Transfer from your bank account or credit card

From paying your friends to settling daily expenses, you can now send money easily via Local Account Fund Transfer with Standard Chartered Digital Banking.

Features

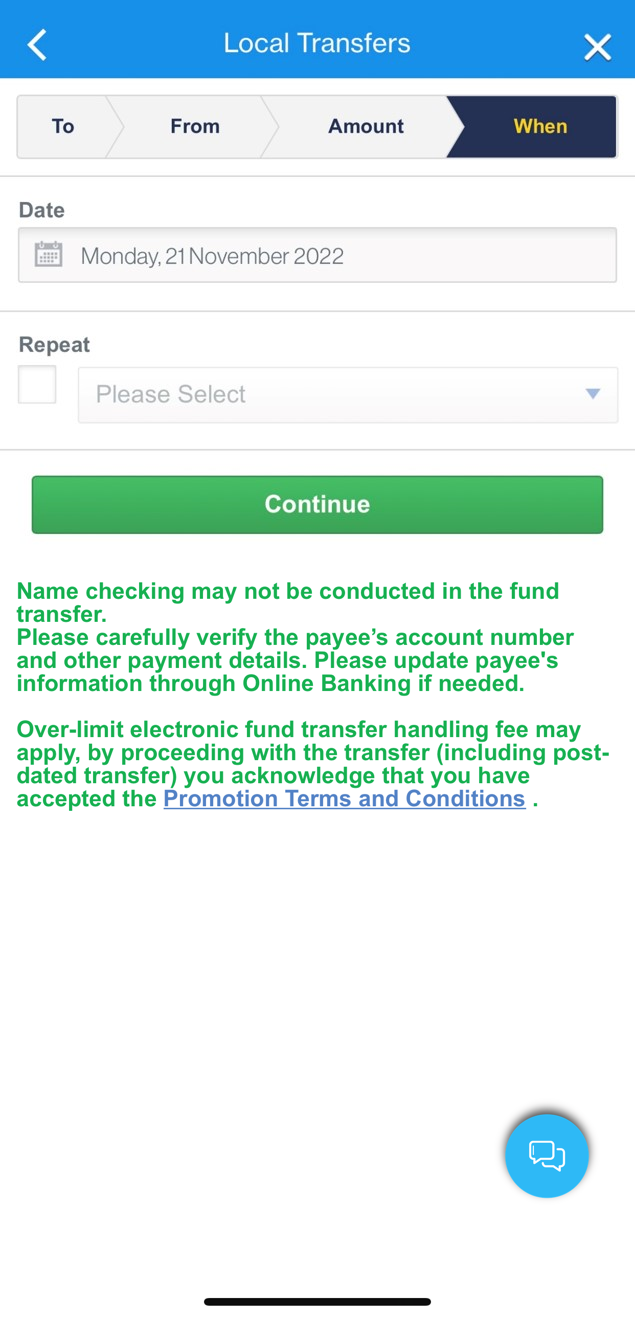

Make regular transfers in the future

Pay your monthly expenses on time by setting a transfer date and scheduling recurring transactions

Transfer with Credit Card

Enjoy no handling fee for the first HKD60,000 in every calendar month to improve your financial flexibility

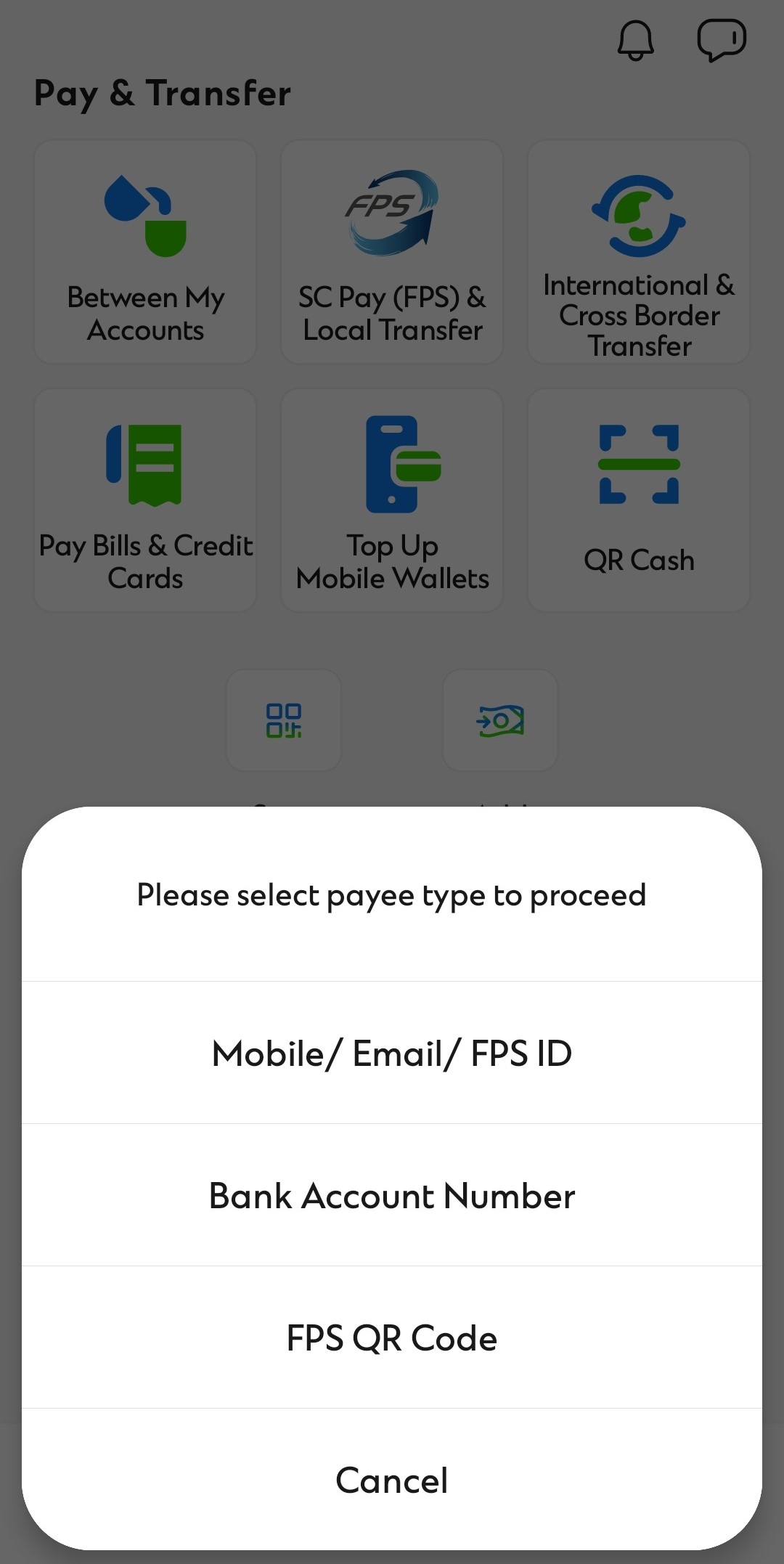

Transfer with SC Pay (FPS)

Send money also using mobile number, email address or FPS ID if the payee has registered for FPS

