From 1 August to 31 December 2025, New Payroll Clients¹ who sign up for a Payroll Account and receive a monthly salary of HKD20,000 or above (each an “Eligible Payroll Client”) will enjoy the following offers:

- Priority Private/ Priority Banking

- Premium Banking/ Easy Banking

Limited Time Payroll Offer up to HKD1,000 (from now till 31 Dec 2025)

- HKD20,000 – HKD79,999 of monthly salary can earn HKD400 cash rebate

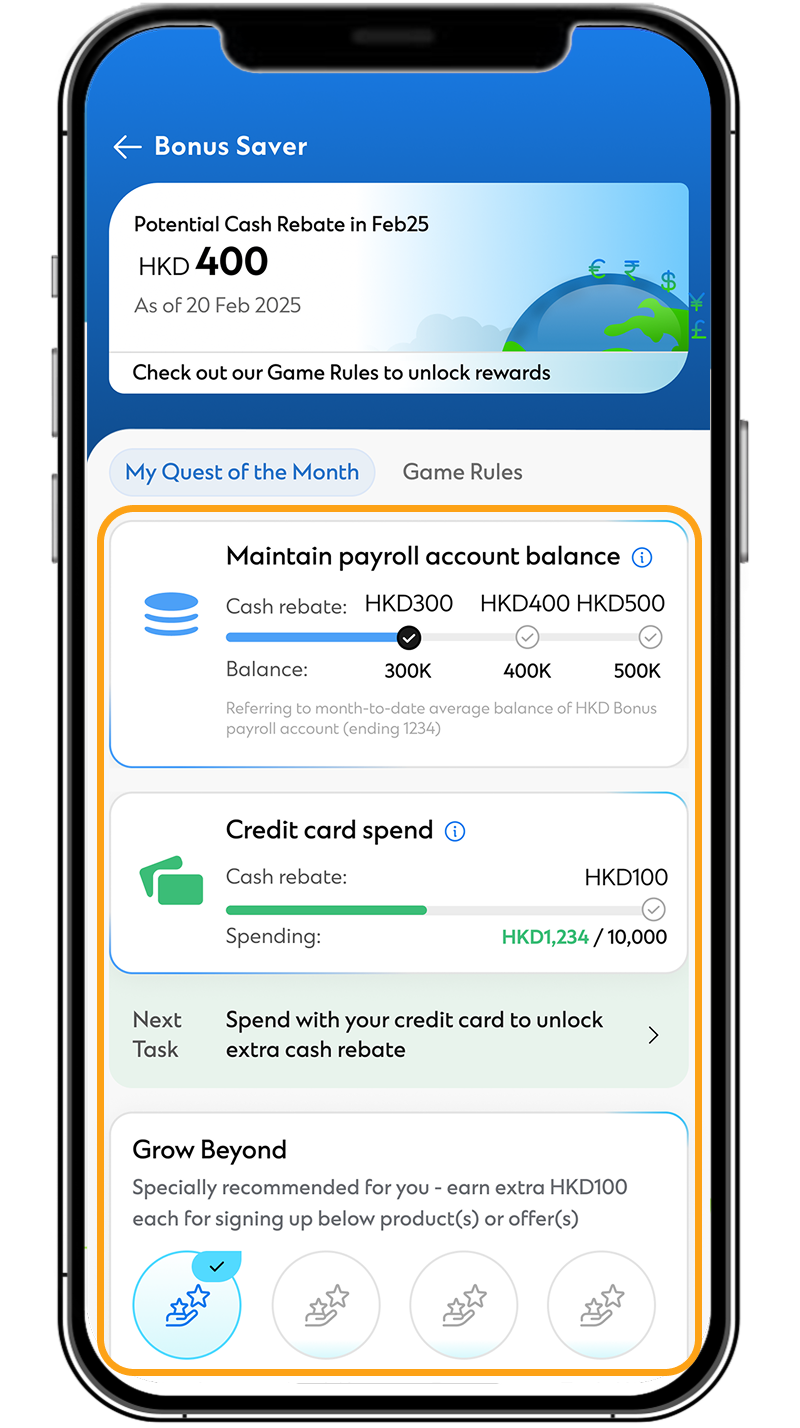

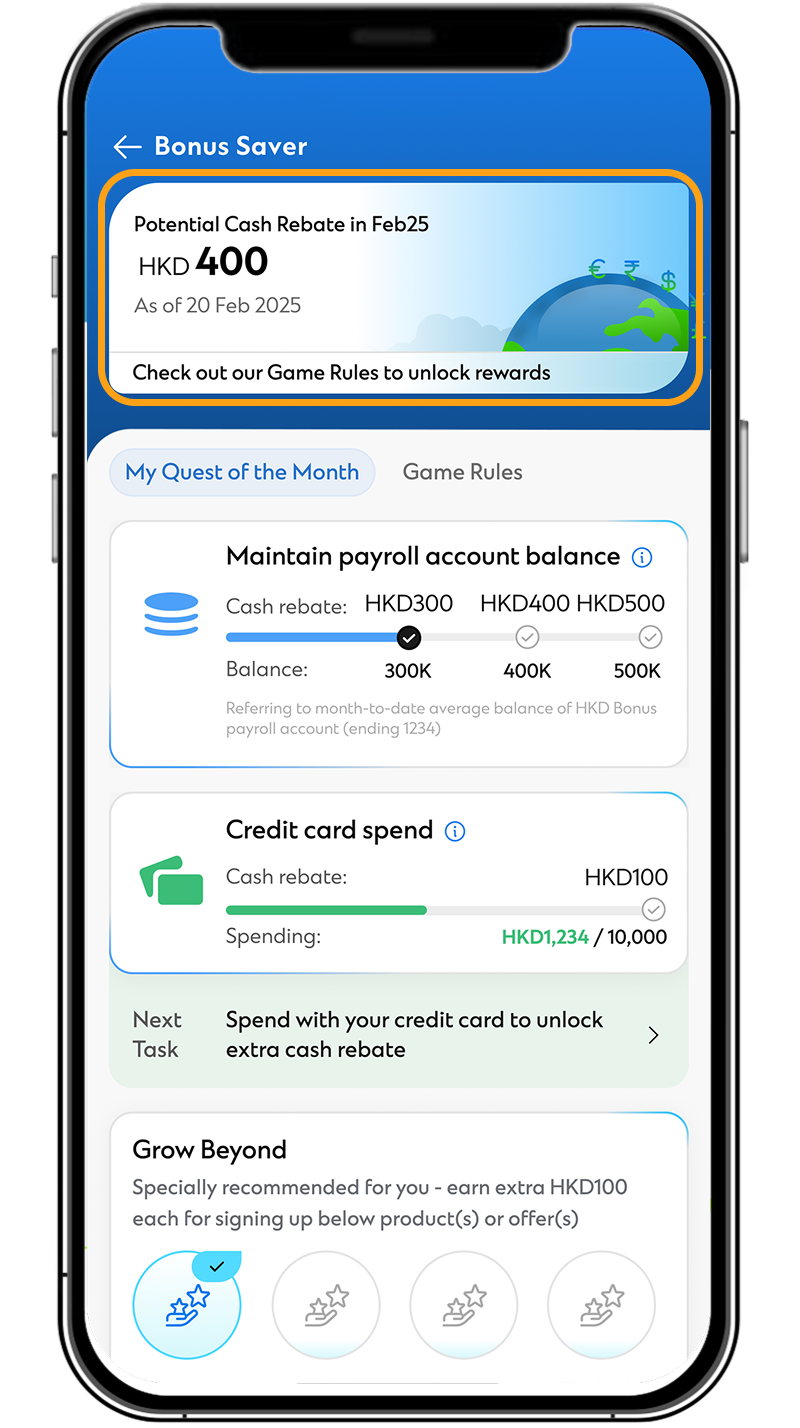

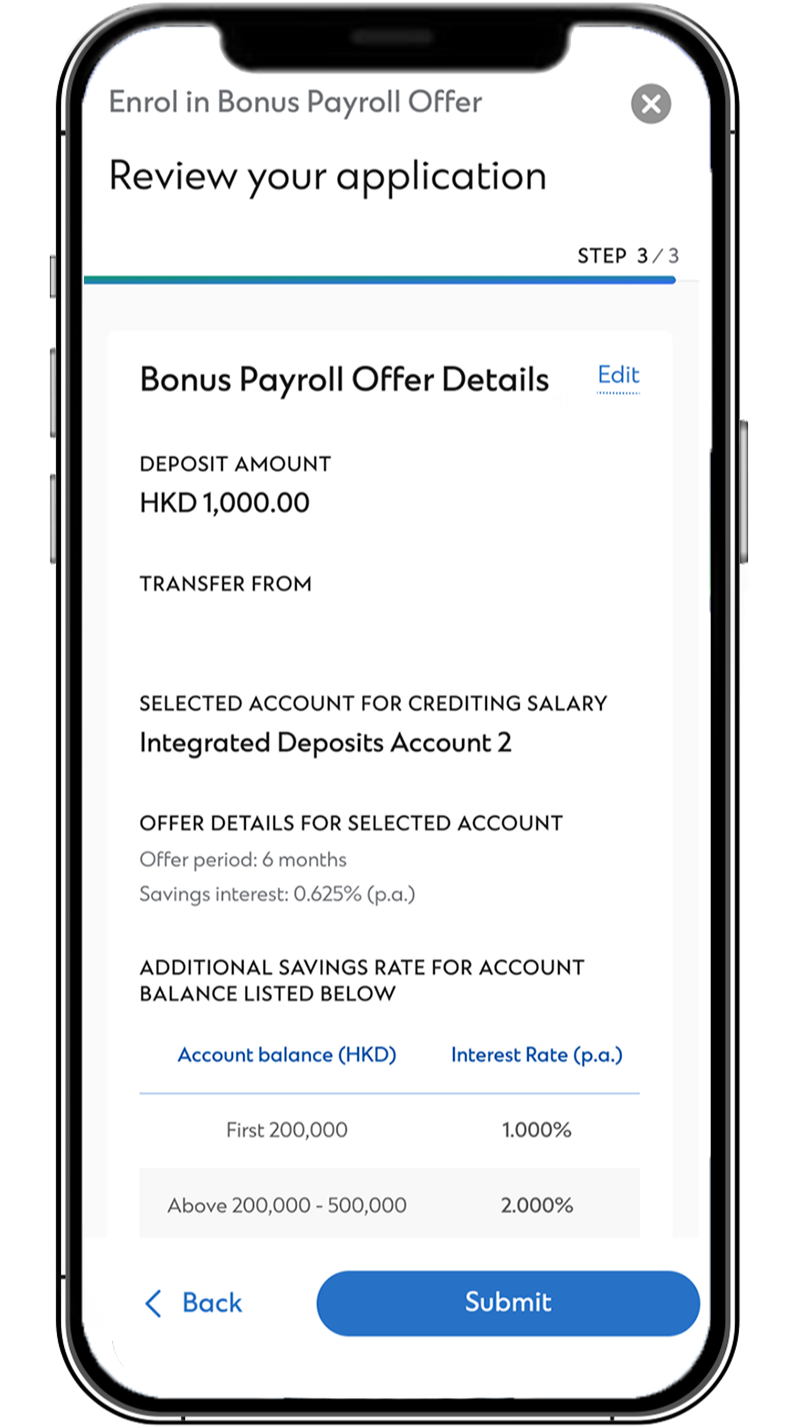

Maintain designated payroll deposits balance to earn up to HKD6,000/year

Earn HKD100/month for every HKD100,000 deposits balance in payroll account. Up to HKD500 monthly

Earn up to HKD1,200/year upon designated credit card spending

Earn HKD100/month upon accumulating credit card retail spending of HKD10,000 or above in a month

Limited Time Payroll Offer up to HKD1,000 (from now till 31 Dec 2025)

Maintain designated payroll deposits balance to earn up to HKD3,000/year

Earn HKD50/month for every HKD100,000 deposits balance in payroll account. Up to HKD250 monthly

Earn up to HKD600/year upon designated credit card spending

Earn HKD50/month upon accumulating credit card retail spending of HKD10,000 or above in a month

