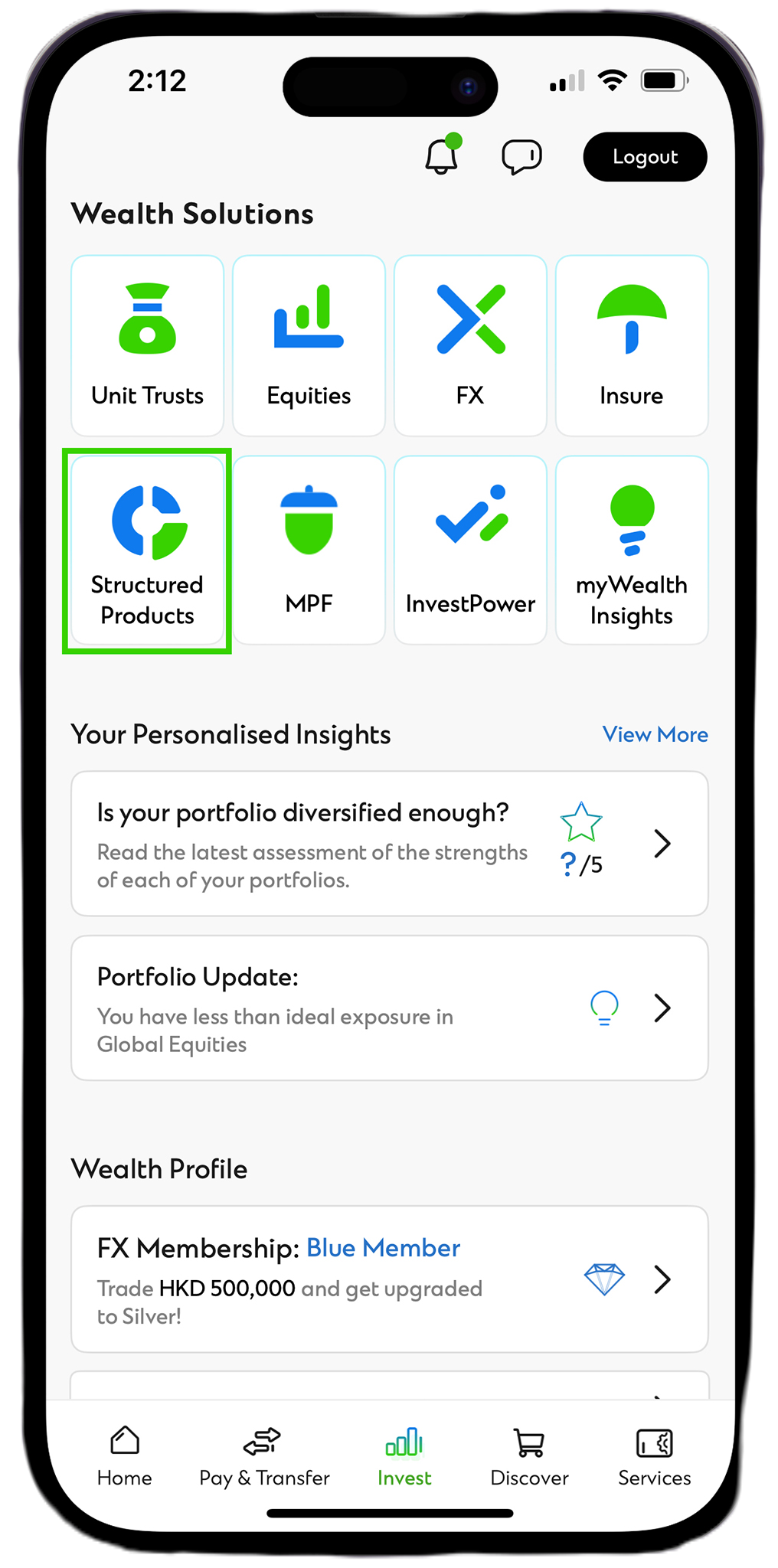

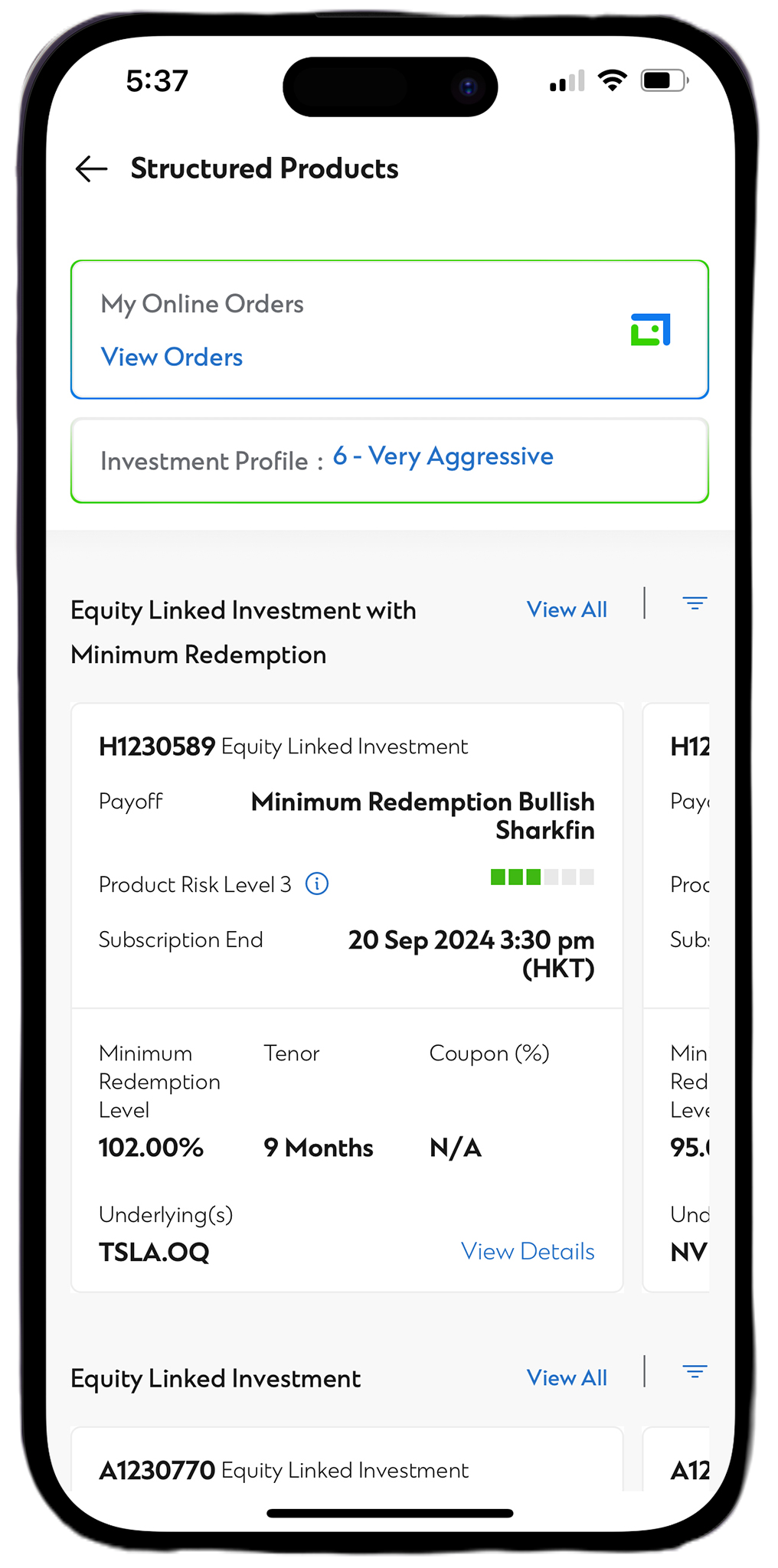

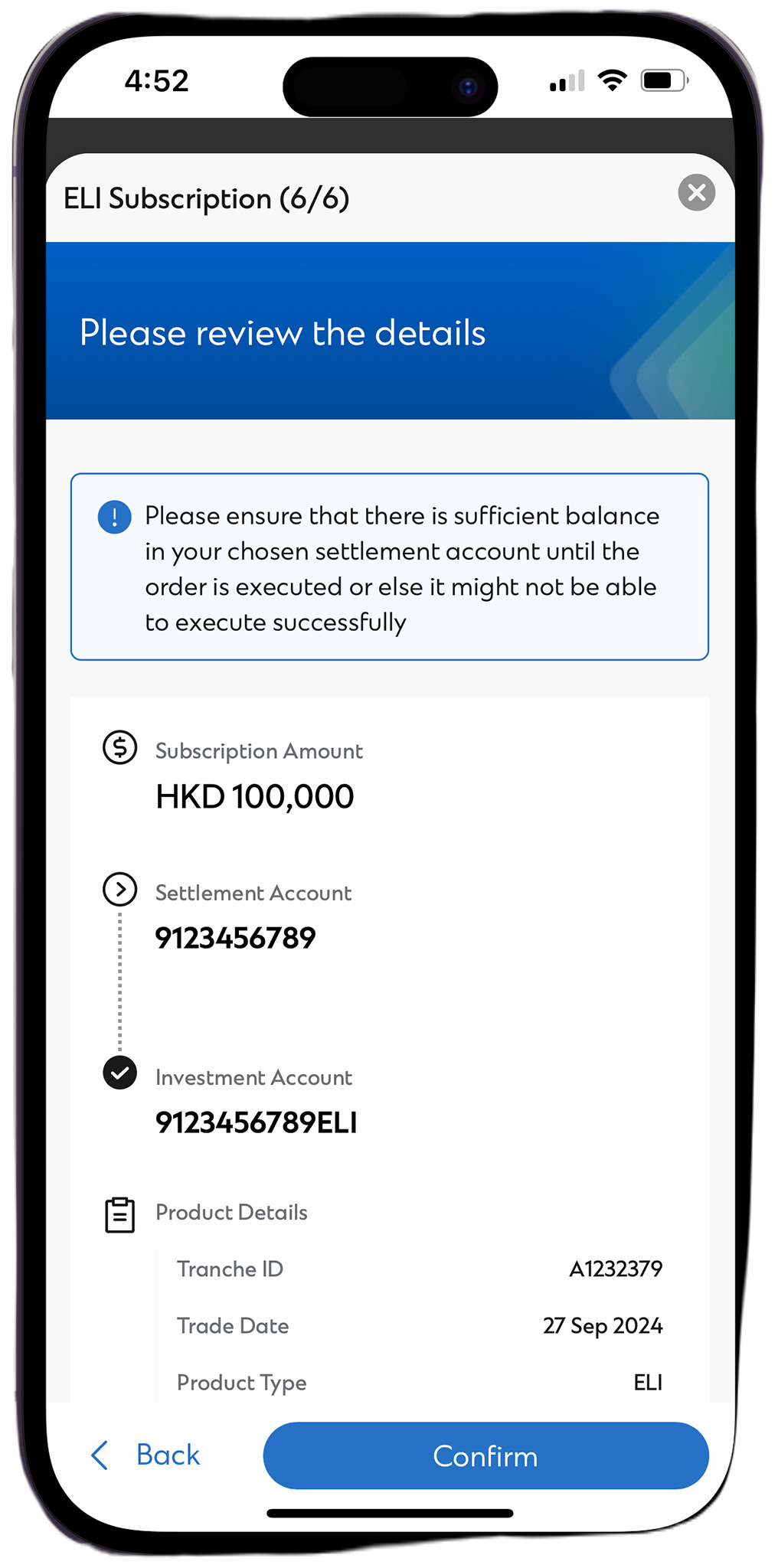

You can place Strcutured products (Equity-Linked Investments & Structured Notes) subscription orders via Online Strcutured Products Platform.

Learn more about Equity-Linked Investments (ELI)

Minimum Redemption

Decide your risk at your choice! It guarantees a minimum return on your principal, when held to maturity, regardless of the underlying stock performance.

Airbag

The airbag feature, helps cushion the losses in the event of a market downturn. As long as the underlying stock price is at or above the airbag level, your principal and potential return are protected.