How to make Local Account Fund Transfer

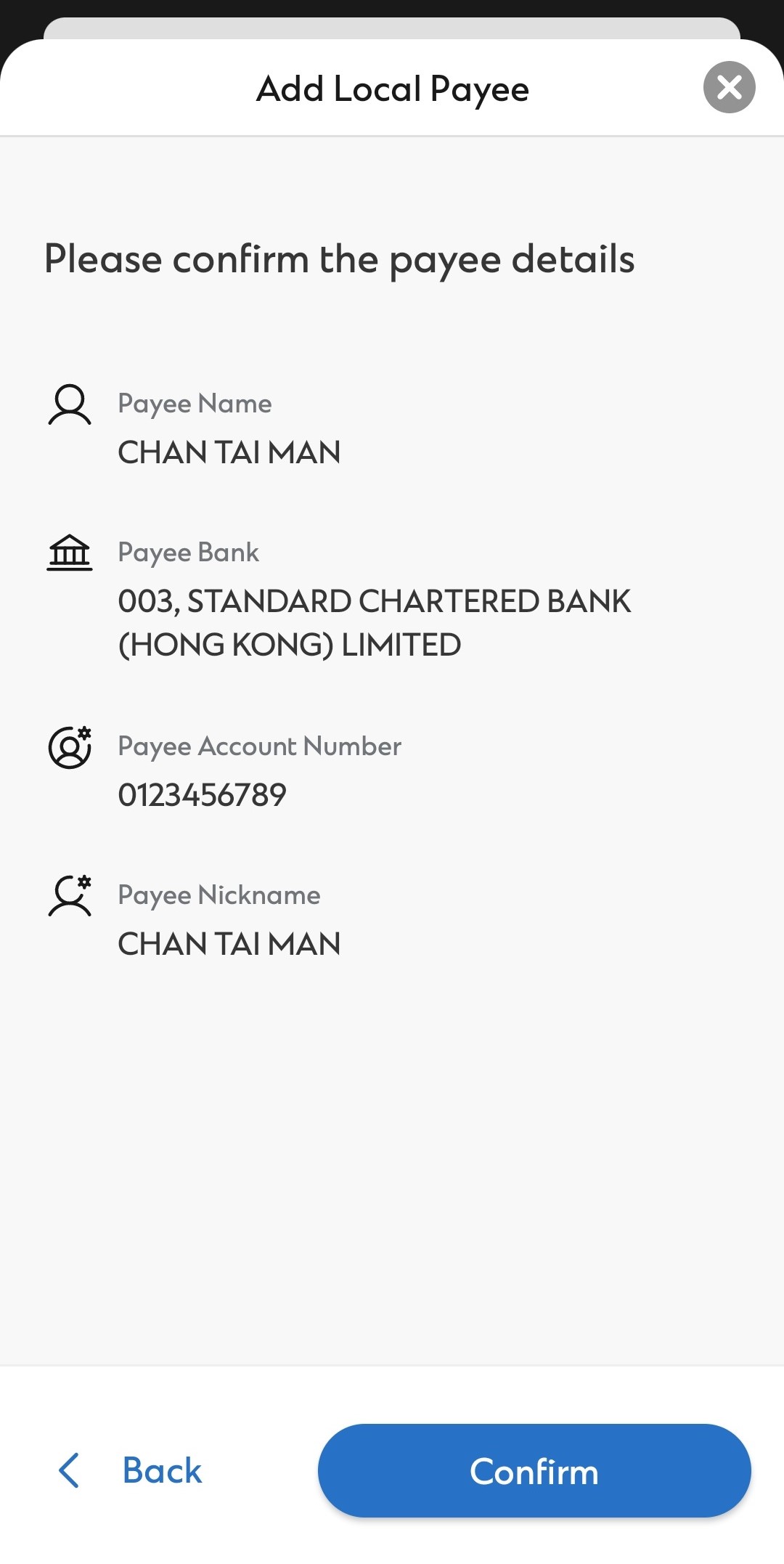

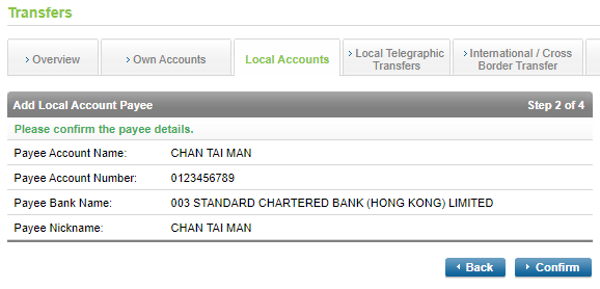

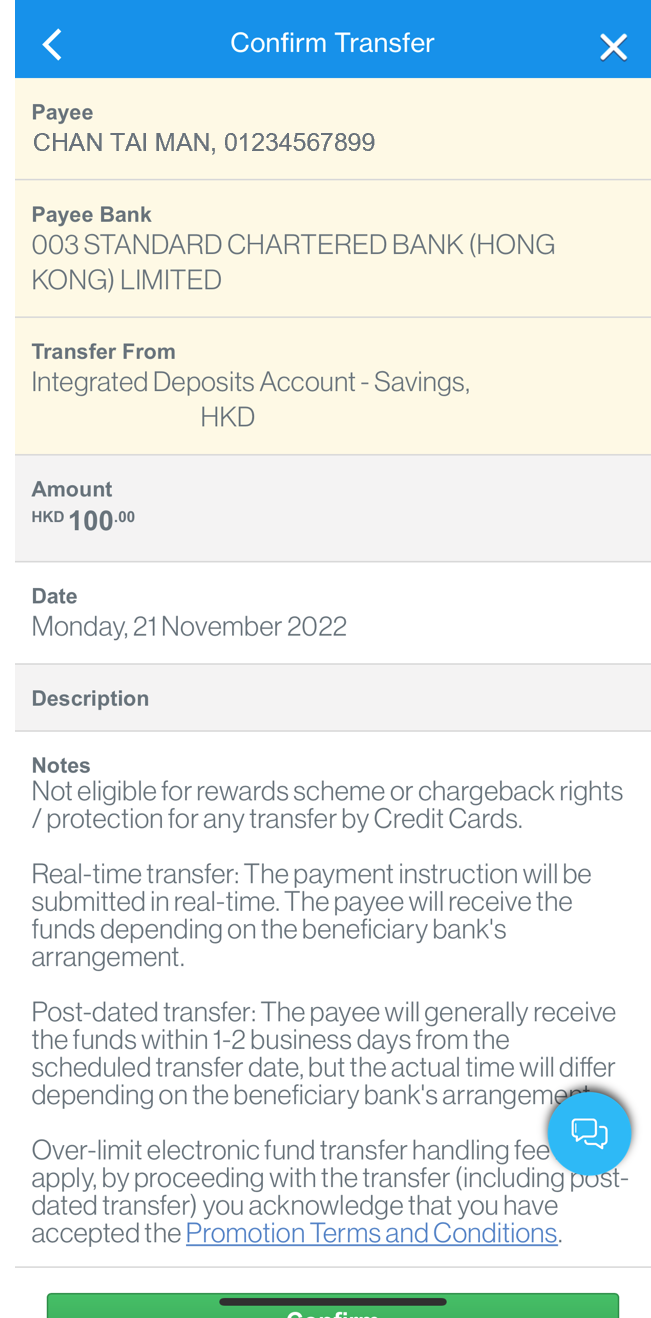

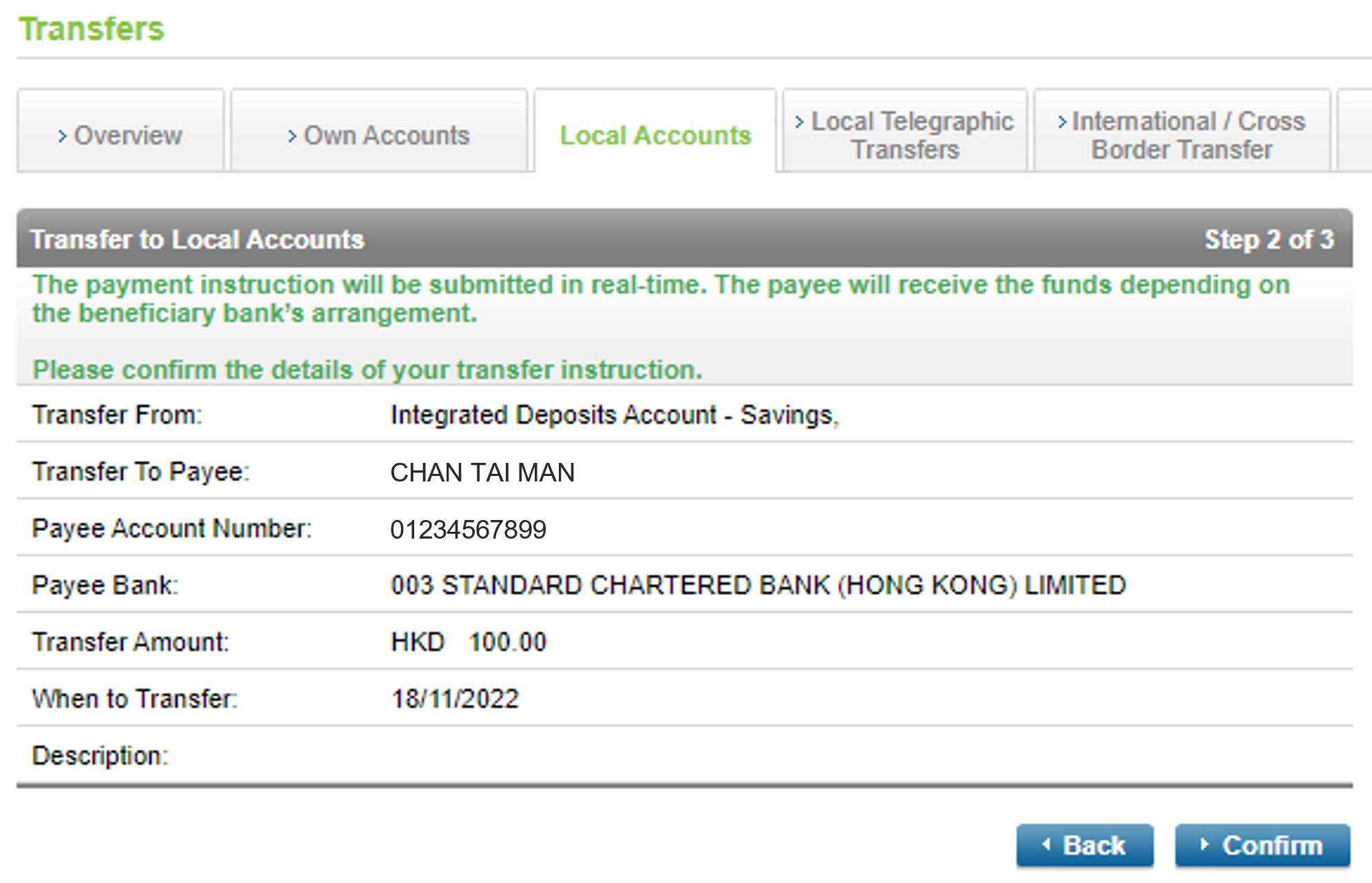

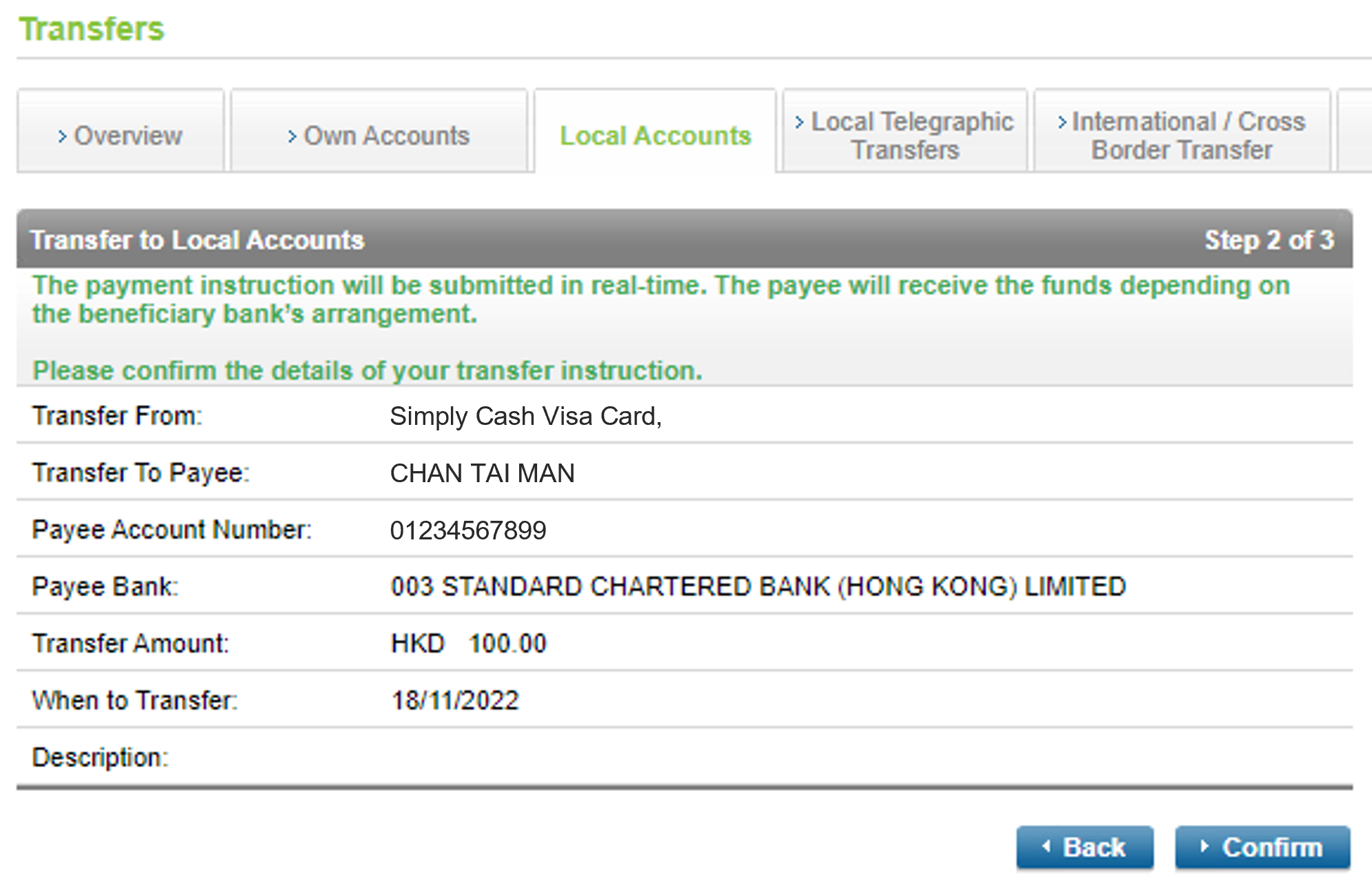

Remember to check your payment details (ie. Payee’s account number and name) before submitting a transaction.