Payroll Reward Calculator

Total estimated rewards for the 1st year

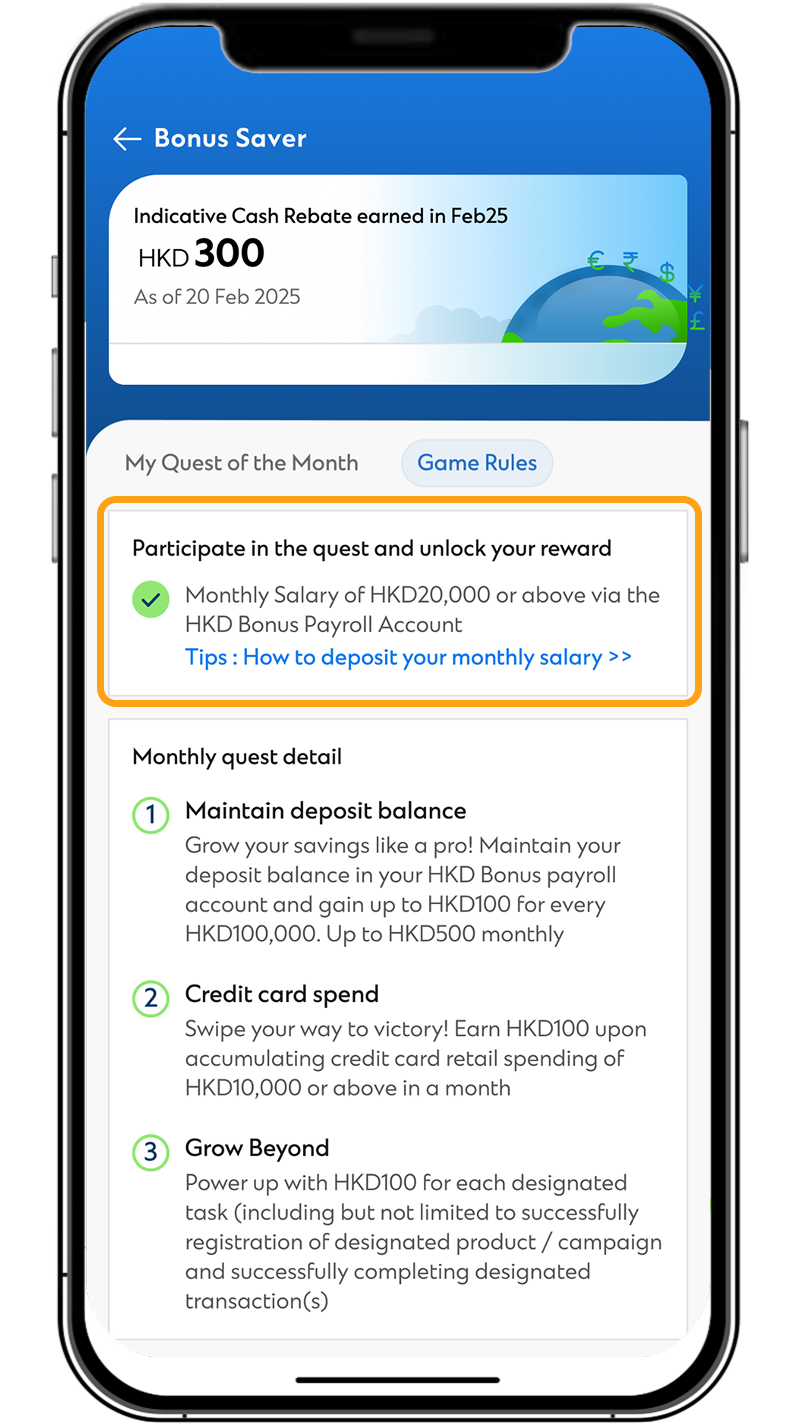

Bonus Saver Mission: “Maintain Payroll Deposit Balance”

Bonus Saver Mission: “Credit Card Spend” Rewards

Asia Miles Payroll Offer#

*Limited Time Payroll Offer for Bonus Saver Campaign*

From 2 October 2025 to 31 December 2025, new payroll clients who deposit a designated monthly salary amount will receive an extra cash rebate up to HKD$1,000

Only applicable to principal cardholder of Standard Chartered Cathay Mastercard® issued by the Bank. The above calculation is for reference only. Account opening is not available on Sundays and Public Holidays. The final rewards will be subject to the account sign up date, payroll date, banking plan, monthly salary, daily balance of HKD Payroll Account, Credit Card spending and the client’s fulfilment during the whole bonus period.

Other Payroll Account Offers

Earn up to 3,000 miles quarterly for monthly salary credit2

[Payroll Account monthly salary requirement: HKD20,000 or more]

- Priority Private clients: 1,000 miles per month

- Priority Banking clients: 800 miles per month

- Premium Banking clients: 300 miles per month

Unlimited securities BUY brokerage waiver offer. Better than being the boss!

Make your salary work for you. Priority Private and Priority Banking Payroll clients opening a new securities account during the promotion period will enjoy unlimited securities BUY brokerage waiver to earn passive income and save on commissions!

Standard Chartered Cathay Mastercard® annual fee waiver

Payroll Account clients can enjoy annual fee waiver3, and earn all rewards with just one card

