Prudential Entrust Multi-Currency Plan

Multi-currency plan for plan for wealth accumulation and legacy planning. Your wealth could be rolled over to future generations with a range of seamless legacy planning tools.

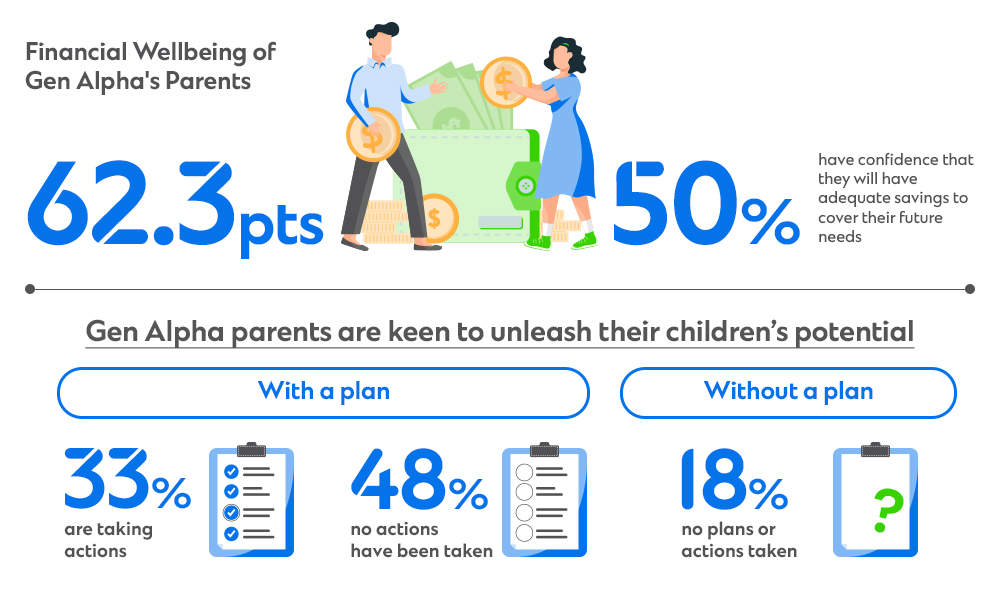

Only 37% of Gen Alpha (the generation born between 2010 and 2024) parents are saving for their children’s future1

Nearly 60% of Gen Alpha parents aim to give ongoing financial support to their kids, while 94% of Gen Alpha parents believe they will have to financially support their children until the age of 251

Nearly 60% of Gen Alpha parents aim to give ongoing financial support to their kids, while 94% of Gen Alpha parents believe they will have to financially support their children until the age of 251

For “present financial security,” the 36-49 age group scores the lowest2

It can be explained by the various financial burdens including familial duties, such as childcare and children’s education(27%)2

It can be explained by the various financial burdens including familial duties, such as childcare and children’s education(27%)2

| Item | Annual Tuition | Years | Total Expenses | |

| Pre-school | Playgroup (once a week) | HKD 15,080 – 23,4003 | 1 | HKD 15,080 – 23,400 |

| Pre-nursery | HKD 36,905 – 145,9204 | 1 | HKD 36,905 – 145,920 | |

| Kindergarten | Private non-profit / Private Kindergarten | HKD 43,000 – 134,5305 | 3 | HKD 129,000 – 403,590 |

| International Kindergarten | HKD 78,067 – 251,6806 | 3 | HKD 234,201 – 755,040 | |

| Primary School | Government Subsidized Primary School | HKD 7,370 – 77,3907 | 6 | HKD 44,220 – 464,340 |

| Private Primary School | HKD 34,000 – 211,6108 | 6 | HKD 204,000 – 1,269,660 | |

| International Primary School | HKD 115,900 – 232,4806 | 6 | HKD 695,400 – 1,394,880 | |

| Secondary School | Government Subsidized Secondary School | Free – HKD 136,5849 | 6 | HKD 9,000 – 819,50410 |

| Private Secondary School | HKD 12,500 – 258,470 | 6 | HKD 79,900 – 1,550,820 | |

| International Secondary School | HKD 158,900 – 266,1006 | 6 | HKD 953,400 – 1,596,600 | |

| University | Local University | HKD 42,10011 | 4 | HKD 168,400 |

| UK University (accommodation and living expenses) | HKD 100,000 – 420,00012 (HKD 110,000 – 400,000)12 | 3 | HKD 300,000-1,260,000 (HKD 330,000-1,200,000) | |

| US University (accommodation and living expenses) | HKD 320,000 – 440,00012 (HKD 110,000 – 170,000) 12 | 4 | HKD 1,280,000- 1,760,000 (HKD 440,000-680,000) | |

| Canadian University (accommodation and living expenses) | HKD 53,000 – 350,00012 (HKD 90,000 – 150,000) 12 | 4 | HKD 212,000- 1,400,000 (HKD 360,000-600,000) | |

| Australian University (accommodation and living expenses) | HKD 210,000-340,00012 (HKD 110,000-160,000) 12 | 3 | HKD 630,000- 1,020,000 (HKD 330,000-480,000) |

Nearly 90% high-net-worth families plan to send their children abroad13

The most popular destinations for study abroad for high-net-worth families are the United Kingdom, the United States, Switzerland, Germany, Singapore, Australia, Canada, France, New Zealand and Japan13

The most popular destinations for study abroad for high-net-worth families are the United Kingdom, the United States, Switzerland, Germany, Singapore, Australia, Canada, France, New Zealand and Japan13

Nurturing and customising your family foundation with love and trust

Multi-currency plan for plan for wealth accumulation and legacy planning. Your wealth could be rolled over to future generations with a range of seamless legacy planning tools.