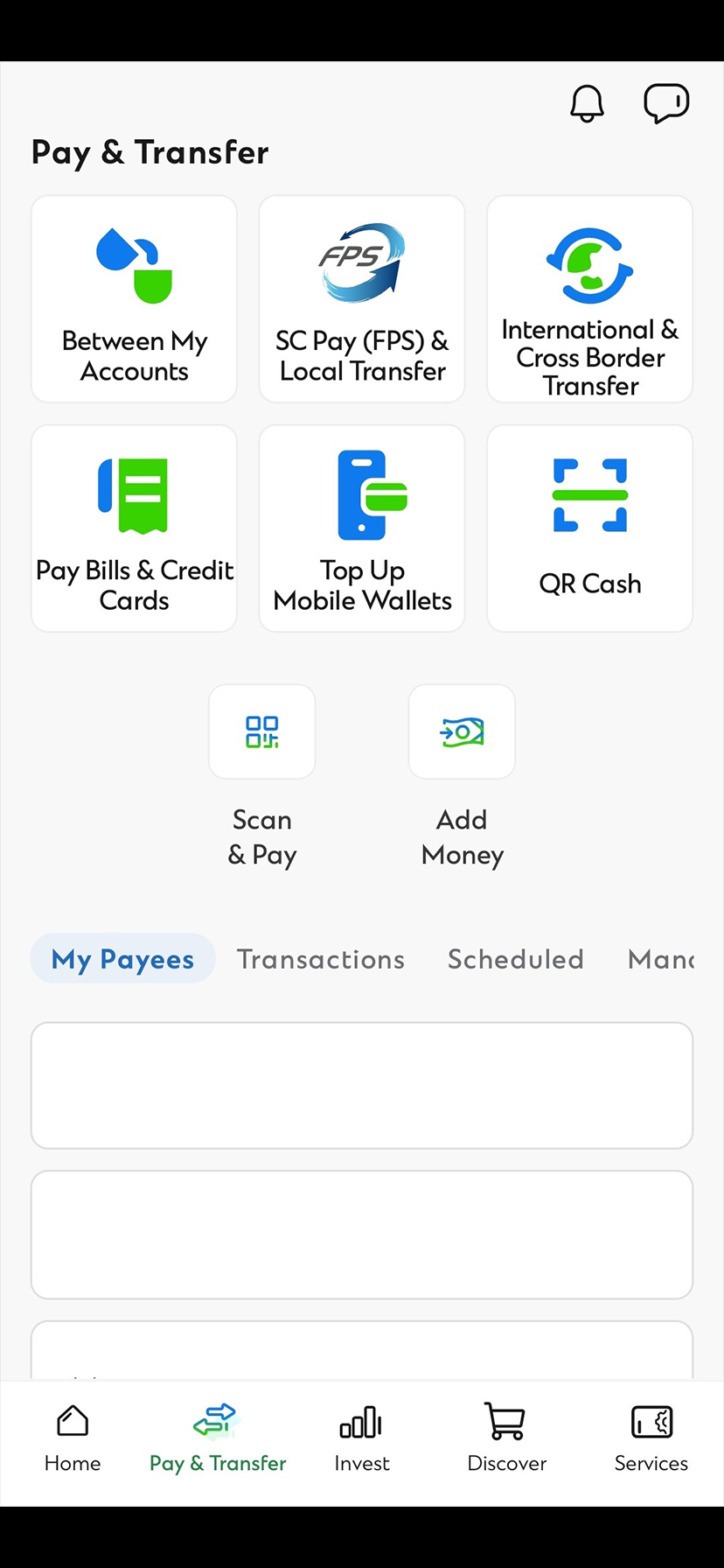

- SC Mobile App

- Online Banking

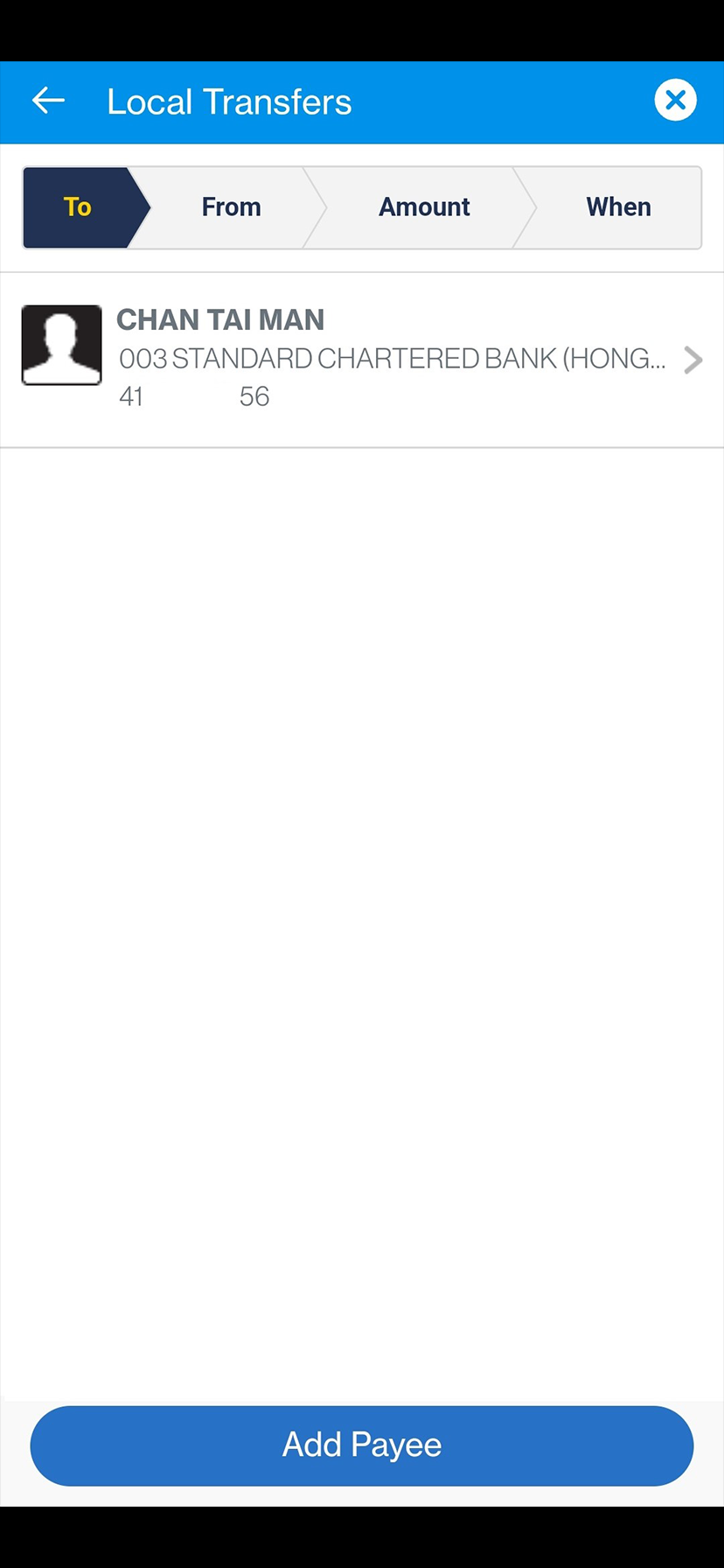

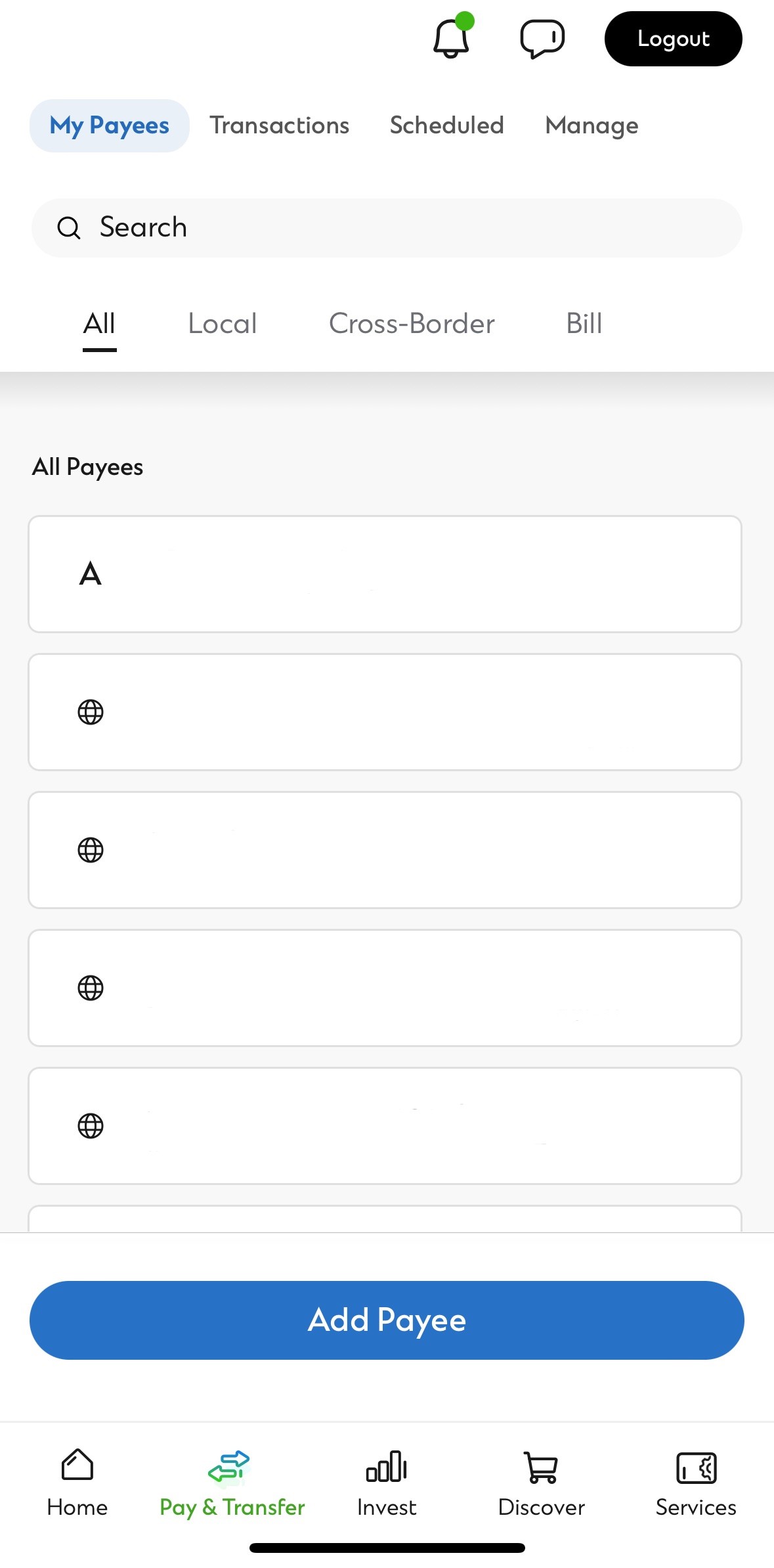

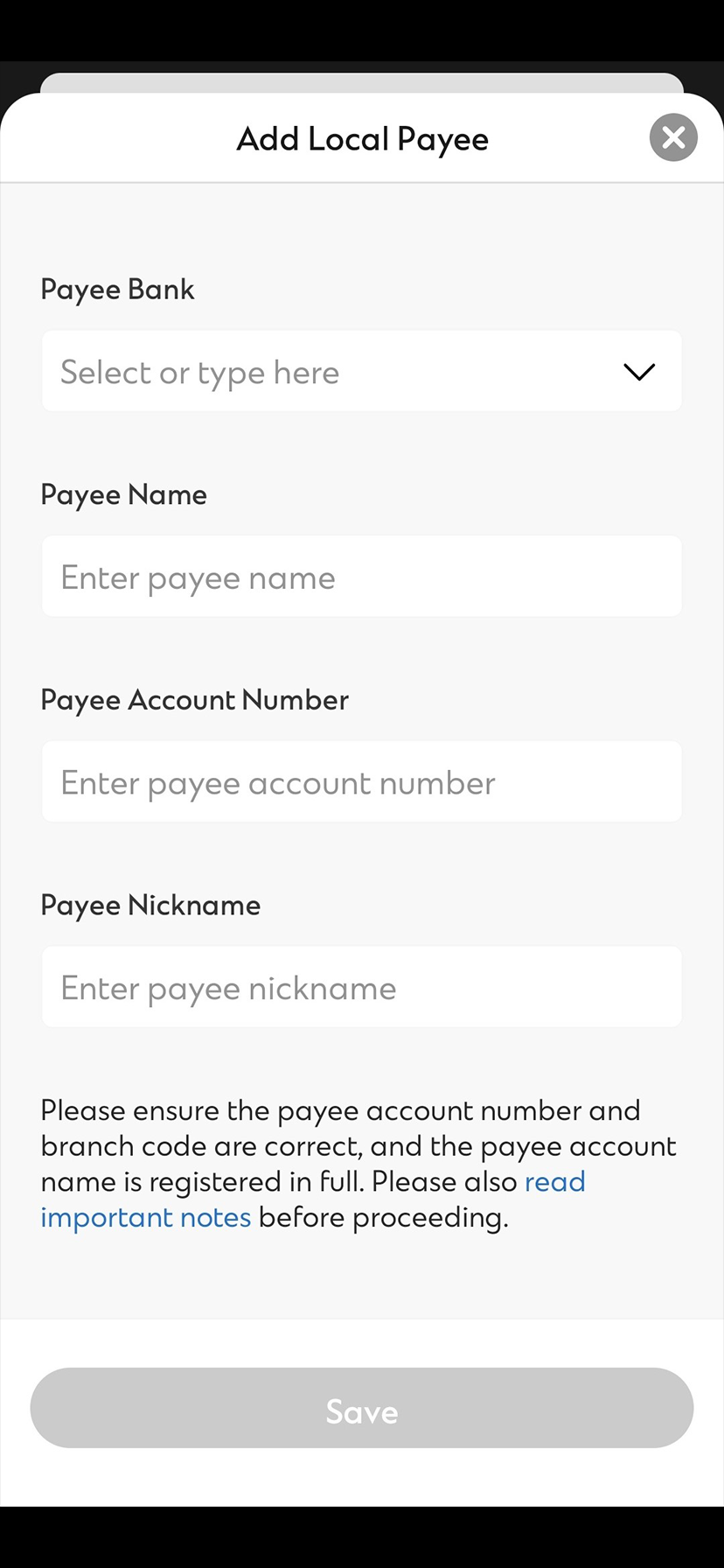

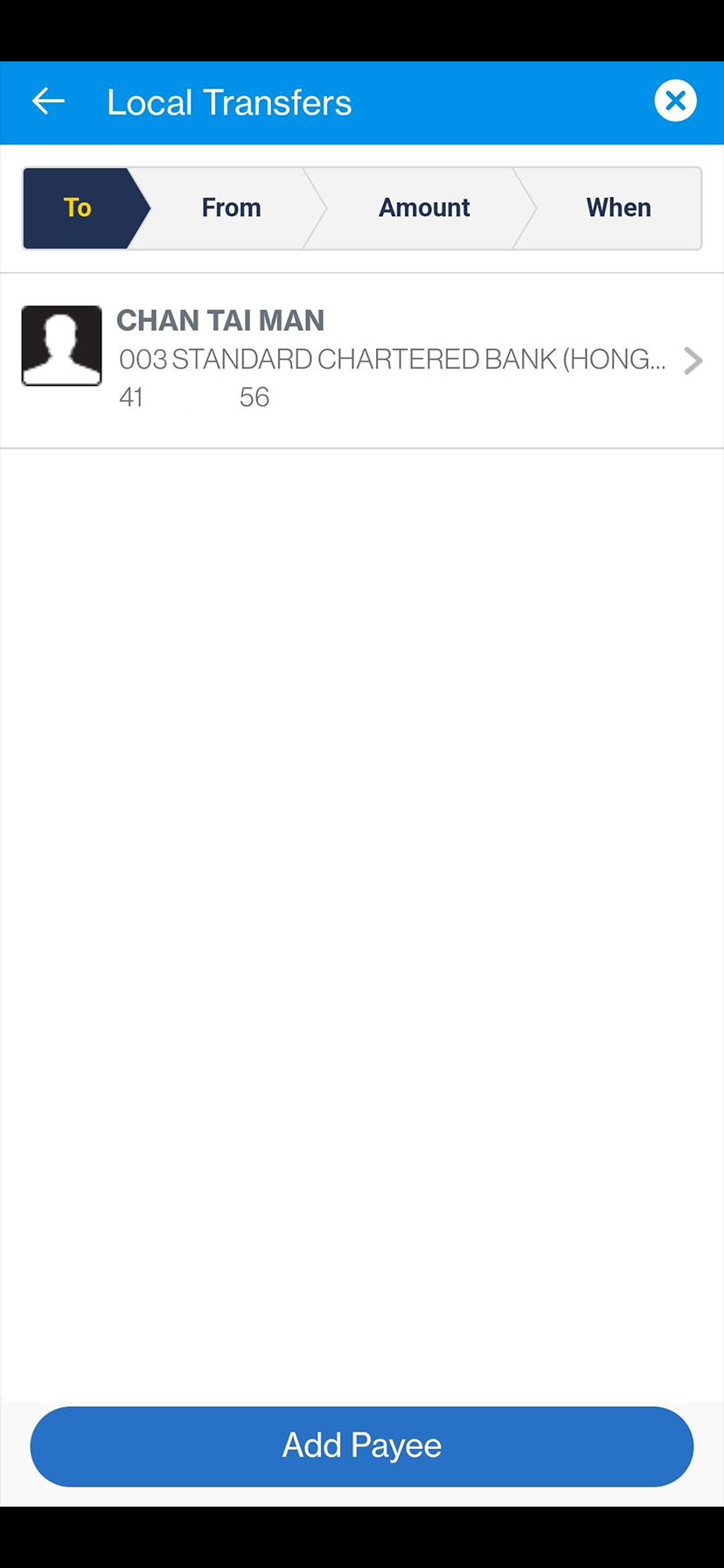

Add payee on SC Mobile App

Add payee on SC Mobile App

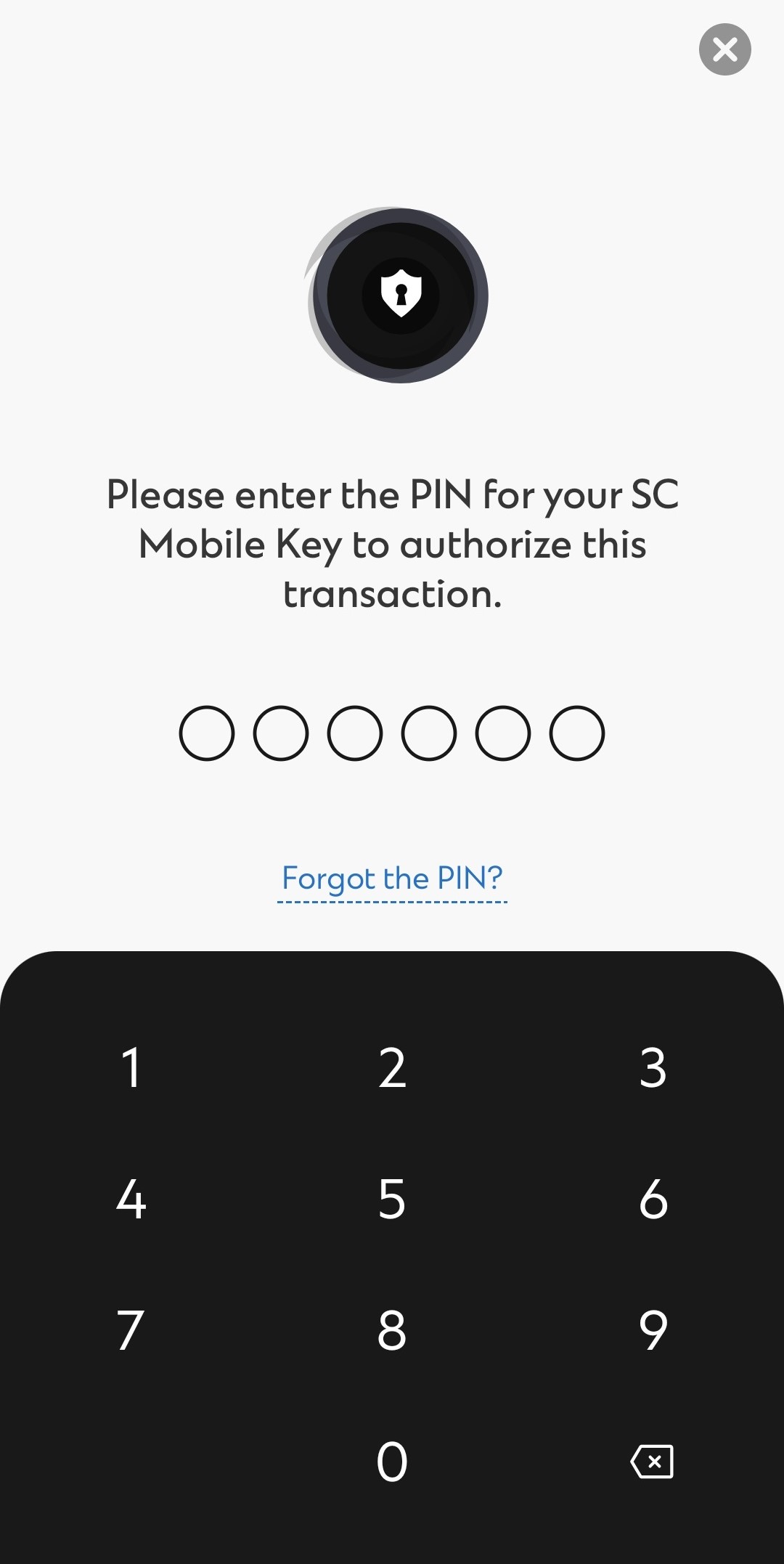

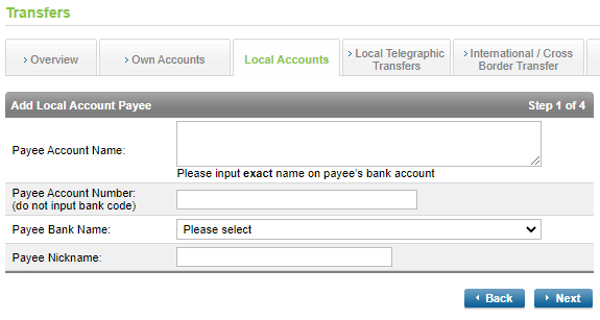

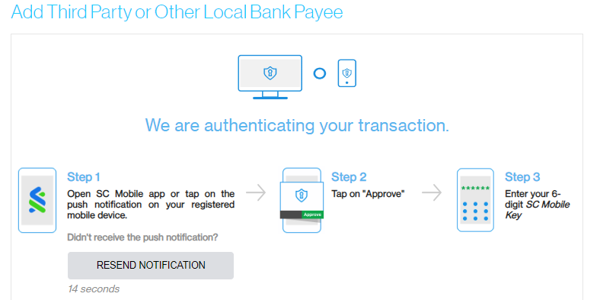

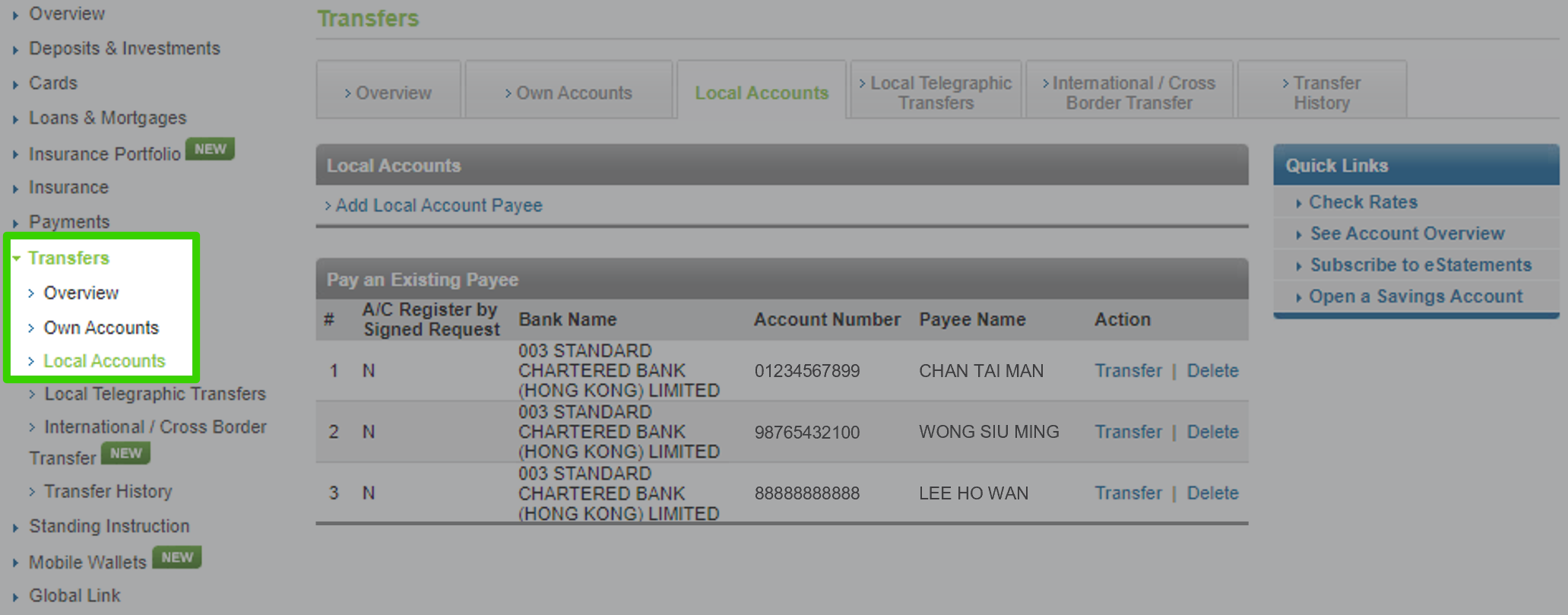

Add payee on Online Banking

Add payee on Online Banking

- SC Mobile App

- Online Banking

