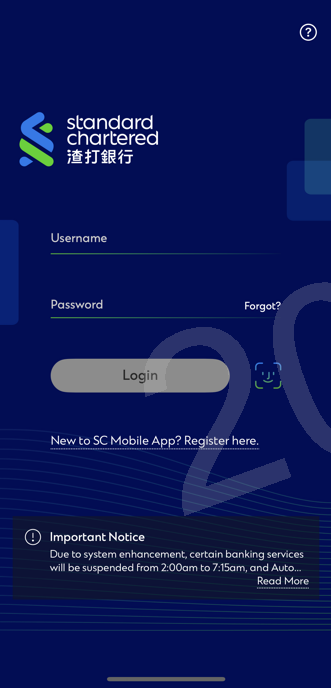

How to apply via SC Mobile App

- For New To Bank Clients

- For existing cardholders who have registered SC Mobile App

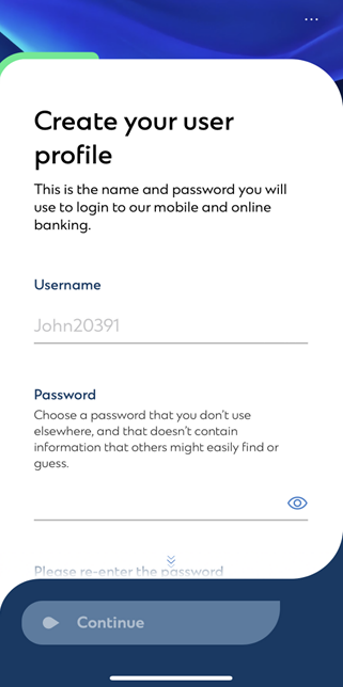

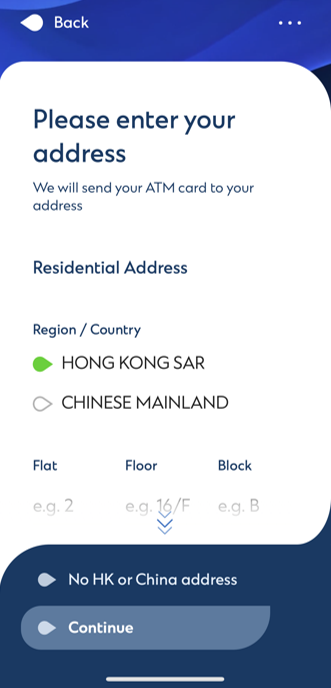

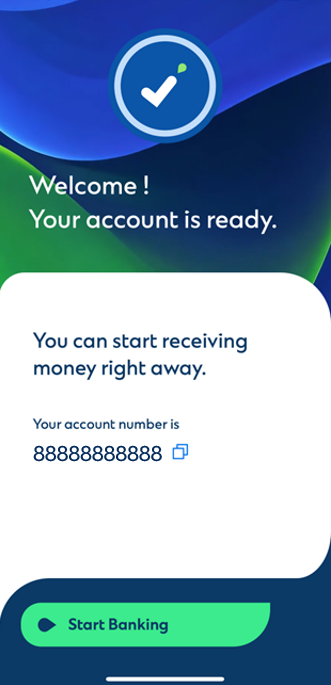

For New To Bank Clients

For New To Bank Clients

For existing cardholders who have registered SC Mobile App

For existing cardholders who have registered SC Mobile App

Tips on account opening

Before your application

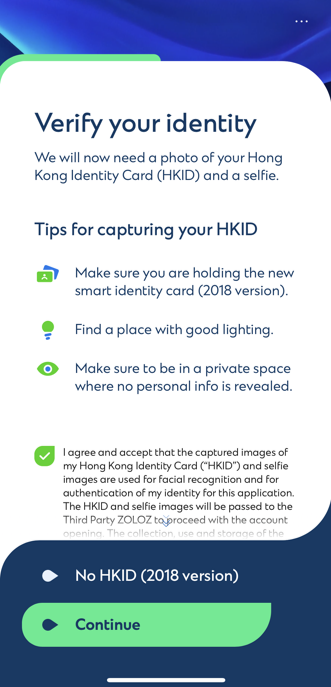

HKID verification

Selfie verification

Banking plans

After opening an account, you can choose the banking plan that best suits you

| EASY BANKING | ||

|---|---|---|

Relationship Balance Requirement

Maintenance fee

| Attractive Offers Sign up for Easy Banking and earn up to 51,400 Asia Miles with various offers | 24/7 Support

|

| PREMIUM BANKING | ||

|---|---|---|

Relationship Balance Requirement

Maintenance fee

| Welcome Offer

| Privileges & expertise

|

| PRIORITY BANKING | ||

|---|---|---|

Relationship Balance Requirement

Maintenance fee

| Welcome Offer

| Privileges & expertise

|

Who can apply via SC Mobile App

To be eligible to apply for Integrated Deposits Account (IDA) via SC Mobile app, you should be: |

|---|

• Not currently holding any Standard Chartered Bank (Hong Kong) Limited deposit account, including Savings Account(s), Current/ Cheque Account(s), Integrated Deposits Account(s) and Time Deposit Account(s); • Holding a valid Hong Kong Identity Card (2018 Version); |

