At the earliest effect from March 2025, the application of remitting TWD / MOP / KRW via online channels may no longer be accepted. In view of this, you may select other currency (e.g. HKD / USD) as remitting currency for funds transfer to Taiwan / Macau / Korea via online channels.

With effect from 2nd January 2026, the issuance of demand draft(s) service will be demised for individual clients. You can make a transfer to overseas payee using “International / Cross Border Transfer” function via Online Banking or SC Mobile app. Demand draft(s) issued before the above date will not be affected.

PREPARE BELOW INFORMATION BEFORE SUBMITTING YOUR REMITTANCE

- Australia- BSB Code (in 6 digits)

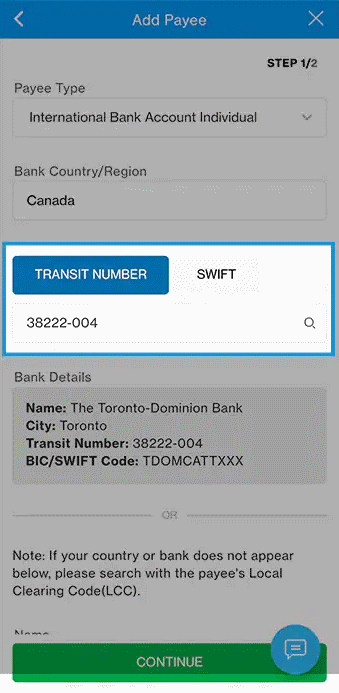

- Canada- Transit Number (in 8 digits) , consist of 5 digits branch transit number and 3 digits financial institution number

- UK- Sort Code (in 6 digits)

- US- ABA Routing Number (in 9 digits)

SENDING MONEY TO YOUR SCB ACCOUNT? PROVIDE BELOW INFORMATION TO THE SENDING BANK!