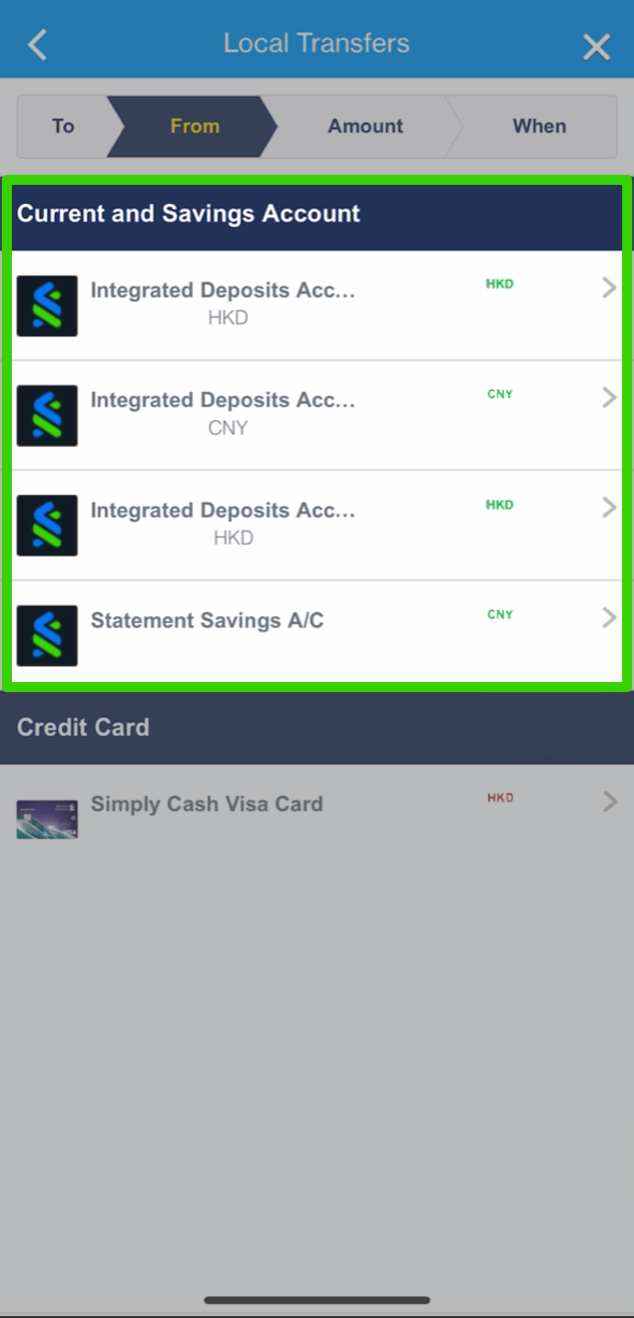

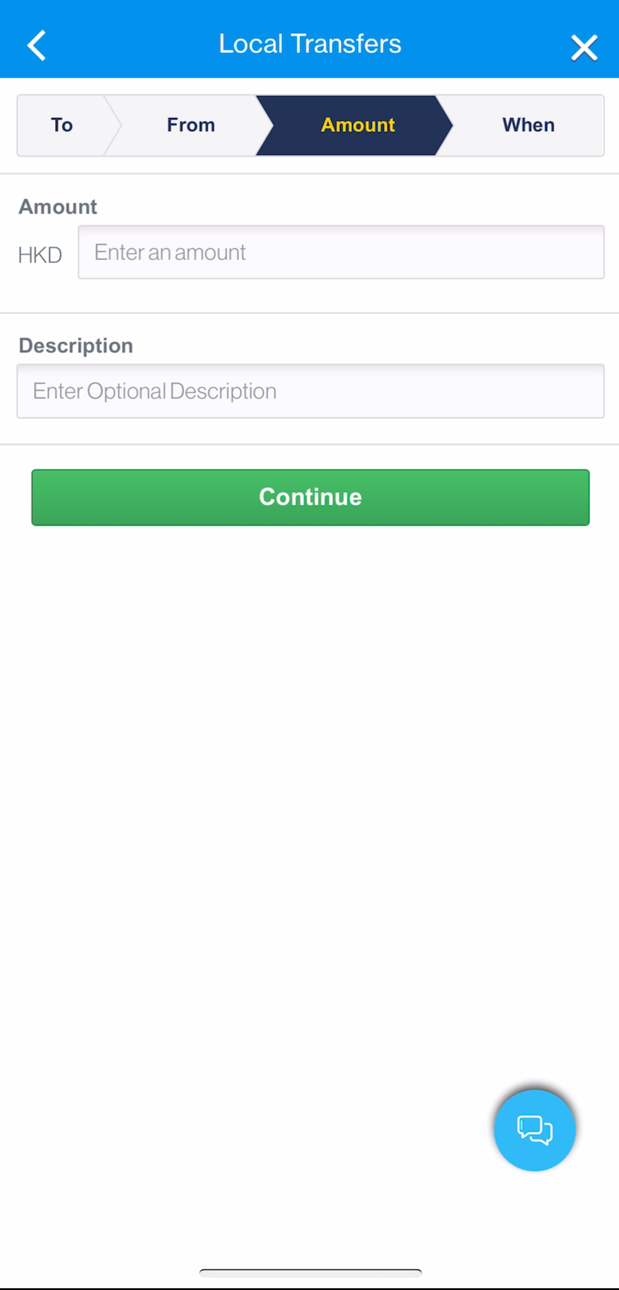

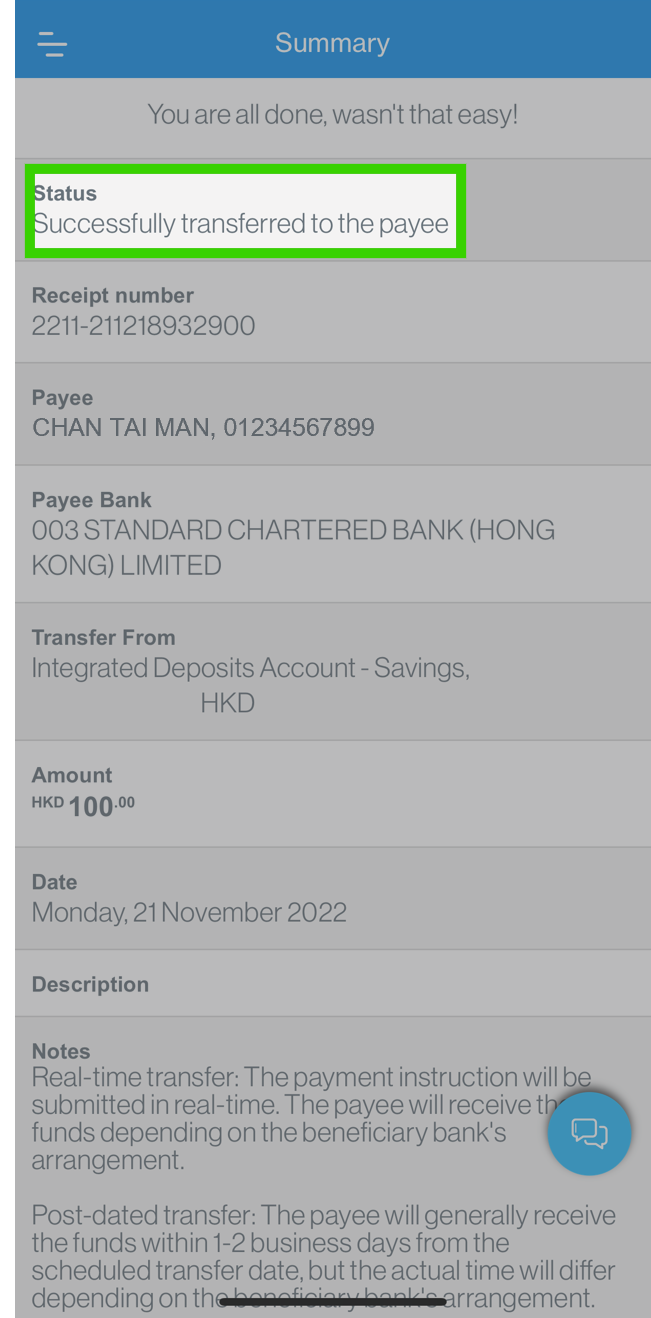

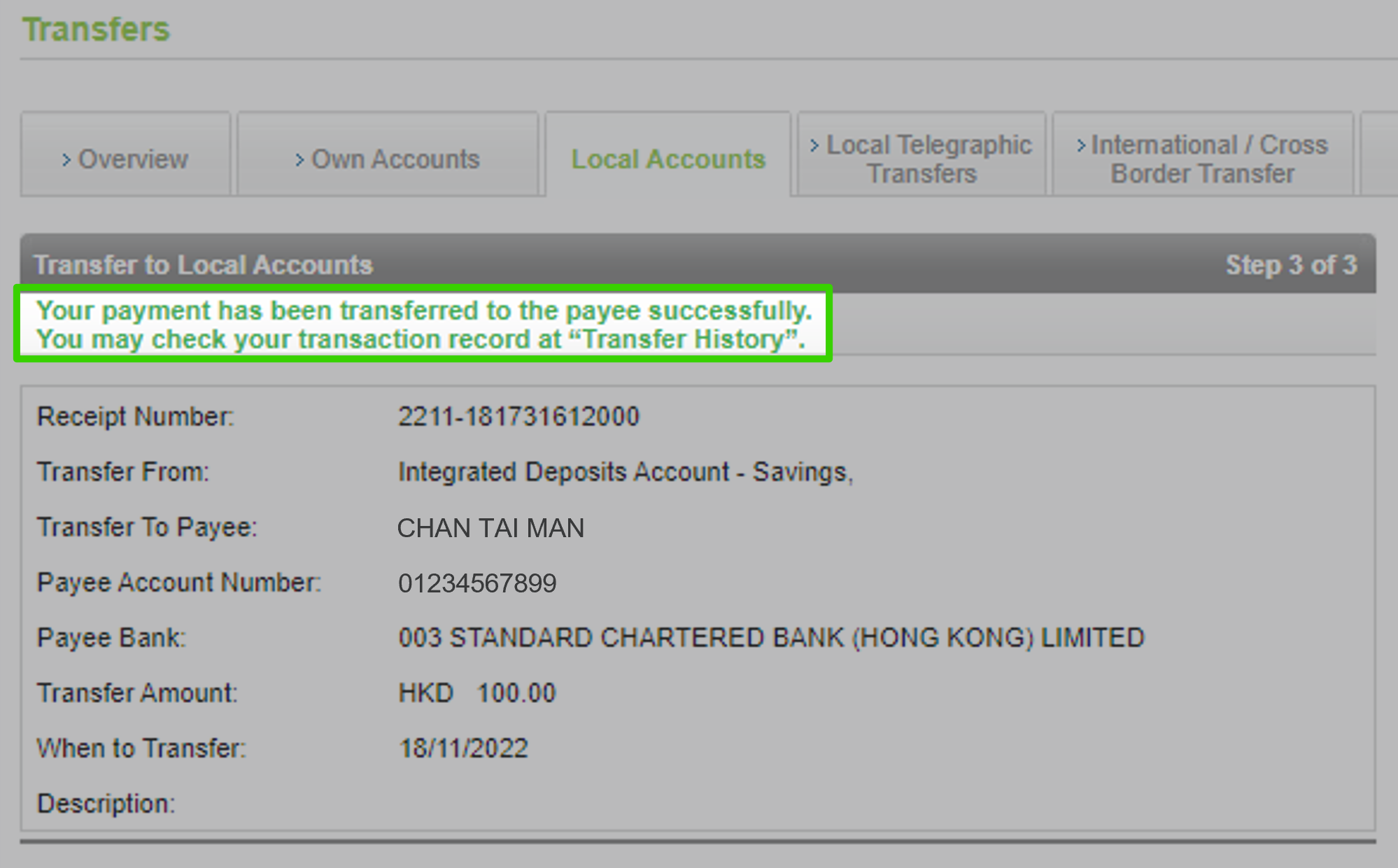

Transfer from current or savings account via SC Mobile App

Transfer from current or savings account via SC Mobile App

- SC Mobile App

- Online Banking

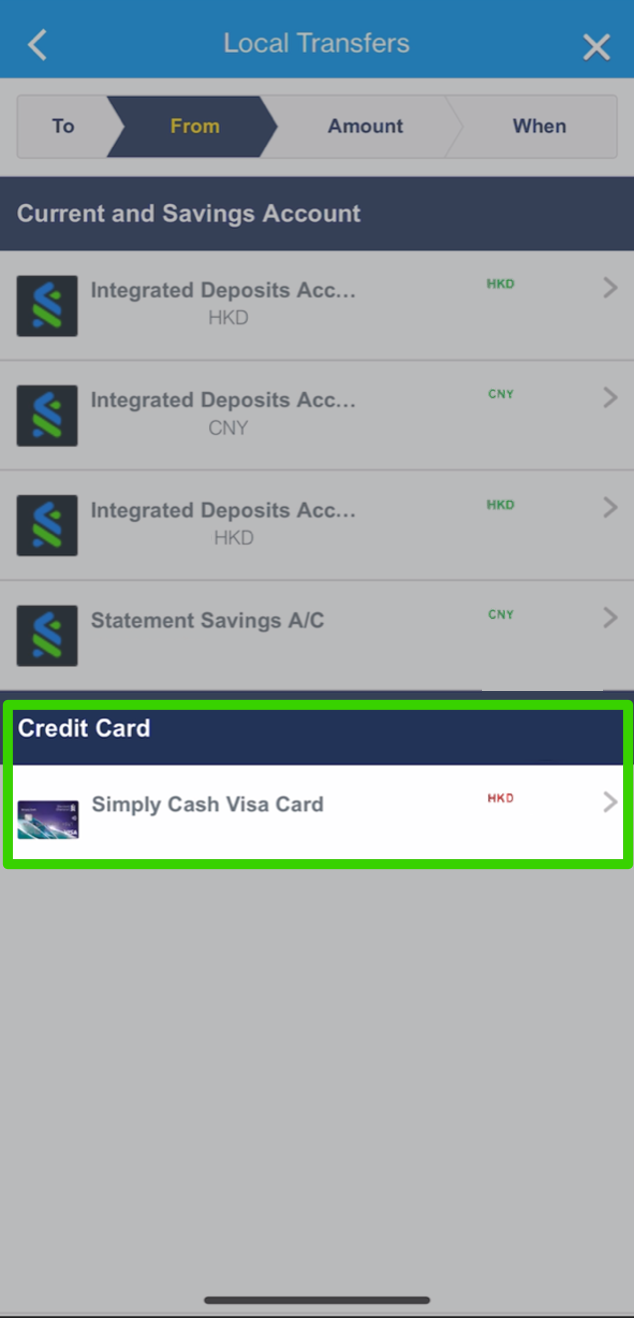

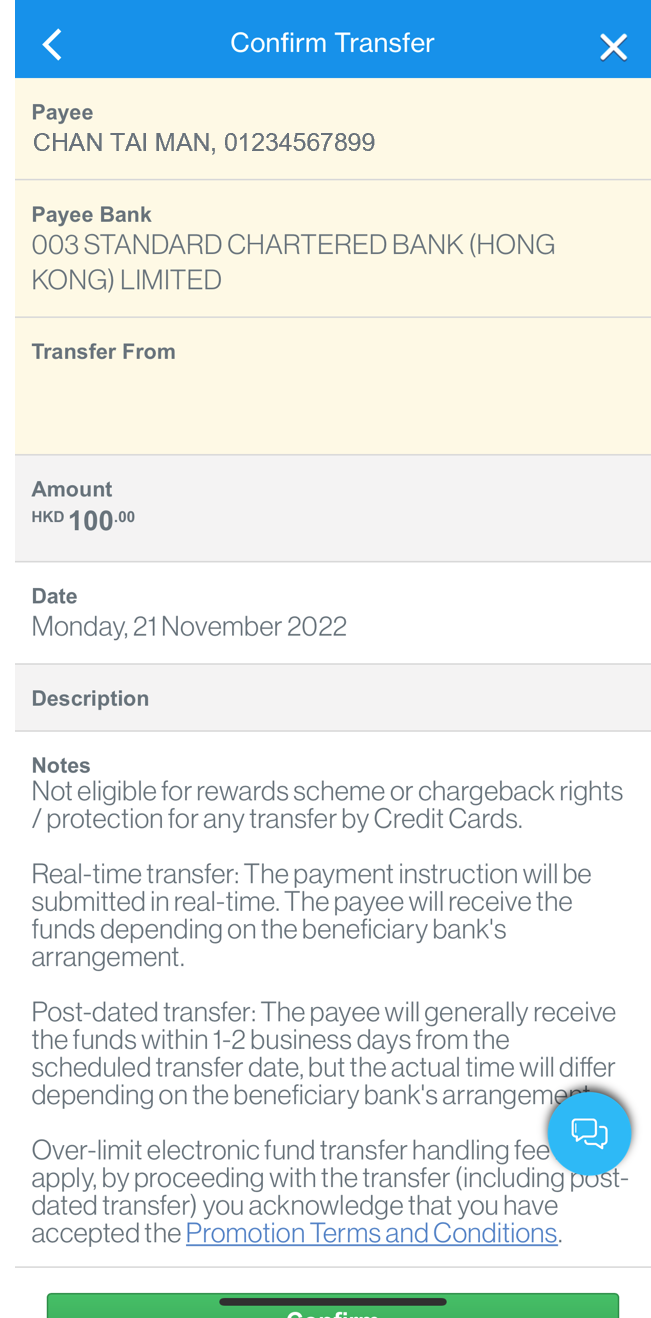

Transfer from credit card via SC Mobile App

Transfer from credit card via SC Mobile App

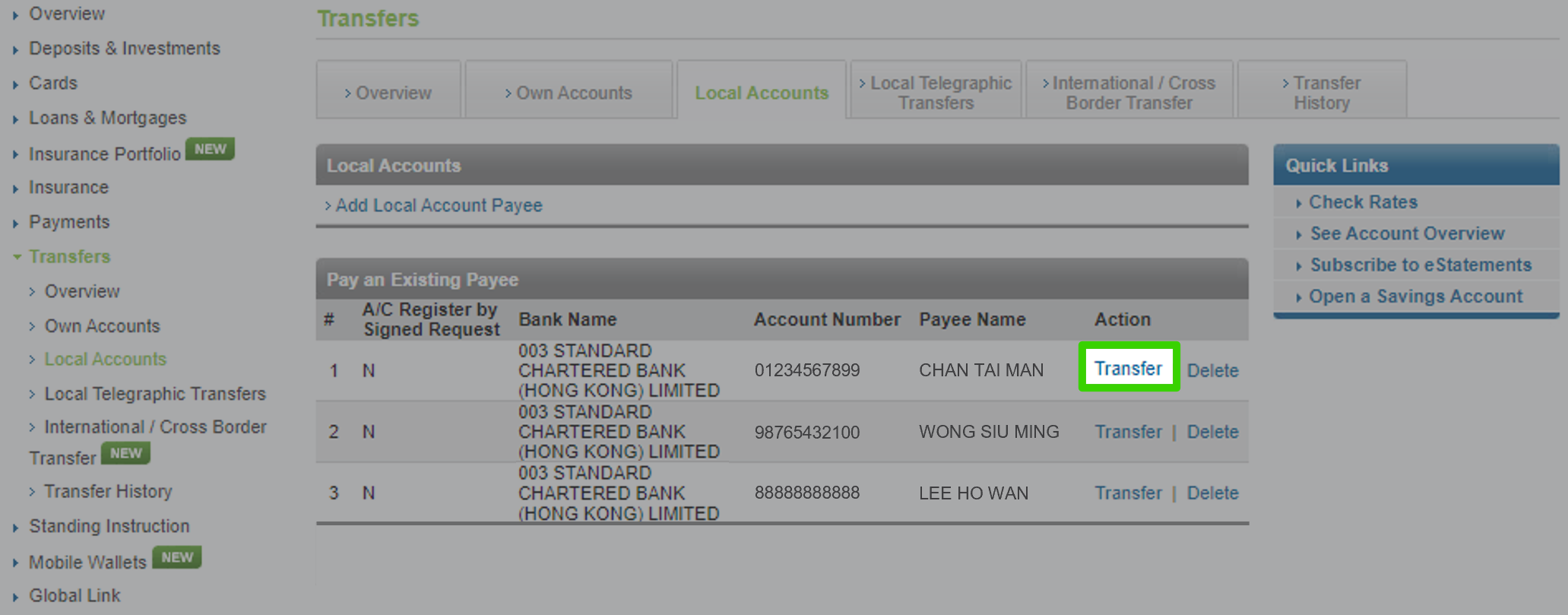

