Asia Miles Time Deposit Miles Reward Calculator

Applying From

Your Time Deposit amount

Asia Miles

The above Asia Miles reward is for reference only. Account opening is not available on Sundays and Public Holidays. The final Asia Miles reward and the 0.01% p.a. interest rate will be calculated based on the total deposit balance at the time of account opening.

Discover anything but average destinations

$numberOfDestinations Destinations within reach

$numberOfDestinations Destinations you almost reach

*Based on the Asia Miles required for redeeming the Standard Flight Award as of 15 April 2025.

LIMITED TIME EXTRA REWARDS

From now until 30 September 2025, Standard Chartered Cathay Mastercard® clients who setup 12-month Asia Miles Time Deposits online with cumulative new funds balance as below can enjoy extra Asia Miles:

CUMULATIVE NEW FUNDS BALANCE

- HKD500,000 / USD68,000 or above

LIMITED TIME EXTRA ASIA MILES TIME DEPOSIT REWARD

- 28,000 Asia Miles

Please refer to the extra rewards below:

ELIGIBLE CARD | ASIA MILES TIME DEPOSIT EXTRA MILES REWARD |

|---|---|

| Standard Chartered Cathay Mastercard | 28,000 Asia Miles |

| Standard Chartered Cathay Mastercard – Priority Banking | 38,000 Asia Miles |

| Standard Chartered Cathay Mastercard – Priority Private |

LIMITED TIME EXTRA REWARDS FOR PRIORITY BANKING/ PRIORITY PRIVATE NEW CLIENT

From now until 31 March 2026, Priority Banking New Clients or Priority Private New Clients who setup 12-month Asia Miles Time Deposits online with cumulative new funds balance as below can enjoy extra reward of 10,000 miles:

ASIA MILES TIME DEPOSIT CUMULATIVE NEW FUNDS BALANCE

- How to set up an Asia Miles Time Deposit using SC Mobile App

- How to update Cathay Membership Details

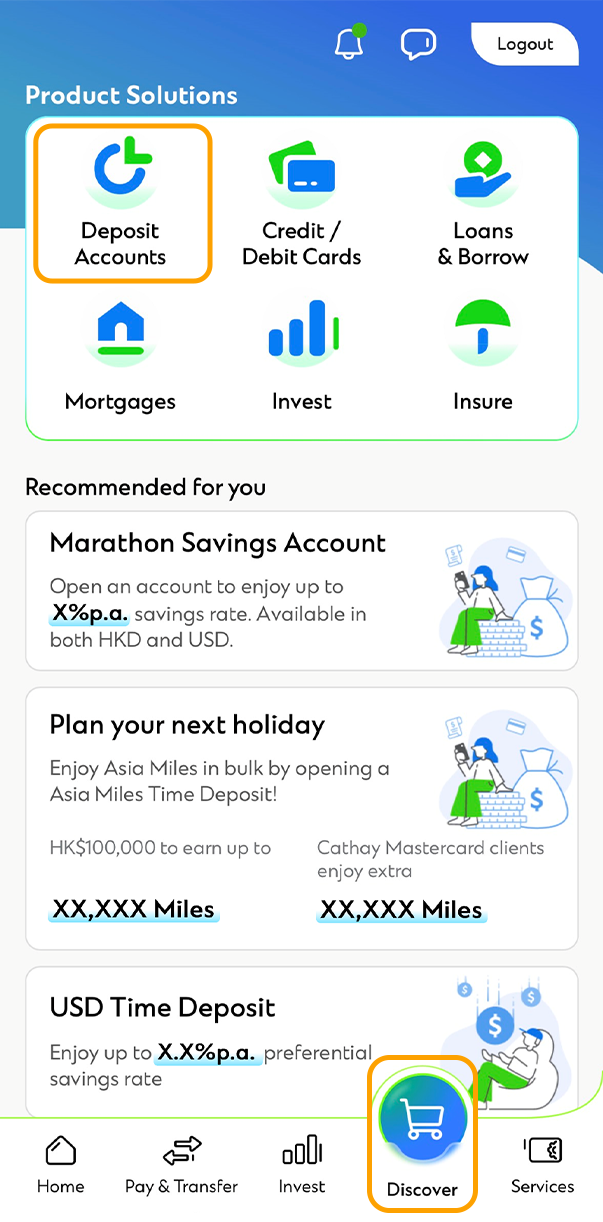

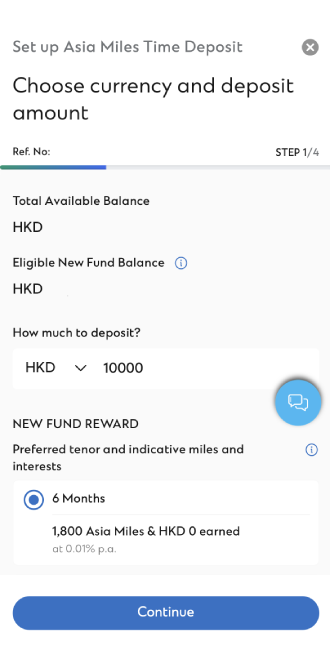

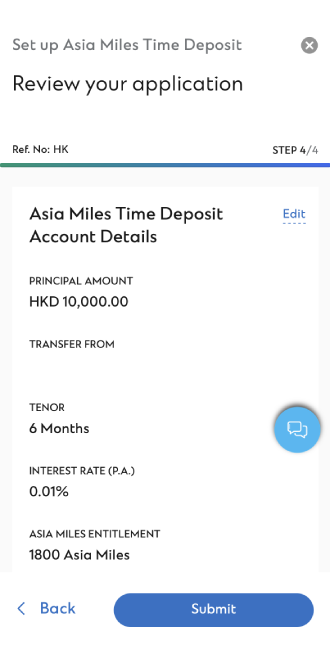

How to set up an Asia Miles Time Deposit using SC Mobile App

How to set up an Asia Miles Time Deposit using SC Mobile App

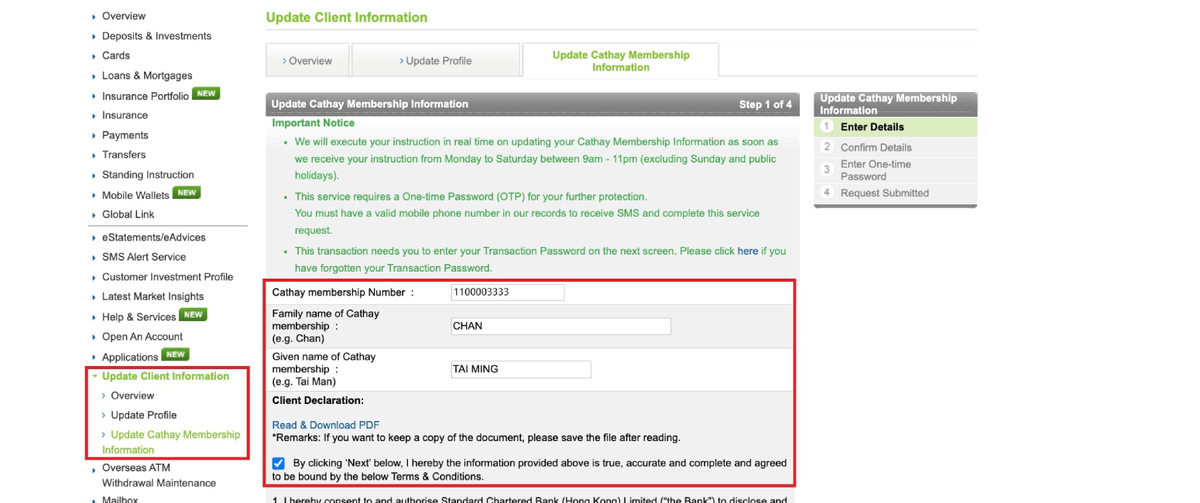

How to update Cathay Membership Details

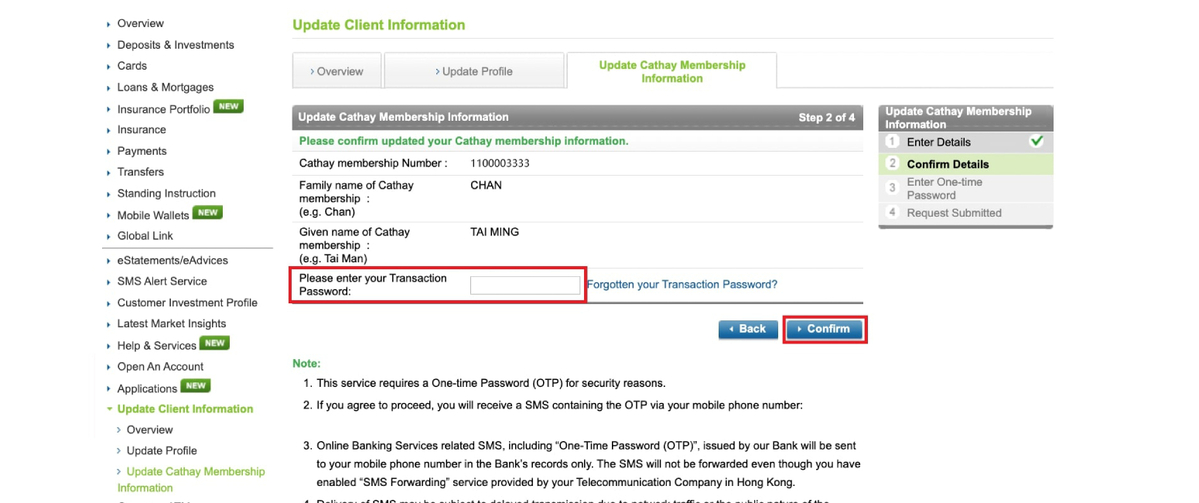

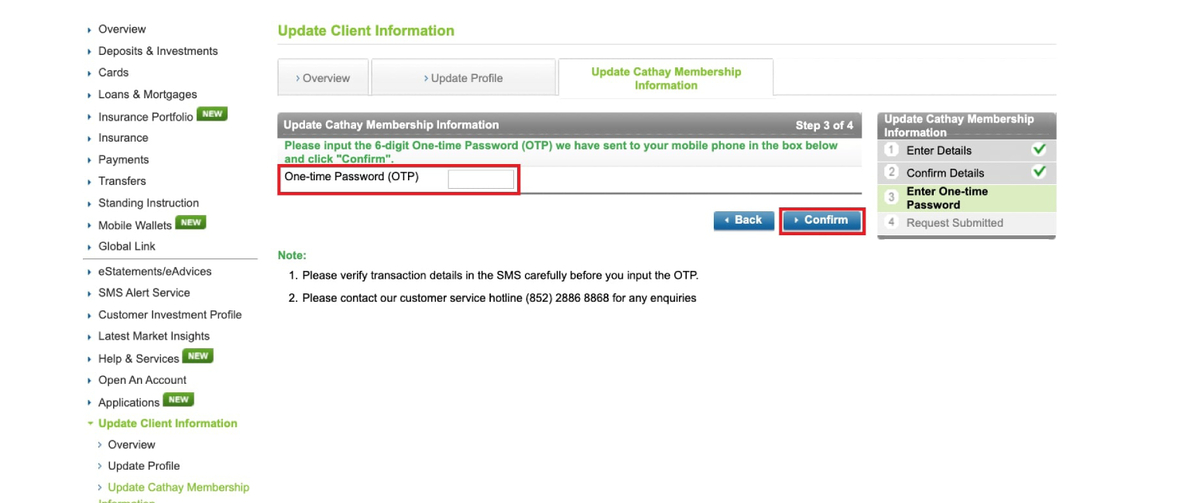

Clients who successfully set up an Asia Miles Time Deposit. Please update or register your Cathay membership account information via online banking now.

If you have bound your mobile phone with SC Mobile Key, please follow the relevant instructions to update or register your Cathay membership account information.

- Update Cathay Membership Information Login Now

- New to Online Banking? Register Now

- SC Mobile App

- Others

- Existing SC Mobile App clients can apply through the QR code to logon and enjoy preferential interest rate.

- New users can download the App through App Store / Google Play.

Scan QR code to download/ login SC Mobile App now

for Android users without Google Play, please click here to download the Android application package (APK)

Other Account Opening Channels

- Click here to log in Online Banking (Service hours: 9am-11pm, Monday to Saturday, except public holidays); or

- Visit any of our branches; or

- Via phone instruction; or

- Access My RM platform (For existing Priority Private or Priority Banking clients only)

Tips for earning miles with Asia Miles Time Deposit

Not necessarily. Existing Standard Chartered clients can also enjoy the Asia Miles Time Deposit new funds offer. As long as you transfer funds from another bank into your Standard Chartered account within four working days (excluding Sundays and public holidays) before or on the day you open the Asia Miles Time Deposit account, the funds will be considered new and you will be eligible to earn corresponding Asia Miles from the offer.

The minimum deposit to open an Asia Miles Time Deposit account online via SC Mobile/Online Banking is HKD10,000. However, if you open the account at a branch or through “MyRM,” the minimum balance required is HKD100,000.

No, you don’t. You can redeem your Asia Miles as long as your Asia Miles Time Deposit has been active for at least 3 months.