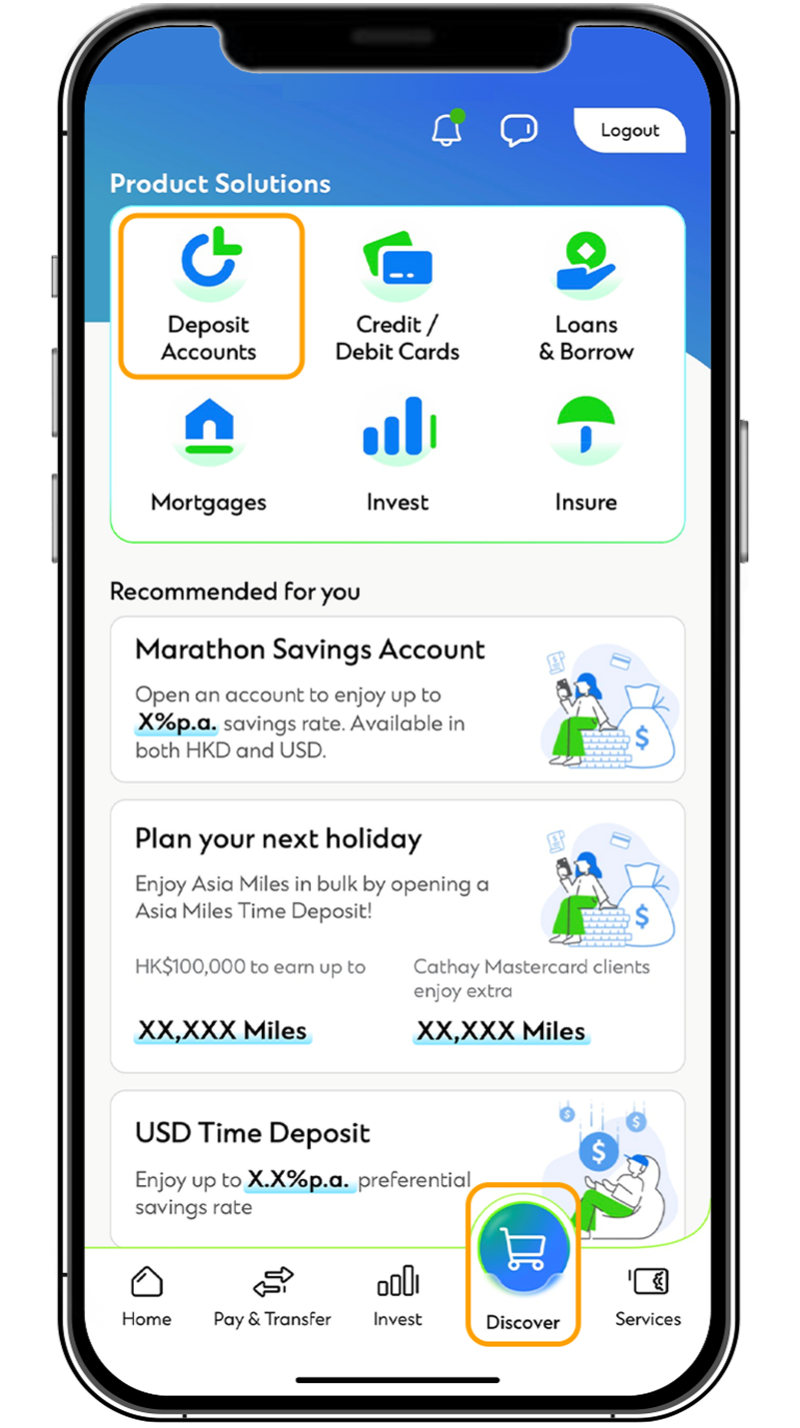

Boost your Salary with Bonus Saver