Strike Price

The strike price is set by you, allowing you to purchase the underlying stock at your desired price at maturity.

Potential Return

Depending on the price movement of the underlying stock, you can potentially earn a higher return than traditional time deposits.

Tenor & Callable feature

Flexible tenor range from 2-11 months. Callable feature allows investors to receive potential returns before the maturity date.

I want to participate the markets with downside protection

How does Minimum Redemption work?

Minimum Redemption feature

- guarantee a minimum return on your principal at maturity

Scenario A: Final closing price is below the minimum redemption price

Scenario A | Principal | Final value | Change in value | Coupon |

|---|---|---|---|---|

| Invest in the stock | 100 | 60 worth of stock | -40% | NO |

| Equity Linked Investment (ELI) | 100 | 90 worth of cash (Principal is protected when closing within airbag) | -10% | YES (if applicable) |

Elaboration:

Assuming your initial investment is HK$100,

- Although the underlying stock, on the maturity date, closes below the minimum redemption price (HK$60 < HK$90), you will receive your principal back at the minimum redemption level (HK$90). Your loss is limited at HK$10, plus any potential return/coupon.

- If you had purchased the stock, you will suffer an unrealized loss of HK$40.

The above calculations and examples are purely hypothetical and for illustration purpose only. They do not reflect a complete analysis of all possible gain or loss scenarios, and they should not be relied on as an indication of the actual return or duplicated under real investment conditions.

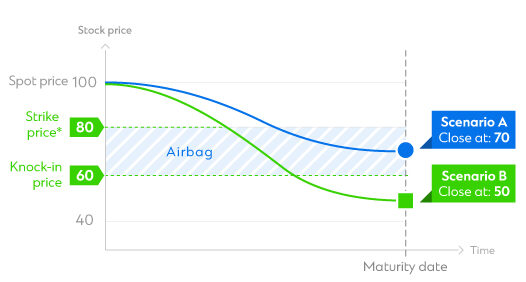

How does Airbag work?

Airbag (Knock-in) feature

- As long as the underlying stock price is at or above the airbag level, your principal and potential return are protected

Scenario A: Final closing price is above the knock-in price

Scenario B: Final closing price is below the knock-in price

| SCENARIO A | PRINCIPAL | FINAL VALUE | CHANGE IN VALUE | COUPON |

|---|---|---|---|---|

| Invest in the stock | 100 | 70 worth of stock | -30% | NO |

| Equity Linked Investment (ELI) | 100 | 100 worth of cash (Principal is protected when closing within airbag) | 0% | YES (if applicable) |

SCENARIO B | PRINCIPAL | FINAL VALUE | CHANGE IN VALUE | COUPON |

|---|---|---|---|---|

| Invest in the stock | 100 | 50 worth of stock | -50% | NO |

| Equity Linked Investment (ELI) | 100 | 62.5 worth of stock (Receive the stock when closing below airbag) | -37.5% | YES (if applicable) |

Elaboration:

Assuming your initial investment is HK$100,

- If the final closing price is above the knock-in price (HK$70>HK$60), you will receive your full principal back with any potential coupon at maturity. If you had purchased the stock, you will suffer an unrealized loss of HK$30.

- If the final closing price is below the knock-in price (HK$50 < HK$60), you will receive physical delivery of 1.25 stock at strike price (HK$100/HK$80). The stock worths HK$62.5 (1.25 x HK$50) and the unrealized loss is HK$37.5. If you had purchased the stock, you will suffer an unrealized loss of HK$50.

The above calculations and examples are purely hypothetical and for illustration purpose only. They do not reflect a complete analysis of all possible gain or loss scenarios, and they should not be relied on as an indication of the actual return or duplicated under real investment conditions.

