Faster Payment System (FPS) – Real-time transfers and payments for free

Faster Payment System (FPS) – Real-time transfers and payments for free

Faster Payment System (FPS)

Explore transfer and payment services by FPS for managing your daily finances easier

Convenience with SC Pay (FPS)

Enter only mobile number, email address or FPS ID to start sending money – Bank account number is no longer needed

Pay at ease with QR code

Pay in merchant app or website

Why SC Pay (FPS)

24/7 Instant payment and transfer

Send or receive money instantly with just a mobile number, email address or FPS ID – Bank account number no longer needed

Transfer from bank account or credit card

Add flexibility to choosing your source account while paying via SC Pay (FPS)

Pay in Hong Kong Dollar or Renminbi

Real-time and free of charge local transfer in both currencies

Pay in a fun way

Delight your friend with fun-filled animated stickers created by popular illustrators upon each successful transaction via SC Pay (FPS) Learn more

- From 1 August 2021 onwards, if you have enabled Push Notification service in SC Mobile App or maintained your email address with the bank, instead of SMS, you may receive email or Push Notification when you receive money via FPS.

- The daily limit of Non-registered Payee Transfer is uplifted to HKD300,000 effective from 25 June 2023. For details, please refer to here .

SC Pay (FPS) made payment easier

How to register SC Pay (FPS)

How to register SC Pay (FPS)

-

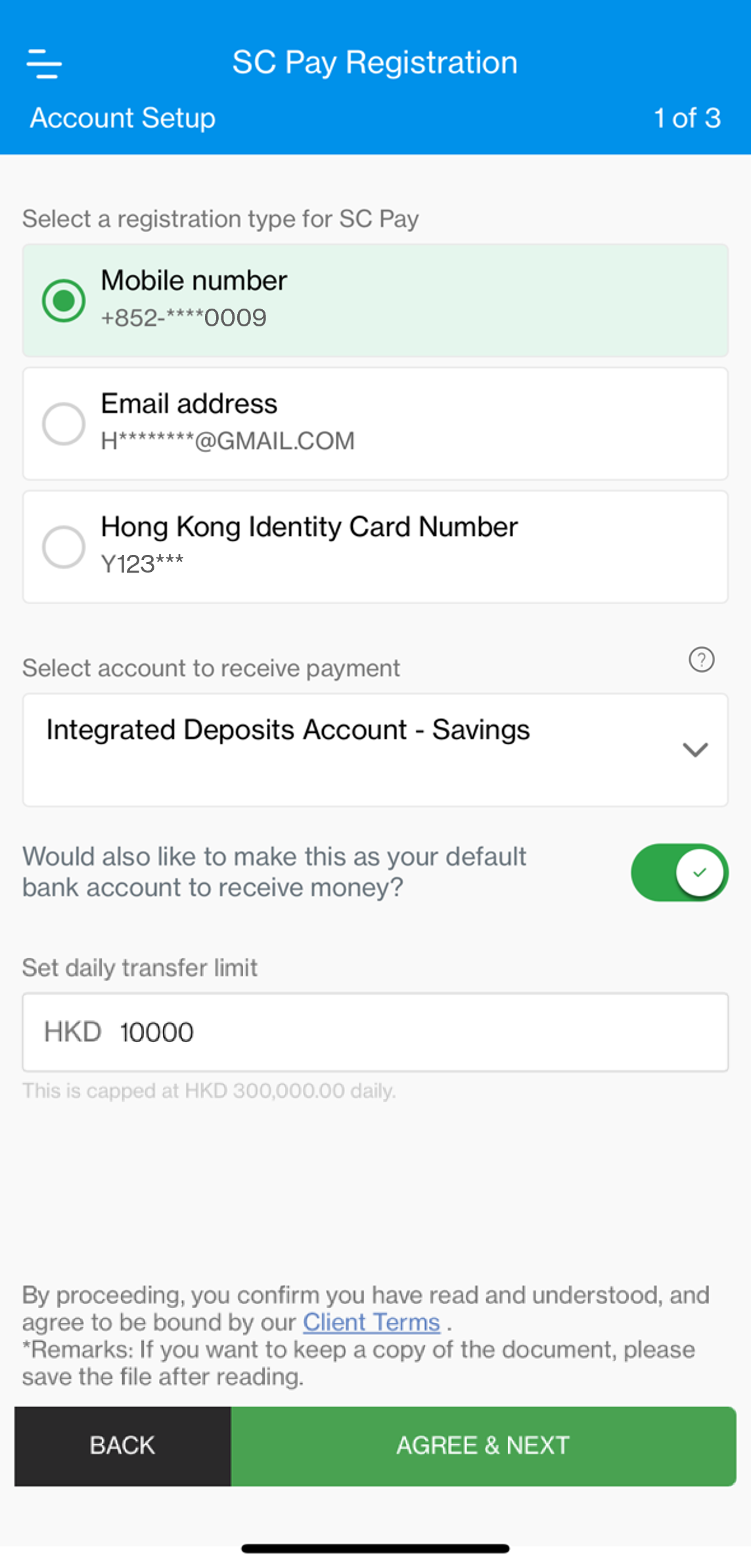

Step 1

After login to SC Mobile App, go to ‘Pay & Transfer’ then select ‘Manage’ and ‘SC Pay (FPS) Registration and Settings’

-

Step 2

Select mobile number or email address to register with, then your bank account to send and receive money (Note: HKID only allows receiving money from institutions).

You can also set Standard Chartered Bank as your FPS default receiving bank and change the pre-set daily transfer limit (maximum HK$300,000).

-

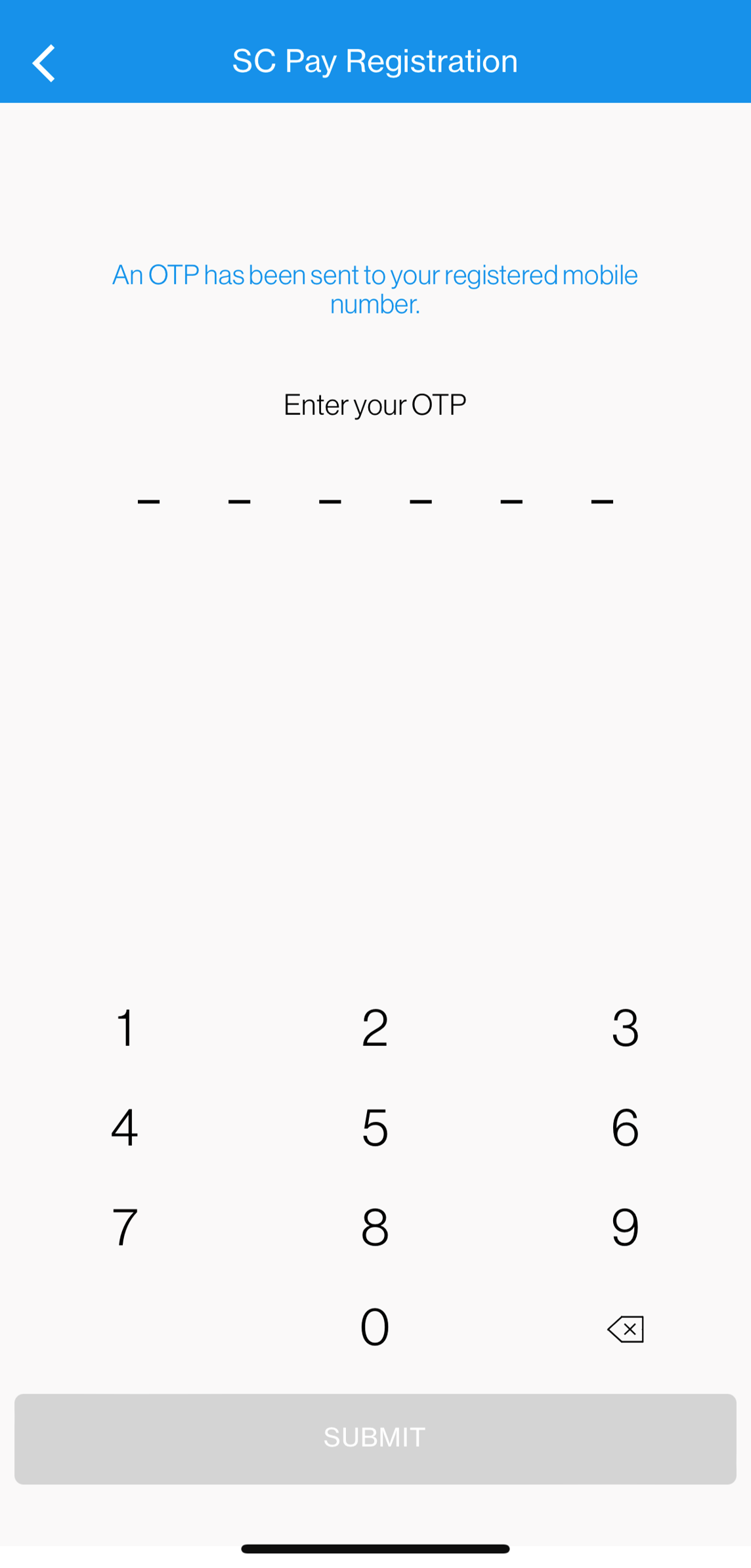

Step 3

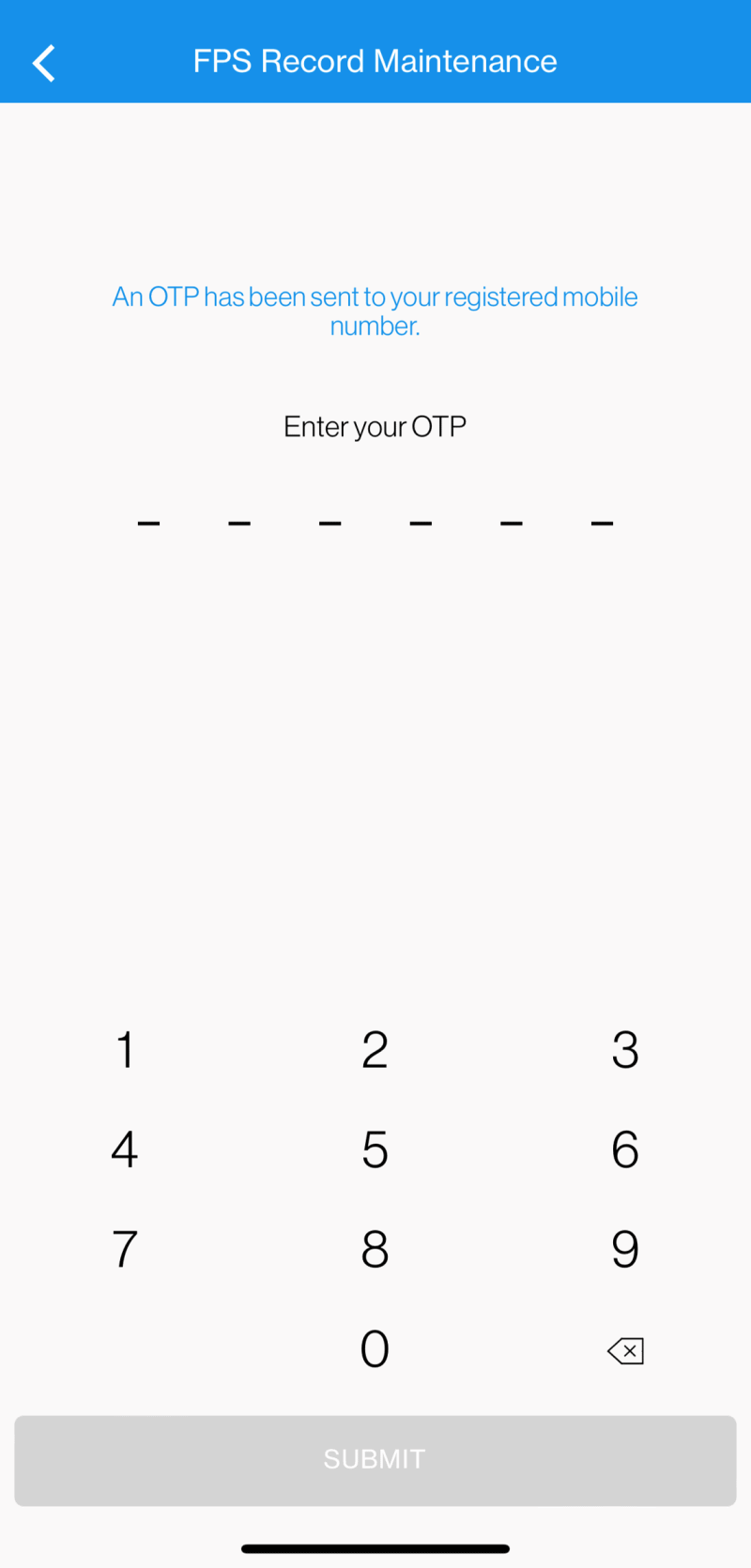

Enter SMS or email One-Time Password (OTP) to authenticate the registration

-

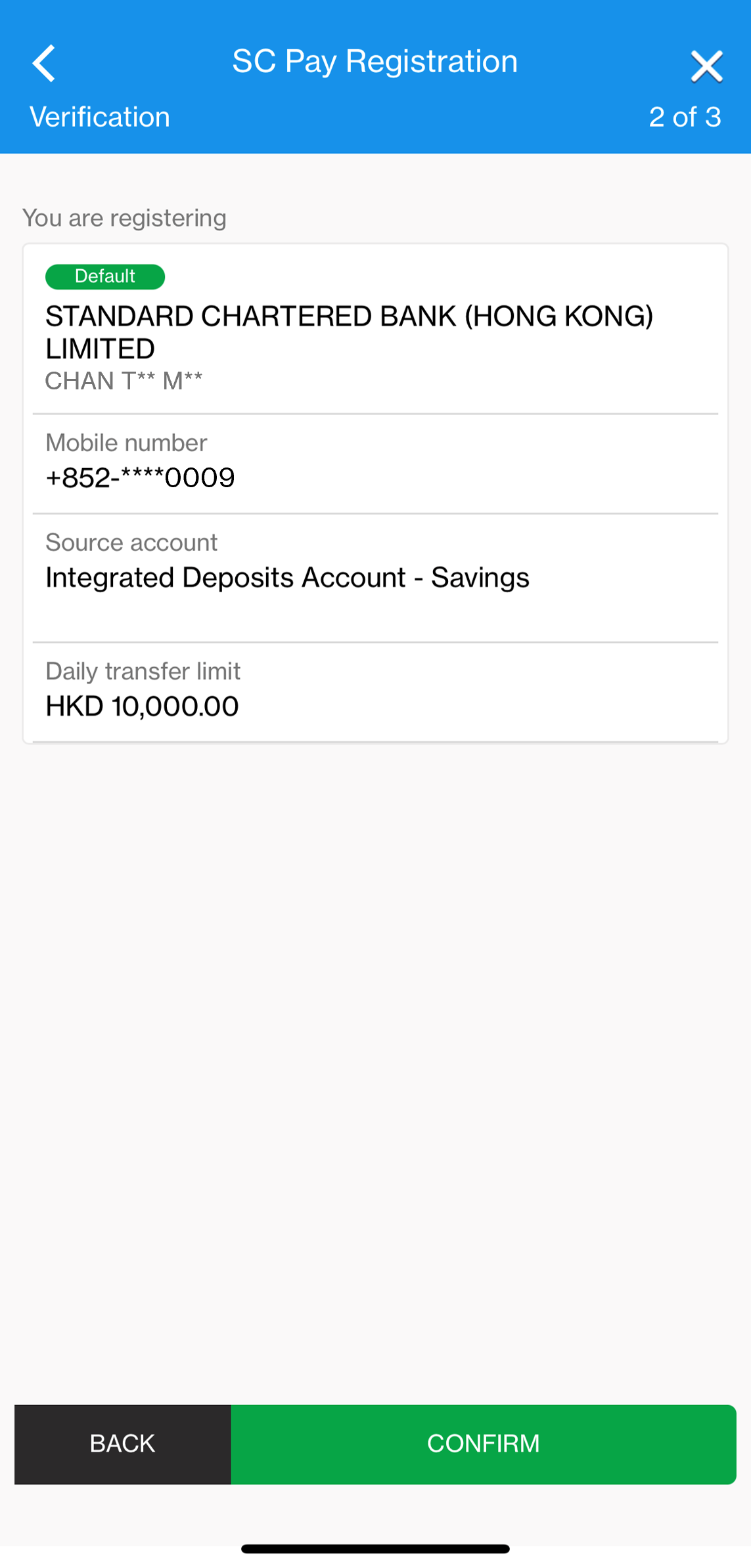

Step 4

Review registration details and tap ‘Confirm’ to complete

How to register SC Pay (FPS)

Step 1

After login to SC Mobile App, go to ‘Pay & Transfer’ then select ‘Manage’ and ‘SC Pay (FPS) Registration and Settings’

Step 2

Select mobile number or email address to register with, then your bank account to send and receive money (Note: HKID only allows receiving money from institutions).