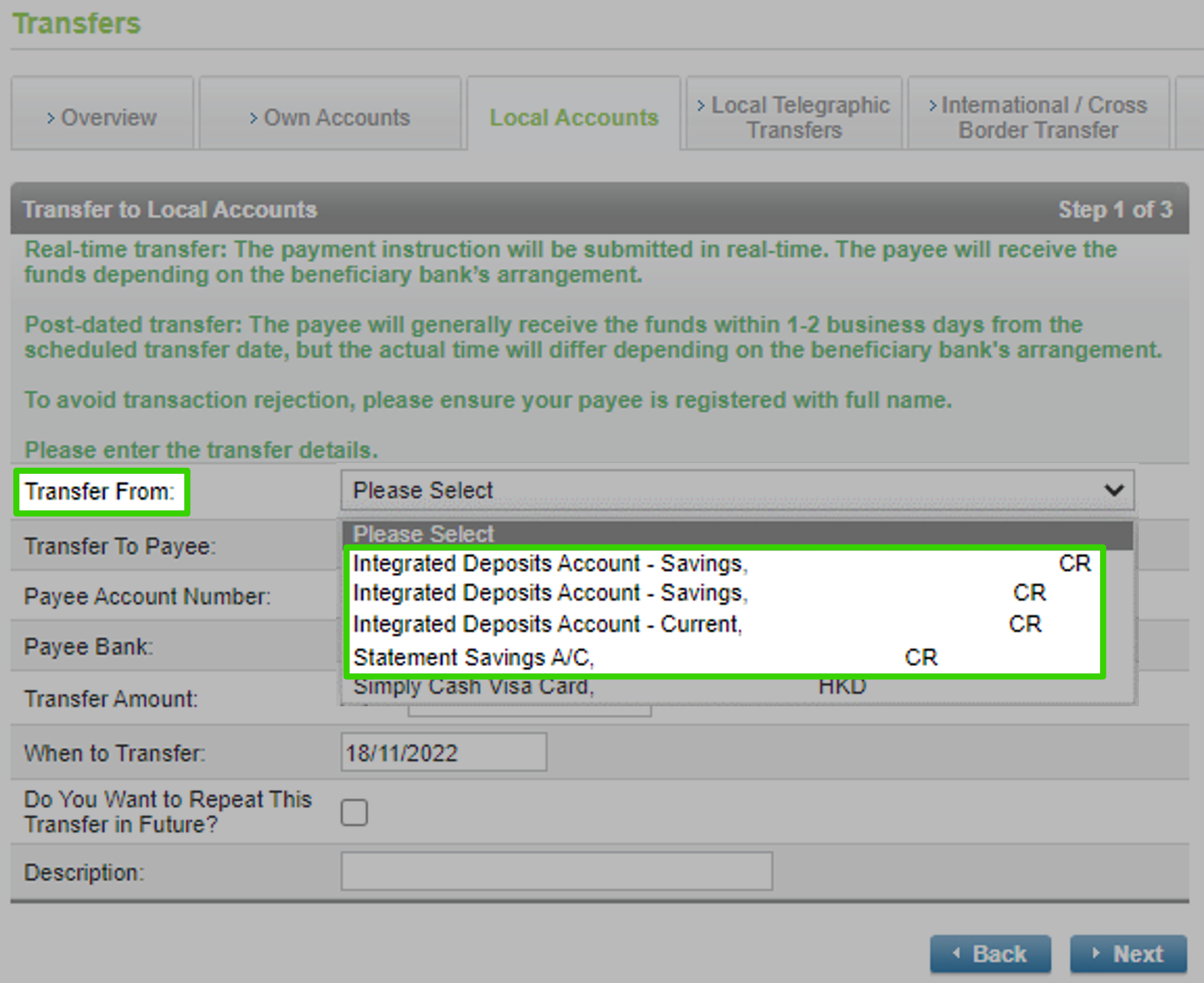

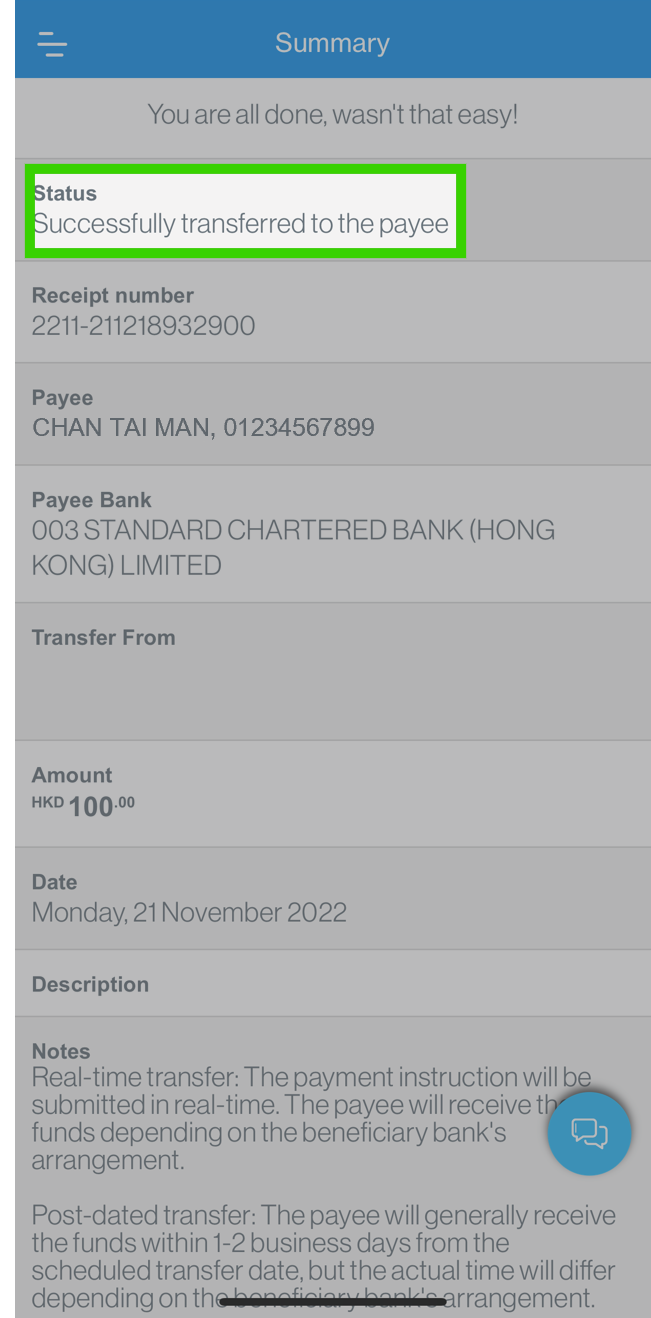

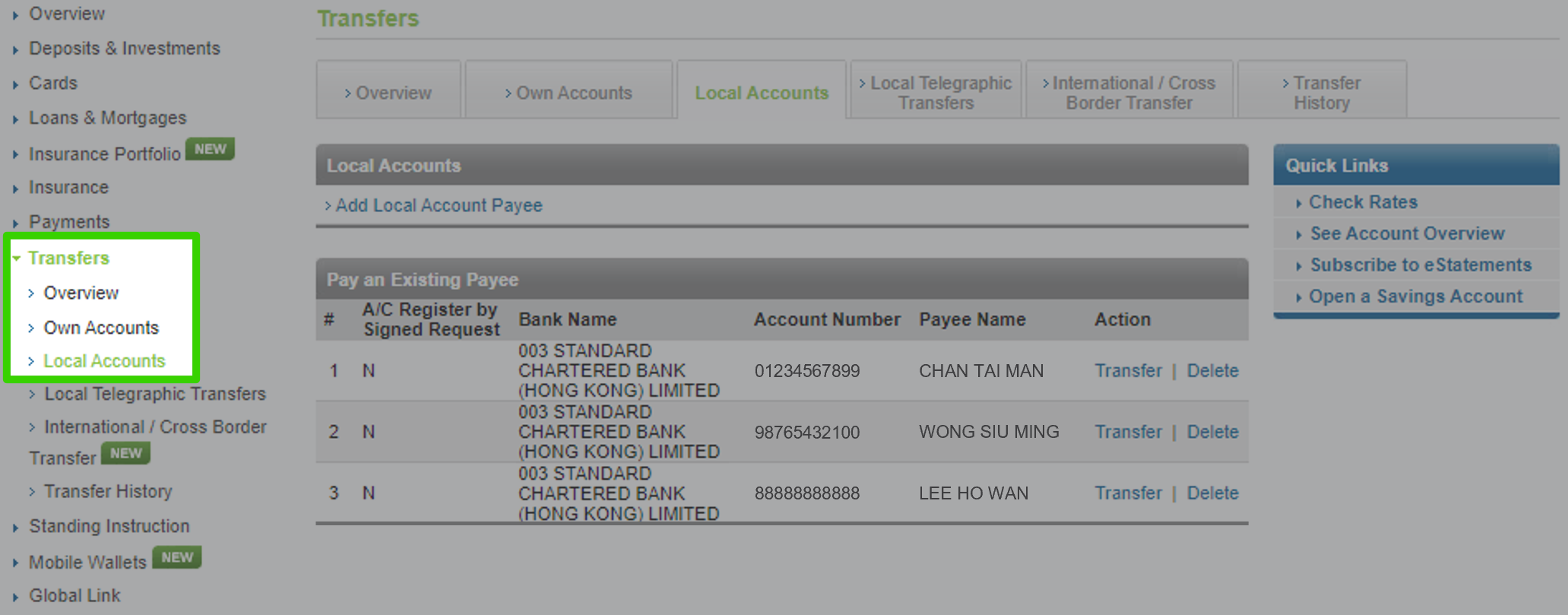

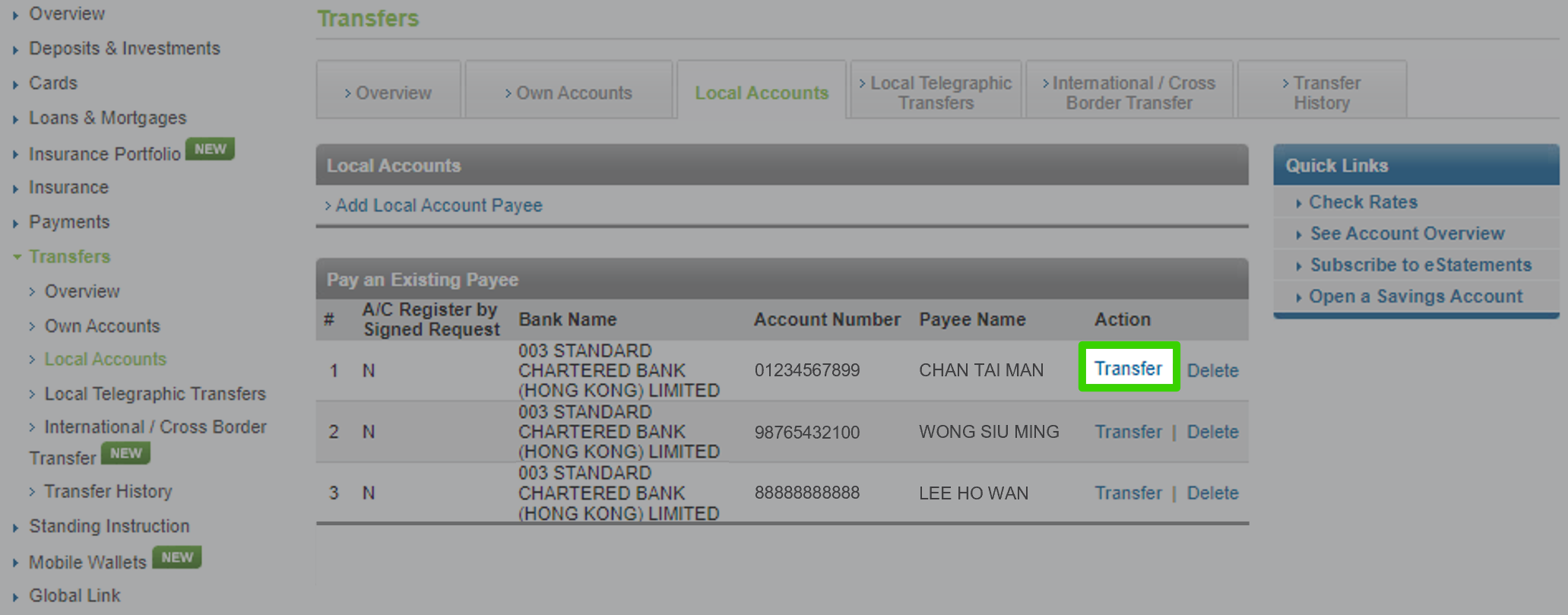

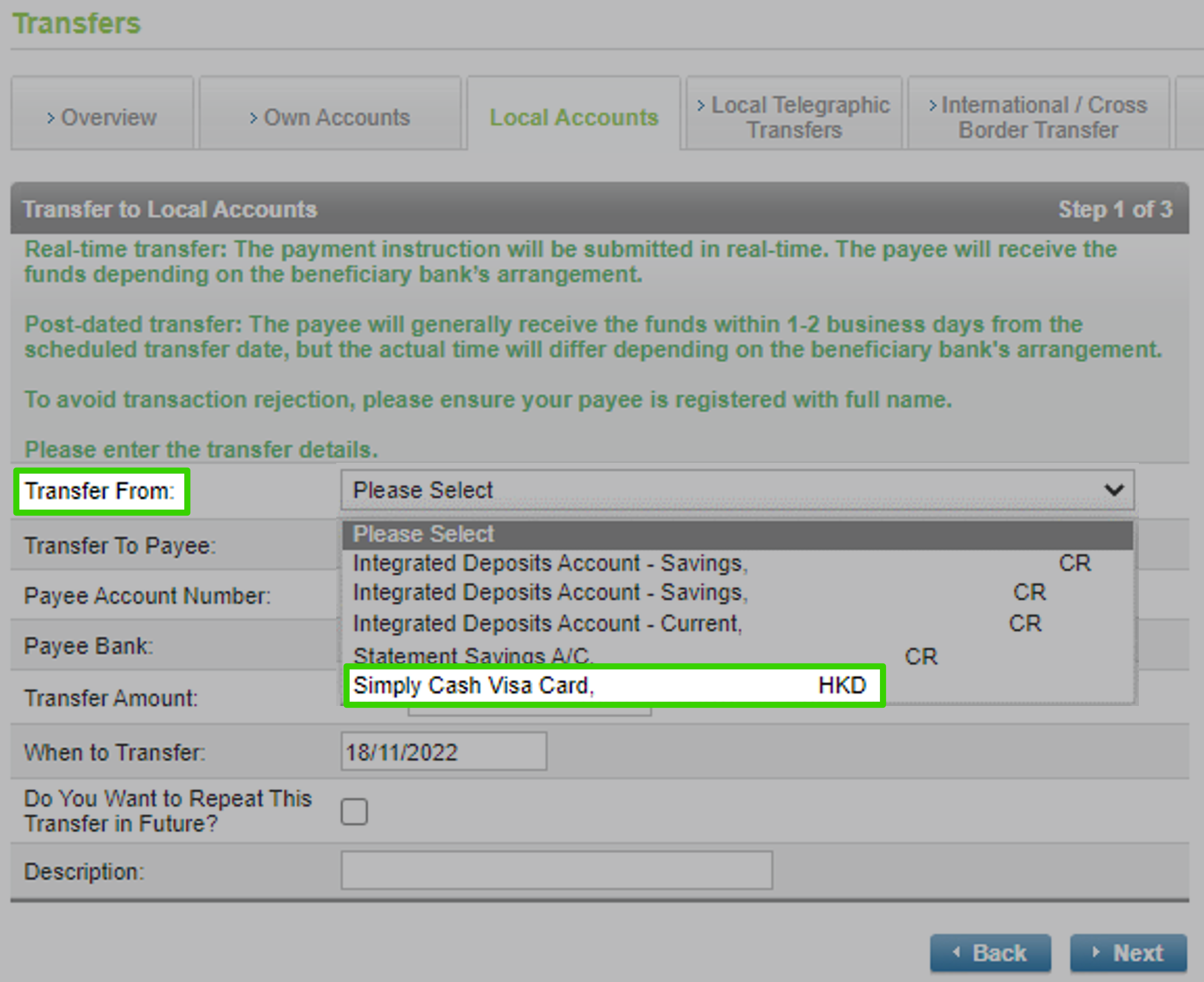

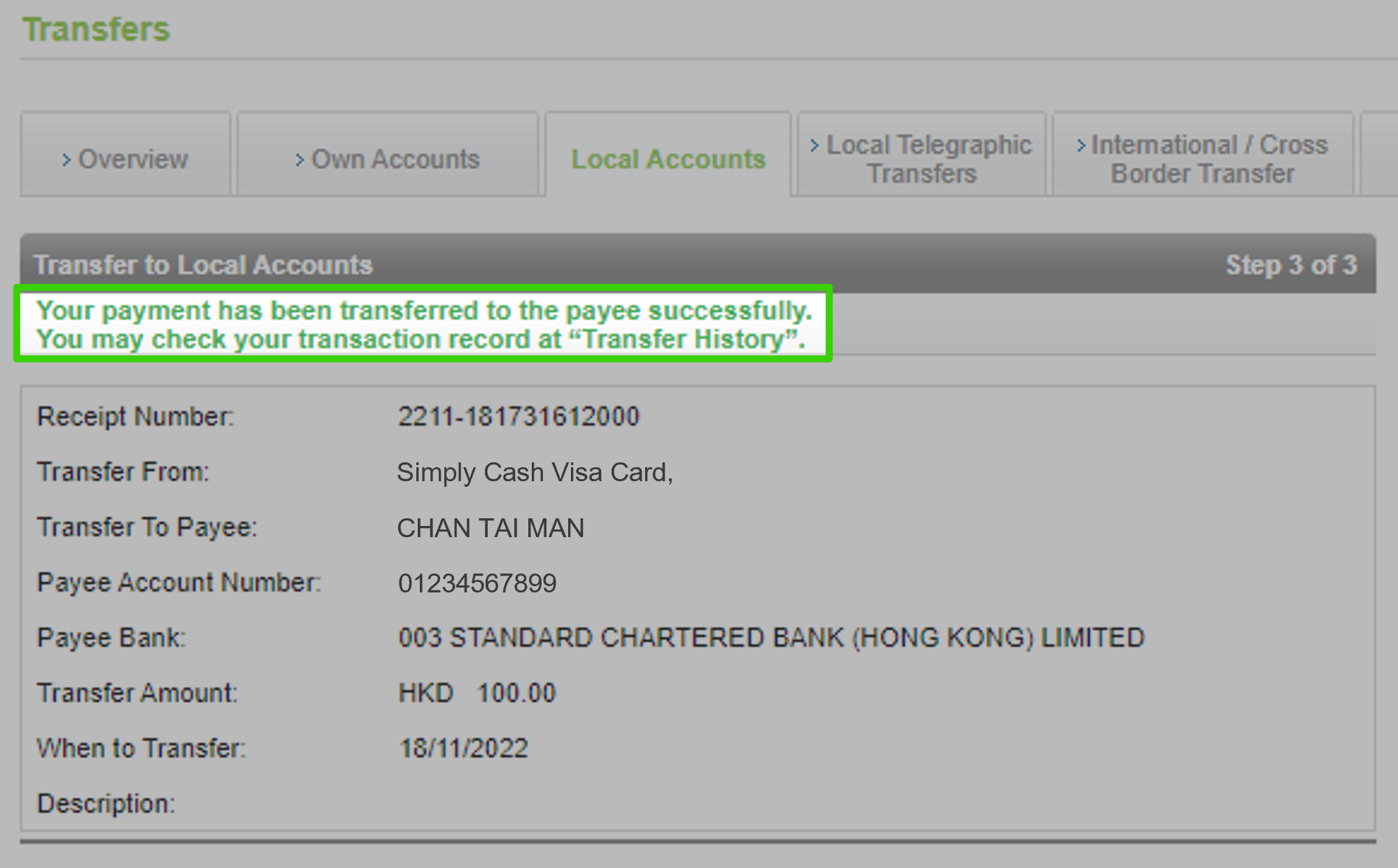

Transfer from credit card via Online Banking

Transfer from credit card via Online Banking

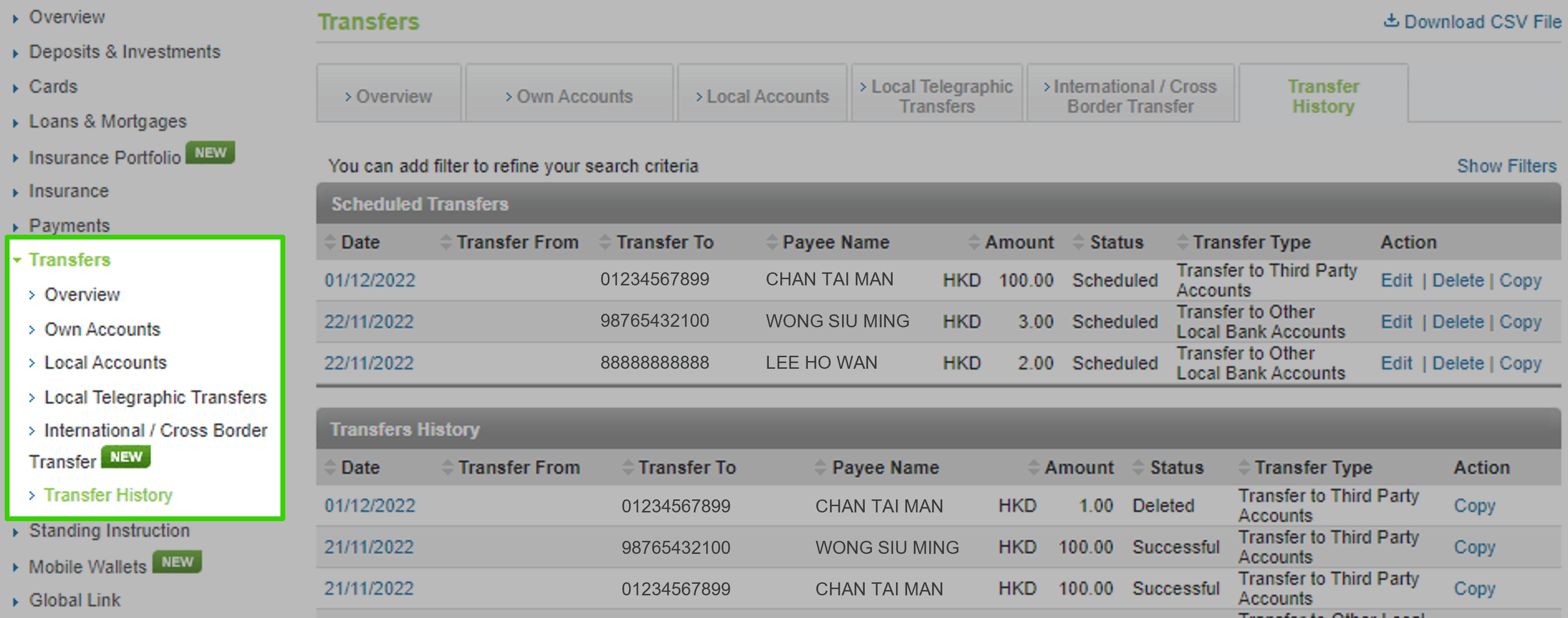

- Edit scheduled transfer

- Delete scheduled transfer

Edit scheduled transfer on Online Banking

Edit scheduled transfer on Online Banking

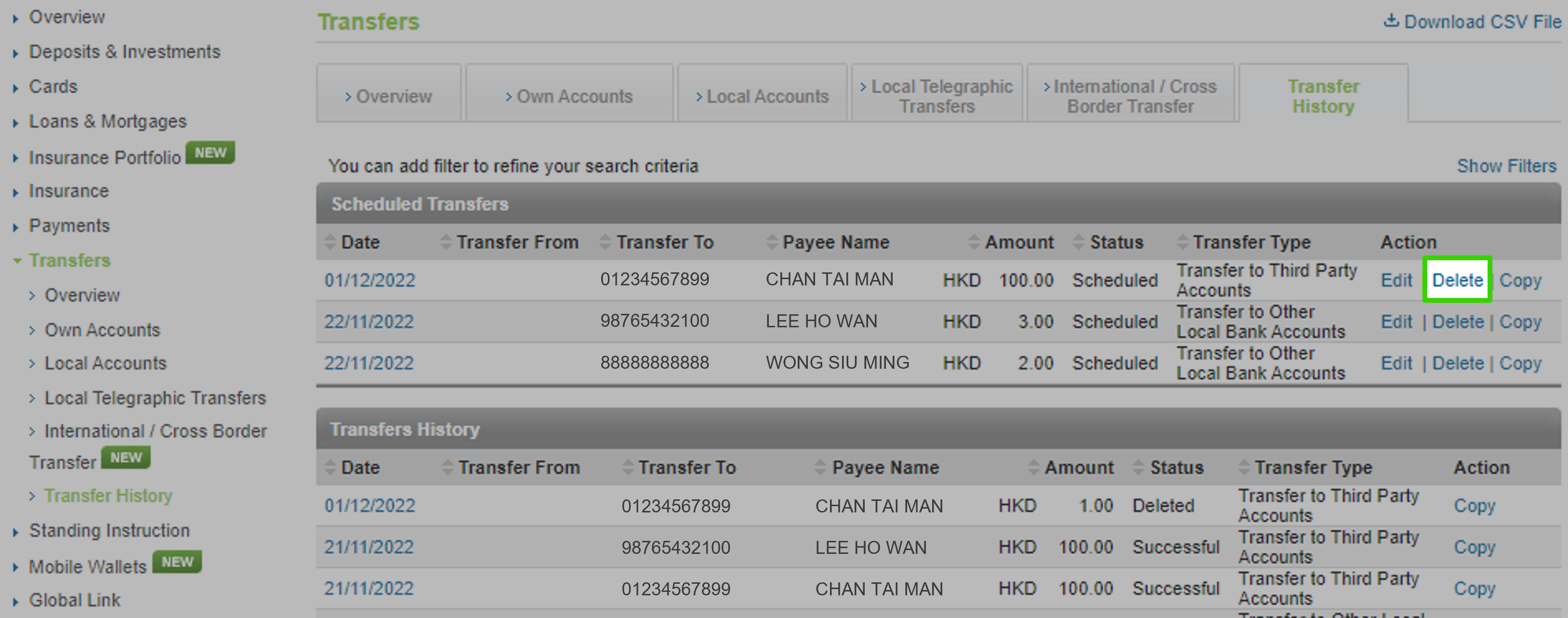

