Online Time Deposit

From now until 28 February 2026, you can enjoy the following preferential interest rates by setting up Time Deposit with new funds via SC Mobile App or Online Banking to enjoy exclusive preferential interest rates.

Online New Fund Time Deposit Offers

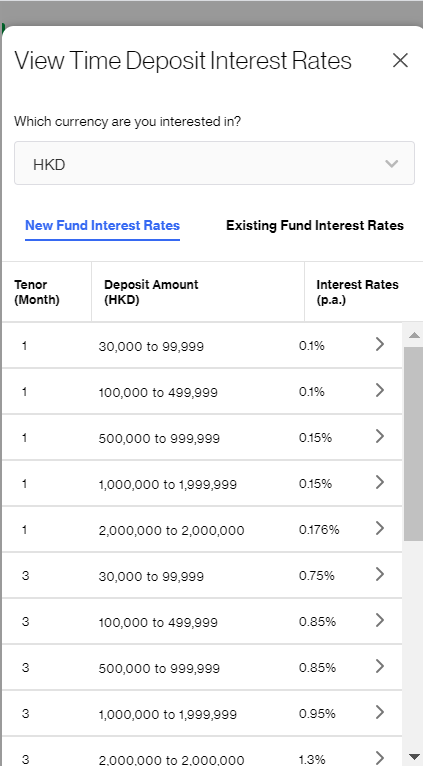

HKD Time Deposit Special Annual Interest Rates (%)

Regular new funds of HKD10,000 or above | ||

|---|---|---|

| CURRENCY | TENOR | PREFERENTIAL INTEREST RATE (P.A.) |

| HKD | 3 months | 2.30% |

| 6 months | 2.10% | |

| 12 months | 2.20% | |

USD Time Deposit Special Annual Interest Rates (%)

Regular new funds of USD2,000 or above | ||

|---|---|---|

| CURRENCY | TENOR | PREFERENTIAL INTEREST RATE (P.A.) |

| USD | 3 months | 3.20% |

| 6 months | 3.20% | |

| 12 months | 2.90% | |

RMB Time Deposit Special Annual Interest Rates (%)

Regular new funds of RMB10,000 or above | ||

|---|---|---|

| CURRENCY | TENOR | PREFERENTIAL INTEREST RATE (P.A.) |

| RMB | 3 months | 1.00% |

| 6 months | 1.10% | |

| 12 months | 1.20% | |

GBP Time Deposit Special Annual Interest Rates (%)

Regular new funds of GBP2,000 or above | ||

|---|---|---|

| CURRENCY | TENOR | PREFERENTIAL INTEREST RATE (P.A.) |

| GBP | 3 months | 3.30% |

| 6 months | 3.10% | |

| 12 months | 3.00% | |

AUD Time Deposit Special Annual Interest Rates (%)

Regular new funds of AUD2,000 or above | ||

|---|---|---|

| CURRENCY | TENOR | PREFERENTIAL INTEREST RATE (P.A.) |

| AUD | 3 months | 3.30% |

| 6 months | 3.10% | |

| 12 months | 3.00% | |

CAD Time Deposit Special Annual Interest Rates (%)

Regular new funds of CAD2,000 or above | ||

|---|---|---|

| CURRENCY | TENOR | PREFERENTIAL INTEREST RATE (P.A.) |

| CAD | 3 months | 2.20% |

| 6 months | 2.10% | |

| 12 months | 2.00% | |

NZD Time Deposit Special Annual Interest Rates (%)

Regular new funds of NZD2,000 or above | ||

|---|---|---|

| CURRENCY | TENOR | PREFERENTIAL INTEREST RATE (P.A.) |

| NZD | 3 months | 2.30% |

| 6 months | 2.40% | |

| 12 months | 2.50% | |

Remarks

- The Time Deposit interest rates as shown on the relevant Terms and Conditions, this webpage and relevant promotion materials are quoted with reference to interest rates offered by the Bank on 9 October 2025 and are not guaranteed. The Bank reserves the right to make any adjustment to the Time Deposit interest rate Offer from time to time at its sole absolute discretion, as per prevailing market conditions.

