Priced for perfection?

Steve Brice

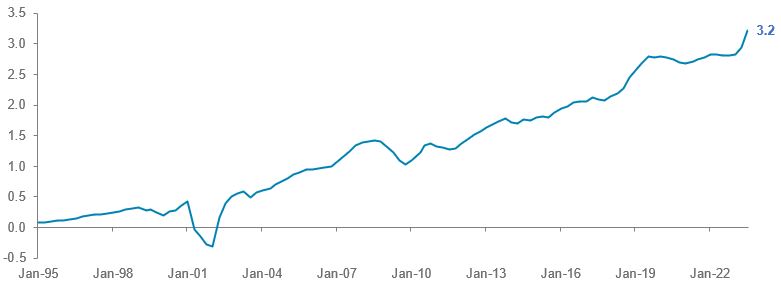

In financial markets, there is an inherent tug-of-war between themes/stories and valuations. We are seeing one play out in the equity markets right before our eyes, in the semiconductor industry. This reminds me of my formative investment years of the late 1990s. While we should not blindly follow historical examples, this comparison is something for investors to bear in mind when it comes to making financial decisions and sizing investment positions.

Let me start with a caveat. I am not a stock picker. It is incredibly difficult to consistently pick stocks that outperform. This is borne out by the difficulty fund managers have in outperforming their benchmarks over the long term, especially in the more developed, liquid and efficient markets. Therefore, this article is meant to be more thought-provoking rather than implying an outlook for the stocks mentioned.

In the late 1990s, the internet was the craze. Truly incredible things were happening. Adding ‘.com’ to the name of your company could lead to a significant revaluation of your stock prices, seemingly disregarding any changes to your business model. Indeed, a privately-owned company I worked for at that time did exactly that, sparking speculation internally that the owners were looking to sell the company.

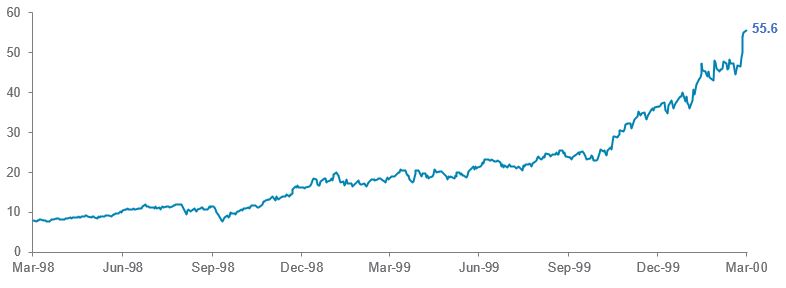

There were, of course, companies that actually did have strong internet-focused business models and a very strong competitive advantage. One such company was Cisco Systems, a company that built networks upon which the internet was based. Unsurprisingly, given the hype and its positioning, the stock performed extraordinarily well. At its peak in March 2000, Cisco traded almost seven times the price of just two years earlier.