You can also set Standard Chartered Bank as your FPS default receiving bank and change the pre-set daily transfer limit (maximum HK$300,000).

Step 3

Enter SMS or email One-Time Password (OTP) to authenticate the registration

Step 4

Review registration details and tap ‘Confirm’ to complete

- Transfer with SC Pay (FPS)

- Share personalised sticker

Transfer with SC Pay (FPS)

-

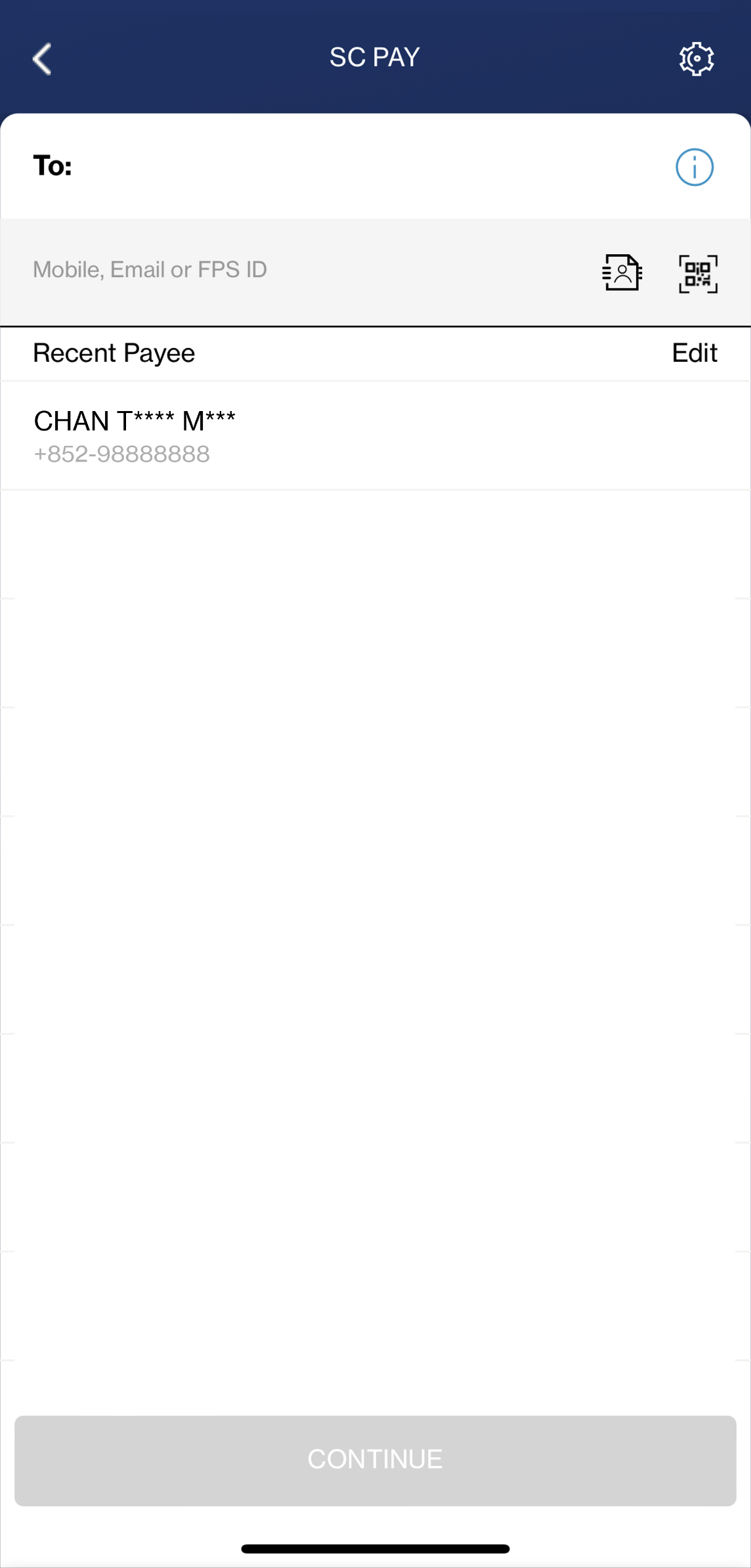

Step 1

Choose payee from phone book or enter payee’s mobile number/email/FPS ID

-

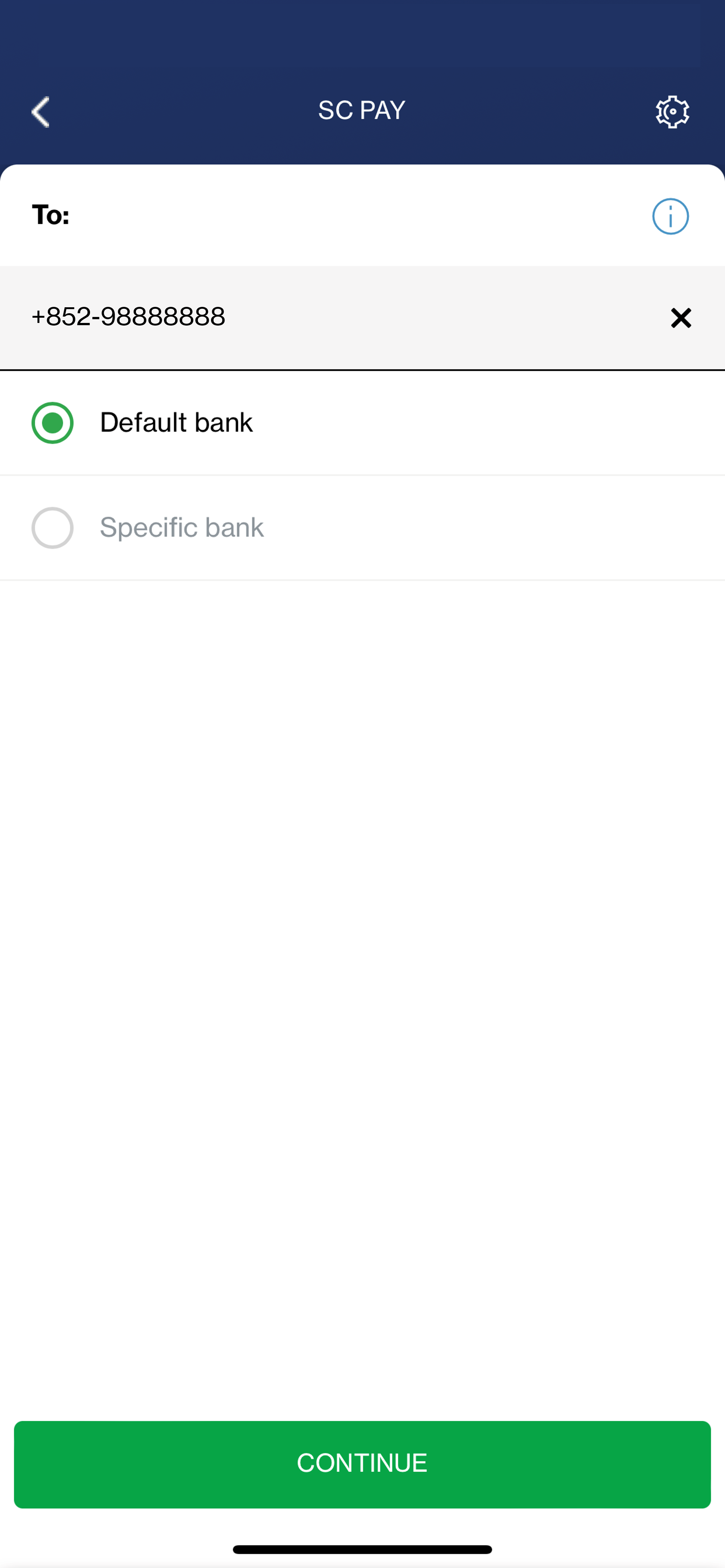

Step 2

Choose sending money to payee’s default bank account or specific bank account

-

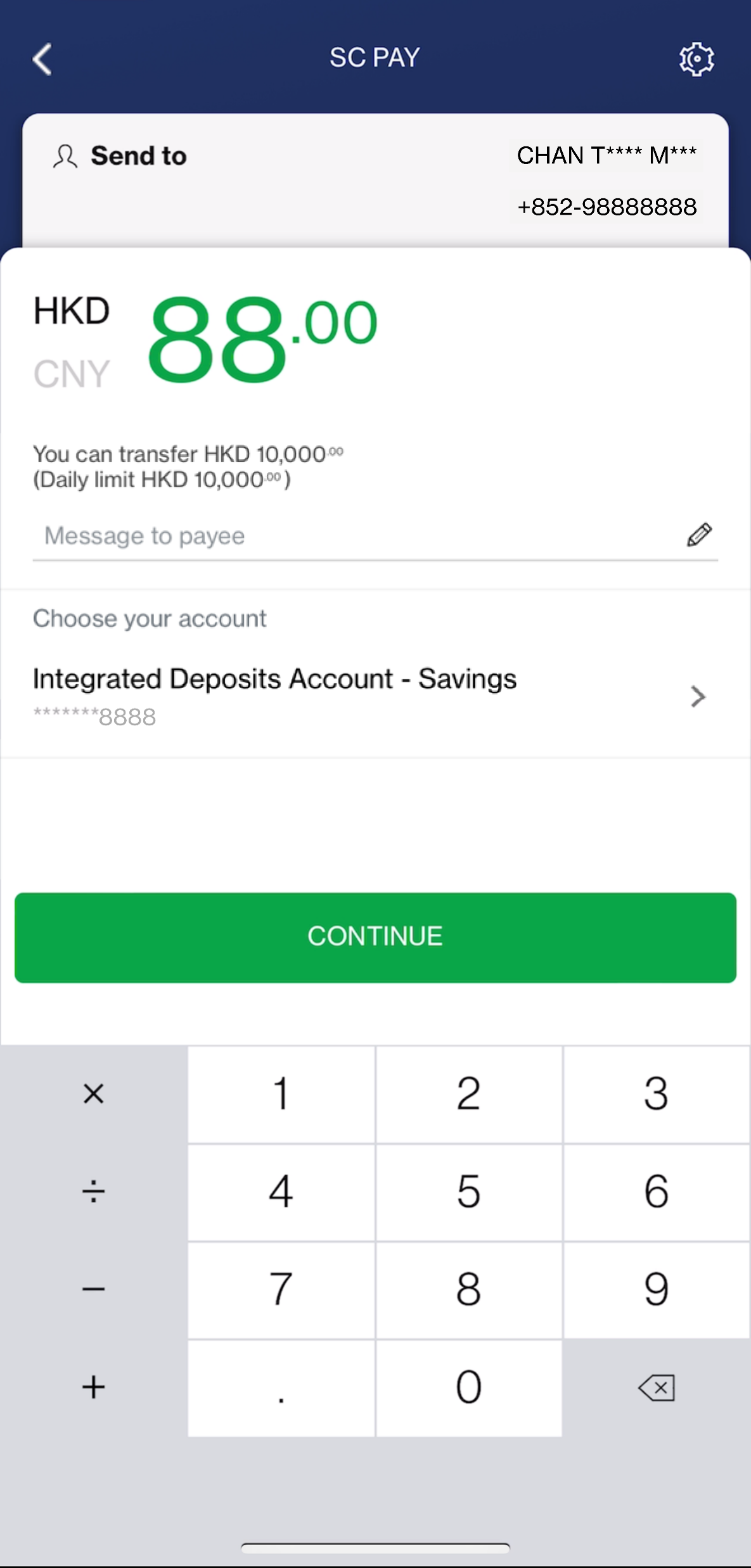

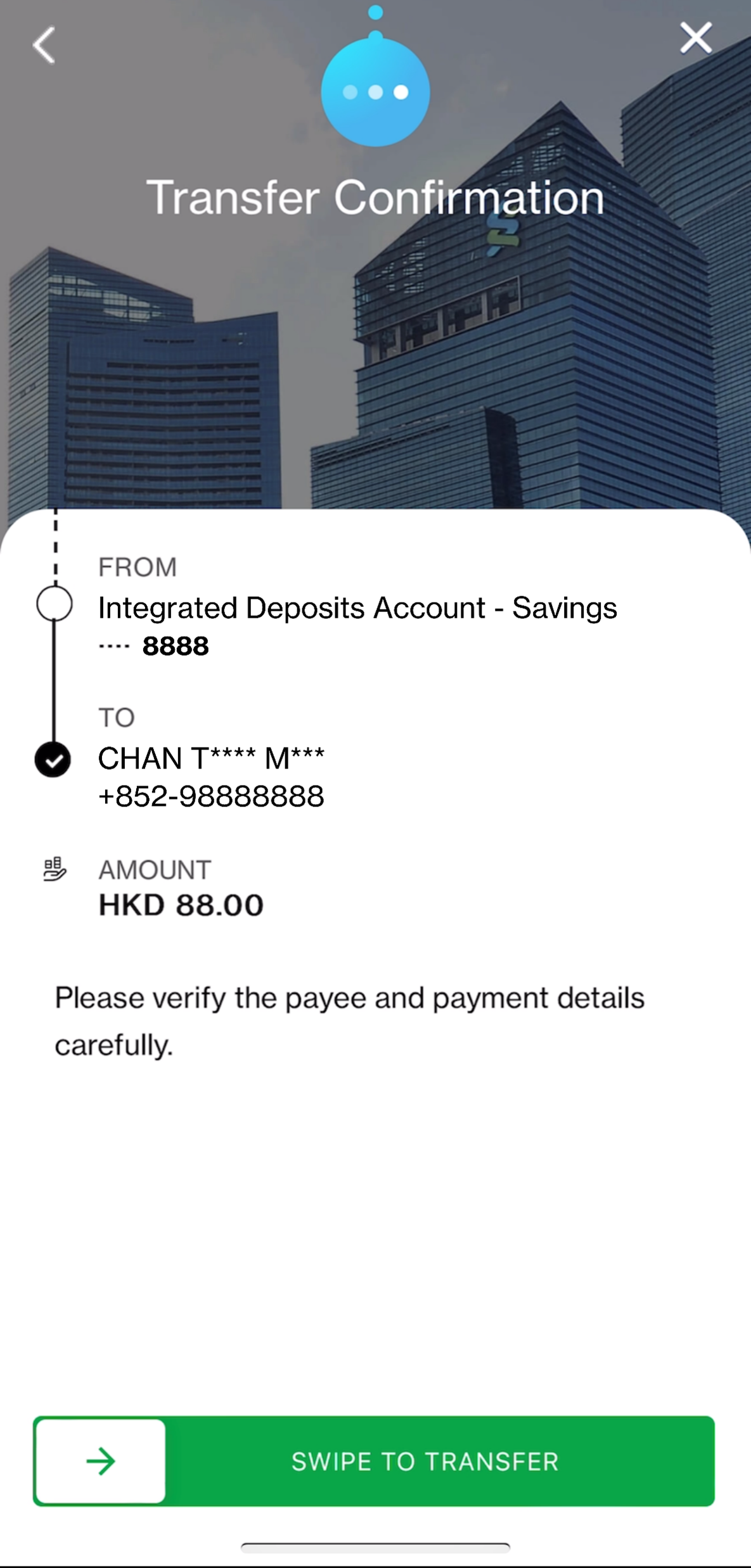

Step 3

Enter transfer amount and payment description (optional)