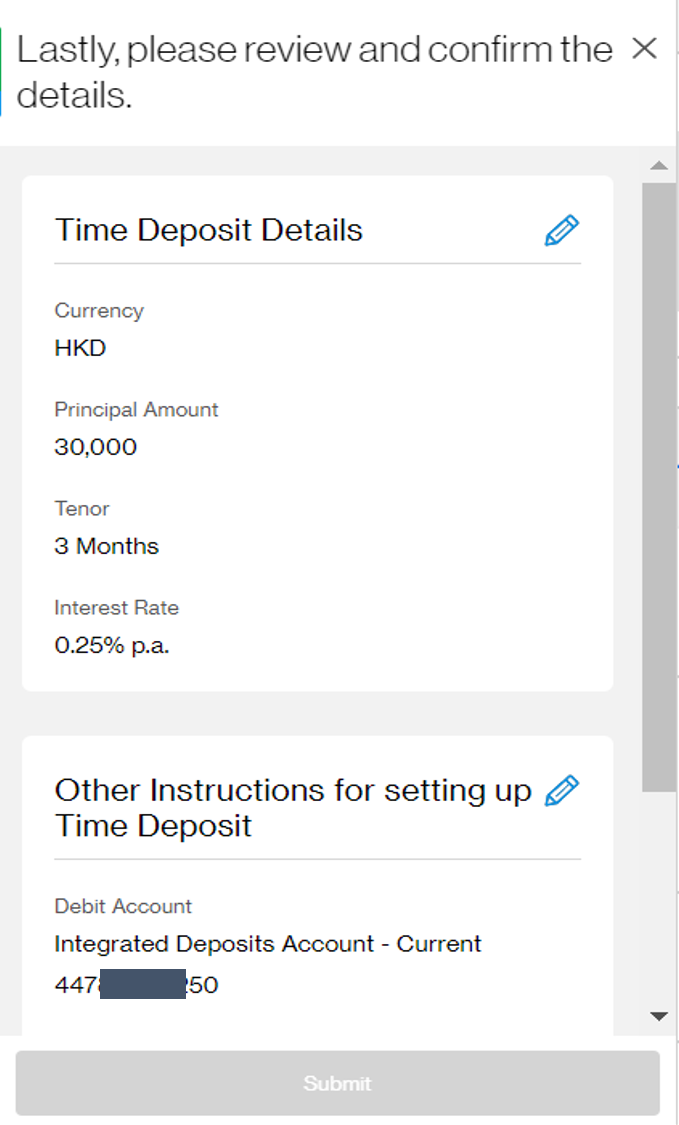

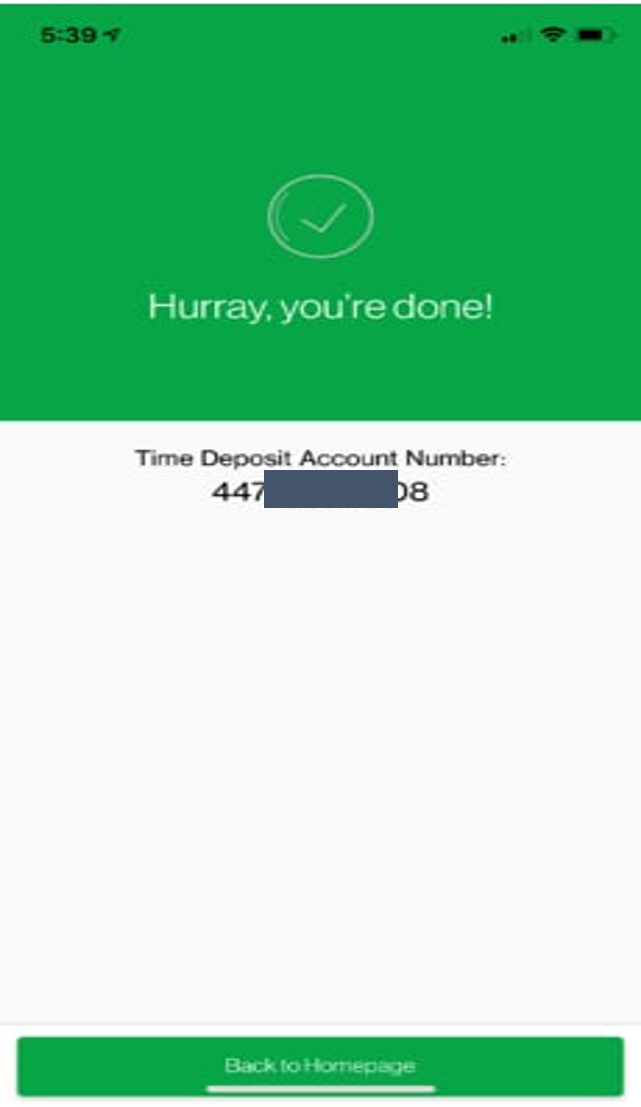

How to set up Time Deposit via SC Mobile

How to set up Time Deposit via SC Mobile

- SC Mobile App

- Others

- Existing SC Mobile App clients can apply through the QR code to logon and enjoy preferential interest rate.

- New users can download the App through App Store / Google Play.

Scan QR code to download/ login SC Mobile App now

for Android users without Google Play, please click here to download the Android application package (APK)

Other Account Opening Channels

- Click here to log in Online Banking (Service hours: 9am-11pm, Monday to Saturday, except public holidays); or

- Visit any of our branches; or

- Via phone instruction; or

- Access My RM platform (For existing Priority Private or Priority Banking clients only)