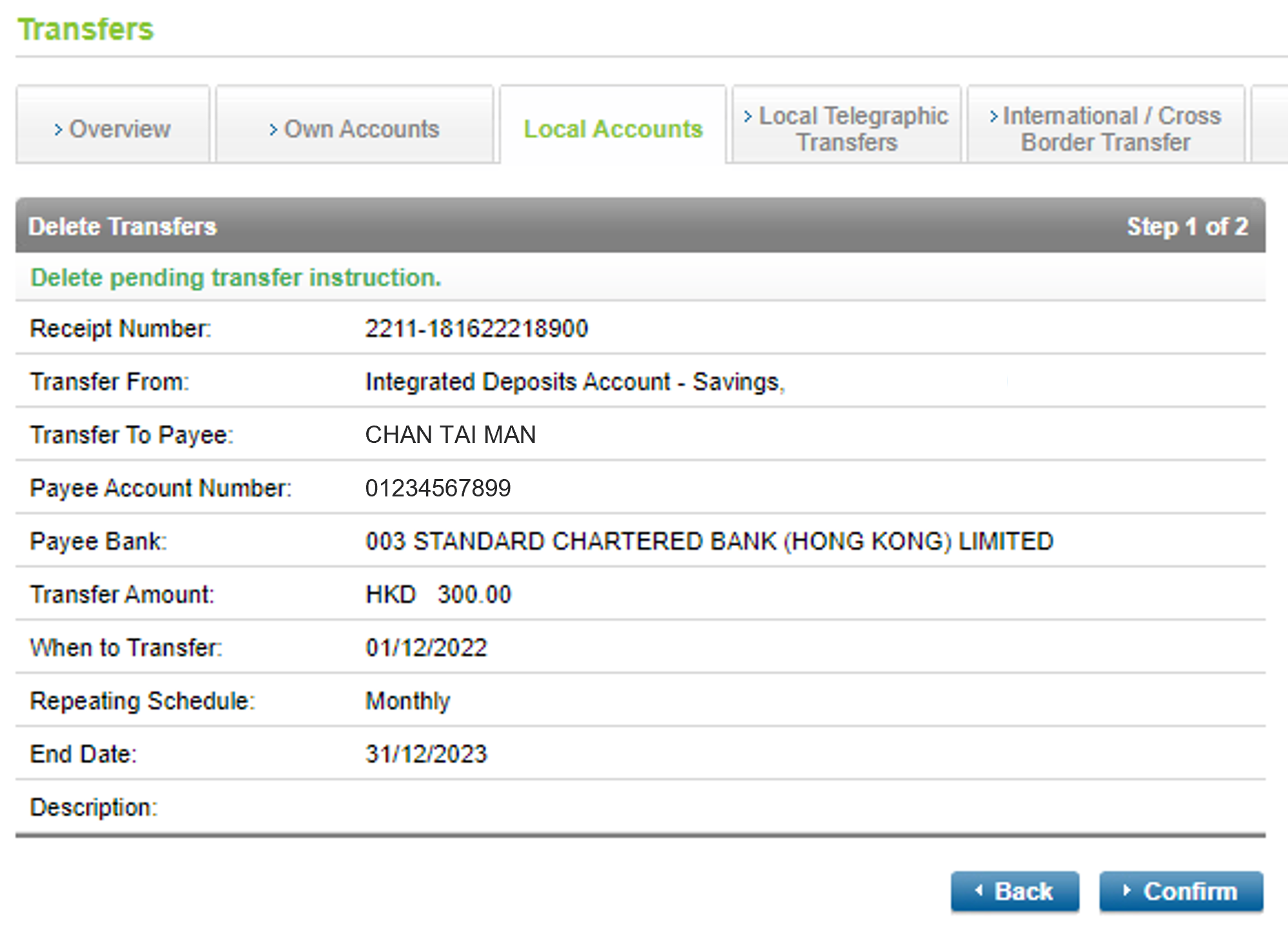

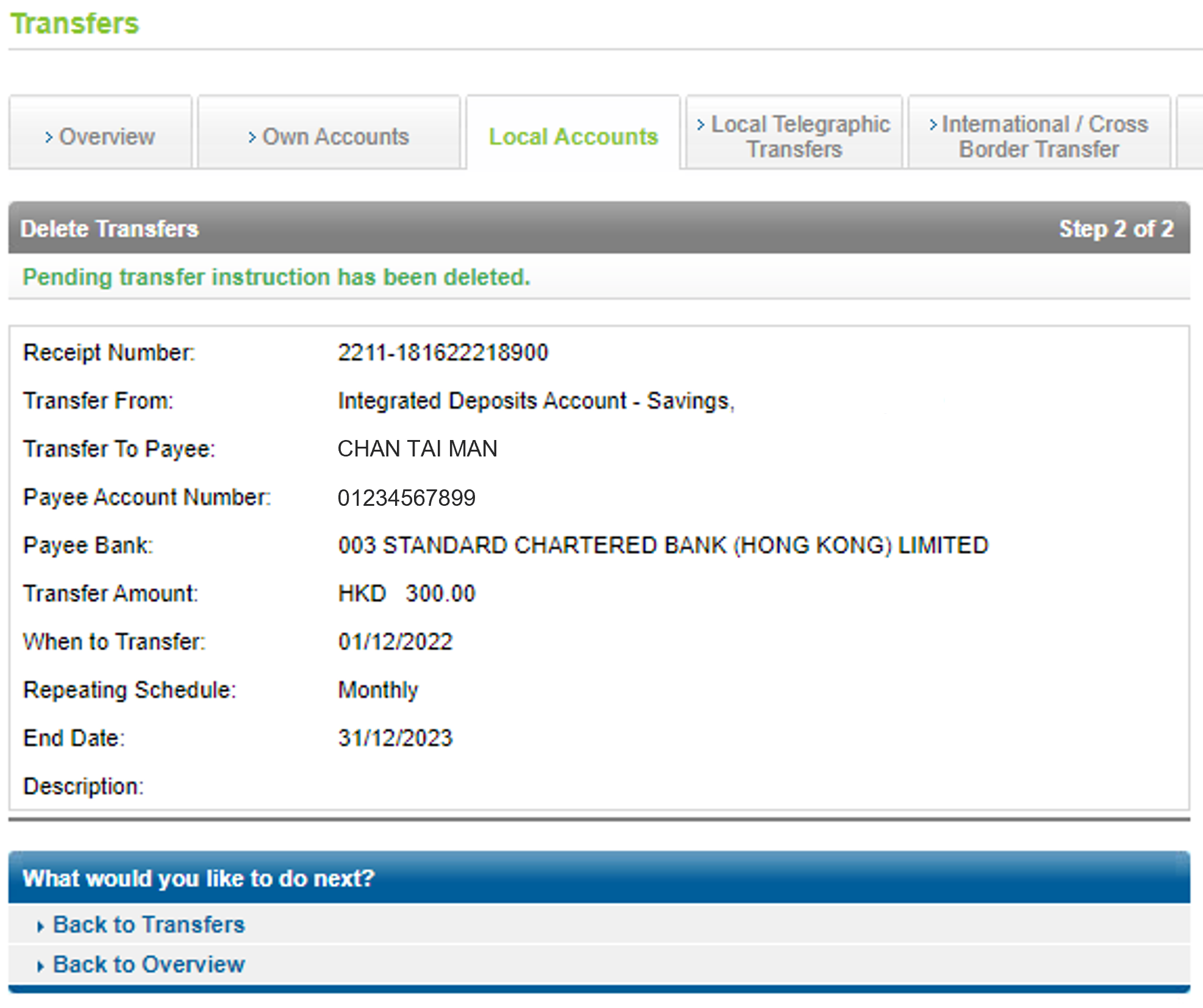

Delete scheduled transfer on Online Banking

Delete scheduled transfer on Online Banking

56 days Interest free period up to 56 days |

0% As low as 0% handling fee1 |

6 - 60 months tenor Flexible instalment period of 6 – 60 months tenor |

Manage your finances on the go

Experience SC Mobile App now

Scan QR code to download SC Mobile App now

for Android users without Google Play, please click here to download the Android application package (APK)

General FAQs

You can register for Digital Banking via our Online Banking or SC Mobile App – click here to learn more.

You can transfer in HKD or CNY, depending on the currency of the selected bank account or credit card to send money from (not applicable to UnionPay Dual Currency Platinum Credit Card).

Transfer limit for real-time / scheduled / recurring transfers from by credit card is subject to your available credit card limit as well as the overall daily online transfer limit and the Third Party Fund Transfer Limit on the day of transaction. More info available here.