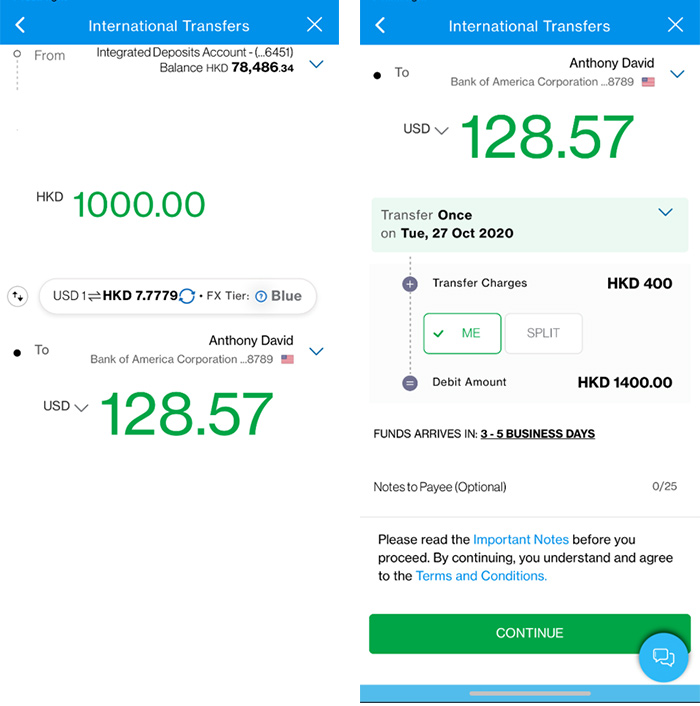

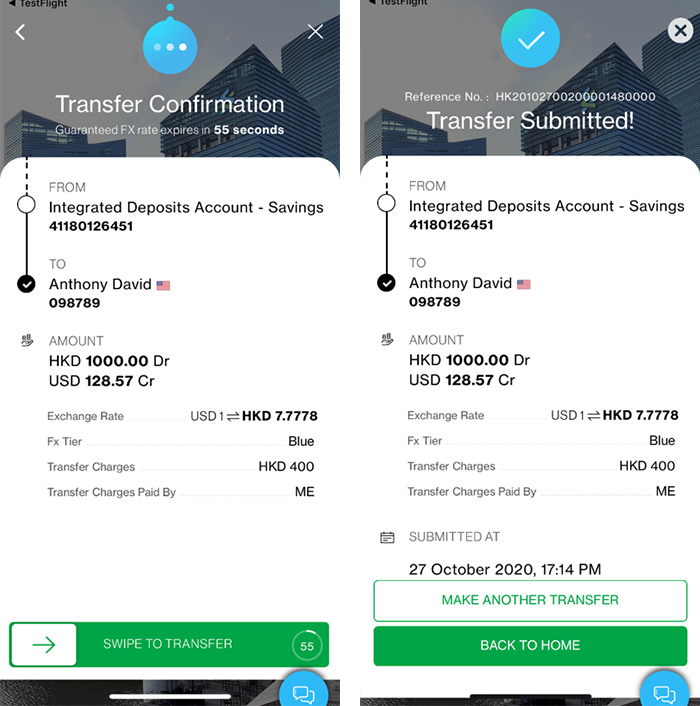

1st time remitting via SC Mobile App / Online Banking?

No worries, check out the below demonstration:

- Add new payee

- Initiate a transfer

1. Eligibility as follow :

• Remittance to individual accounts in domicile currency to Australia, Canada, Euro Zone countries, Singapore , UK & US ; and

• Remittance transaction amount below HKD1,000,000 (or equivalent currency)

$0 correspondent bank charge for such remittance transaction and earliest same day arrival of funds.

2. $0 Service Fee is exclusive to Priority Banking and Priority Private customers (Note: Solely for remittance to China, the service fee will be debited firstly and refunded to customers later).

3. The digital remittance service is bound by the related Terms and Conditions. For details, please click here.

4. Please read the Important Notes related to our digital remittance service.

5. For remittance via online or mobile banking in the following currencies: BND, DKK, INR, LKR, NOK, PHP, PKR, SEK, THB, ZAR, you can only select HKD or USD account as the debit source. Please visit branch if you wish to select other currency as the remittance debit account.

6. All remittance instructions made via SC Mobile or Online banking, with foreign currency exchange performed on spot, are entitled to participate in the FX Membership program (except for instructions involving CNY or cancelled transactions). For details, please visit com/hk/fx and refer to Terms and Conditions of the FX Membership program set out on the website.

7. For transfer in odd currencies, foreign exchange controls for remittance transactions may be in force. You should understand the controls and assess the risks before initiating any remittance in such currencies.

- Foreign Exchange:

- Foreign exchange involves risks. Fluctuation in the exchange rate of a foreign currency may result in gains or significant losses in the event that the customer converts deposit from the foreign currency to another currency (including Hong Kong Dollar).

- RMB Deposit Service:

- Renminbi (“RMB”) exchange rate, like any other currency, is affected by a wide range of factors and is subject to fluctuations. Such fluctuations may result in gains and losses in the event that the customer subsequently converts RMB to another currency (including Hong Kong Dollar); and

- RMB is currently not freely convertible and conversion of RMB through banks in Hong Kong is subject to restrictions specified by the Bank and regulatory requirements applicable from time to time. The actual conversion arrangement will depend on the restrictions prevailing at the relevant time.

Frequently Asked Question (FAQ)

Our Service Scope

We support remittane in 24 currenceis, including:

| SC MOBILE / STANDARD CHARTERED ONLINE BANKING | BRANCHES |

|---|---|---|

Main Currency | AUD, CAD, CHF, CNY, EUR, GBP, HKD, JPY, NZD, SGD and USD

Note: | |

Other Currency | BND, DKK, INR, LKR, NOK, PHP, PKR, SEK, THB and ZAR

Note: | BND, DKK, INR, LKR, NOK, PHP, PKR, SEK, THB and ZAR

Note: |

You can complete the Outward Remittance Application form and submit to any of our branches in person. Or simply login to our Online Banking / SC Mobile App to submit an application anytime anywhere and enjoy lower fees.

You can remit up to HK$2,000,000 (or equivalent) daily via Online Banking / SC Mobile App. There is no transaction limit for remittance via branch.

Please prepare below information :