-

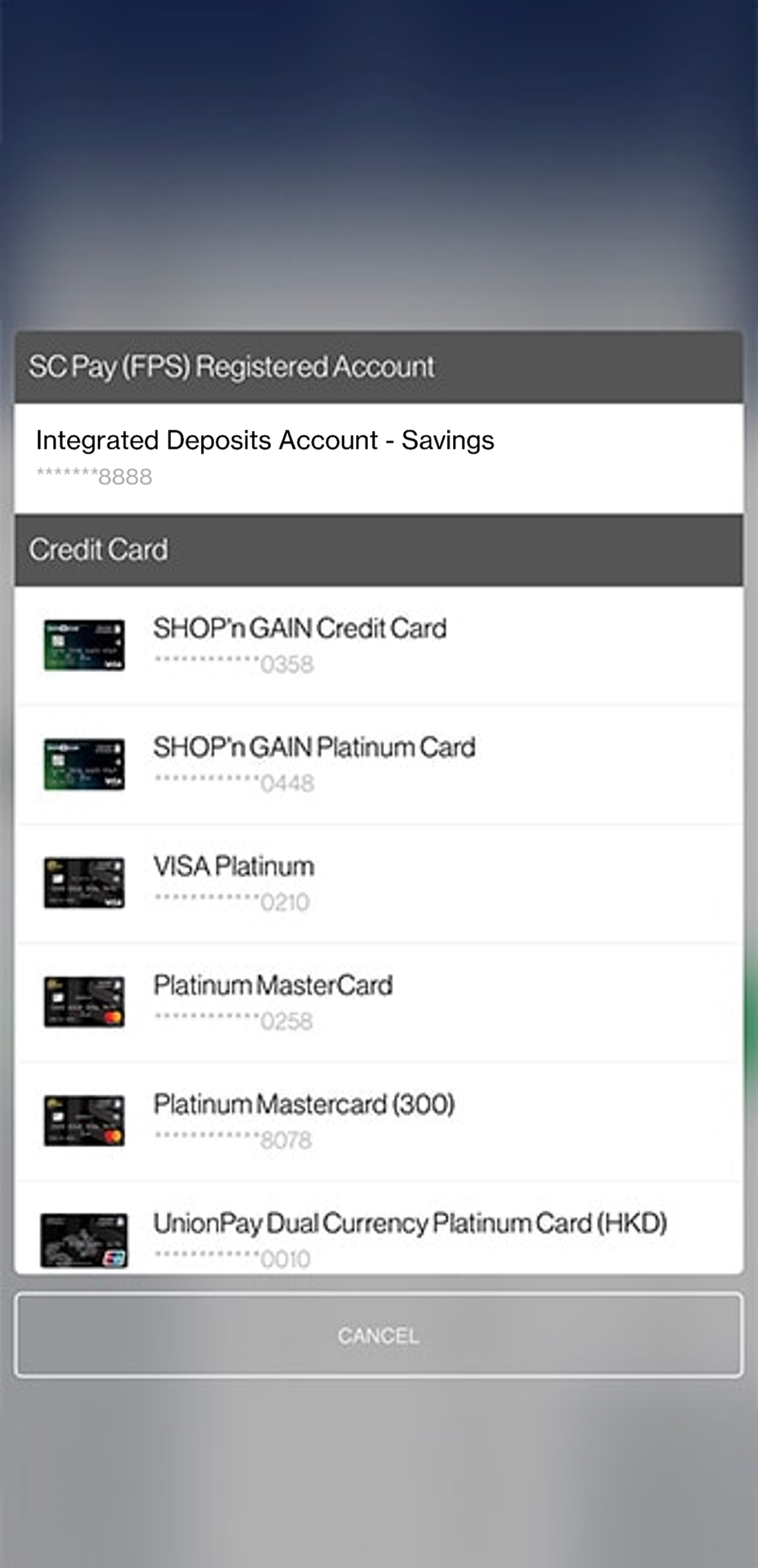

Step 4

Select source account – You may send money from chosen current/savings account or credit card

-

Step 5

Review details and confirm transfer

-

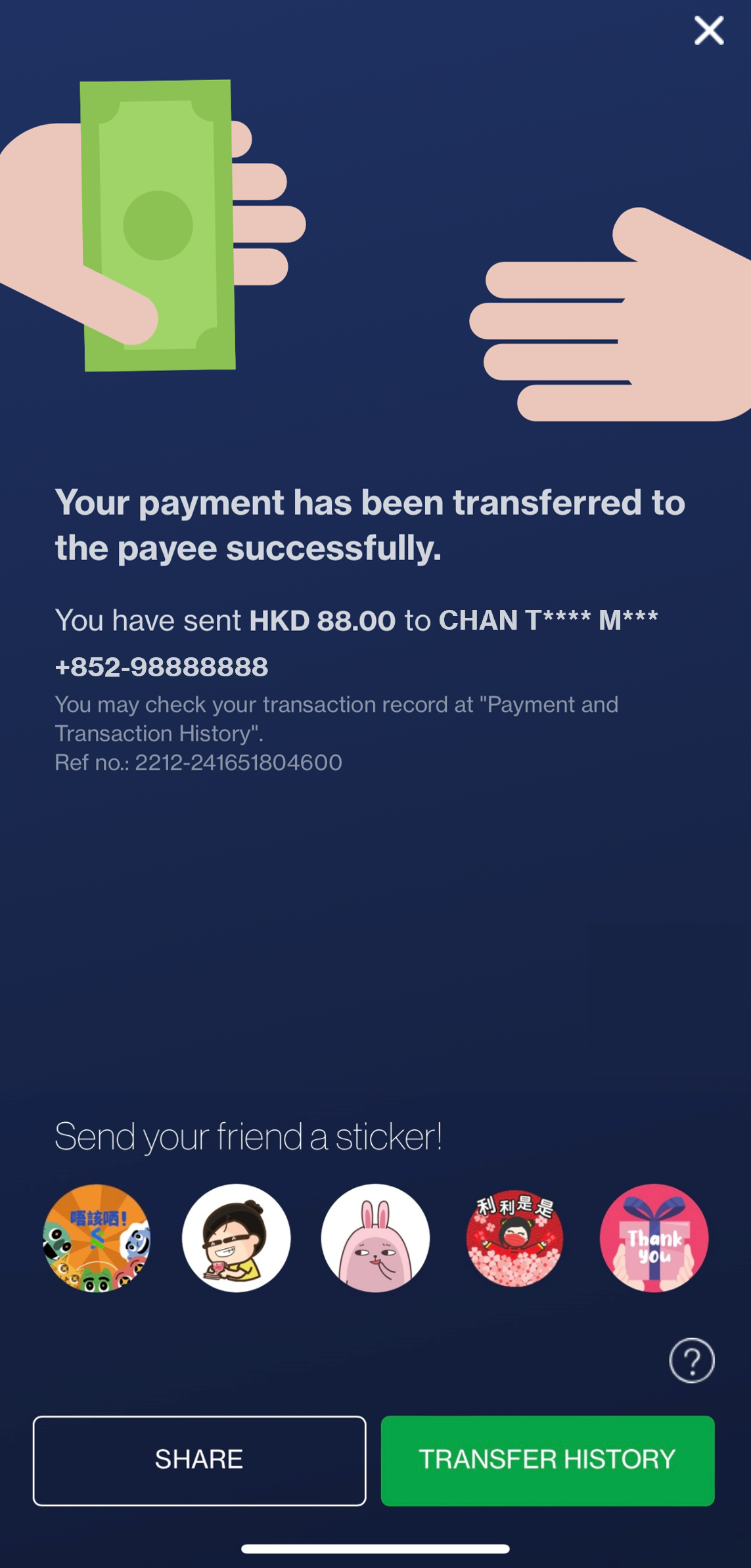

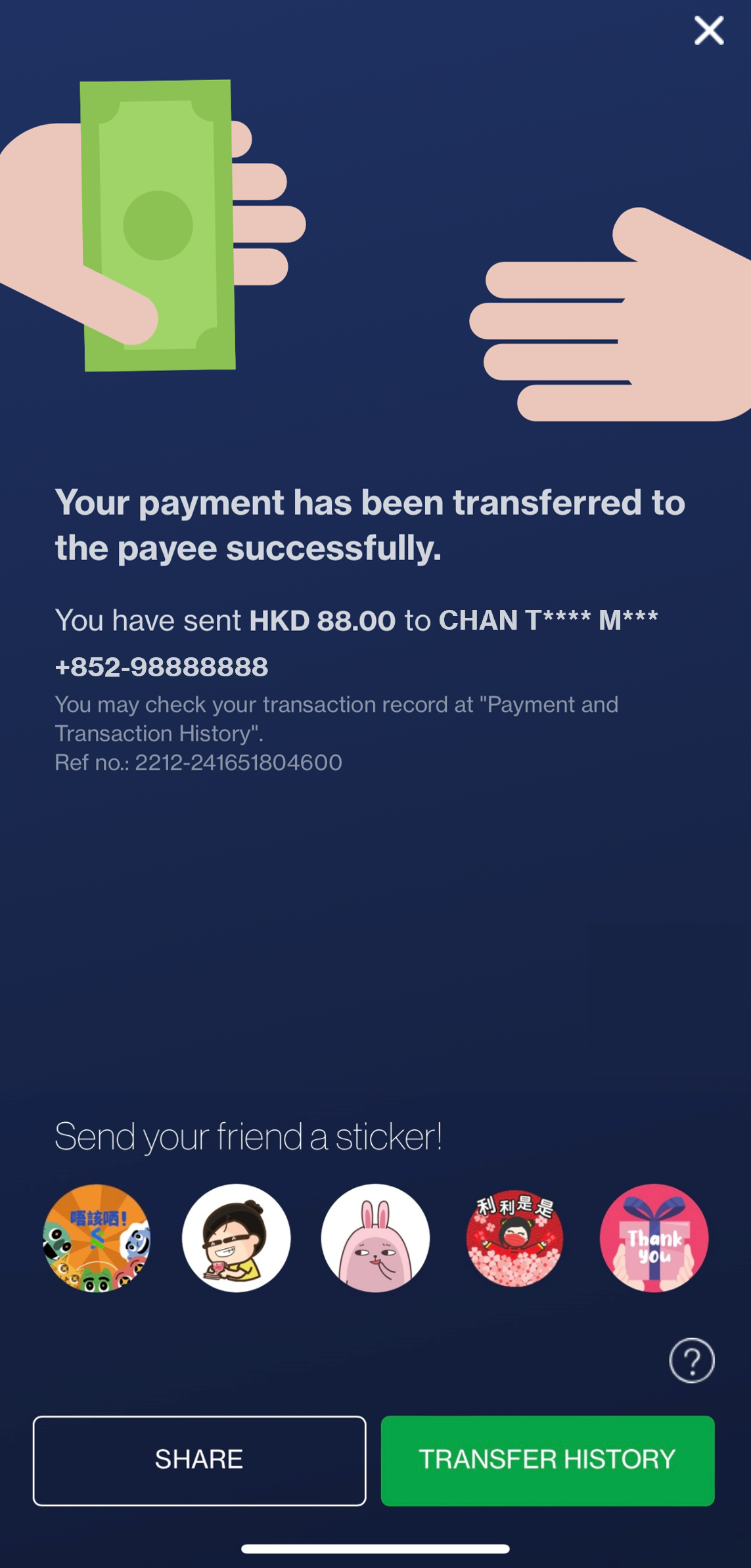

Step 6

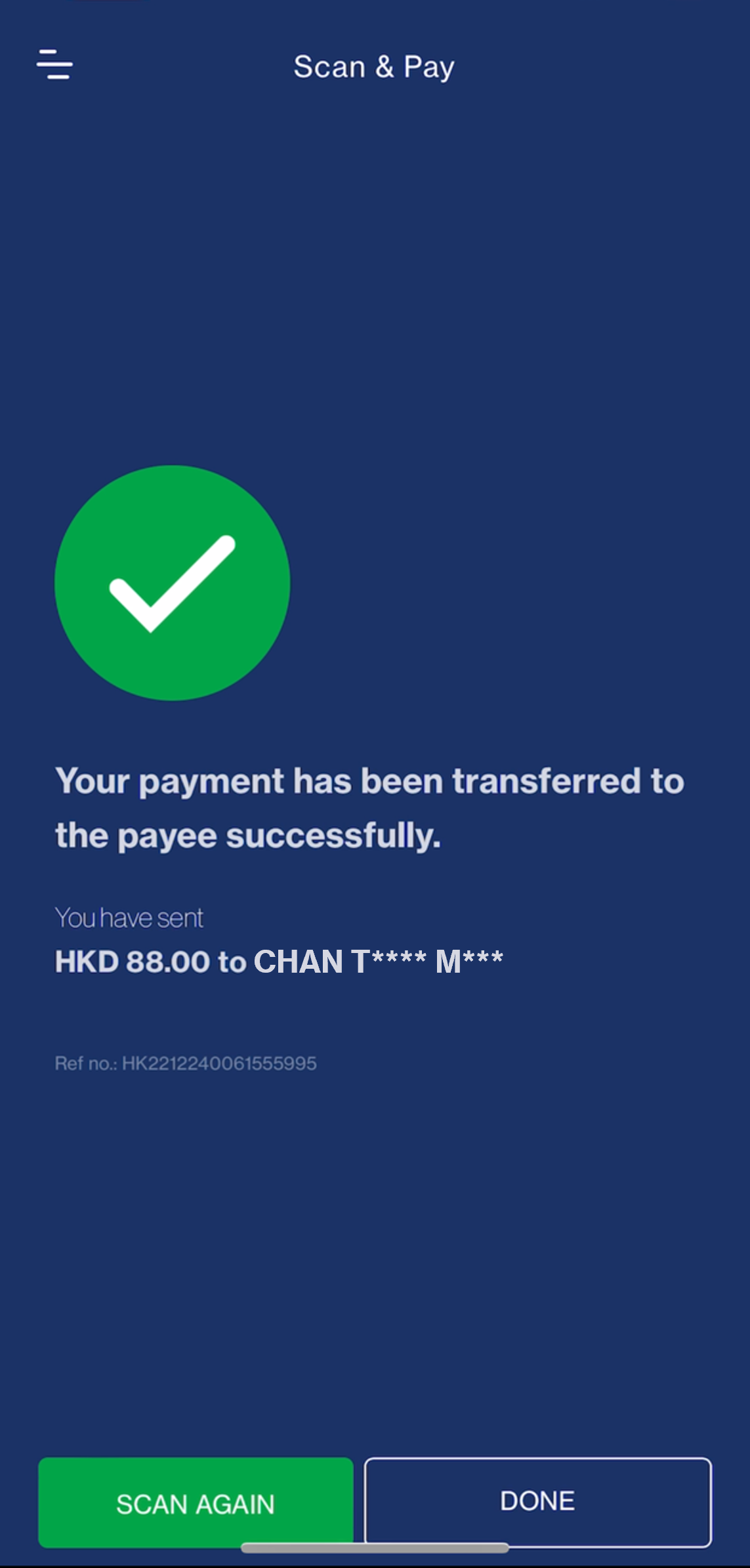

You will immediately know whether the transfer is successful

Transfer with SC Pay (FPS)

