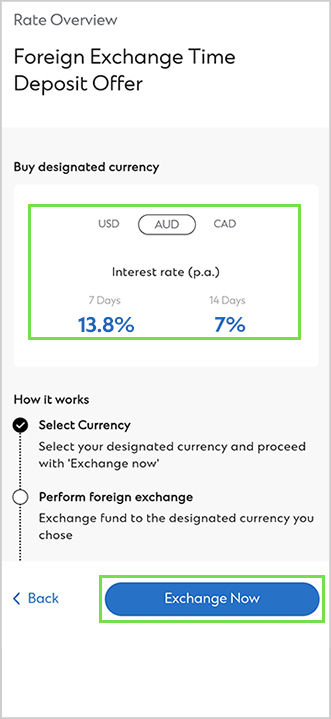

7-day and 14-day (p.a.) on Foreign Exchange Time Deposit

|

Set up by Priority Private or Priority Banking clients / Platinum Forex Members

|

Others

|

|||

|---|---|---|---|---|

| 7-day APR | 14-day APR | 7-day APR | 14-day APR | |

Note: The above interest is for reference only. The final interest will be calculated based on the account sign up date. For FXTD in HKD/GBP, the interest will be calculated in simple interest and on a 365-day or 366-day basis (for leap year). For FXTD in other currencies, the interest will be calculated in simple interest and on a 360-day basis. Account opening is not available on Sundays and Public Holidays.

Enjoy high yield from your deposits while trading foreign currency to fund your travels, education and more

- Trade foreign currency to fund travels

- Prepare a fund for overseas study, immigration, or residency

- Earn high yield by using deposits to invest

Trade foreign currency to fund travels

Want to trade foreign currency in preparation for your travels? You don’t have to go to a money changer! Exchanging currencies through Standard Chartered is not only convenient, but also a way to use short-term deposits to earn high interest and subsidise travel expenses! Frequent travellers can also take advantage of the low currency value to exchange foreign currency and open a Time Deposit to prepare for future travels.

- Exchange foreign currency at preferential rates quickly before departure, with flexible fixed deposits for 7 or 14 days and earn interest to subsidise travel expenses

- Up to 7 currency options# available, covering different travel destinations. Have it all done through SC Mobile, and exchange foreign currency anytime, anywhere.

- With a Multi-Currency Mastercard Debit Card, you can withdraw foreign currency at designated overseas locations or even pay directly with the card in foreign currency, free of fees and exchange rate losses.

#Up to 7 foreign currencies to choose from: HKD, USD, RMB, AUD, NZD, CAD, and GBP.

Prepare a fund for overseas study, immigration, or residency

- Looking to immigrate or study overseas, and in need of converting currency? Standard Chartered provides direct access for your multi-currency needs. You can also set up a 7- or 14-day Foreign Exchange Time Deposit to earn high interest returns to help cover your expenses. With remittance destinations across the globe, you can enjoy the high-yield advantages of Foreign Exchange Time Deposit with up to 13.8% p.a., while idle funds can be placed in 7-day or 14-day deposits to accumulate reserves.

- 7 foreign currencies to choose from#, with more than 200 remittance destinations, to cater for the needs of Hong Kongers everywhere.

- Same-day delivery to 30+ regions, including popular study destinations such as the UK, Australia, Canada and New Zealand.

#Up to 7 foreign currencies to choose from: HKD, USD, RMB, AUD, NZD, CAD, and GBP.

Earn high yield by using your spare money to deposit as investment

- Take advantage of idle funds in foreign currency and deposit them to lock in preferred interest rates for continuous earning. Short-term Foreign Exchange Time Deposits are extremely low risk and are subject to subtle changes in the macro environment, easily increasing your reserves. High-yield Foreign Exchange Time Deposits can accrue up to 13.8% p.a., letting your funds earn more.

- Set up price alerts on SC Mobile, and get notified when target exchange rate is reached, and automatically redeem funds at a price threshold to easily track and lock in your preferred rate.

- Flexible deposit terms of 7 days or 14 days, respectively, keep funds liquid and help you seize different investment opportunities.