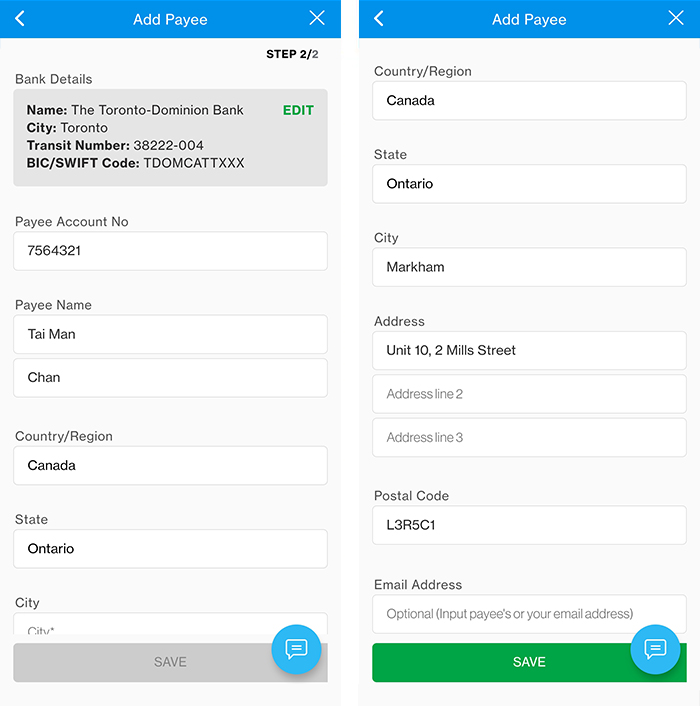

- Payee Bank Account Number. If you are remitting to UK or Europe, please provide the payee’s International Bank Account Number (IBAN)

- Payee Account Name. It must be same as the one registered with the beneficiary bank.

- Payee Full Address, including province and postal code,

- Payee Bank Name

- Payee Bank SWIFT Code (in 11 characters). If you are remitting to the following countries, please obtain the local clearing code from the beneficiary or beneficiary bank:

- Australia- BSB Code (in 6 digits)

- Canada- Transit Number (in 8 digits) , consist of 5 digits branch transit number and 3 digits financial institution number

- UK- Sort Code (in 6 digits)

- US- ABA Routing Number (in 9 digits)

Timing

Different currencies and channels subject to different cut- off time. Please refer to below table for details.

| CUURRENCY | VIA ONLINE BANKING/ SC MOBILE | VIA BRANCH |

|---|---|---|

| 澳元 (AUD) | 12:00 | 9:30 |

| 新加坡元 (SGD) | 17:00 | 10:30 |

| 人民幣 (RMB) | 14:30 | 14:30 |

| 加元 (CAD) | 17:00 | 15:45 |

| 歐羅(EUR) | 17:00 | 16:00 |

| 英鎊 (GBP) | 17:00 | 16:00 |

| 美金(USD) | 17:00 | 17:00 |

| 紐西蘭元(NZD) | 17:00 | 9:30 |

| 日圓(JPY) | 17:00 | 9:15 |

| 瑞士法朗(CHF) | 17:00 | 15:45 |

| 泰幣 (THB) | 17:00 | 11:00 on the day before the intended transfer date |

Note: The above cut- off time is only applicable to clearing days (i.e Monday – Friday) . For submission during non- clearing days ( i.e. Saturday) and public holidays, the processing will be moved to next clearing day.

Once receiving your remittance instruction, our bank will remit out the funds once all internal reviews and processing completed.

Based on different factors such as remittance currency, amount, destination & payee type, the bank will instruct available and appropriate payment intermediaries to execute the remittance. At the same time, payment intermediaries may also conduct additional reviews to further ensure compliance with regulations. Afterwards, the beneficiary will receive the funds .

The process normally takes 1-5 working days to complete.

The Bank will execute your remittance instruction once we debited the remittance amount from your account. We will remit the payment after all relevant internal procedures have been cleared. As we may contact you for additional documents such as income proof, address proof, customer ID, and information on source of funds to complete the internal procedures, please pay attention to the contact number +852 3843 9988 and provide the required additional documents in time to avoid any processing delay.

The day when the beneficiary receives the fund depends on several factors, such as processing time needed by the intermediary bank(s)/ beneficiary bank and the clearing mechanism of local and beneficiary bank. It may take longer time for payment to countries where exchange control is in place, or where it is the beneficiary bank’s requirement to release fund only upon contact with the beneficiary, or if the payment has to go through a number of intermediary banks.

To ensure your remittance application can be processed timely, please ensure the correctness & completeness of the information you provided on the application form.

For remittance in certain currencies ( e.g. KRW, MOP and TWD), foreign exchange controls may be in force. Or for remittance to certain destinations , the bank may need to appoint several payment intermediaries to process your instruction hence may result in longer fund delivery time. You should reserve sufficient time and assess the risks before initiating any remittance in such currencies / to such destinations.