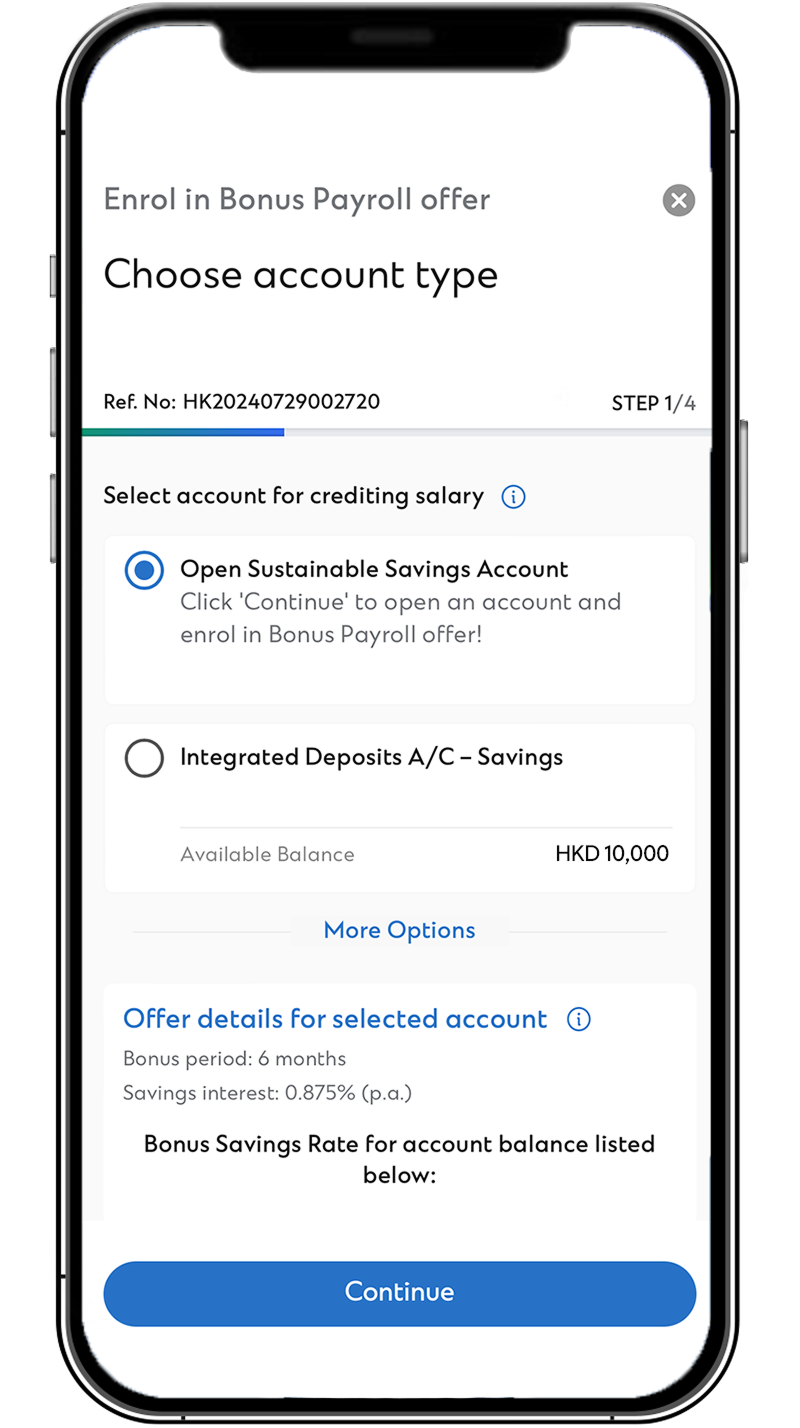

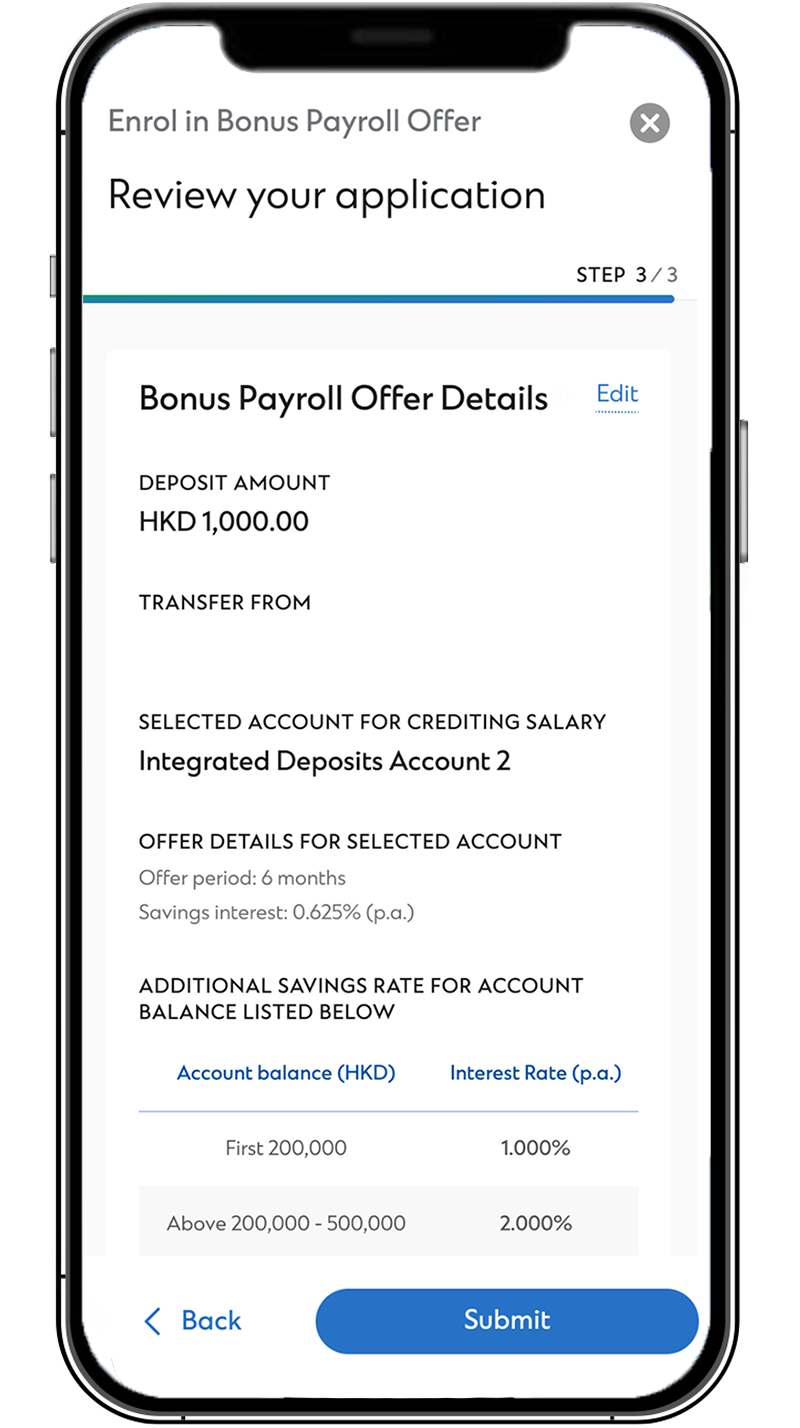

- How it works?