Step 1

Choose payee from phone book or enter payee’s mobile number/email/FPS ID

Step 2

Choose sending money to payee’s default bank account or specific bank account

Step 3

Enter transfer amount and payment description (optional)

Step 4

Select source account – You may send money from chosen current/savings account or credit card

Step 5

Review details and confirm transfer

Step 6

You will immediately know whether the transfer is successful

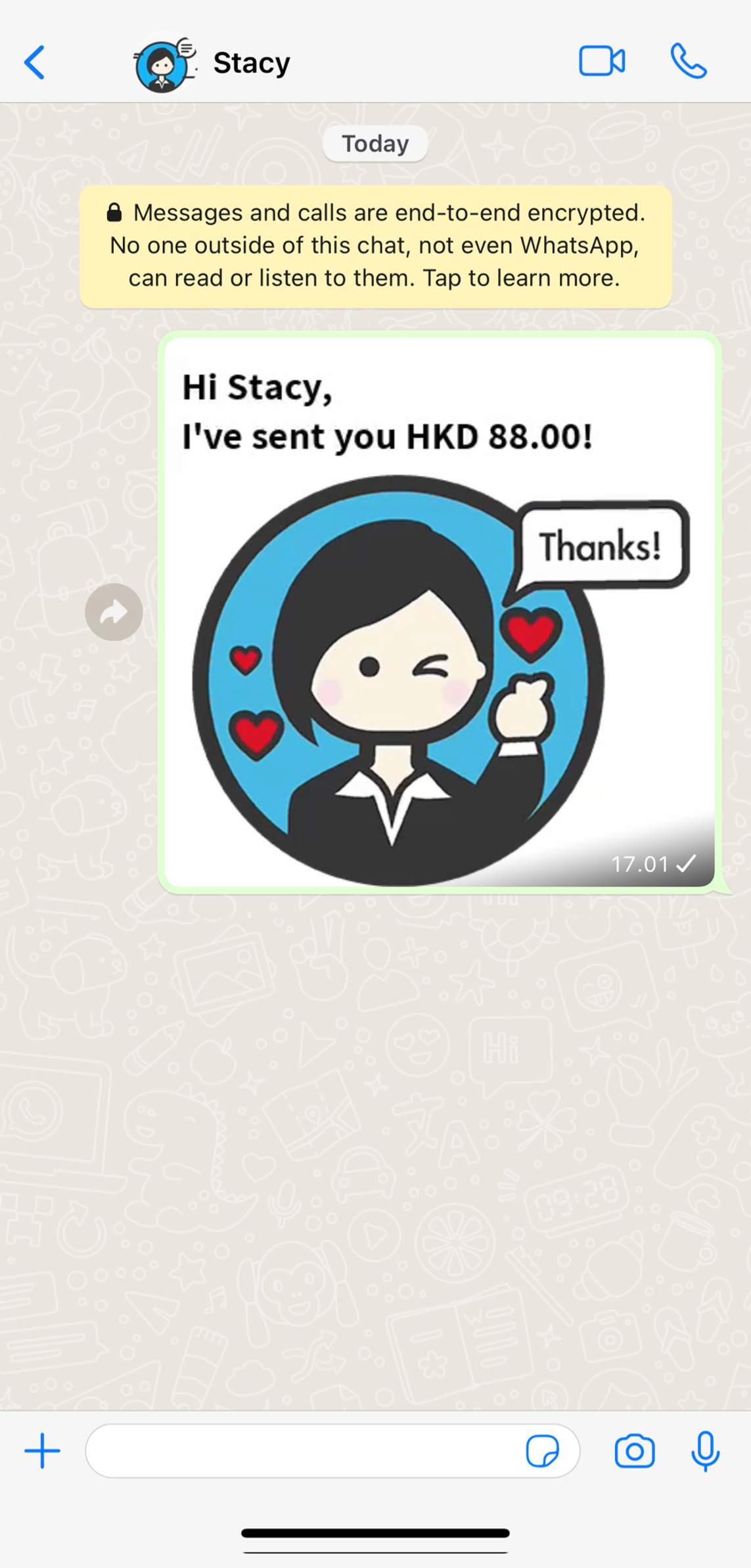

Share personalised sticker

-

Step 1

Upon successful transfer, go to select a sticker by tapping any of the 5 theme icons or ‘Share’

-

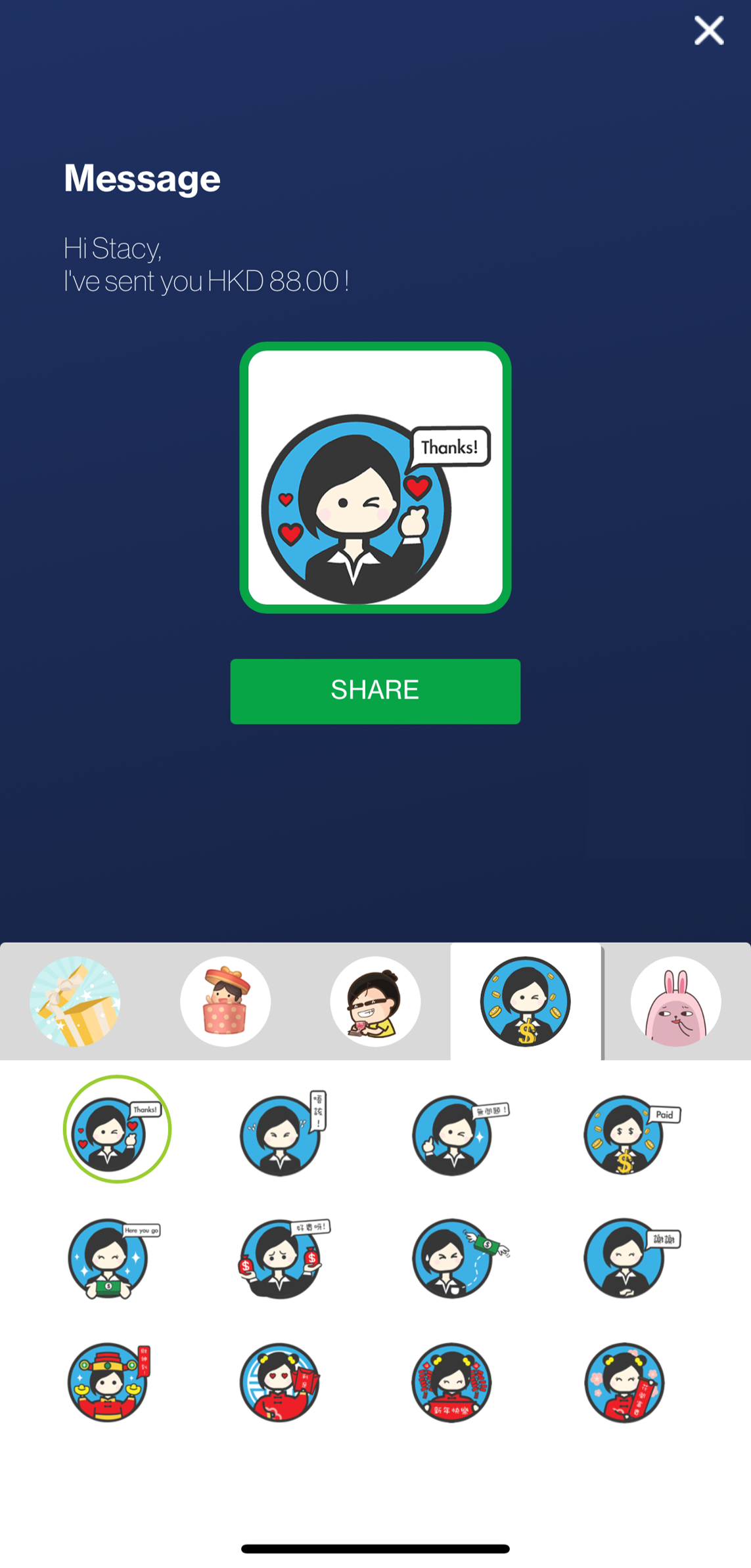

Step 2

Choose a sticker from 5 themes

-

Step 3

After choosing a sticker, transfer amount and payee name in your phone book (if any) will be automatically added. Then select the messaging platform for sharing the sticker

-

Step 4

Send the sticker to your friends to notify them of the transfer you have made

Share personalised sticker

Step 1

Upon successful transfer, go to select a sticker by tapping any of the 5 theme icons or ‘Share’

Step 2

Choose a sticker from 5 themes

Step 3

After choosing a sticker, transfer amount and payee name in your phone book (if any) will be automatically added. Then select the messaging platform for sharing the sticker

Step 4

Send the sticker to your friends to notify them of the transfer you have made

- Send

- Receive

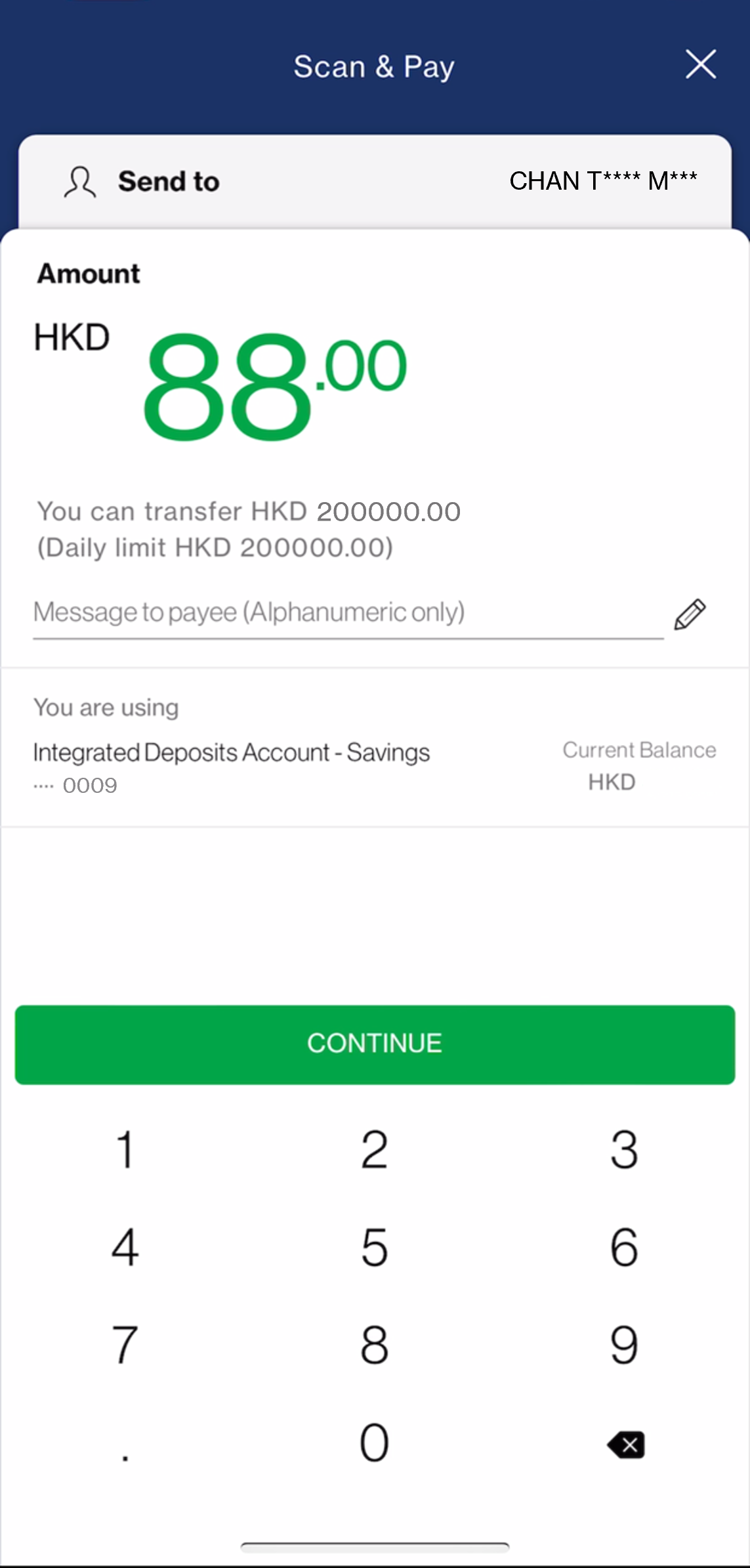

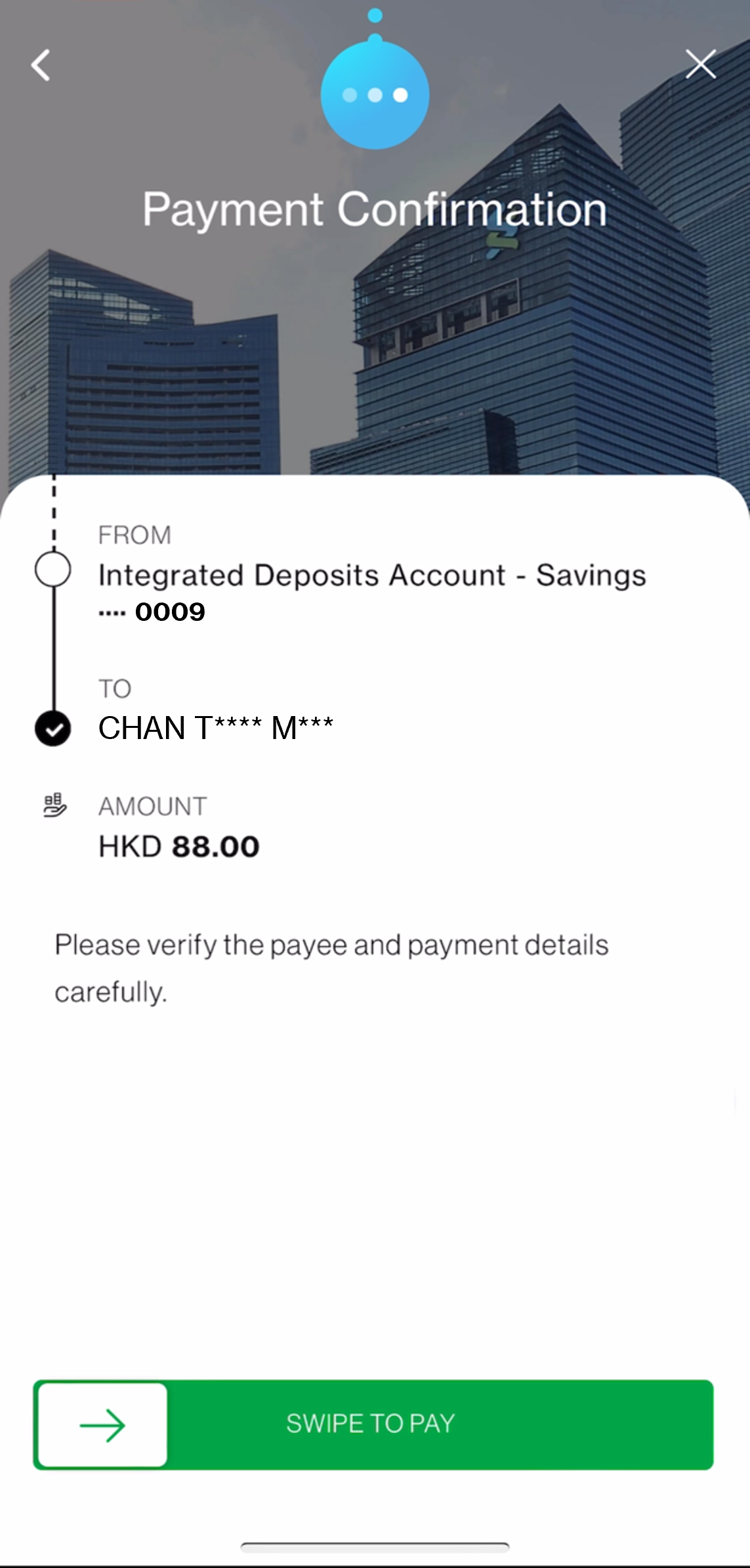

Send

-

Step 1

Select ‘Scan & Pay’ in ‘Pay & Transfer’

