Additional Authentication for Online Transactions

| The additional authentication service by using SC Mobile App or One-time Password (OTP) is a security feature for online payment transactions. It provides added assurance by authenticating your identity when you make an online transaction with your Standard Chartered Visa card / Mastercard® at designated online merchants carrying the following marks*: |

| *From June 2020 onwards, the authentication process is gradually upgraded to the latest EMV 3-D Secure version based on the new global payment industry specification. The service logos provided by Visa card and Mastercard® which are displaying on the OTP servicing page will also be updated accordingly as shown below. |

|

|---|

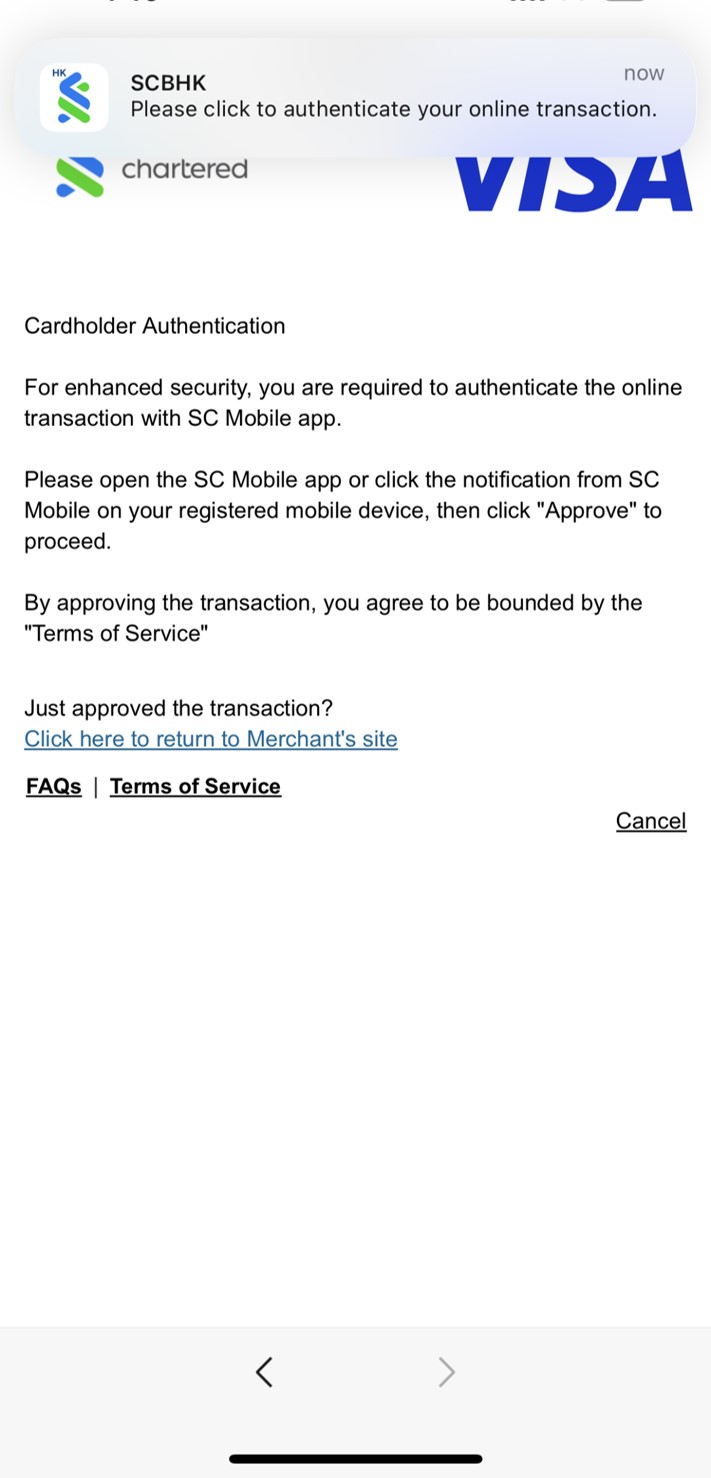

