What is myWealth?

myWealth service generates investment ideas with rationale backed by the Bank’s house views, based on your current portfolio holdings^ and risk profile*, in a tailor-made approach systematically.

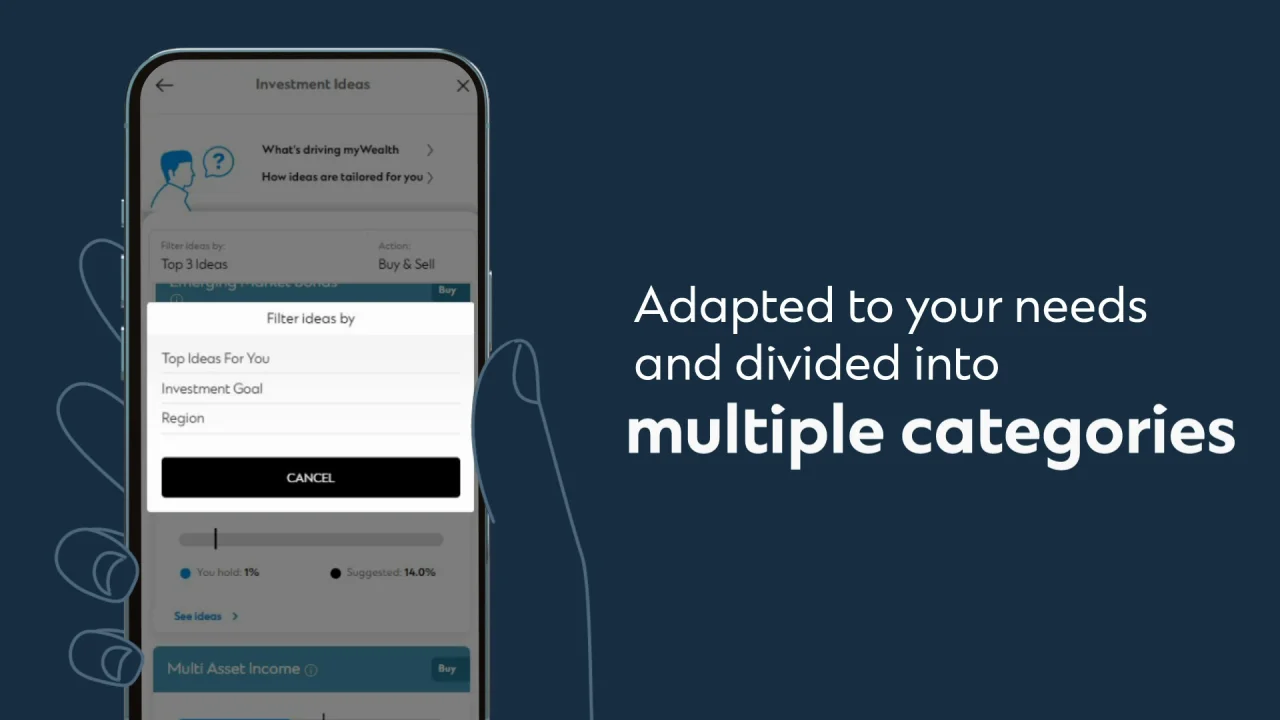

- PERSONALISED IDEAS

- HEALTH CHECK

- ASSET ALLOCATION

- MARKET INSIGHTS