Top Underlying Stock

| SECTOR | STOCK NAME | STOCK CODE |

|---|---|---|

| Industrials | Contemporary Amperex Technology | 3750.HK |

| Consumer Discretionary | Alibaba Group Holding Ltd | 9988.HK |

| Consumer Discretionary | Pop Mart International Group Ltd | 9988.HK |

| Information Technology | XIAOMI CORPORATION | 1810.HK |

| Financials | HONG KONG EXCHANGES AND CLEARING LIMITED | 388.HK |

| Financials | The Goldman Sachs Group, Inc. | GS UN |

| Communication Services | Alphabet Inc | GOOGL UW |

| Information Technology | Amphenol Corporation | APH |

| Information Technology | Advanced Micro Devices Inc | AMD UW |

| Health Care | Johnson & Johnson | JNJ UN |

List above is the popular# HK stocks and US stocks linked to Equity-Linked Investment offered by SCBHK in the specified offer period^.

#Popular Stock Underlyings refer to the HK and US Stocks which are the most frequently chosen as the underlying stocks of Equity-Linked Investment offered by SCBHK during the aforementioned offer period.^ The above information is past sales record and for reference only. It is not and shall not be considered as investment advice. It does not constitute any offer or solicitation of offer to subscribe, transact or redeem any investment products. If you would like to obtain the latest information on the relevant products, please contact our relationship manager. Suitability assessment is required before subscribing for the relevant products.

^Last update and quotation date: 2/1/2026.

