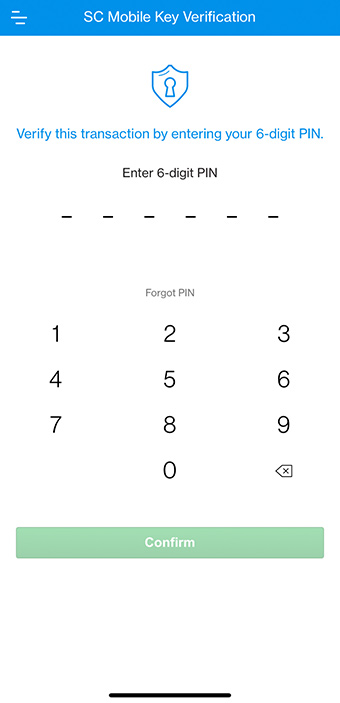

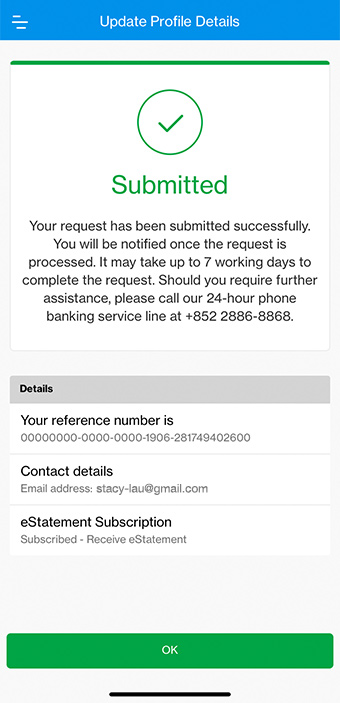

Update email address on SC Mobile App

Update email address on SC Mobile App

Note:

• You will be able to subscribe to eStatements once your update email address request is processed successfully and it normally takes less than 7 business days.

• Alternatively, you can complete a Change of Customer Information Request Form and return to any branch or mail to the bank.

Update email address on Online Banking

Update email address on Online Banking

Note:

• You will be able to subscribe to eStatements once your update email address request is processed successfully and it normally takes less than 7 business days.

• Alternatively, you can complete a Change of Customer Information Request Form and return to any branch or mail to the bank.

- SC Mobile App

- Online Banking

Update email address on SC Mobile App

Update email address on SC Mobile App

Note:

• You will be able to subscribe to eStatements once your update email address request is processed successfully and it normally takes less than 7 business days.

• Alternatively, you can complete a Change of Customer Information Request Form and return to any branch or mail to the bank.

- If you are holding both ATM card AND Credit card, please register Online Banking account with your ATM card information in order to view both your bank account and credit card eStatements.

- If you are holding Credit card with us only, you are recommended to register Online Banking account with Tele-electronic Identification Number (TIN) in order to enjoy comprehensive services. Click here to learn more about TIN.

- If you forgot your ATM PIN or don’t have ATM card number, please visit our branches to request.

- Joint account holder may be required to submit a paper form for subscribing eStatements, click here to learn more.

- Mortgage Annual Statement (paper or eStatement format) is only sent to Primary Borrower.

Paper Statement Fee and Waivers

From 1 December 2024, Paper Statement Fee (‘the Fee’) (HKD10 per month per customer) will be directly debited from the relevant account if you receive any of the following paper statement(s).

STATEMENTS THAT ARE APPLICABLE TO PAPER STATEMENT FEE |

|---|

| ‧Consolidated Statement ‧Credit Card Statement(s) (except Standard Chartered SHOP’n GAIN Platinum Credit Card, Standard Chartered SHOP’n GAIN Credit Card, Standard Chartered Corporate VISA Card, Standard Chartered Visa Signature Business Card and designated Mastercard (card number starting with 5488)) ‧Current/Savings account Statement(s) ‧Standard Chartered Revolving Cash Card Statement(s) ‧Manhattan Revolving Personal Loan Statement(s) |

THE FEE WILL BE WAIVED FOR BELOW CUSTOMERS AUTOMATICALLY |

|---|

| ‧Customers aged below 18 or aged 65 or above ‧Customers who hold Click-a-Count ‧Recipients of government disability allowances, allowance for elderlies or Comprehensive Social Security Assistance |

1. Paper Statement Fee will not apply to passbook savings account and corporate accounts.

2. Equivalent amount of HKD10 will be charged from other savings/current accounts if there is no HKD savings/current account available.