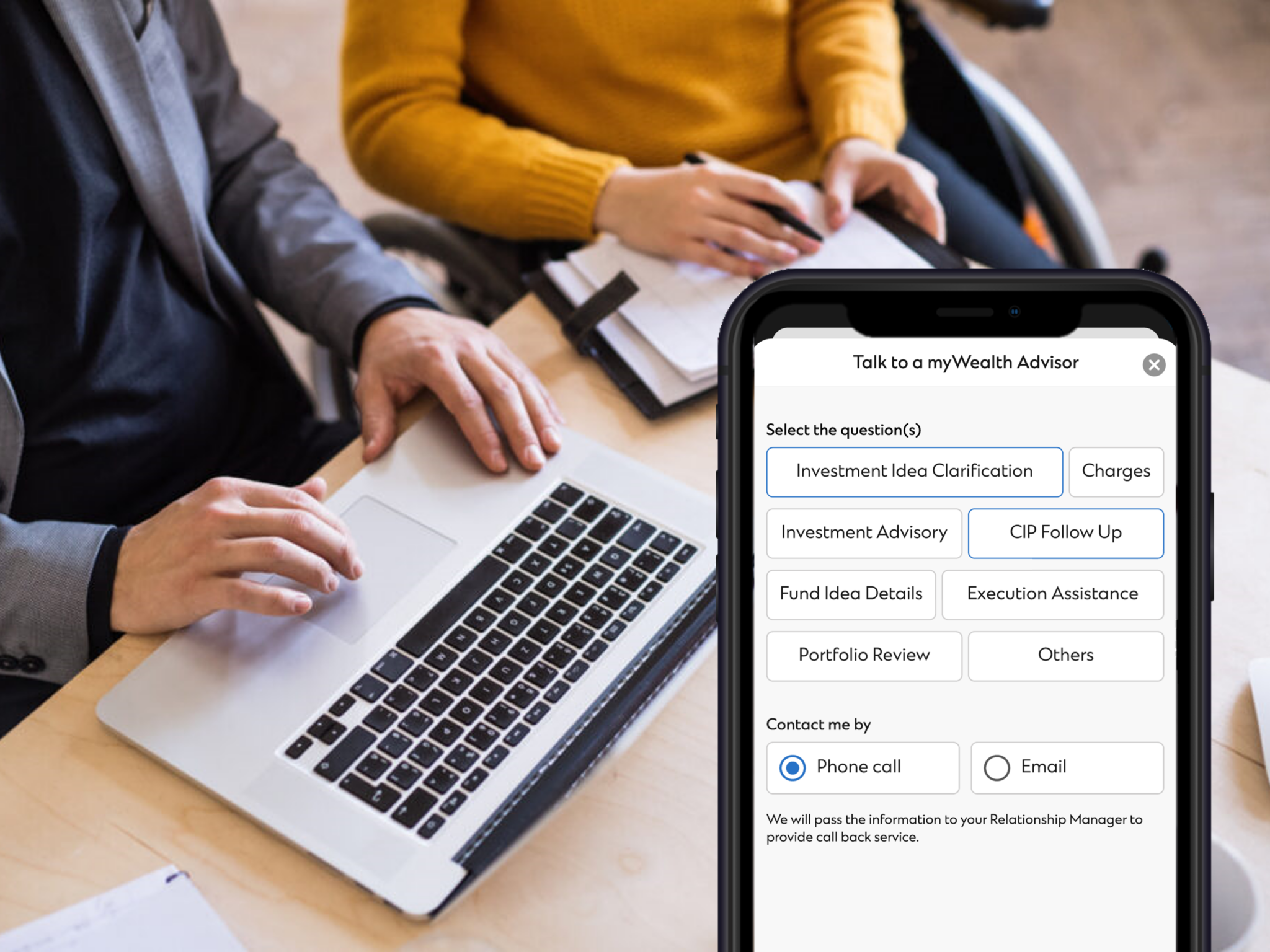

- ALL ROUND SUPPORT

- SEAMLESS SYNCHRONIZATION

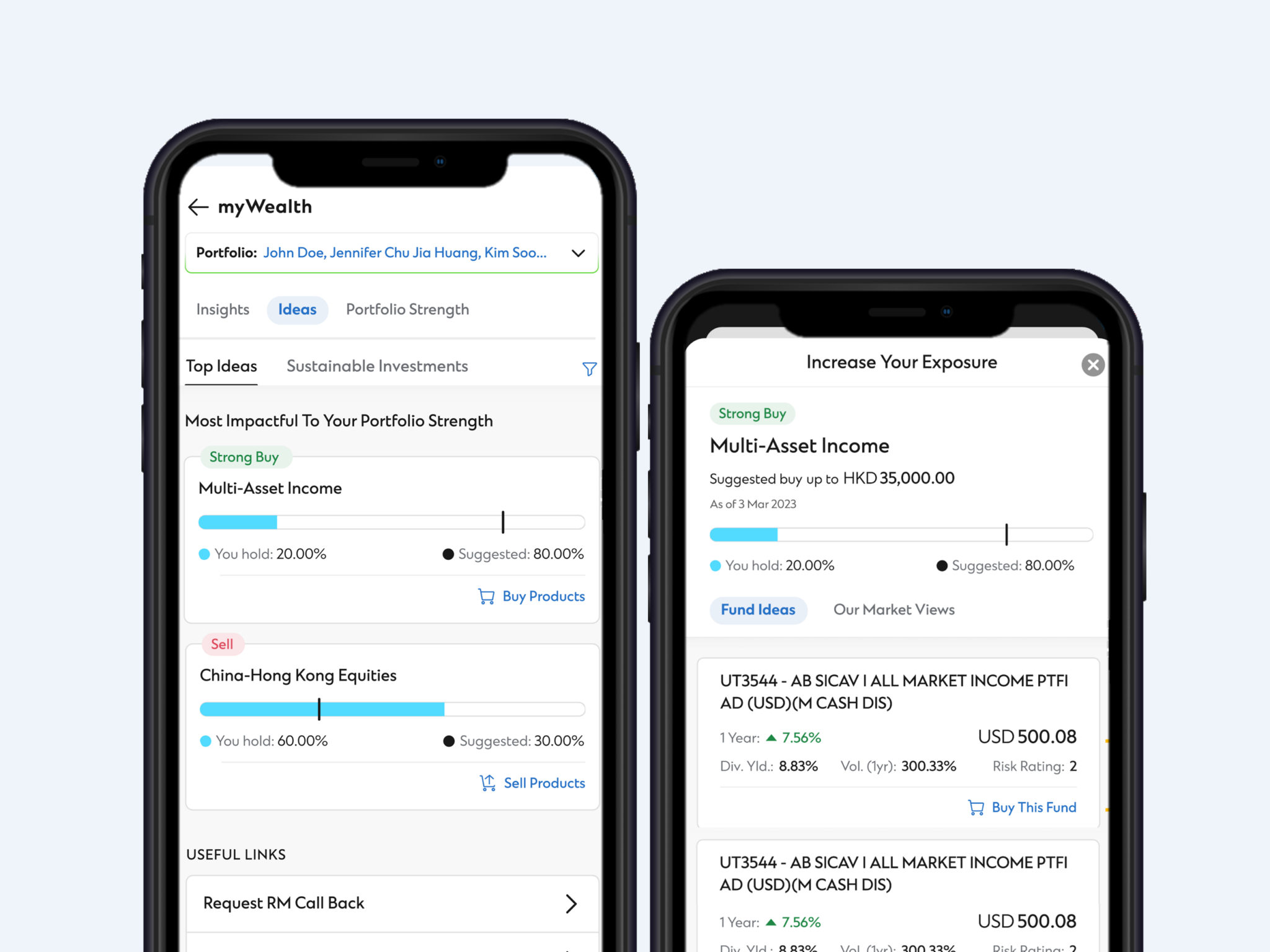

PERSONALISED IDEAS