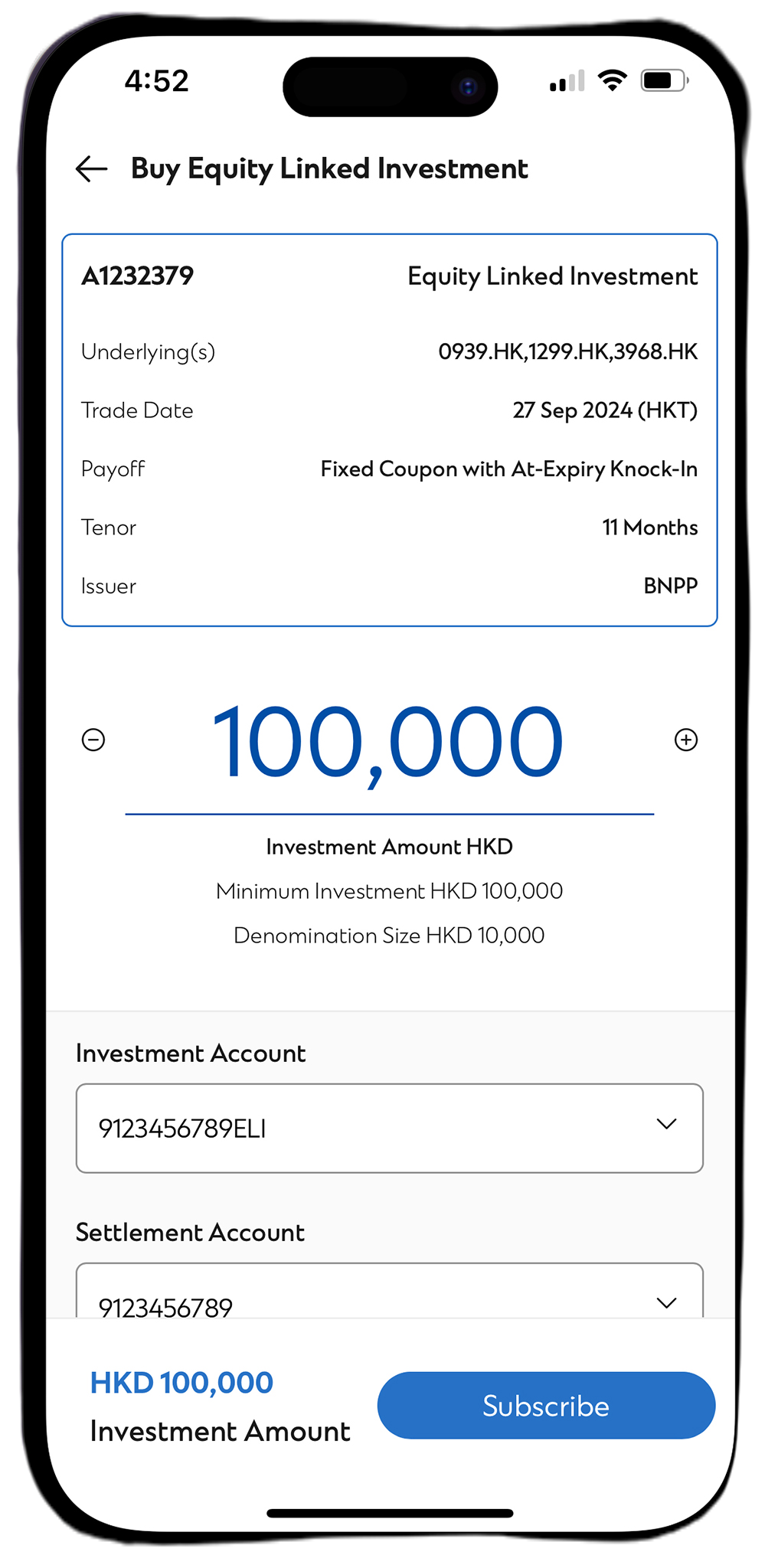

5 steps to trade on Online Structured Products Platform

5 steps to trade on Online Structured Products Platform

FAQ

Basic FAQs

Structured Products are investments involving derivatives, with returns linked to underlying assets, such as equities, interest rates, or currencies. We offer a wide range of Structured Products including Equity-Linked Investments, Structured Notes, Structured Investment Series to our investors.

We offer a range of major currencies for Structured Products, including HKD, USD, AUD, CAD, CHF, JPY, NZD, EUR, GBP and RMB.

The return will be determined by the performance of the worst performing underlying equity.

Not all Structured products are principal protected and in extreme cases, you may lose some or all of the investment amount. Please read the relevant documents of the Structured Products you are interested in for more details on product features.

Customer Investment Profile captures your overall general attitude towards investment risks as an investor. We need you to maintain a valid profile if you want to trade via Online Structured Products platform. You may review and update your Customer Investment Profile through Online Banking and SC Mobile regularly.

The minimum investment amount can be different for each product type, please refer to the product details and related documents of the relevant product(s)

Please ensure that a valid W8-BEN form has been submitted to the Bank. You can submit the form by uploading it here.