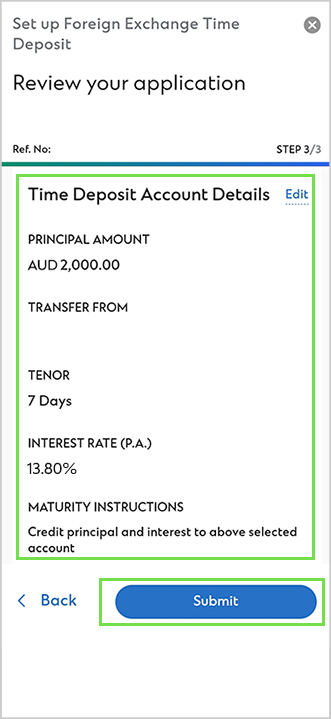

How to set up Foreign Exchange Time Deposit via SC Mobile App

How to set up Foreign Exchange Time Deposit via SC Mobile App

Service hours: 9am-11pm, Monday to Saturday, except public holidays

* Photos are for reference only.

- SC Mobile App

- Others

- Existing SC Mobile App clients can apply through the QR code to logon and enjoy preferential interest rate.

- New users can download the App through App Store / Google Play.

Scan QR code to download/ login SC Mobile App now

for Android users without Google Play, please click here to download the Android application package (APK)

Other Account Opening Channels

- Click here to log in Online Banking (Service hours: 9am-11pm, Monday to Saturday, except public holidays); or

- Visit any of our branches; or

- Via phone instruction; or

- Access My RM platform (For existing Priority Private or Priority Banking clients only)

Foreign Exchange Time Deposit FAQs

To open a high-interest Foreign Exchange Time Deposit, the minimum deposit in HKD or RMB is HKD10,000, while designated foreign currencies require the equivalent of HKD2,000.

There are two term options for Foreign Exchange Time Deposits: 7 days and 14 days. Clients are required to choose at least a 7-day deposit term to earn high yield on their Foreign Exchange Time Deposit.

In theory, you can withdraw your deposits as and when needed, but it is not recommended as fees or penalties may incur affecting your yield.

Foreign Exchange Time Deposits have shorter deposit terms with only 7-day and 14-day options and higher interest rates. They are suitable for clients who are about to exchange currencies but still have a 7 to 14-day period to accrue interest.

As for Online Time Deposits, the deposit term is longer, divided into 3, 6 and 12 months. Interest rates are relatively lower, but they provide the option to lock in your preferred interest rates for the long term.

You can choose a deposit plan according to your personal and financial needs.

When your deposit matures, your funds will not be considered as new funds. To continue enjoying the high interest rates, you can invest the yield amount in another currency as a Time Deposit.

- For Eligible FX Transactions conducted via SC Mobile App or Standard Chartered Online Banking, both the Eligible FX Transactions and the FXTD must be placed under “Foreign Exchange Time Deposit Account” via “Time Deposits” menu in SC Mobile App or “Open a Time Deposit” menu in Standard Chartered Online Banking in order to enjoy this Offer.

- The required minimum opening balance of the FXTD via SC Mobile App / Online Banking is HKD/RMB10,000 or 2,000 in original currency.

- The required minimum opening balance of the FXTD via branch / “My RM” platform is HKD100,000 or equivalent in other designated currency.

- The FXTD interest rates as shown above and on the relevant promotion materials are quoted with reference to interest rates offered by the Bank as of 1 August 2025 and are not guaranteed. The Bank reserves the right to make any adjustment to the time deposit interest rate of the Offer from time to time at its sole and absolute discretion, as per prevailing market conditions. You may approach our branch staff / visit SC Mobile App or Standard Chartered Online Banking to enquire about the interest rate applied on the FXTD for this Offer.

Risk Disclosure Statements for RMB Deposit Services

- Renminbi (“RMB“) exchange rate, like any other currency, is affected by a wide range of factors and is subject to fluctuations. Such fluctuations may result in gains and losses in the event that the client subsequently converts RMB to another currency (including Hong Kong dollars); and

- RMB is currently not freely convertible and conversion of RMB through banks in Hong Kong is subject to restrictions specified by the Bank and regulatory requirements applicable from time to time. The actual conversion arrangement will depend on the restrictions prevailing at the relevant time.

Foreign Exchange Risk Disclosure Statement

- Foreign Exchange involves risks. Fluctuation in the exchange rate of a foreign currency may result in gains or significant losses in the event that the client converts deposit from the foreign currency to another currency (including Hong Kong Dollar).