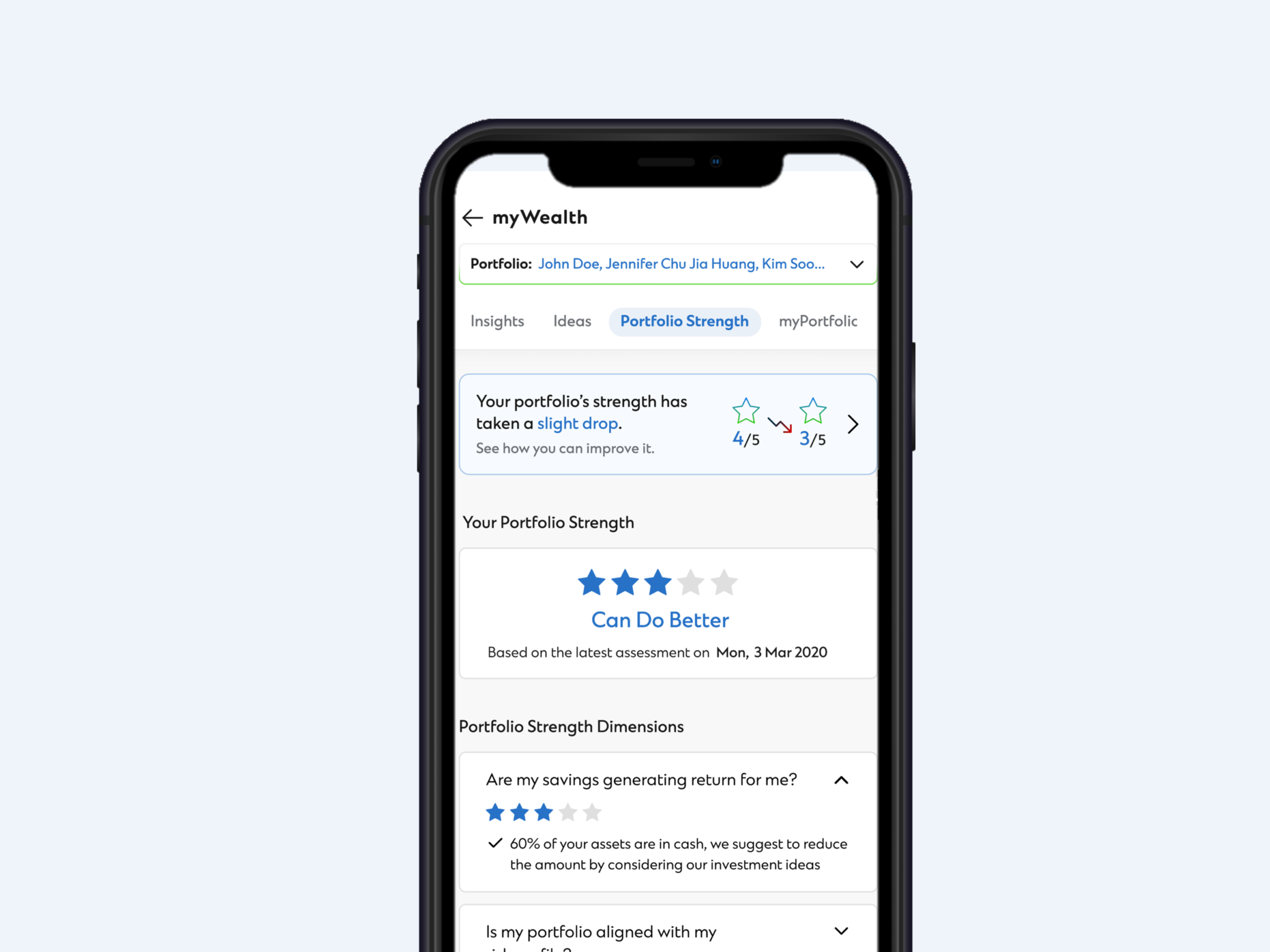

HEALTH CHECK

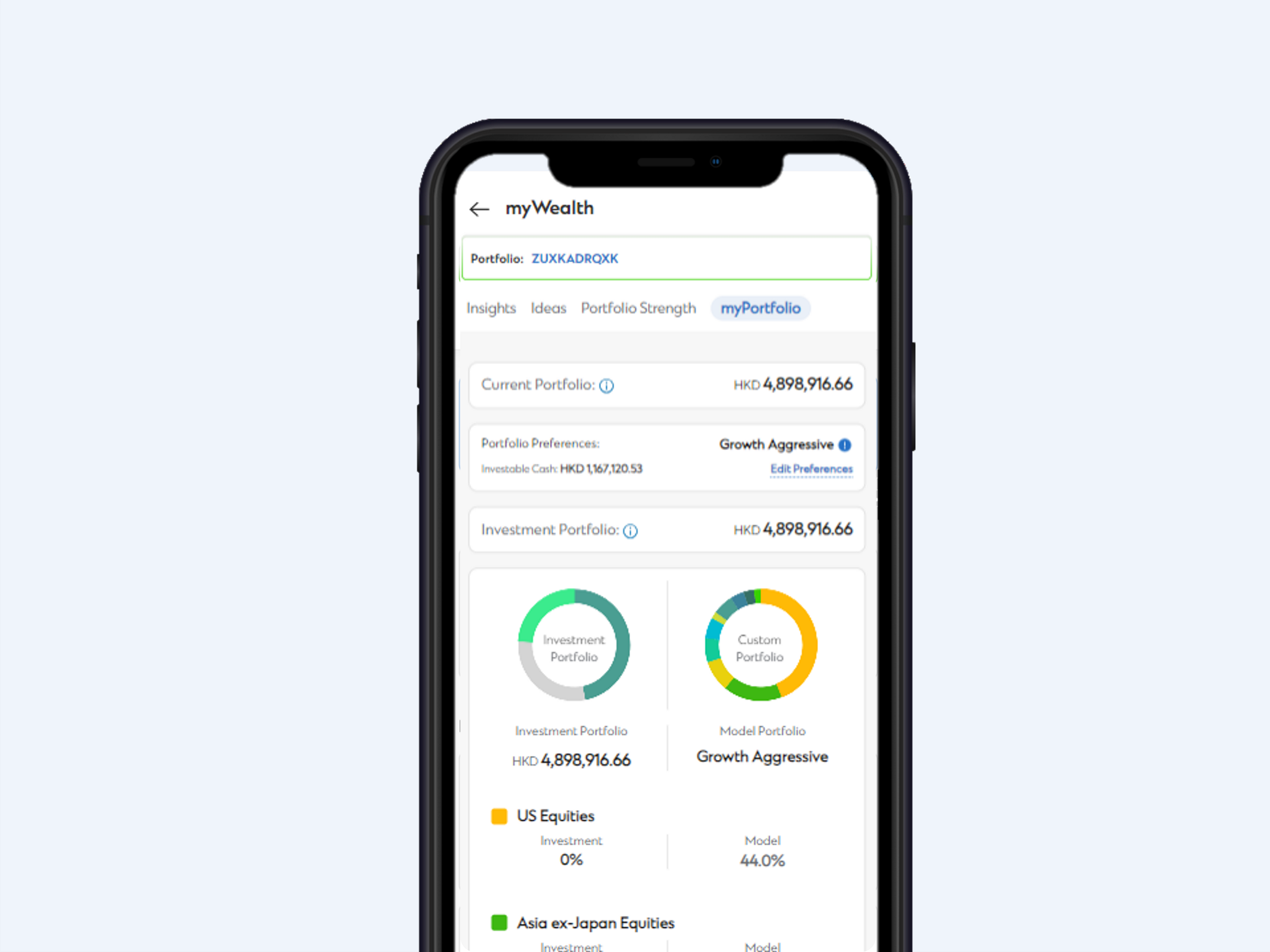

Health Check

- You can conduct an analytics-driven health check to see how your portfolio health can be improved

- Make targeted actions to improve your portfolio health based on a portfolio strength score given with assessments on diverse aspects:

- Your cash holdings

- Portfolio risk

- Level of diversification

- The Bank’s Chief Investment Office (CIO) house views

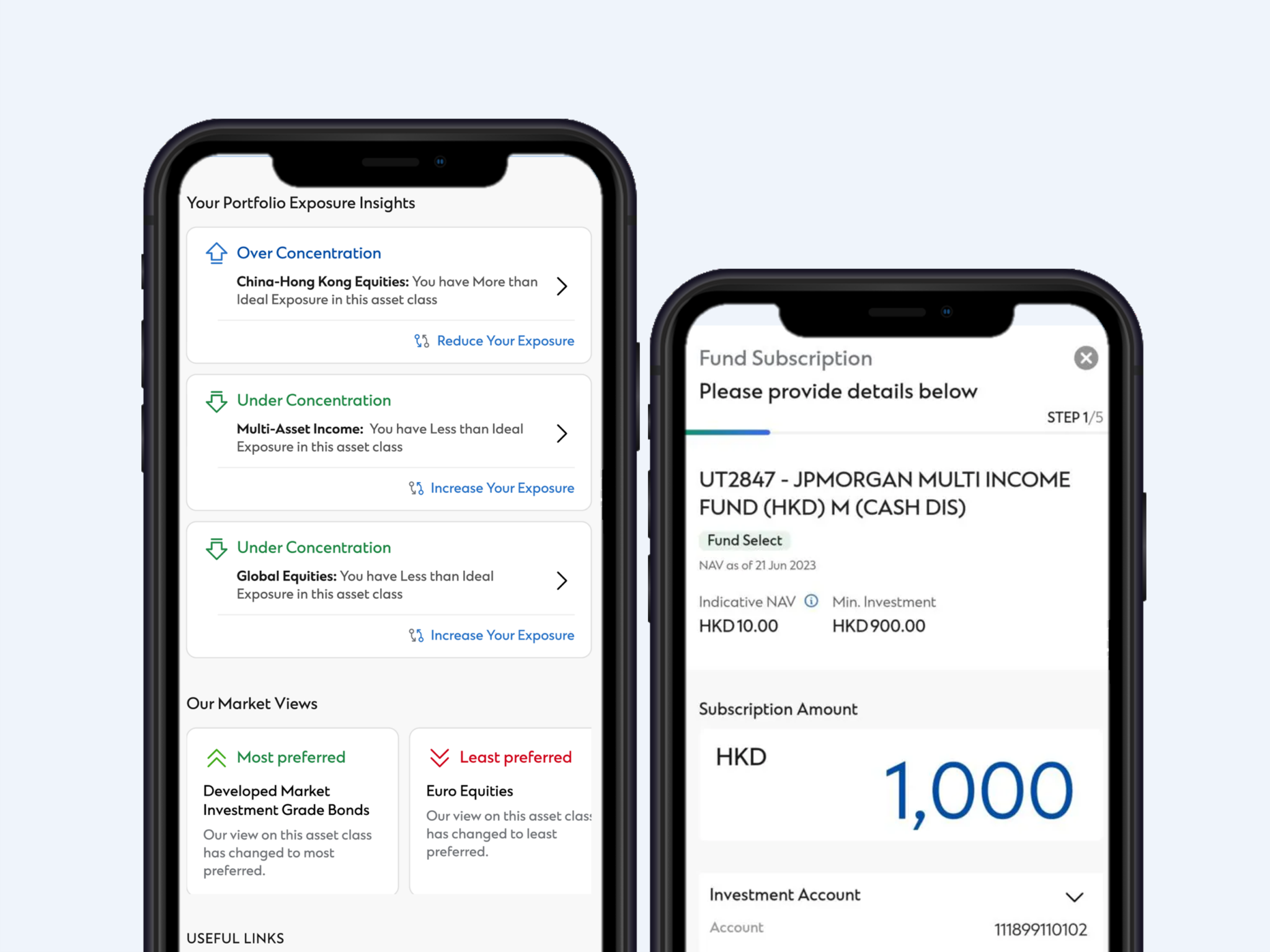

ASSET ALLOCATION

Asset Allocation