Risk Disclosure Statement

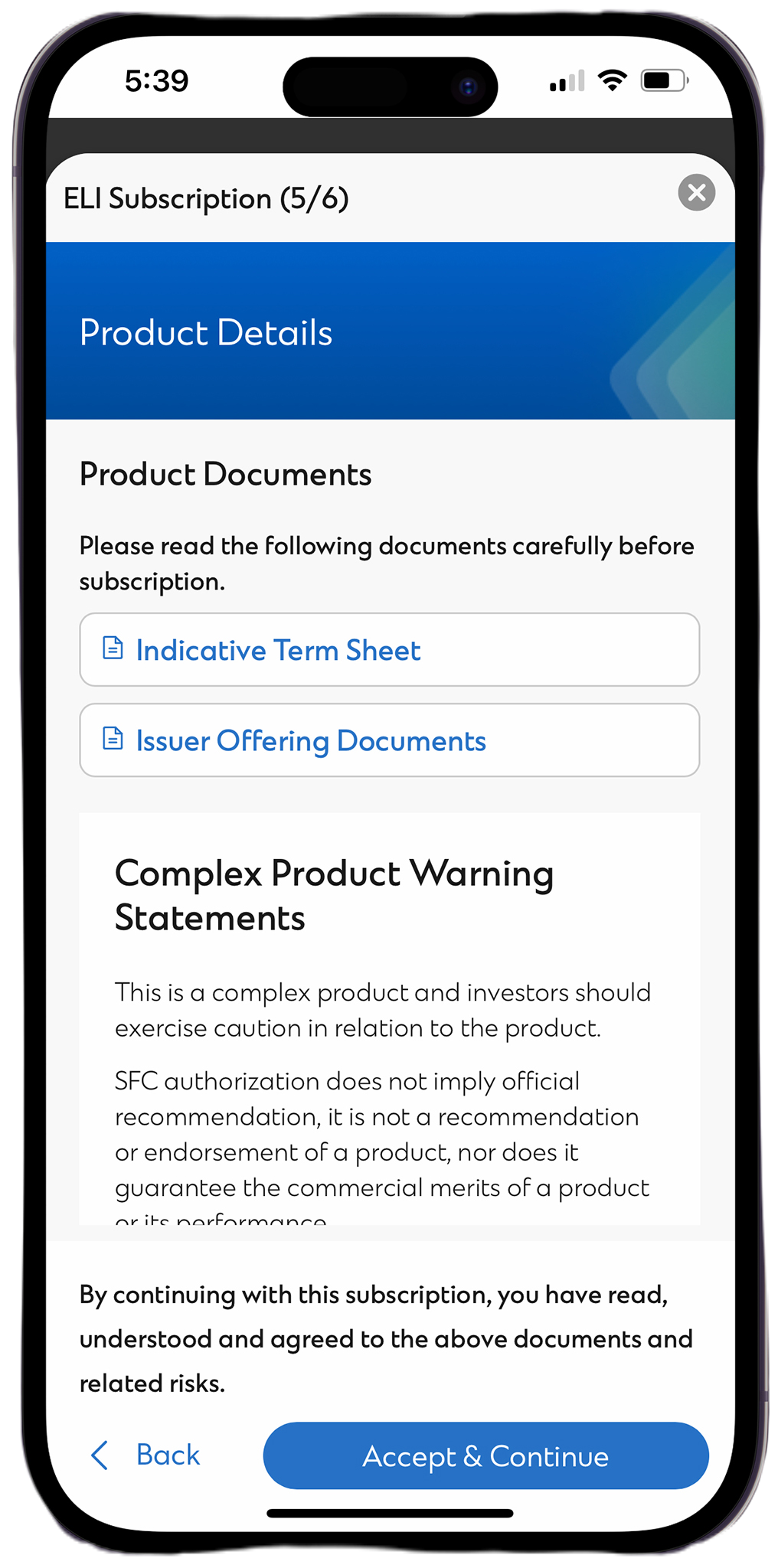

- Equity Linked Investments are structured products involving derivatives. The Investment decision is yours but you should not invest in the Equity Linked Investments unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives.

- SFC authorization does not imply official recommendation, it is not a recommendation or endorsement of a product, nor does it guarantee the commercial merits of a product or its performance.

- ELI Contracts are NOT equivalent to time deposits.

- The price or value of the Equity Linked Investments (ELIs) fluctuates, sometimes dramatically. The price or value of the ELIs may move up or down, and may even become valueless. It is as likely that losses will be incurred rather than profit made as a result of subscribing for, buying and selling the ELIs. Investors should therefore carefully consider whether such transactions are suitable in light of their financial position and investment objectives before entering into such transactions.

- Not principal protected: ELIs are not principal protected. You may suffer a loss if the prices of the underlying asset(s) of an ELI go against your view. In extreme cases, you could lose your entire investment.

- Limited potential gain: the potential return on your ELI may be capped at a predetermined level specified by the issuer.

- Credit risk of the issuer: when you purchase an ELI, you rely on the credit-worthiness of the issuer. In case of default or insolvency of the issuer, you will have to rely on your distributor to take action on your behalf to claim as an unsecured creditor of the issuer regardless of the performance of the reference asset(s).

- No collateral: ELIs are not secured on any assets or collateral.

- Limited market making: issuers may provide limited market making arrangement for their ELIs. However, if you try to terminate an ELI before maturity under the market making arrangement provided by the issuer, you may receive an amount which is substantially less than your original investment amount.

- Investing in an ELI is not the same as investing in the reference asset(s): during the investment period, you have no rights in the reference asset(s). Changes in the market price of such reference asset(s) may not lead to a corresponding change in the market value and/or potential payout of the ELI.

- Conflicts of interest: issuer of an ELI may also play different roles, such as the arranger, the market agent and the calculation agent of the ELI. Conflicts of interest may arise from the different roles played by the issuer, its subsidiaries and affiliates in connection with the ELI.

Note

This webpage does not constitute any offer, invitation or recommendation to any person to enter into any transaction described therein or any similar transaction, nor does it constitute any prediction of likely future price movements. Investors should not make investment decisions based on this webpage alone, This webpage has not been reviewed by the Securities and Futures Commission or any regulatory authority in Hong Kong.