After internal review, we may invite you to visit branch to open an Integrated Deposits Account if we require additional information / documentation from you. To save your waiting time, you may make an appointment on our website to open the account at a preferred branch.

Foreign Exchange

Enjoy HKD100 welcome offer with an accumulated FX transaction of HKD10,000.

Allianz Accident Protect Essentials

Apply exclusively via SC Mobile App to enjoy coverage for only HKD25 monthly premium. Learn More

Manage your finances on the go

Experience SC Mobile App now

Scan QR code to download SC Mobile App now

for Android users without Google Play, please click here to download the Android application package (APK)

FAQs

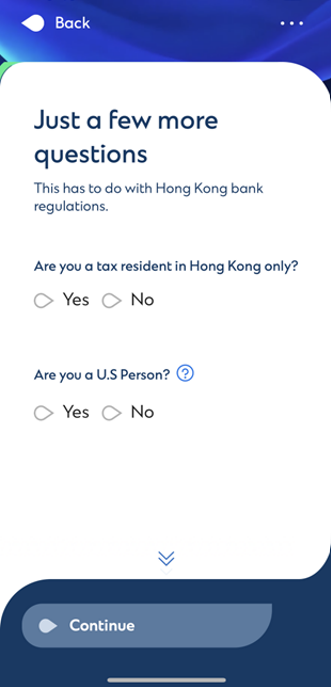

To be eligible to apply for Integrated Deposits Account (IDA) via SC Mobile app, you should be:

- Not currently holding any Standard Chartered Bank (Hong Kong) Limited deposit account, including Savings Account(s), Current/ Cheque Account(s), Integrated Deposits Account(s) and Time Deposit Account(s);

- Holding a valid Hong Kong Identity Card (2018 Version);

- 18 years old or above;

- a non – US Resident, non-US citizen and not holding a US Permanent Resident Card (Green Card);

- Opening this account for personal use purpose;

- Residing in Hong Kong or China;

After internal review, we may invite you to visit branch to open an Integrated Deposits Account if we require additional information / documentation from you. To save your waiting time, you may make an appointment on our website to open the account at a preferred branch.

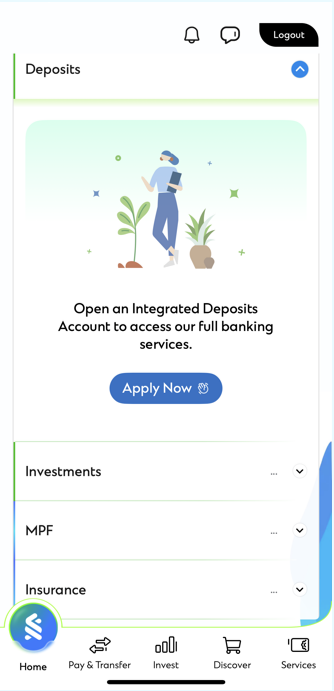

Yes, as long as you do not or did not hold any deposit account with us and meet the other requirements listed above. You may log onto the app and

- Click “Apply Now” under “Deposits” at Home Tab; OR

- Click “Apply Now” under “Enjoy Full Banking Services” at Pay & Transfer Tab; OR

- Click “Apply Now” under “Enjoy Full Banking Services” at Invest Tab; OR

- Click “Apply Now” under “Enjoy Full Banking Services” at Discover Tab

If you have not yet registered SC Mobile App, please register for it first.

Yes, as long as you are a new client with us now and meet the above requirements.

ATM Card will be dispatched upon the account is successfully opened. Normally you will receive the ATM card within 5 working days, excluding Saturdays, Sundays and public holidays.

Using myWealth

- Investing can be complex due to changing market conditions. You have your own personal circumstances, specific needs and investment objectives. You may also hold assets elsewhere. These factors, which can change from time to time, and your holdings held elsewhere have not been factored in by the service.

- Please do not execute trades on your own by simply relying on these investment ideas in isolation.

- Notwithstanding any discussion with your Relationship Manager, before deciding to proceed with any investment transaction, you should make an independent assessment about the risks, merits and appropriateness of each investment transaction, and seek independent professional advice.