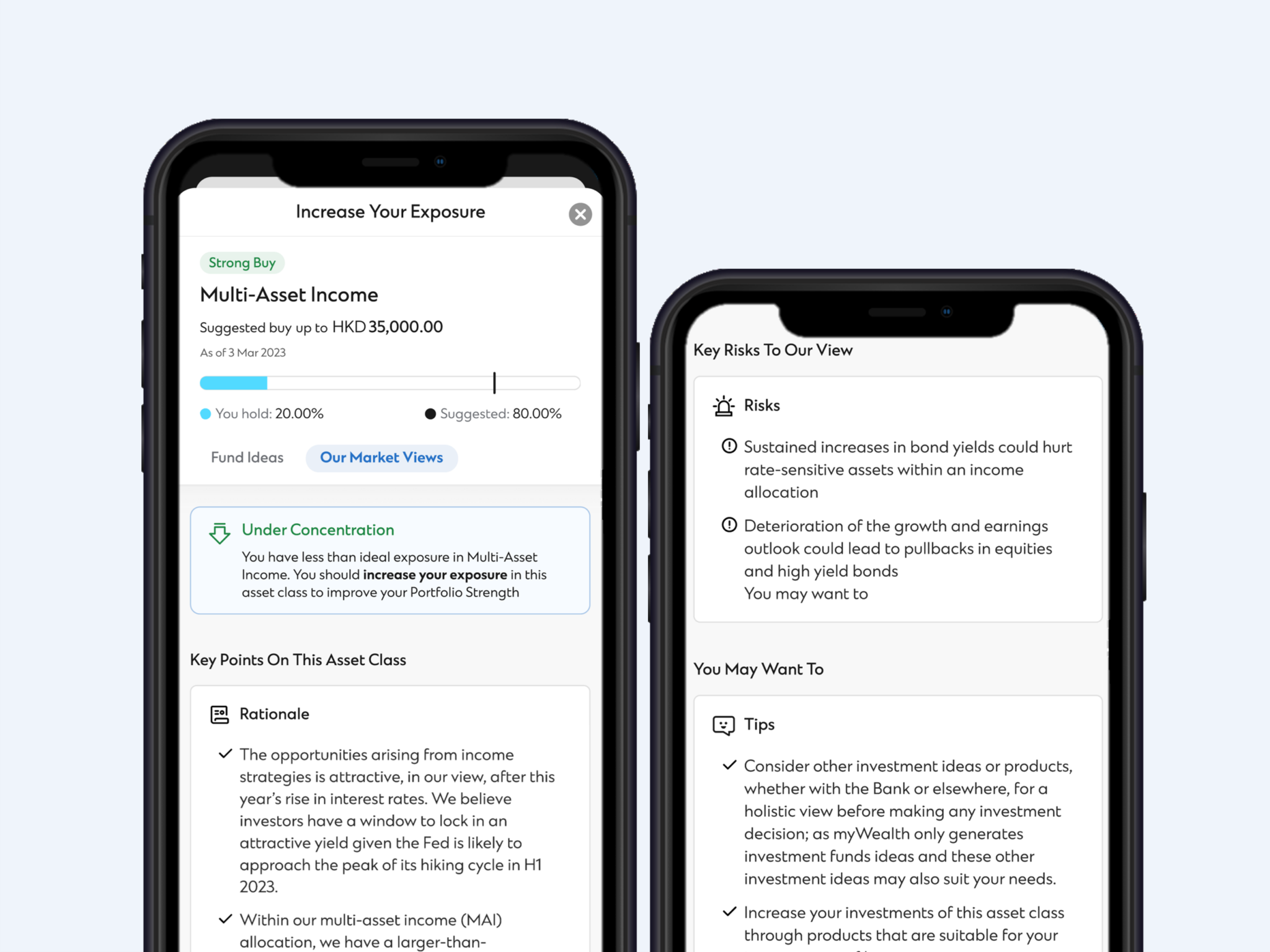

Backed by our CIO’s house view, you can easily diversify your investments across various asset classes to balance potential risks and returns.