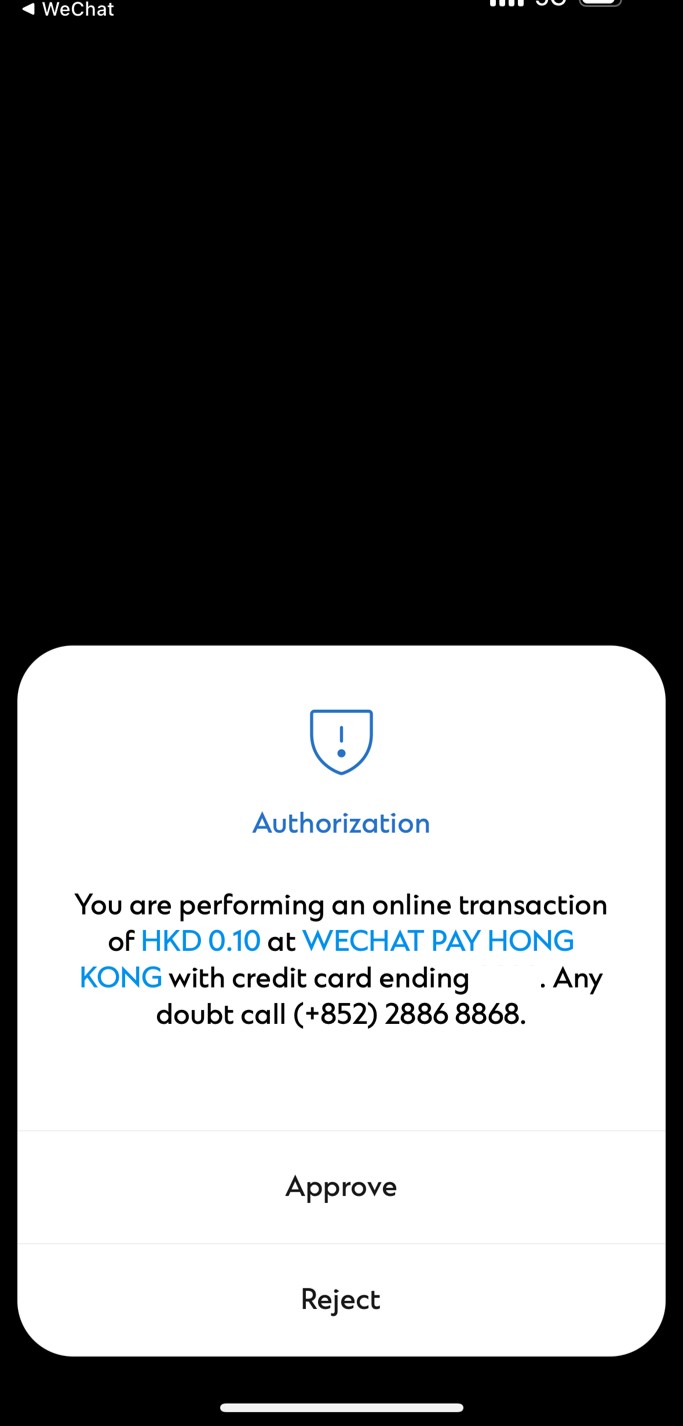

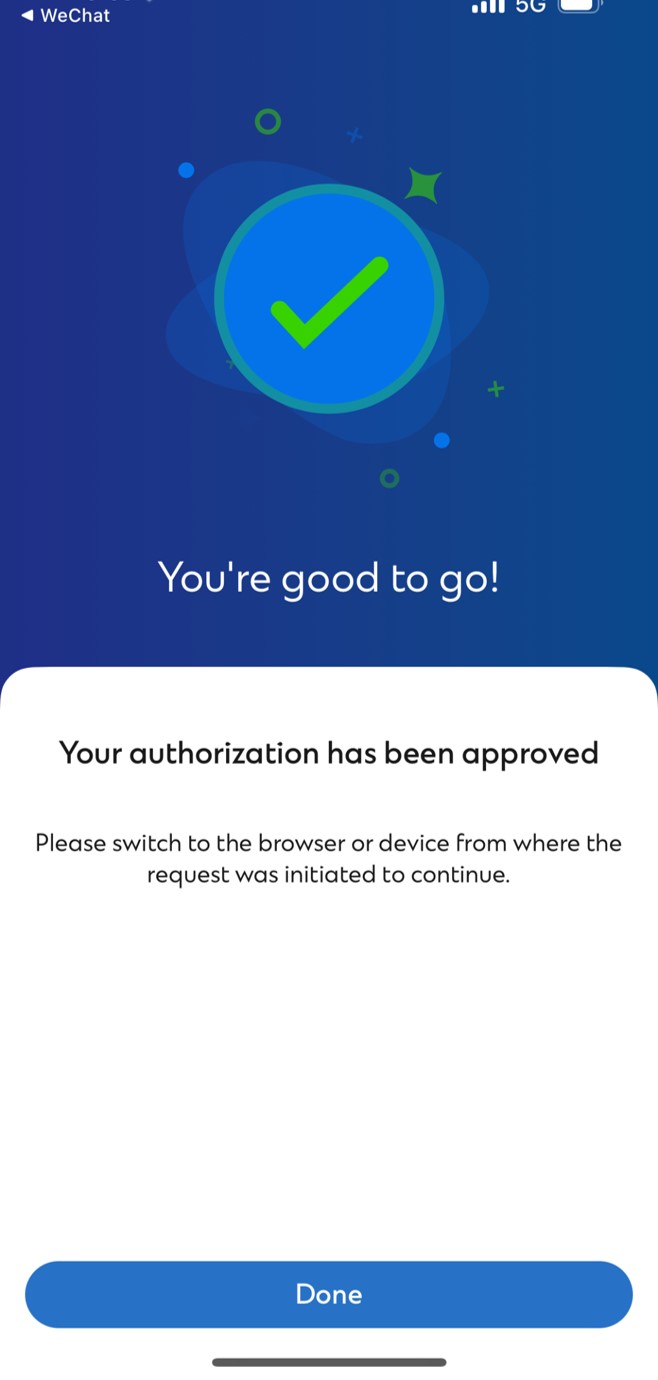

Authenticate online transaction by SC Mobile App

If you have activated the SC Mobile Key in your SC Mobile APP, you will be requested to authenticate the online transaction via the SC Mobile App.

One-time Password (“OTP”)

If you have not activated the SC Mobile Key or authentication via SC Mobile App is not available, an OTP may be sent to the principal/ supplementary cardholder’s valid mobile telephone number via SMS and the OTP must be entered online to complete the transaction. Supplementary cardholders can input the name printed on the supplementary card to send the OTP to their registered mobile telephone number instead.

Please note that OTP can only be sent to a valid mobile telephone number registered in the credit/ debit card system of the Bank. If you have not registered a mobile telephone number, you cannot make online transactions at participating online stores.

Card-Not-Present (“CNP”) Transactions

To improve the security of transactions that are completed without physical presentation of credit/ debit cards, an email or SMS will be sent to you as a notification for such transactions. CNP transactions that may trigger email, SMS or Push Notification on SC Mobile App include but are not limited to:

.Online transactions

.Mail / telephone orders

Please note that CNP transactions may be declined if you do not have a valid mobile telephone number registered in the credit/ debit card system of the Bank.