- We are not providing portfolio monitoring services and are not obliged to review, manage or monitor the performance of your investment holdings.

- The products involved are not principal protected and you may lose all or part of your original investment amount. There are possible disadvantages from subscribing, selling or switching and the Bank makes no warranty on your decision to buy, sell or switch at any material time.

- SCB Chief Investment Office & Wealth Management Product specialists provide the following inputs which are used in myWealth algorithms namely 1. Model portfolios or model asset allocation 2. Bank’s House view on asset classes 3. Fund select list. These inputs are refreshed on monthly basis by Bank’s Investment and product specialists.

myWealth service limitations

- myWealth is a direct to client investment service. If you require human interaction, please contact your Relationship Manager for further engagement.

- The investment ideas generated through the myWealth service have taken into consideration your current risk profile, cash balances, investment funds, bonds, equities, structured investments and structured products holdings that you have held with the Bank.

- Your investment concentration, holdings in insurance, leverage or other loans with the Bank, and any other investment holdings, assets / liabilities outside the Bank are not considered in the myWealth service.

- Currently, myWealth only generates investment ideas on investment funds based on your current asset allocation and the model asset allocation under predefined rules.

- myWealth does not offer automatic portfolio rebalancing.

- The algorithms may include performance data and statistics that are derived based on historical data and methodologies formulated on various assumptions.

- Extreme events such as drastic market declines are not explicitly modelled.

- Prices and market values are for your information only and their accuracy is not guaranteed, and they may not be relied upon by any party as the basis for making any trading, hedging or investment decision. Prices including those of exchange traded securities are generally based upon the last traded price at close of market. Funds are valued based on the latest available net asset value. Where any price is provided, it represents an indicative market valuation only and as an estimated value may differ substantially from prices at which you may be able to sell a product and may not include redemption charges or other charges .

- Only applicable to new Standard Chartered banking clients who do not hold any Standard Chartered Bank (Hong Kong) Limited deposit account, including Savings Account(s), Current/ Cheque Account(s), Integrated Deposits Account(s) and Time Deposit Account(s). For existing clients, please log in to Online Banking or visit the branch for account opening.

- To apply via SC Mobile App, you must have a mobile device which is supported with iOS version 14 or above (iPhone 6S or later model) or with Android version 9.0 or above or Harmony 2; and equipped with front and back camera, and with gravity sensor.

- For any of the Bank’s products services , or application or utilising any of the Bank’s services that requires your handwritten signature, e.g. cheque book request, please visit any of our branches to provide us with a specimen of your handwritten signature.

- If the average daily Relationship Balance of the Priority Banking client within the quarter falls below HKD1,000,000, a maintenance fee of HKD900 will be charged for the quarter. For details, please refer to the Service Charges booklet.

- My RM services are only applicable to selected Priority Banking clients.

- Promotion Terms and Conditions for Priority Banking

- Promotion Terms and Conditions for Priority Banking Mobile Sign-up Reward

- Promotion Terms and Conditions for Premium Banking New Funds Growth Reward

- Promotion Terms and Condition for Premium Banking Online Reward

- Terms and Conditions for FX Membership Program exclusive for clients trading Foreign Exchange

This webpage does not constitute any prediction of likely future price movements. Investors should not make investment decisions based on this webpage alone. This webpage has not been reviewed by the Securities and Futures Commission or any regulatory authority in Hong Kong.

Risk Disclosure Statement for RMB Deposit Services

- Renminbi (“RMB”) exchange rate, like any other currency, is affected by a wide range of factors and is subject to fluctuations. Such fluctuations may result in gains and losses in the event that the client subsequently converts RMB to another currency (including Hong Kong dollars); and

- RMB is currently not freely convertible and conversion of RMB through banks in Hong Kong is subject to restrictions specified by the Bank and regulatory requirements applicable from time to time. The actual conversion arrangement will depend on the restrictions prevailing at the relevant time.

Foreign Exchange Risk Disclosure Statement

- Foreign Exchange involves risks. Fluctuation in the exchange rate of a foreign currency may result in gains or losses in the event that the client converts a time deposit from the foreign currency to HKD.

myWealth Risk Disclosure Statements

- Investment involves risks. The prices of investment products fluctuate, sometimes dramatically and the worst case may result in loss of your entire investment amount. Past performance is no guide to its future performance.

- Investors should read the terms and conditions contained in the relevant offering documents and in particular the investment policies and the risk factors and latest financial results information carefully and are advised to seek independent professional advice before making any investment decision.

- Investors should consider their own investment objectives, investment experience, financial situation and risk tolerance level.