-

Step 2

Scan QR code or import from your phone album

-

Step 3

Enter transfer amount (if applicable) and payment description (optional)

-

Step 4

Review details and confirm transfer

-

Step 5

You will immediately know whether the transfer is successful

Send

Step 1

Select ‘Scan & Pay’ in ‘Pay & Transfer’

Step 2

Scan QR code or import from your phone album

Step 3

Enter transfer amount (if applicable) and payment description (optional)

Step 4

Review details and confirm transfer

Step 5

You will immediately know whether the transfer is successful

Receive

-

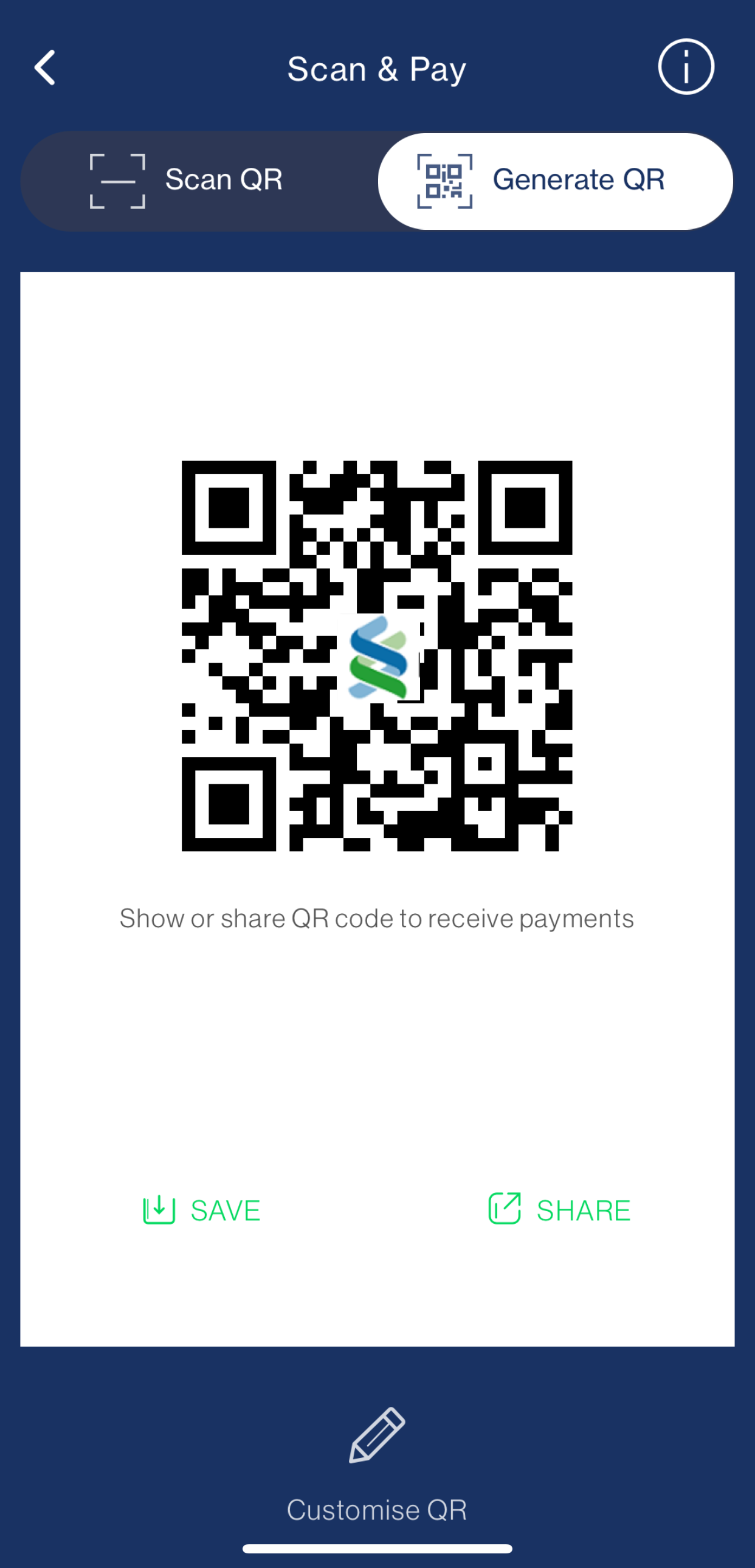

step 1

Tap ‘Generate QR’ and share for receiving money. If you wish to specify the amount, tap ‘Customise QR’.

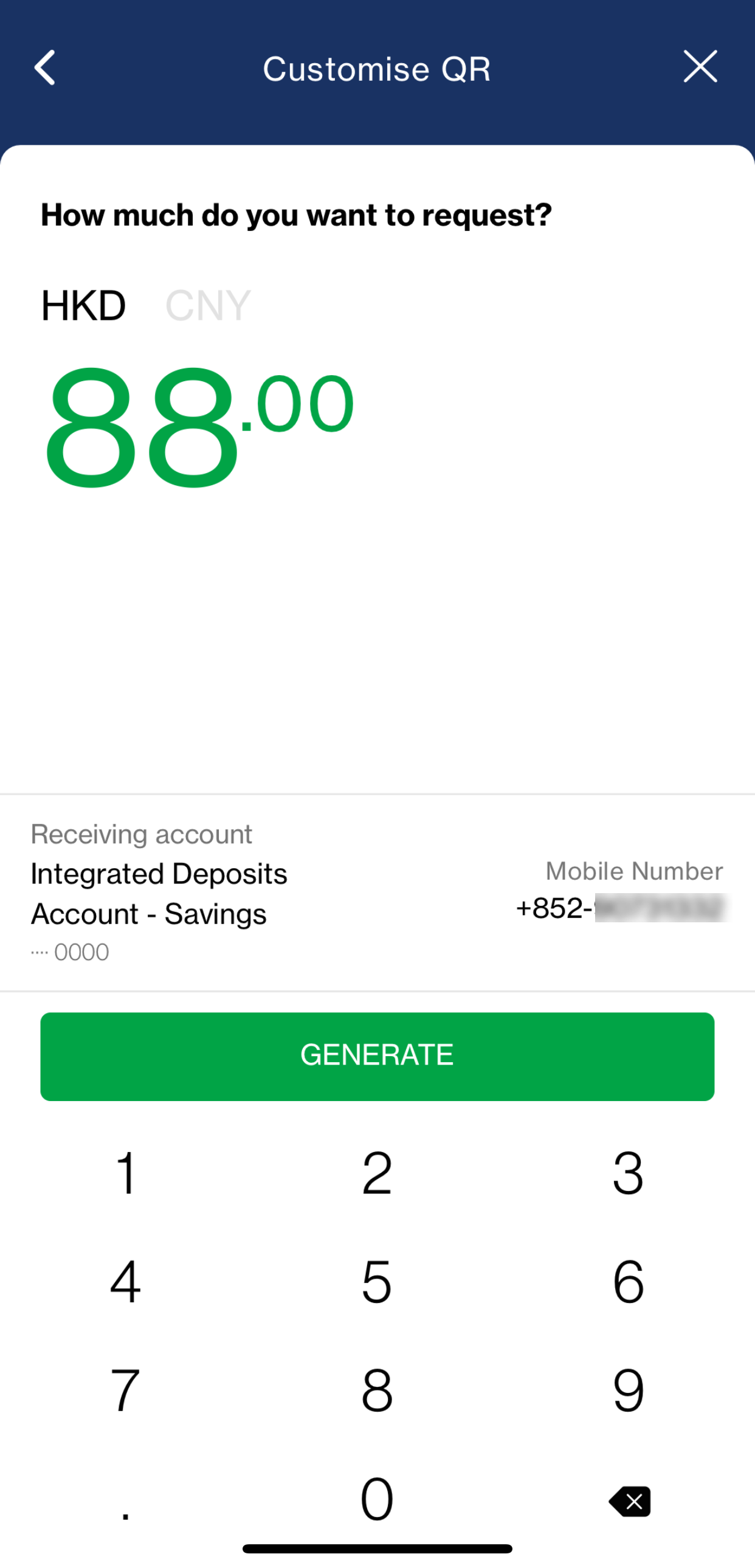

-

Step 2

Specify request amount then tap ‘Generate’

-

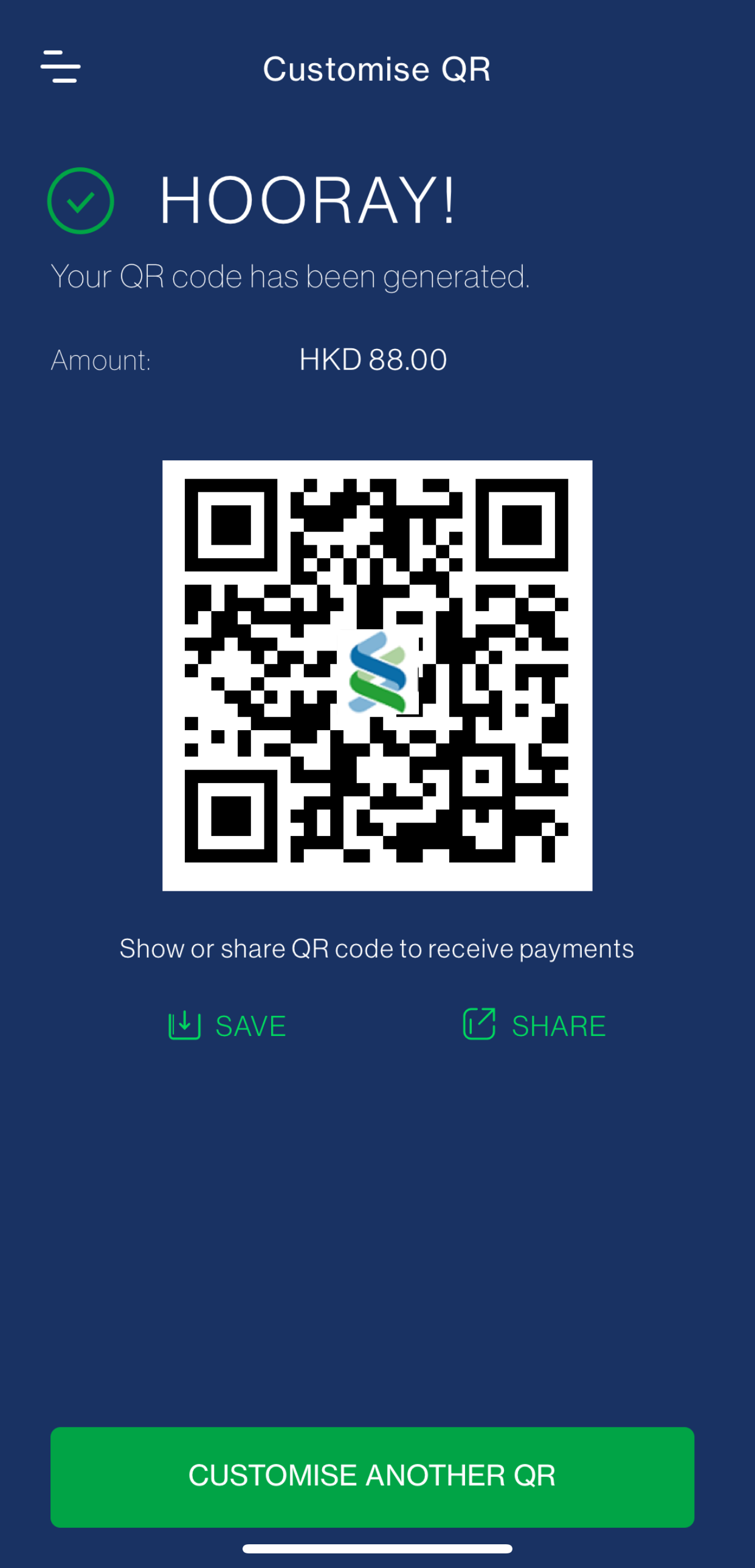

Step 3

QR code with specified amount is generated - You can now share to receive payments

Receive

step 1

Tap ‘Generate QR’ and share for receiving money. If you wish to specify the amount, tap ‘Customise QR’.