- myWealth evaluates your portfolio by assessing your current cash holdings, asset allocations according to your risk appetite and incorporating the latest market insights from our CIO house view

- Access through myWealth quality funds filtered by our Fund Select team from over hundreds of investment funds for your selection

MARKET INSIGHTS

How does myWealth work?

Analyse

Analyse portions of your investment holdings with the Bank

Categorise

Categorise your holdings based on underlying asset classes

Compare

Compare your current asset allocation to the Bank’s model portfolio based on your risk profile

Rate

Rate your personalised ideas into multiple categories based on the Bank’s house view on the asset class

Explore how myWealth works in two minutes

Watch this short video and learn how to use it now

Manage your finances on the go

Experience SC Mobile App now

Scan QR code to download SC Mobile App now

for Android users without Google Play, please click here to download the Android application package (APK)

- ^ “Your current portfolio holdings” refers to your holdings with Standard Chartered Bank (Hong Kong) Limited (the “Bank”).

- * Based on your current risk profile at the Bank, you can factor in your preferred risk profile at a lower risk level but not a higher risk level.

Using myWealth

- Investing can be complex due to changing market conditions. You have your own personal circumstances, specific needs and investment objectives. You may also hold assets elsewhere. These factors, which can change from time to time, and your holdings held elsewhere have not been factored in by the service.

- Please do not execute trades on your own by simply relying on these investment ideas in isolation.

- Notwithstanding any discussion with your Relationship Manager, before deciding to proceed with any investment transaction, you should make an independent assessment about the risks, merits and appropriateness of each investment transaction, and seek independent professional advice.

- We are not providing portfolio monitoring services and are not obliged to review, manage or monitor the performance of your investment holdings.

- The products involved are not principal protected and you may lose all or part of your original investment amount. There are possible disadvantages from subscribing, selling or switching and the Bank makes no warranty on your decision to buy, sell or switch at any material time.

- SCB Chief Investment Office & Wealth Management Product specialists provide the following inputs which are used in myWealth algorithms namely 1. Model portfolios or model asset allocation 2. Bank’s House view on asset classes 3. Fund select list. These inputs are refreshed on monthly basis by Bank’s Investment and product specialists.

myWealth service limitations

- myWealth is a direct to client investment service. If you require human interaction, please contact your Relationship Manager for further engagement.

- The investment ideas generated through the myWealth service have taken into consideration your current risk profile, cash balances, investment funds, bonds, equities, structured investments and structured products holdings that you have held with the Bank.

- Your investment concentration, holdings in insurance, leverage or other loans with the Bank, and any other investment holdings, assets / liabilities outside the Bank are not considered in the myWealth service.

- Currently, myWealth only generates investment ideas on investment funds based on your current asset allocation and the model asset allocation under predefined rules.

- myWealth does not offer automatic portfolio rebalancing.

- The algorithms may include performance data and statistics that are derived based on historical data and methodologies formulated on various assumptions.

- Extreme events such as drastic market declines are not explicitly modelled.

- Prices and market values are for your information only and their accuracy is not guaranteed, and they may not be relied upon by any party as the basis for making any trading, hedging or investment decision. Prices including those of exchange traded securities are generally based upon the last traded price at close of market. Funds are valued based on the latest available net asset value. Where any price is provided, it represents an indicative market valuation only and as an estimated value may differ substantially from prices at which you may be able to sell a product and may not include redemption charges or other charges .

Risk Disclosure Statement

- Investment involves risks. The prices of investment products fluctuate, sometimes dramatically and the worst case may result in loss of your entire investment amount. Past performance is no guide to its future performance.

- Investors should read the terms and conditions contained in the relevant offering documents and in particular the investment policies and the risk factors and latest financial results information carefully and are advised to seek independent professional advice before making any investment decision.

- Investors should consider their own investment objectives, investment experience, financial situation and risk tolerance level.