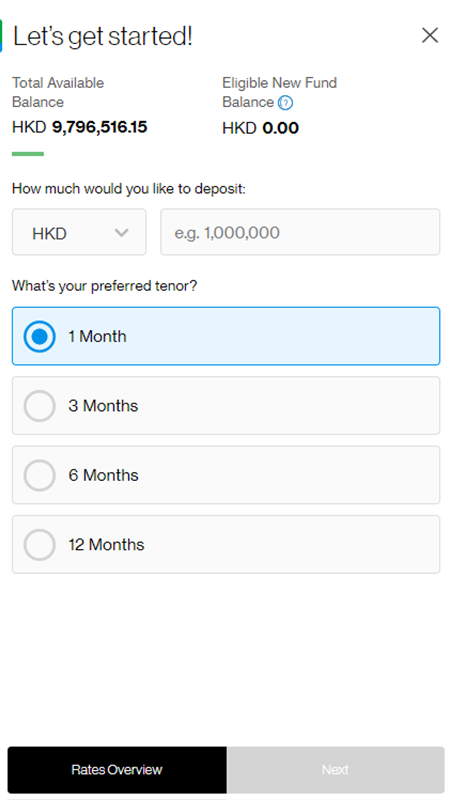

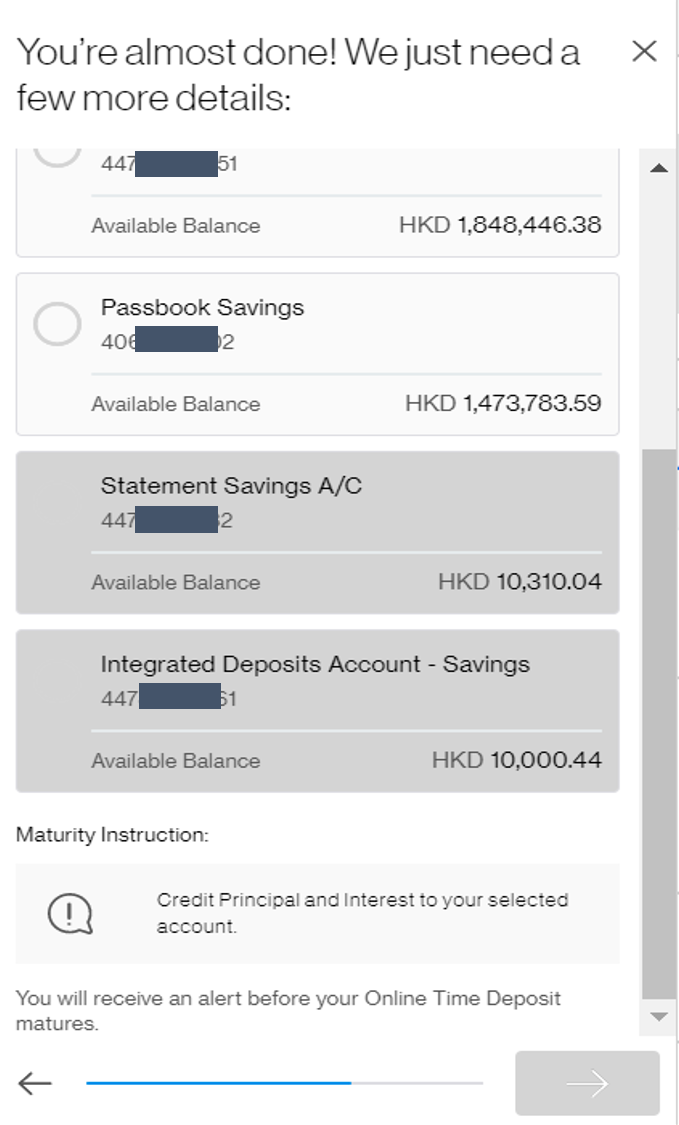

Open a Time Deposit via Online Banking or SC Mobile App

- We offer 10 currencies for your selection

(HKD, USD, CNY, AUD, NZD, CAD, GBP, EUR, CHF, JPY)

- You could choose among the specific tenors from 1 month to 12 months

- The minimum Time Deposit amounts are as follows:

Currency | Minimum amount |

|---|---|

| HKD | HKD10,000 |

| USD | USD2,000 |

| CNY | CNY10,000 |

| AUD | AUD2,000 |

| NZD | NZD2,000 |

| CAD | CAD2,000 |

| GBP | GBP2,000 |

| EUR | EUR2,000 |

| CHF | CHF2,000 |

| JPY | JPY200,000 |

- Enjoy a preferential interest rate based on your Time Deposit amount and tenor.

- Customers must have declared their tax status and/or jurisdictions of tax residence to open a Time Deposit via Online Banking or SC Mobile App.

(Remark: If you have not declared yet, please visit any of our branches to submit the information.)

- Servicing hours: 9am – 11pm, Monday to Saturday (excluding Public Holiday)

Frequently Asked Questions about Time Deposits

“New Funds” refers to funds deposited into a Time Deposit account within 4 days of account opening via cash, other bank cheques/bank drafts, electronic payments or wire transfers. These funds cannot come from renewals of existing Time Deposits, internal bank transfers or funds transferred from the maturity of high-yield currency-linked deposits with the bank.

Both Hong Kong Dollar (HKD) and US Dollar (USD) Time Deposits offer unique advantages, depending on which aligns better with your investment goals.

Advantages of HKD Time Deposits:

- Save on currency exchange fees

- Lower entry threshold compared to USD deposits

Advantages of USD Time Deposits:

- Higher interest rates compared to HKD deposits

- Ideal for transferring USD overseas for education or immigration needs while earning returns

Simply open a Standard Chartered Time Deposit account online and deposit a minimum of RMB 10,000 in new funds to qualify for the special Time Deposit interest rate. This offer is ideal for individuals who frequently travel between both locations.

Risk Disclosure Statements for RMB Deposit Services

- Renminbi (“RMB”) exchange rate, like any other currency, is affected by a wide range of factors and is subject to fluctuations. Such fluctuations may result in gains and losses in the event that the client subsequently converts RMB to another currency (including Hong Kong dollars); and

- RMB is currently not freely convertible and conversion of RMB through banks in Hong Kong is subject to restrictions specified by the Bank and regulatory requirements applicable from time to time. The actual conversion arrangement will depend on the restrictions prevailing at the relevant time.

Foreign Exchange Risk Disclosure Statement

- Foreign Exchange involves risks. Fluctuation in the exchange rate of a foreign currency may result in gains or significant losses in the event that the client converts deposit from the foreign currency to another currency (including Hong Kong Dollar).