3. For joint account holder, if the primary account holder belongs to one of the exempted groups, the said account will also be exempted from paying the Paper Statement Fee. Joint account holder may be required to submit a paper form for subscribing eStatements, click here to learn more.

4. Starting from 31 Oct 2021, the paper statement fee donation arrangement to charity has been ended.

Manage your finances on the go

Experience SC Mobile App now

Scan QR code to download SC Mobile App now

for Android users without Google Play, please click here to download the Android application package (APK)

FAQs

eStatements are electronic statements made available on SC Mobile App/ Standard Chartered Online Banking. eStatement contains the same information as your paper statements.

eAdvices are electronic advices made available on SC Mobile App/ Standard Chartered Online Banking. eAdvice contains the same information as your paper advices.

eAdvice service is gradually rolling out to our users. When the eAdvice service is introduced, you will receive your advice in electronic format automatically.

No, eStatement/ eAdvice Service is offered to you free of charge!

eAdvice service is gradually rolling out to our users. When the eAdvice service is introduced, you will receive your advice in electronic format automatically.

You can do so by logging to the SC Mobile App/ Standard Chartered Online Banking.

eStatement Service is available to Consolidated Statements, Integrated Deposits/ Savings / Current Account Statements, Mortgage Annual Statement, Credit Card Statements, Manhattan Revolving Personal Loan Statements and Manhattan id Platinum Card. Except Shop’n Gain Credit Card and designated MasterCard (card number starting with 5488).

eAdvice service is gradually rolling out to our users. When the eAdvice service is introduced, you will receive your advice in electronic format automatically.

Email Alert is a service that will notify you by email when your eStatement/ eAdvice is ready on SC Mobile App/ Standard Chartered Online Banking. It is at your option to receive an Email Alert.

There could be many reasons which prevent you from receiving your Email Alerts at your email mailbox. You are advised to check:

* whether your email mailbox has exceeded the storage limit

* whether your email settings have caused any email sent by us to be filtered as spam/ junk mail

* whether the email address which you have registered with us is up-to-date

If in doubt, please call our Customer Service Hotline below.

* Priority Banking (852)2886-8866

* Premium Banking (852)2886-8877

* Other customers (852)2886-8888

Yes, you can save a copy of the eStatement/ eAdvice to your computer so that you can easily retrieve it in the future. To save a copy of your eStatement/ eAdvice, you can click “File” then “Save As” from your Acrobat menu and specify the location where you want the document to be saved on your computer. Since the eStatements/ eAdvices contain sensitive account and personal information, you are advised to keep any such copy in a location secured from third party access.

You can cancel your eStatement/ eAdvice Service at any time by logging into SC Mobile App/ Standard Chartered Online Banking or completing the eStatement/eAdvice Subscription/Maintenance Form. Upon receipt and confirmation of your cancellation of eStatement/ eAdvice Service, we will resume the delivery of paper statements/ advices. You will be charged with Paper Statement Fee (HK$10 per month) which will be debited in relevant account monthly starting from January 2024.

Should you require any assistance, you can contact our Customer Service Hotline below.

* Priority Banking (852)2886-8866

* Premium Banking (852)2886-8877

* Other customers (852)2886-8888

Starting from Jan 2020, if you have registered eStatement service on or before Jan 2019, you could view the eStatement from Jan 2019 to the latest in SC Mobile App/ Online Banking and the eStatements will be accumulated up to 7 years i.e 2026.

Starting from Jan 2020, if you have registered eStatement service after Jan 2019, you could view the eStatement from the month you registered til the latest in SC Mobile App/ Online Banking and the eStatement(s) will be accumulated up to 7 years i.e 2026.

For newly introduced eStatement type (i.e. Mortgage Annual Statement), eStatement will be accumulated up to 7 years starting from the time they are launched in eStatement format.

Please click here for information about Paper Statement Fee FAQ

1. How to subscribe eStatements for joint account?

All both-to-sign joint account holder are required to complete and sign on one eStatements subscription paper form and return to any branch or mail to the bank.

For either-to-sign joint account, either one of the joint account holder can subscribe to eStatements online.

2. How to subscribe consolidated eStatements for joint name mortgage account?

All borrowers are required to complete and sign on one eStatements subscription paper form and return to any branch or mail to the bank.

Only the primary borrower would be able to view the Mortgage Annual eStatement via Online Banking / SC mobile app. Note that all correspondences related to your mortgage, no matter in paper form or electronic format, is addressed to the Primary Borrower only.