Step 2

Specify request amount then tap ‘Generate’

Step 3

QR code with specified amount is generated - You can now share to receive payments

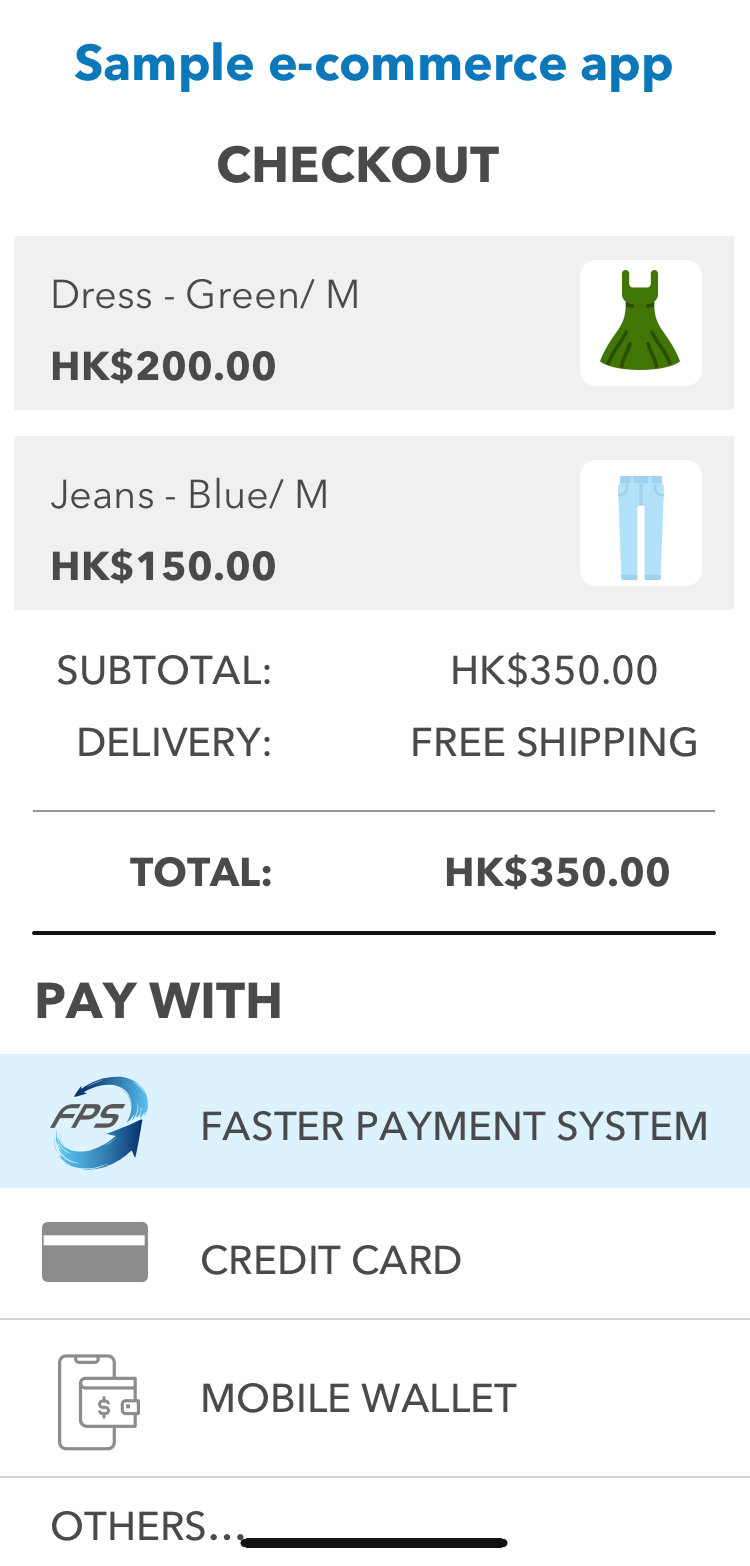

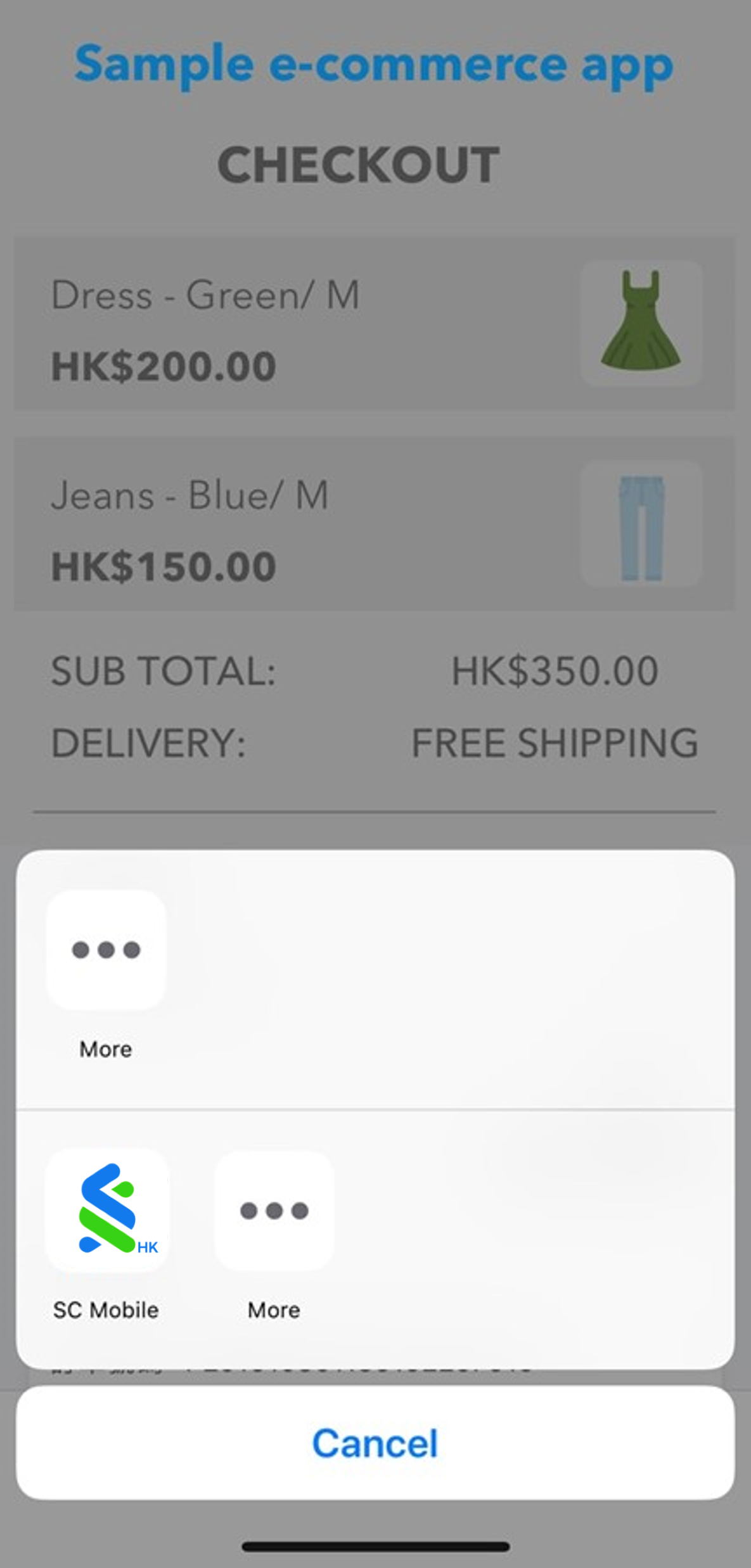

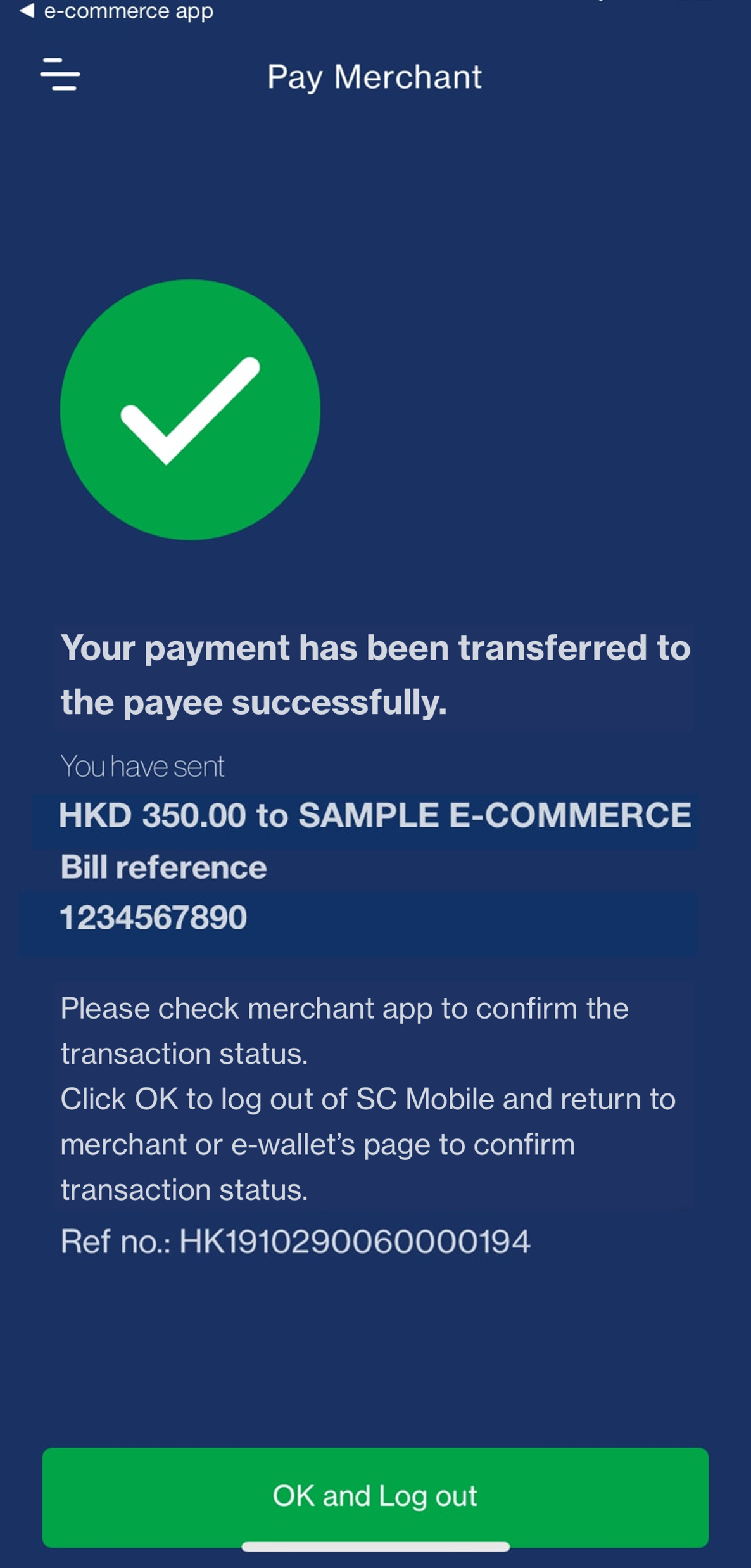

Pay in merchant app or website

-

Step 1

In merchant app or website, choose to pay via FPS

-

Step 2

Select SC Mobile App

-

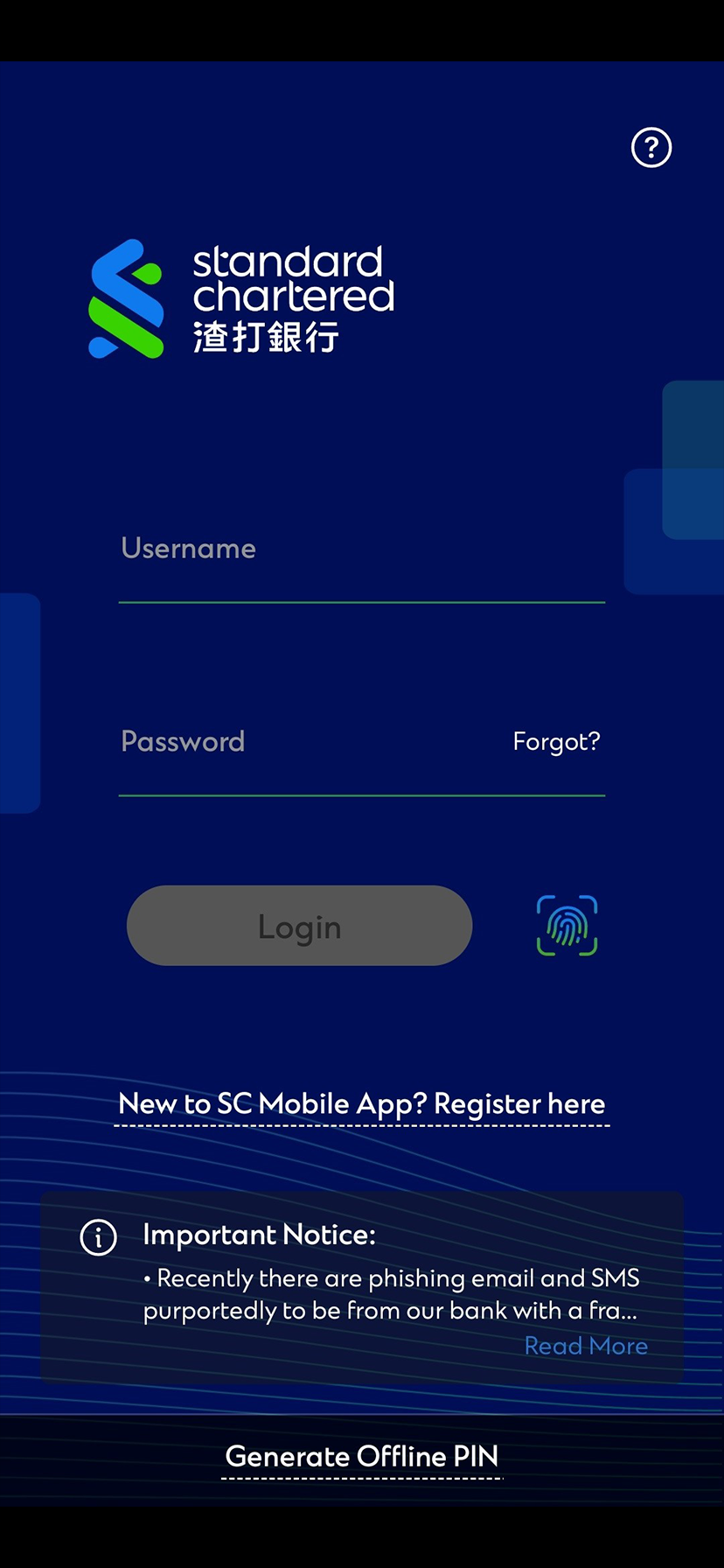

Step 3

You will be directed to SC Mobile App - Login to continue payment

-

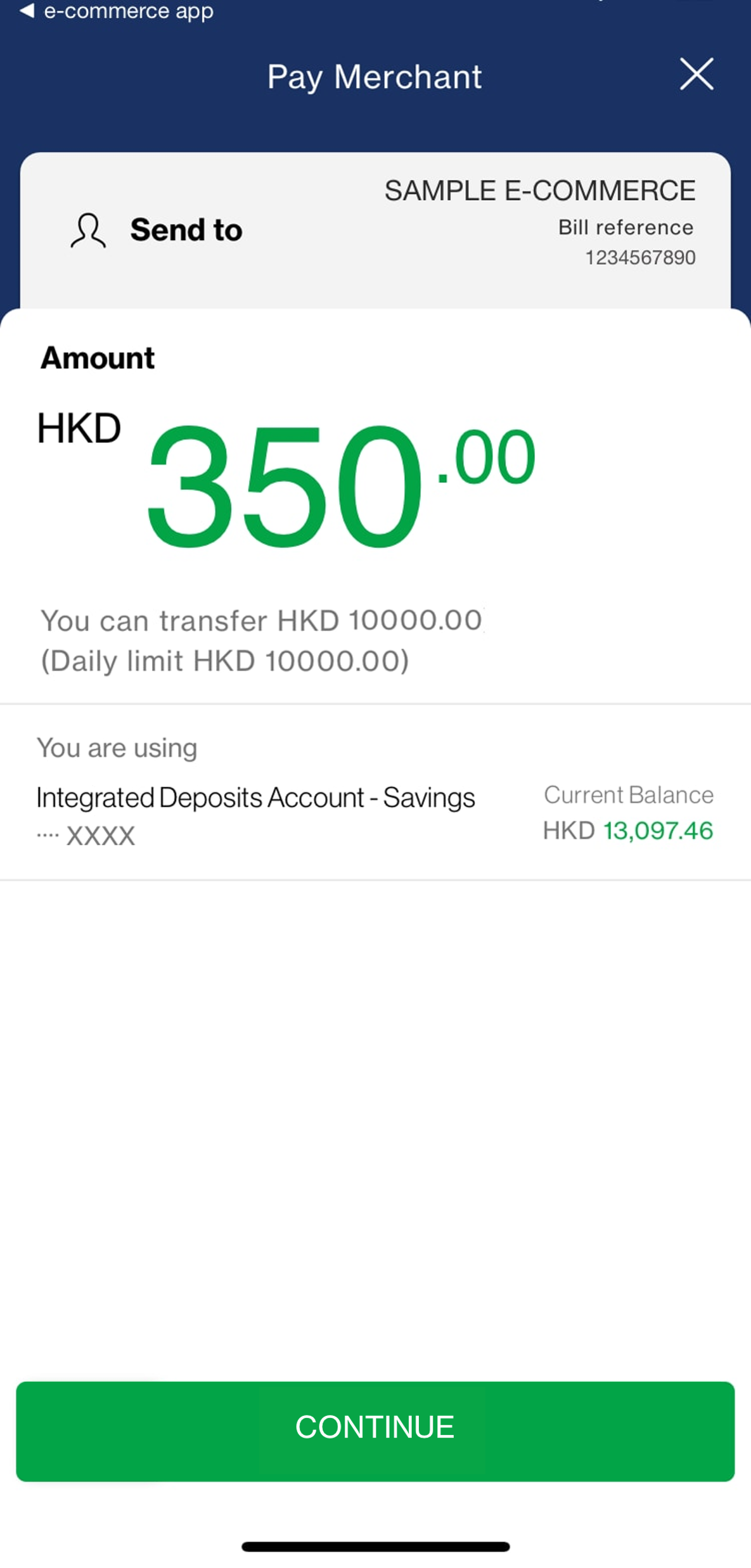

Step 4

Merchant name, bill reference and amount will be automatically filled in

-

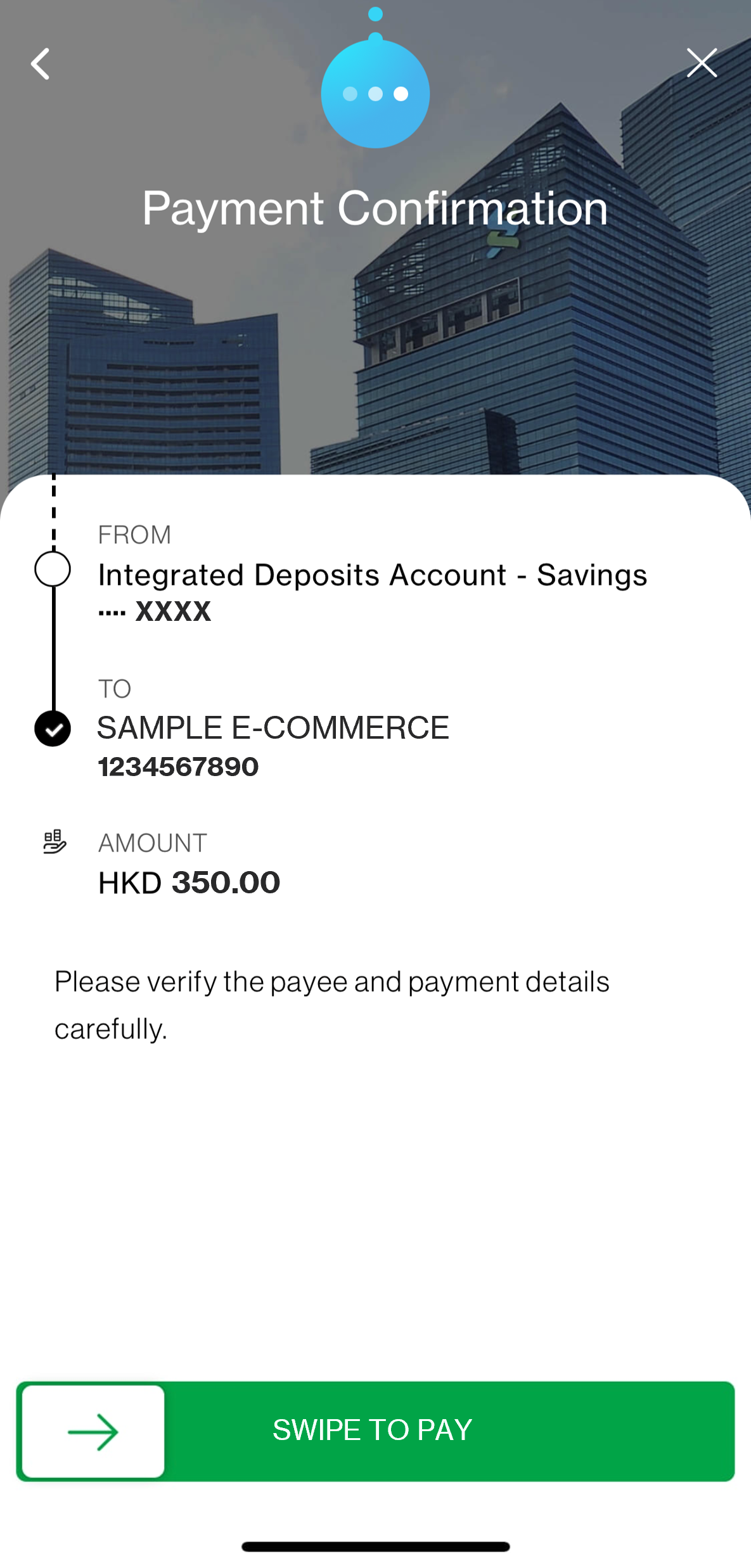