Service Charges

Please refer to the Outward Remittance section of our latest service charge booklet. You are reminded to ensure the balance in your account is sufficient to cover all applicable charges, in order to avoid any processing delays of your remittance instruction.

The bank may instruct different payment intermediaries / correspondent banks to execute the remittance instruction based on the payee account type, remittance destination, currency, and amount. Hence resulting in different charges.

Correspondent bank charge is the handling fee charged by corresponding banks for executing the remittance instruction. For details, please refer to the Outward Remittance section of our latest service charge booklet.

In general, correspondent bank charge is waived for remittance made to individual account in domicile currency, with amount below HKD1,000,000 per transaction to Australia, Canada, Euro Zone Countries¹, Singapore, UK and US via Online Banking / SC Mobile.

However, there are some exceptions where correspondent banks charges still apply:

- Payment made by client with US/ Canada address

- Payment made to payee’s account with a BIC/SWIFT code not on the list of The Association of Banks (ABS) in Singapore: https://www.abs.org.sg/docs/library/swift_bic_codes.pdf

- Other scenarios whereas the payment must transfer via SWIFT network

¹ Includes the following countries: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Lichtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Republic of Ireland, Romania, Slovakia, Slovenia, Spain, Sweden and Switzerland.

You can request the charges to be paid by yourself , shared between yourself and the payee or fully borne by the payee* :

- If you request the charges to be paid by yourself, the bank will deduct the service fee and minimum HK$250 correspondent bank charges from your account.

- If you request the charges to be shared with payee, the bank will deduct the service fee from your account, while the correspondent bank charges will be deducted directly from the remittance amount by the beneficiary bank.

- If you request the charges to be fully borne by payee, both service fee and correspondent bank charges will be deducted from the remittance amount. This option is only available for remittance application submitting at branches

We recommend selecting all charges to be paid by yourself , as to ensure the full remittance amount will be received by the beneficiary.

Foreign Exchange

For remittance in AUD, CAD, CHF, CNY, EUR, GBP, JPY, NZD, SGD, USD, DKK, INR, NOK, SEK, THB and ZAR via Online Banking / SC Mobile, real-time Fx rate will be displayed on the “ Submit Transfer” screen and guaranteed for a minute.

For remittance in other currencies via Online Banking / SC Mobile, or remittance via branch, the exchange rate displayed is indicative only . The final rate applicable will be the prevailing Fx rate on the date we process your payment. You may refer to bank statement or Outward Remittance Advice for the FX details.

Please note that all remittance instructions made via SC Mobile or Online banking, with foreign currency exchange performed on spot, are entitled to participate in the FX Membership program (except for instructions involving CNY or cancelled transactions). For details, please visit https://www.sc.com/hk/investment/foreign-exchange/ and refer to Terms and Conditions of the FX Membership program set out on the website.

Transaction Enquiry

You will receive a SMS to confirm the instruction your account has been debited. We will then send you an Outward Remittance advice with the instruction details to confirm that your remittance have been processed and send out from the bank.

In such case , funds will be credited back to your account and a remittance advice for this returning fund will be sent to you.

If your instruction is rejected due to incorrect payee details, we recommend you reaching out to the beneficiary and collect the latest information before attempting to submit the instruction again. If the instruction is rejected again, we suggest exploring alternative payment methods that better suits your needs.

Yes, in general, you will be able to get the refund. Please note, shall the refund involves Fx , the returned amount may be different from the original sending amount Also if the rejection is due to insufficient funds in the debiting account, a penalty charge of HKD $100 will be imposed.

You can request for an investigation by filling in the application form , provide below details . and return the form to any of our branches:

- Transaction Reference Number , date and amount

- Beneficiary full name and account number

An enquiry fee of HK$250 will be imposed. Please refer to our latest service charge booklet for details.

Yes. Shall you need to cancel or amend your instruction, you can complete the Outward Remittance Cancellation / Amendment Request Form (OR013G) and submit to any of our branches.

The Bank will charge a fee of HKD250 for each cancellation or amendment instruction, as well as any additional charges imposed by intermediary bank if applicable. Please refer to our latest service charge booklet for details.

Cancellation or amendment of any processed remittance instructions subject to the consent of the payment intermediaries, correspondent, or beneficiary banks. The bank reserves right to accept or reject any amendment instructions such as amendment of beneficiary name and/or beneficiary account number) at our sole discretion irrespective of whether the instruction has already been effected.