Maintaining a valid mobile telephone number

For credit card, a valid mobile telephone number refers to a local Hong Kong 8-digit mobile number, with international mobile telephone numbers excluded. For debit card, a valid mobile telephone number refers to a local Hong Kong 8-digit mobile number or a valid international mobile number. If you would like to update your registered mobile telephone number with the Bank, you may submit your request via the following channels:

- Select “Services” > “Edit Personal Details” after logging in to SC Mobile App or log in to Online Banking and click “Personal Details” to update mobile number

- Download the Change of Contact Information Form for Individual Client and mail it back to the Bank

- Visit any one of our branches to submit the Change of Contact Information Form for Individual Client

Tokenization

Visa and Mastercard’s new credit/ debit card e-commerce tokenization service, makes your credit/ debit card account details invisible and protected during the online payment process. The tokenization service allows payments in the online merchants to be processed without exposing actual account details that could potentially be compromised. As part of this service, Standard Chartered strives to bring you the latest and most secure technology for credit/ debit card payments, for your peace of mind while shopping. Now, you can experience a seamless and more secure online payment.

OTP is not applicable to cardholders of Standard Chartered UnionPay Dual Currency Platinum Credit Card.

From 28 March 2025, we have updated the Terms of Service. Please click here for the updated Terms of Service.

FAQs

No, only participating online merchants will require additional authentication in order to complete transactions. If you have not activated the SC Mobile Key or authentication via SC Mobile App is not available, an OTP may be sent to the principal/ supplementary cardholder’s valid mobile telephone number via SMS.

Supplementary cardholders can use the same service to proceed the online transaction by inputting the name printed on the supplementary card. By then supplementary cardholder will be asked to authenticate the transaction via SC Mobile App, or input the OTP which sent to the registered mobile telephone number.

The additional authentication provides added assurance by authenticating you while using your Standard Chartered Visa Card / Mastercard when making payments to participating online merchants.

No registration is required to enjoy this service. However, SC Mobile App authentication service is only applicable to cardholders who have registered SC Mobile Key in the SC Mobile App. OTP authentication service is only applicable to cardholders who have a valid local mobile number or international mobile number (only applicable to debit card) registered with the bank.

Activate SC Mobile Key in your SC Mobile App Learn more

No, but the service has become available to more and more online stores now.

OTP is only applicable to (a) the Principal Credit Card Cardholder and its Supplementary Cardholder with a valid Hong Kong mobile phone number registered with the credit card system of the Bank, and (b) the Debit Card Cardholder with a valid Hong Kong mobile phone number or International mobile phone number registered with the debit card system of the Bank. If you do not receive your OTP within 30 seconds after submitting your request, you may click “Resend OTP” to request for another one. You should also check if your mobile phone number registered with the system of the Bank is updated.

We will send the OTP according to your mobile phone number in our record. If you are overseas or using overseas mobile service providers, the service provider may not support international SMS. Please consult your service provider and/or hardware supplier for details.

You will not be allowed to click “Resend OTP” to request for another one if you have input a wrong OTP for a few times. Please restart the entire online purchase transaction again.

The OTP is only valid for a certain period after it is issued. You can click “Resend OTP” to request for another OTP if the OTP has expired.

No, customer is not required to have any special registration as the process is between merchant and card issuers only.

E-commerce tokenization service will not impact to customer because tokenization is the process between online merchant and Visa or Mastercard. The online transaction procedures will remain unchanged, customer is required to key in the credit/ debit card details including account number, name and expiry date as showed in online merchant website.

Please quote your credit/ debit card number for refund; refund should be arranged in the same credit/ debit card number.

Each credit/ debit card will be mapped with a unique token number. If the card information has been deleted from the online merchant website, then the token may be deactivated by the merchant. Also, if there is a new credit card info shared by customer to merchant, then the old token will be deactivated and a new token will be created.

E-commerce tokenization service will not impact to customer because it is invisible to customer as it is a process between online merchant and Visa or Mastercard.

You do not need the token number, your card will work seamlessly across multiple different devices and merchants.