Step 5

Review details and confirm transfer

-

Step 6

You will immediately know whether the transfer is successful

Pay in merchant app or website

Step 1

In merchant app or website, choose to pay via FPS

Step 2

Select SC Mobile App

Step 3

You will be directed to SC Mobile App - Login to continue payment

Step 4

Merchant name, bill reference and amount will be automatically filled in

Step 5

Review details and confirm transfer

Step 6

You will immediately know whether the transfer is successful

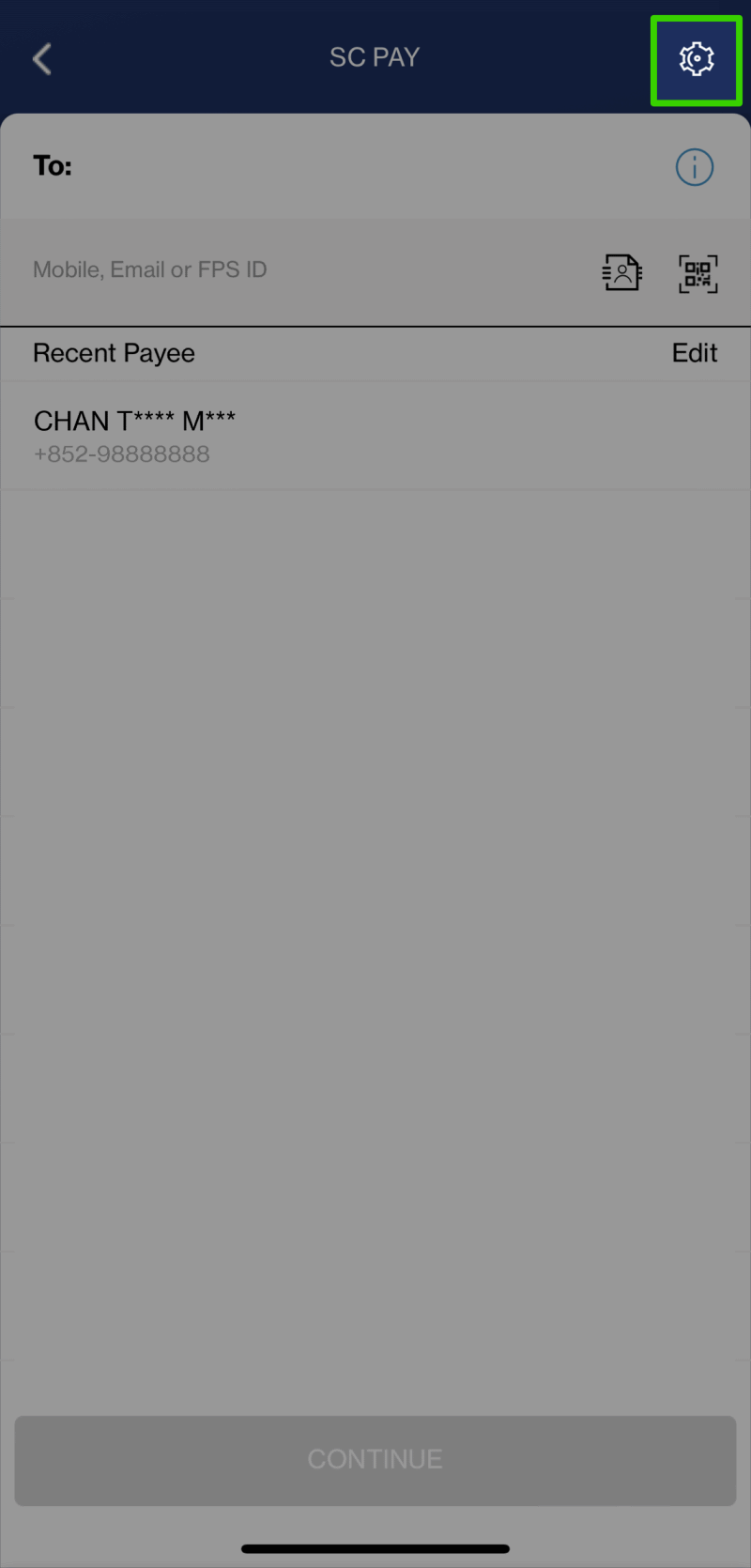

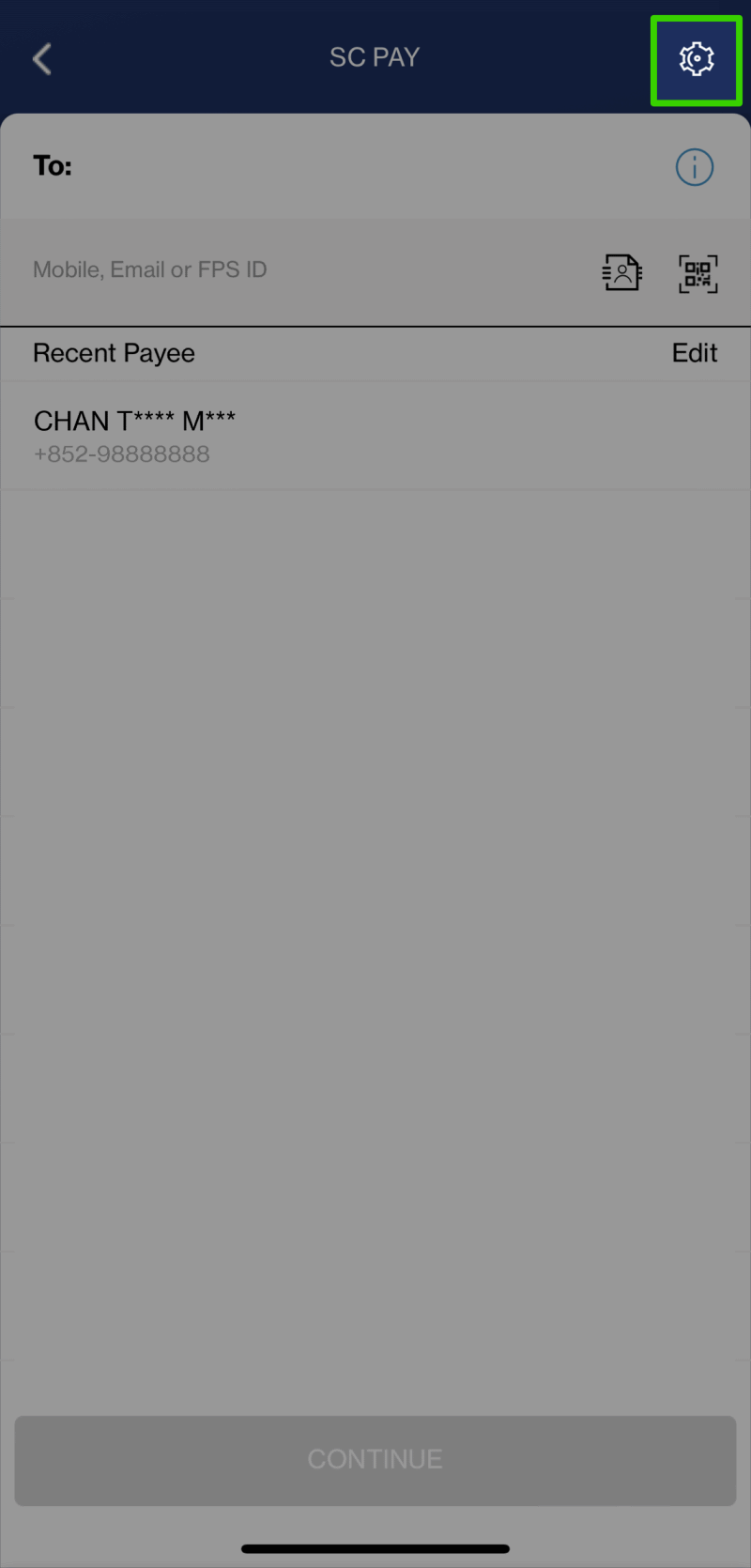

How to set Standard Chartered Bank as the FPS default receiving bank?