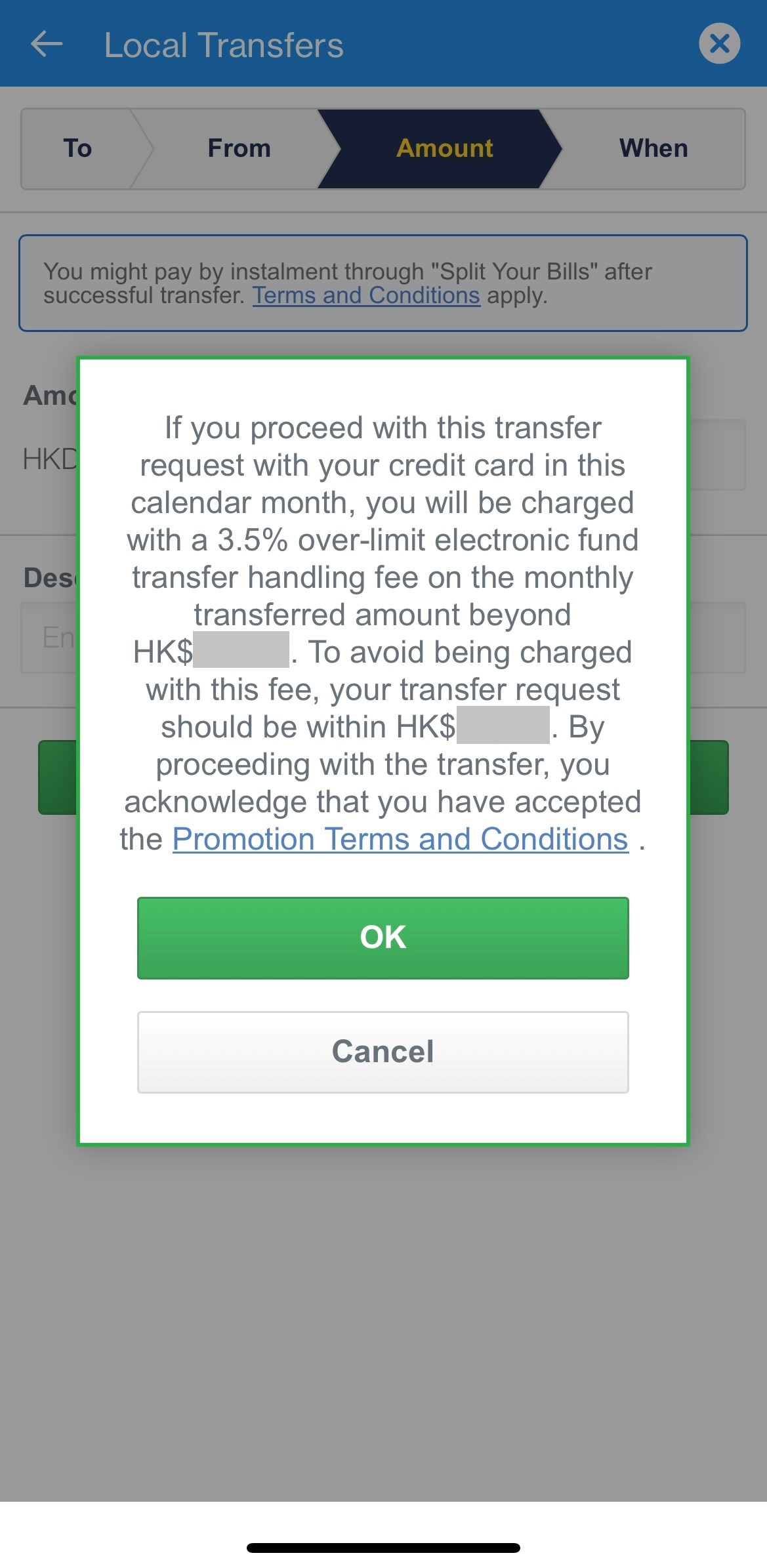

If your monthly aggregated transfer amount from credit card exceeds HKD60,000, over-limit electronic fund transfer handling fee may apply. For details, please refer to here.

FAQs - Credit Card

Local fund transfers on Online Banking/ SC Mobile by credit card are not eligible for rewards scheme or chargeback rights / protection.

You can transfer funds to local bank payees and registered through Online Banking and SC Mobile App.

You can transfer from any valid Standard Chartered / MANHATTAN Visa card or Mastercard (except UnionPay Dual Currency Platinum Credit Card).

Prior to the confirmation of your transfer, if your transfer will be subject to the Over-limit electronic fund transfer handling fee, we will notify you and display the remaining balance that you can transfer for free. Please refer here for illustration.

Prior to the confirmation of your transfer, if your transfer will be subject to the Over-limit electronic fund transfer handling fee, we will notify you and display the remaining balance that you can transfer for free. Please refer here for illustration.

FAQs - Recurring transfer

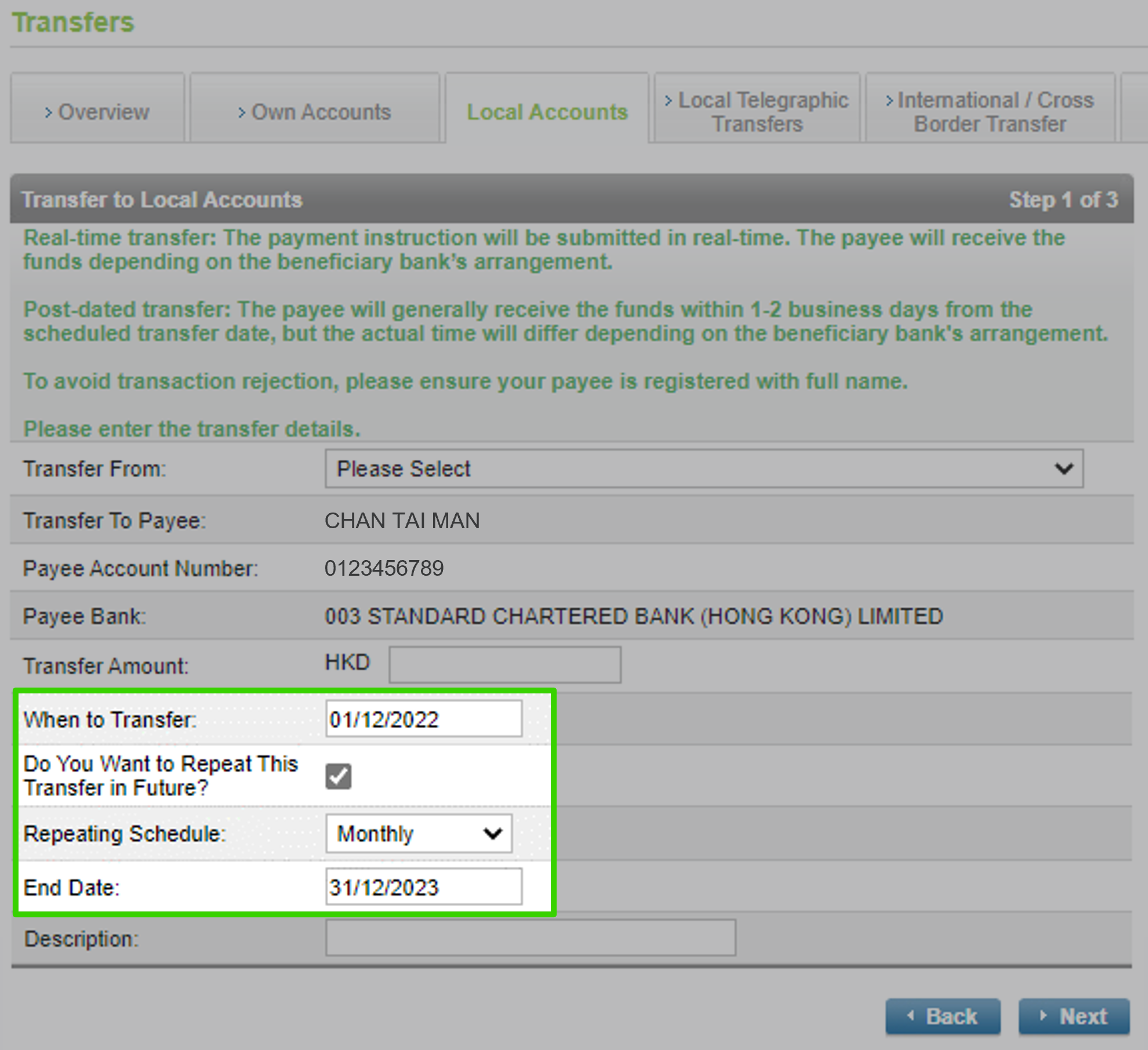

You can set repeating frequency and specific period and for a recurring transfer, which authorises us to automatically send money from your selected source of bank account or credit card on the effective date.

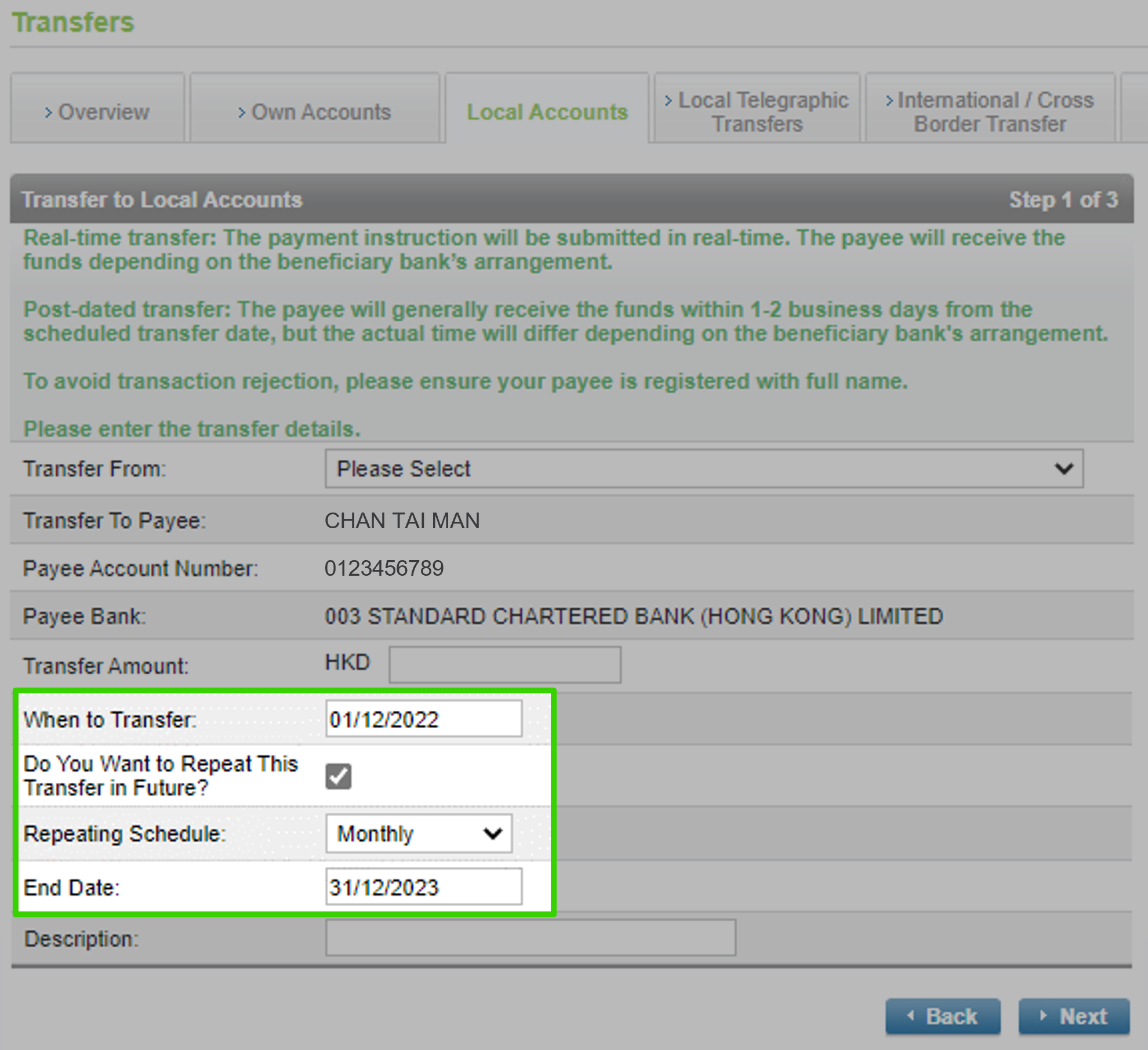

Yes – You can set transfer on a future date and/or recurring transfers following Step 4 of “Transfer from Online Banking” or Step 6 of “Transfer from SC Mobile App”

The payee will generally receive the funds within 1-2 business days from the scheduled transfer date, but the actual time will differ depending on the beneficiary bank’s arrangement. Please reserve enough time and available credit limit for each transfer.

The recurring transfer effective date must be at least one day after set up date.

Need more help? Find out more on our FAQ

1. Over-limit electronic fund transfer handling fee promotion offer:

a. From 1 November 2025 to 31 December 2025 (both dates inclusive), 3.5% handling fee will be waived for transferred amount up to HKD60,000 (the “Offer”). 3.5% handling fee will apply to the transferred amount above HKD60,000 and charges will be debited to the valid Credit Card account with the highest transferred amount if the total accumulated transfers exceed HKD60,000 by such Cardholder in a calendar month (based on the transaction date) when using electronic banking services, person to person (P2P) payment services or mobile device / app / electronic funds transfer platforms effective from time-to-time to make any transfer / top up transaction from Standard Chartered / MANHATTAN Credit Card(s) to a specified account (including but not limited to Octopus Wallet account, AlipayHK account). If the last day of a calendar month is a Sunday, any related transactions made on that day will be counted in the following calendar month.

b. The Offer is only applicable to a cardholder who makes the transfer via Online Banking and SC Mobile App. Your card should be valid and with available credit limit during the transfer.

c. The Bank reserves the right to vary, modify and terminate the Offer and to amend any of these terms and conditions at any time without any notice. In case of disputes, the decision of the Bank shall be final and binding.

d. If there is any inconsistency or conflict between the English version and its Chinese translation, the English version shall prevail.

2. Local Account Fund Transfer on Online Banking/ SC Mobile App are available to Standard Chartered Current / Savings Account and Credit Card holders (except UnionPay Dual Currency Platinum Credit Card). If you do not see the Local Transfers feature on Online Banking/ SC Mobile App, make sure you have registered your account with ATM card and ATM PIN or ATM Card/Credit Card and Tele-electronic identification number (TIN). Credit card only supports Local Account Fund Transfer on Online Banking / SC Mobile App in HKD.

3. Any transfer by credit card subject to your available credit card limit and the maximum daily aggregated transfer limit for third-party fund transfer. More info available here.

4. Asia Miles / 360 Reward Points / Cash Rebate or any other credit card reward campaign and chargeback right / protection is not applicable to transactions via Online Banking/ SC Mobile App local account fund transfer.