Remittance to China – General Purpose

Yes, you can remit to your same name account in Mainland China. HKID card holder can remit up to RMB80,000 per person as per latest RMB Remittance Regulations. Remittance to the Mainland China or other places outside Hong Kong for HKID card holder is subject to local rules and requirements of Mainland China or the relevant jurisdictions. Outward remittance may be rejected due to local regulatory requirements.

Your account will be debit once we processed your instruction. Shall you find your account yet to be debited within a reasonable time, please call to our hotline requesting for an investigation.

Please be reminded that when remitting to China, the payee name you provided must be exactly the same as the one registered in beneficiary bank record. You are suggested to enter the name in PingYin to ensure accuracy.

Remittance to China - Property Purchase

You can remit in any currencies , e.g. HKD, USD and RMB.

If the remittance is in RMB, you must first complete the Outward Remittance Application form and submit to any of our branches in person. On the form, please select “Property Purchase in the Greater Bay Area (CCTFDR)” option in Purpose of Remittance Section, input the property address after the pre-filled Chinese Commercial Code “1129 3494 0575 6356 2075” in Payment Details Section and notify branch staff the payment is for property purchase upon submitting the form. Besides, the remittance currency and debit amount must be in CNY.

If the remittance is in other currencies, you can submit your application via Online Banking or SC Mobile.

It is not required to submit any documents to us to support the remittance.

Remittance via Online Banking / SC Mobile

The limit is pre-set as 0. You can adjust the limit in SC Mobile App* under “Services” > “Pay & Transfer” > “Manage Transfer Limits” > or in Online Banking under "My Preferences” > “Daily Limit Maintenance”.

Shall you do not have any remittance transaction via Online Banking / SC Mobile for more than 13 months, the limit will be reset as 0 and you will need to set it again.

*You need to update the SC Mobile App to the latest version. Refer SC Mobile App Download for details.

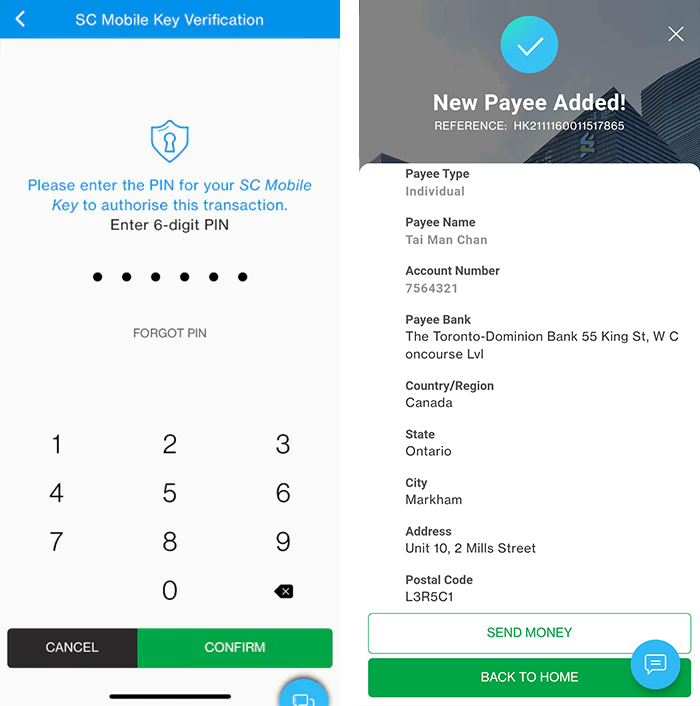

You need to first add a payee then initiate transfer. Please refer to here for detail guidance.

Beneficiary bank information may change from time to time . The accuracy and completeness of payee information will affect the time taken and handling fee imposed by the payment intermediaries to execute the remittance instruction. You are encouraged to update the payee details as per instruction, before initiating any remittance transaction.

Yes, you can do so by selecting the appropriate transfer date and frequency when inputting the transfer details. The date set must be within 3 years of the application date. If you wish to set a recurring transfer, the minimum frequency is 2.

You can view the latest 20 remittance transactions within the past 3 months via “Transfer”> “International Transfer”> “Recent Transactions”. Please note that Renminbi remittance to the mainland China and instruction involving Chinese character encoding will not be shown on this section.

If you wish to check upcoming scheduled transfers, please click the “Scheduled transaction” button on the “ Recent Transactions” page.

Manage your finances on the go

Experience SC Mobile App now

Scan QR code to download SC Mobile App now

for Android users without Google Play, please click here to download the Android application package (APK)