-

Step 1

After entering “SC Pay (FPS)”, tap the setting icon on the upper right corner

-

Step 2

Select your registered mobile number / email address

-

Step 3

Input One-time Password (OTP) sent via SMS or email

-

Step 4

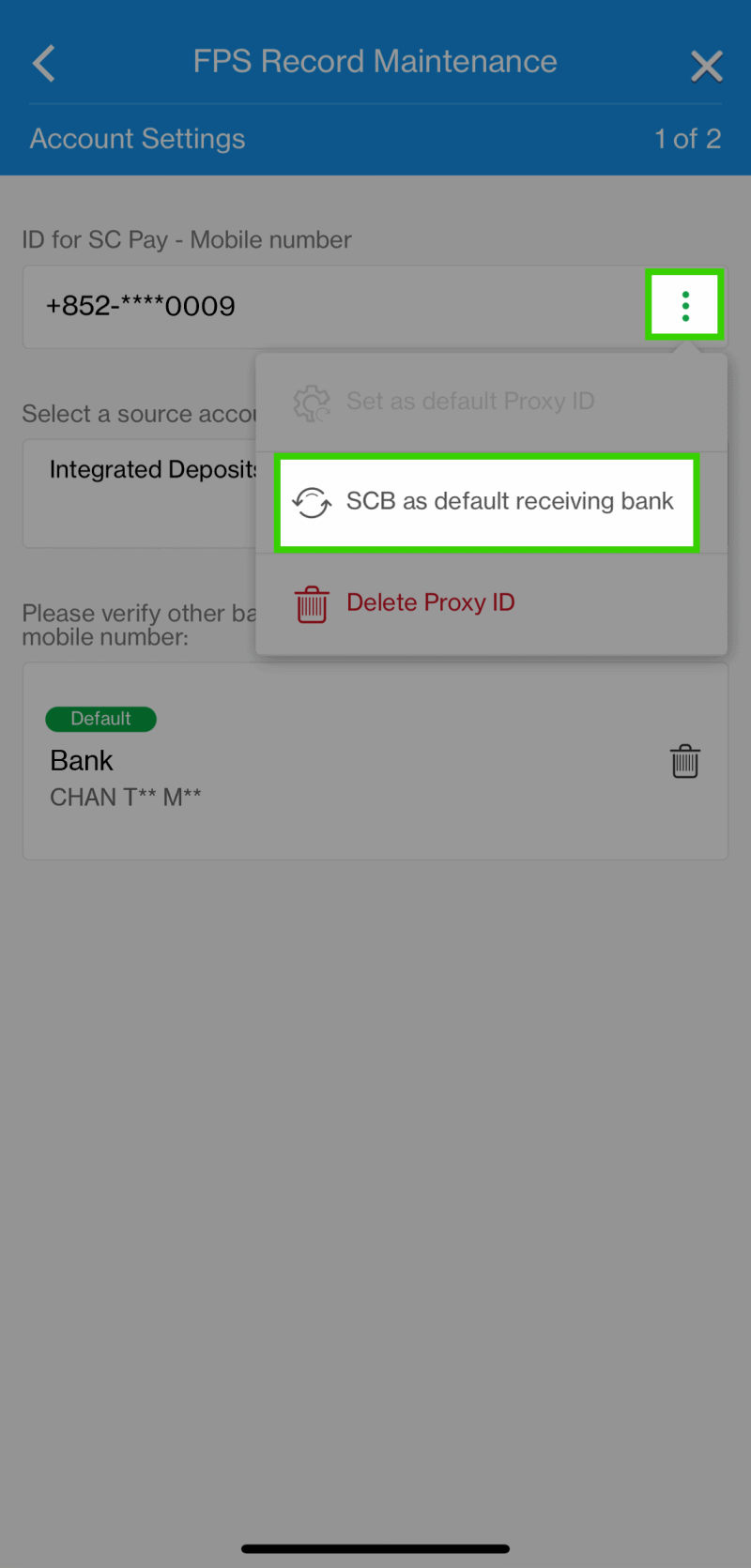

Tap the option icon next to your mobile number or email address – If Standard Chartered Bank is not yet your default receiving bank, “SCB as default receiving bank” will be available to select

-

Step 5

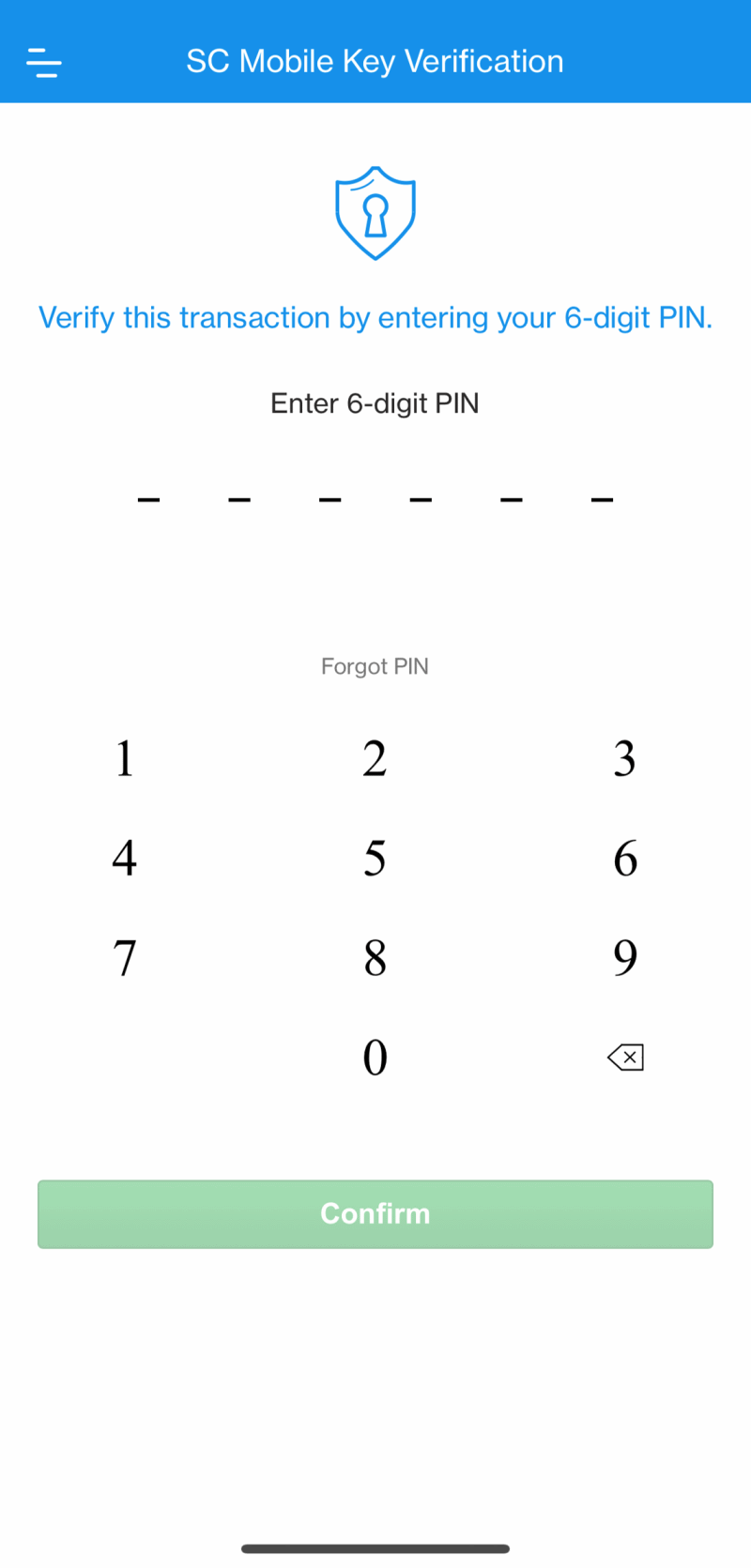

Enter your 6-digit Personal Identification Number (PIN) of SC Mobile Key for verification

-

Step 6

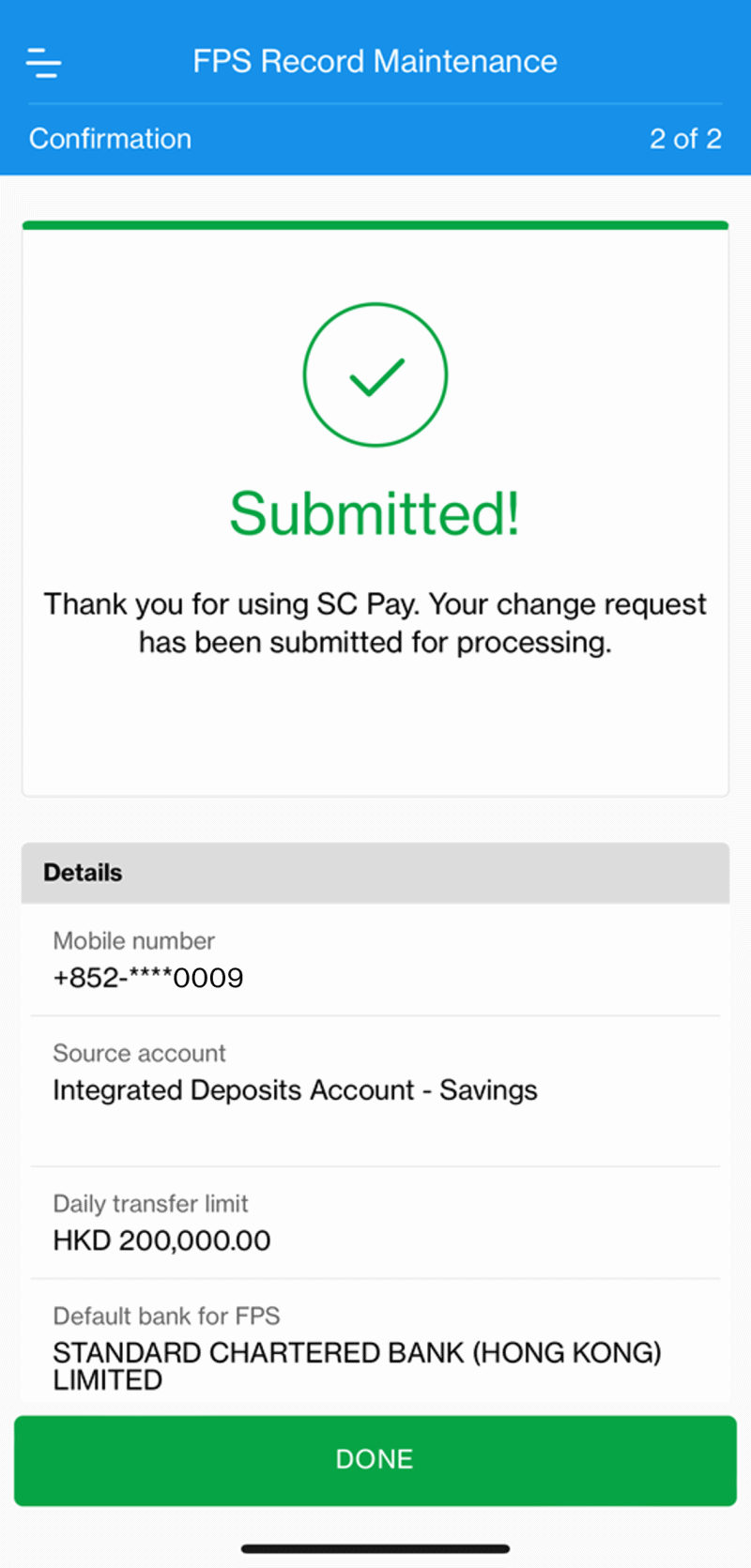

Setting is updated successfully

How to set Standard Chartered Bank as the FPS default receiving bank?

Step 1

After entering “SC Pay (FPS)”, tap the setting icon on the upper right corner

Step 2

Select your registered mobile number / email address

Step 3

Input One-time Password (OTP) sent via SMS or email

Step 4

Tap the option icon next to your mobile number or email address – If Standard Chartered Bank is not yet your default receiving bank, “SCB as default receiving bank” will be available to select

Step 5

Enter your 6-digit Personal Identification Number (PIN) of SC Mobile Key for verification

Step 6

Setting is updated successfully

Standard Chartered provides an all–in-one digital banking services.

Manage your finances on the go

Experience SC Mobile App now

Scan QR code to download SC Mobile App now

for Android users without Google Play, please click here to download the Android application package (APK)

You can receive money from any FPS registered bank account or licensed Stored Value Facilities upon successful service registration. Simply provide the payer your registered Proxy ID (mobile number or email address) and once they submit the payment via their banks, the amount will be automatically credited to your default bank account.

You can check your SC Pay(FPS) transaction via the following:

- Registered account balance via Online Banking and SC Mobile App

- ‘Transfer History’ via Online Banking

- ‘Transactions’ of ‘Pay & Transfer’ via SC Mobile App

- Bank or card statement of registered account

You can login to SC Mobile App, go to “Pay & Transfer”, then “Manage” and select “SC Pay (FPS) Registration and Settings”. In the SC Pay(FPS) Settings page, you can configure your SC Pay (FPS) settings.

No, credit card can only be used for sending money via SC Pay (FPS) but not for receiving payments.

No, as credit card can only be used for sending money via SC Pay (FPS) but not for receiving payments, you can only register SC Pay (FPS) with a valid Standard Chartered Current or Savings account.

‘Scan & Pay’ is a payment service using QR code (Quick Response Code) compatible with the Faster Payment System (“FPS”) through which you can send payments from your eligible source account to a QR Payee by simply scanning the QR Payee’s QR Code and receive payments via this service by generating a QR Code using the SC Mobile App and applications as specified by us from time to time.

‘Scan QR’ is a function that allows you to send/transfer money to friends or merchants simply by scanning a FPS QR code of your friends and merchants. You can also import your friends’ and merchants’ QR code from your device’s photo library.

‘Generate QR’ is a function that allows you to create your own FPS QR code for requesting payments from your friends by showing or sending it to your friends and requesting for the payments, with an option to specify an amount.

To send/transfer or receive payments from QR transactions, the currency of the accounts of the payor and payees must be the same.

To use ‘Scan & Pay’, you need to:

- Be a Standard Chartered Online banking client;

- Download SC Mobile App version 5.7.3 or above;

- Hold an eligible HKD or CNY sole or ‘either-to-sign’ joint account (Current or Savings account); and

- Register SC Pay (FPS) with either mobile number or email address as a proxy

The source account you have selected at “SC Pay (FPS) Registration and Settings” will be the bank account for making and receiving payments by ‘Scan & Pay’.

To change the source account of your Default Proxy:

- Login SC Mobile App.

- Go to “Pay & Transfer”, then “Manage” and select “SC Pay(FPS) Registration and Settings” .

- Select the Default Proxy and enter the One-Time-Password received.

- Change the ‘source account to transfer money via SC Pay’.

There are 2 ways you can access ‘Scan & Pay’ in SC Mobile App:

- Login SC Mobile App, go to ‘Pay & Transfer’ and select ‘Scan & Pay’; or

- While selecting payee in SC Pay (FPS), tap the QR icon appearing next to the payee details input field.

To be able to make FPS payment in merchant app, you will need to:

-Download SC Mobile App version 5.7.21 or above on same device as merchant app; and

-Hold an eligible HKD or CNY sole or “either-to-sign” joint account (Current or Savings); and

-Register for SC Pay (FPS)

You can use SC Mobile App to pay for any merchant apps with the FPS app-to-app payment capability built.

The merchant app may not support returning to merchant app after payment – please switch to merchant app manually.

You will receive SMS and/or email notification on the payment status. Transaction records can also be viewed in Transfer History on Online Banking or SC Mobile App.

Once merchant has received the payment, there should be confirmation on merchant app immediately. If you have any enquiry or dispute with merchant, contact the merchant directly.

Contact the merchant directly in case of any dispute or issues with your order.

Need more Help? Find out more on our FAQ

CLICK HERE

1.SC Pay (FPS) is only applicable to payees who have registered for FPS service. Your payment is also subject to the daily limit for Non-registered Payee Transfer.

2.You will need a valid Standard Chartered Current or Savings account to register for SC Pay (FPS).

3.You may transfer via SC Pay (FPS) on SC Mobile App with Standard Chartered Current/ Savings Account or Standard Chartered Credit Card (except UnionPay Dual Currency Platinum Credit Card). Credit Card only supports SC Pay (FPS) transfers on SC Mobile App in HKD.

4.Any transfer by credit card is subject to your available credit card limit and the daily limit for Non-registered Payee Transfer. For details, please refer to here.

5.Asia Miles/ 360° Reward Points/ Cash Rebate or any other credit card reward campaign and chargeback right/ protection is not applicable to SC Pay (FPS) transactions via SC Mobile App by credit card.

6.Over-limit electronic fund transfer handling fee may apply, if the total accumulated transfer amount exceeds the limit. For details, please refer to here.