The Asia Miles reward you earn from an Asia Miles Time Deposit depend on the deposit term, type of funds, and setup currency. Promotional offers may change from time to time, so please refer to the latest information on Standard Chartered website or SC Mobile App.

Remarks

- Asia Miles Limited will credit the Asia Miles that you are entitled to into your registered Cathay membership account within three months from the date of opening of the Asia Miles Time Deposit Account (“AM TD Account”).

- The amount of Asia Miles shown on this webpage and relevant promotional materials for the Asia Miles Time Deposit Rewards (“AM TD Rewards”) are provided by the bank as of 1 Aug 2025. They are for reference only and are not guaranteed. We reserve the right to adjust the amount of Asia Miles displayed here and on relevant promotional materials at our sole discretion. For more information, please refer to the relevant promotion webpage or contact our branch staff.

- In order to enjoy the AM TD Rewards, you must have a valid Cathay membership account. Otherwise, you have to set up a Cathay membership account through Asia Miles Limited. You must successfully register a valid Cathay membership account in your own name with other required details via Standard Chartered Online Banking (sc.com/hk/login) before the end of the relevant calendar month in which the AM TD account is opened.

- The AM TD Rewards include both 0.01% p.a. interest rate on the AM TD Account and Asia Miles. For AM TD Account in HKD, the interest will be calculated in simple interest and on a 365-day or 366-day basis (for leap year). For AM TD Account in other currencies, the interest will be calculated in simple interest and on a 360-day basis. Early uplift of the Asia Miles Time Deposit is subject to the Bank’s discretion and penalty.

- The amount of Asia Miles that you may be entitled to for AM TD Rewards depends on the amount and the type of the Funds deposited successfully into the AM TD Account. If you wish to enjoy the AM TD Rewards from both New Funds and Existing Funds, separate AM TD Accounts should be set up for each Funds type.“New Funds” refers to the below funds credited to the Eligible Client’s Standard Chartered accounts within 4 working days (excluding Sunday and Public Holiday) before and until the opening date of the AM TD account:

- monies newly deposited into the Bank from other banks via cash, cheque, cashier’s order, Local Bank Transfer Payment through Real Time Gross Settlement (RTGS, also known as Clearing House Automated Transfer System (CHATs)), Transfer through Faster Payment System (FPS) or Telegraphic Transfer from other banks; or

- funds converted from any currency held with the Bank; or

- redemption funds of the following investment or insurance products, including Equity Linked Investment, Debt Securities (Bonds and Structured Notes), Insurance, Securities and Unit Trust.New Funds exclude any renewal or rollover of existing time deposits, transfer of funds from any account within the Bank, any currency converted from Premium Deposits, Structured Deposits and Currency Switching upon maturity, and the sum of principal amount of all Time Deposit(s) and Marathon Savings Account(s) placed during the counting period.“Existing Funds” refers to any monies in your account(s) with the Bank other than New Funds as defined.

- For the avoidance of doubt, Asia Miles membership stated herein are referring to the Cathay membership programme. For details please click here for the Cathay Membership Programme Terms & Conditions.

ACCOUNT OPENING CHANNEL | CURRENCY | MINIMUM ACCOUNT OPENING BALANCE |

|---|---|---|

Standard Chartered Online Banking / SC Mobile App | Hong Kong Dollar (HKD) | HKD10,000 |

| United States Dollar (USD) | USD2,000 | |

| Renminbi (RMB) | CNY10,000 | |

| Branch / “My RM” platform | Hong Kong Dollar (HKD) | HKD100,000 |

| United States Dollar (USD) | USD10,000 | |

| Renminbi (RMB) | CNY100,000 |

Risk Disclosure Statements for RMB Deposit Services

- Renminbi (“RMB”) exchange rate, like any other currency, is affected by a wide range of factors and is subject to fluctuations. Such fluctuations may result in gains and losses in the event that the client subsequently converts RMB to another currency (including Hong Kong dollars); and

- RMB is currently not freely convertible and conversion of RMB through banks in Hong Kong is subject to restrictions specified by the Bank and regulatory requirements applicable from time to time. The actual conversion arrangement will depend on the restrictions prevailing at the relevant time.

Foreign Exchange Risk Disclosure Statement

- Foreign Exchange involves risks. Fluctuation in the exchange rate of a foreign currency may result in gains or significant losses in the event that the client converts deposit from the foreign currency to another currency (including Hong Kong Dollar).