Cultivate wealth with just a single premium: Seamlessly grow, access and pass it on across generations. Features Dividend Lock-in Option to realise the Terminal Dividend and legacy planning tools.

Design the bright future of your children starting today. Plan ahead on your next generation’s higher education funding along with comprehensive life protection.

Leave your contact information, and our Insurance Specialists will get in touch with you to provide tailored advice.

Standard Chartered Bank (Hong Kong) Limited is an insurance agent of Prudential Hong Kong Limited (Licensed Insurance Agency FA1239).

This webpage is intended to be valid in Hong Kong only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Hong Kong. Prudential and Standard Chartered do not offer or sell any insurance product in any jurisdictions outside Hong Kong in which such offering or sale of the insurance product is illegal under the laws of such jurisdictions. This webpage does not constitute a contract of insurance or an offer, invitations or recommendation to any person to enter into any contract of insurance or any transaction described therein or any similar transaction.

The material and information contained on this webpage should be read in conjunction with the relevant product brochure and for the risk disclosure, please refer to the product brochure.

This webpage is for your information only. Customers must not rely on the information in this webpage alone to enter into any transaction. Customers are recommended to seek professional for specific advice.

Standard Chartered Bank (Hong Kong) Limited (“Standard Chartered”) expressly disclaims all liability for the use or interpretation by others of information contained in this webpage.

All information shown is for reference purpose only and should not be considered as an offer or solicitation for any of the products or investments mentioned herein. Some of the information in this webpage may contain projections or other forward-looking statements regarding future events or the future financial performance of countries, markets or companies. These statements are only predictions but actual events or results may materially differ. Any opinion or information contained in this webpage is made on a general estimate basis, without any guarantee of accuracy, and should not be relied upon by the reader as advice. Standard Chartered reserves the right to make changes and corrections to its opinions expressed in this webpage at any time, without any prior notice. You are advised to seek independent advice from appropriate professionals (such as accountants, financial consultants or lawyers, etc) before making any decision on the topic(s) mentioned in this webpage.

Standard Chartered makes no recommendation on using any product or service mentioned in this webpage which are not provided by Standard Chartered or Prudential Hong Kong Limited (“Prudential”), and accepts no liability for any loss or damage arising directly or indirectly from your use of such product or service howsoever arising.

Investing can be complex due to changing market conditions. You have your own personal circumstances, specific needs and investment objectives. You may also hold assets elsewhere. These factors, which can change from time to time, and your holdings held elsewhere have not been factored in.

Notwithstanding any discussion with your Relationship Manager, before deciding to proceed with any investment transaction, you should make an independent assessment about the risks, merits and appropriateness of each investment transaction, and seek independent professional advice.

We are not providing portfolio monitoring services and are not obliged to review, manage or monitor the performance of your investment holdings.

This webpage does not constitute any prediction of likely future price movements.

Investors should not make investment decisions based on this webpage alone.

This webpage has not been reviewed by the Securities and Futures Commission or any regulatory authority in Hong Kong.

1. Prudential “Financial Wellbeing Tracker” 25 February 2025

2. Prudential “Financial Wellbeing Tracker” 4 January 2024

3. Spacious – 6 Prominent Playgroups with Celebrity Endorsement! Must-know Information about Playgroup Admission, April 2023.

4. Champimom – Nursery Class in Kindergarten 2022 | Most Popular Nursery Class Tuition in Hong Kong, August 2022.

5. Champimom – Kindergarten 2022 | Latest Tuition Fee Ranking for Popular K1 Kindergartens in Hong Kong and New Territories, September 2022.

6. Money Hero – Comparison of International School Tuition Fees/Bonds/Rankings in Hong Kong, February 2023.

7. Schooland – Delia (Min Chiu) English Primary School and Hong Yan College, May 2023.

8. Schooland – Delia English Primary School and Kindergarten and Hong Lap College, May 2023.

9. Oh! 爸媽 – List and Tuition Fees of Government Subsidized and Private Secondary Schools, May 2022.

10. Schooland – De La Salle School (Caritas) and Kellett School (IB), May 2023.

11. Joint University Programmes Admissions System – Tuition Fees for Participating Institutions under the “JUPAS” for 9 Programs, May 2023.

12. Education First (EF) – Study Abroad Expenses, May 2023.

13. “Hurun Chinese Luxury Consumer Survey 2022”, Hurun Research Institute

14. “2022 Global Wealth Forecast” report, Standard Chartered Group