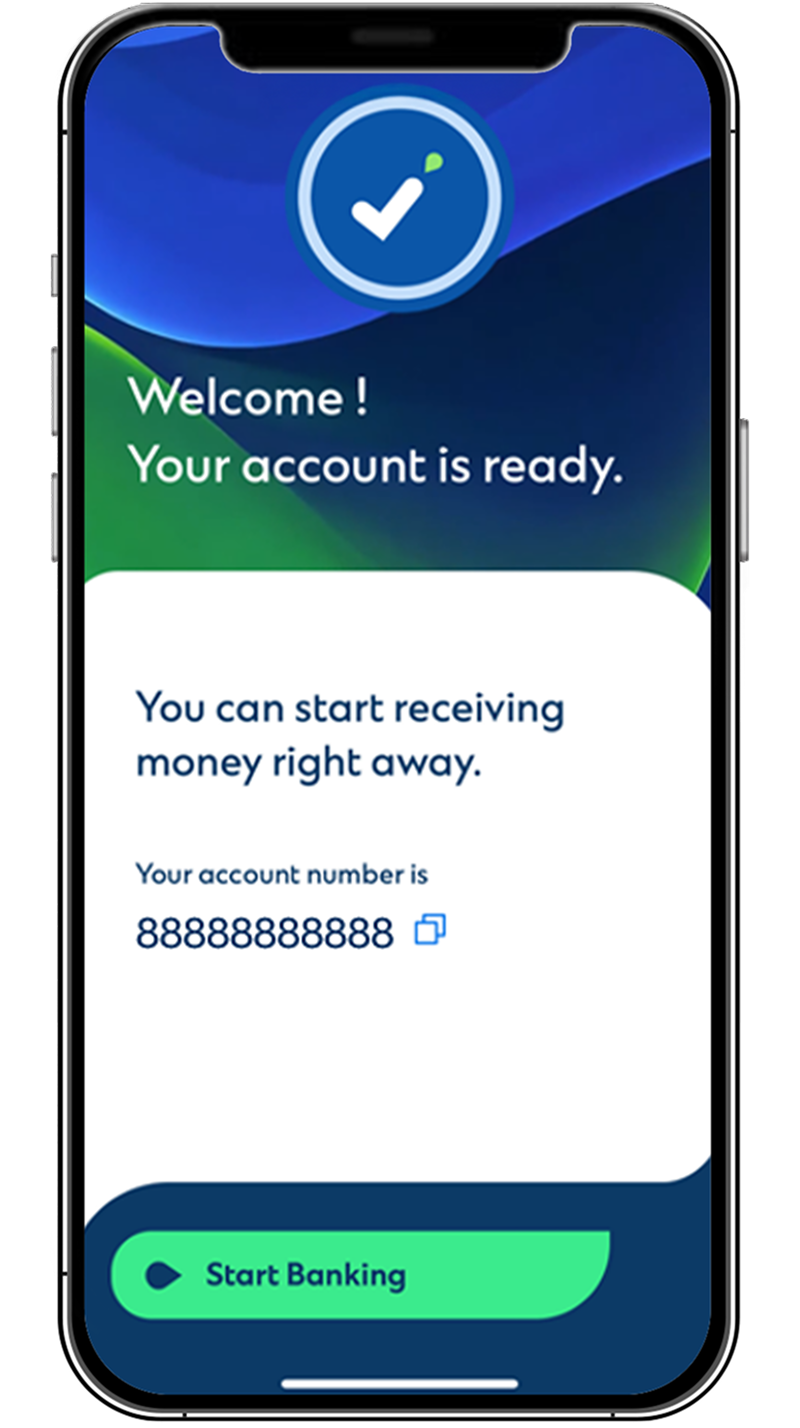

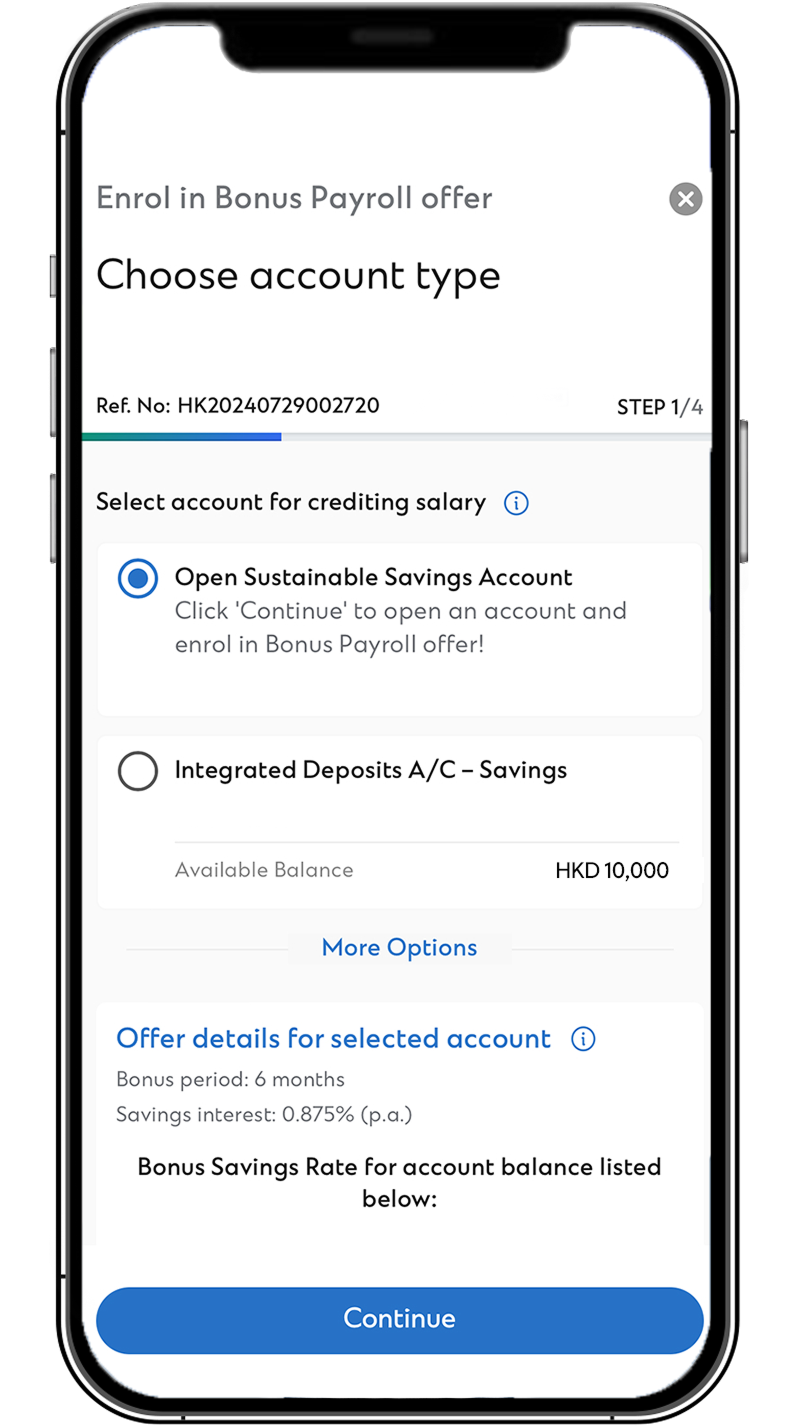

- How to sign up? (New Clients)

- How to sign up? (Existing Clients)

Service hours: 9am – 11pm, Monday to Saturday (except public holidays). Photos are for reference only

Service hours: 9am – 11pm, Monday to Saturday (except public holidays). Photos are for reference only

How do I transfer funds to my new Standard Chartered Payroll Account to enjoy rewards?

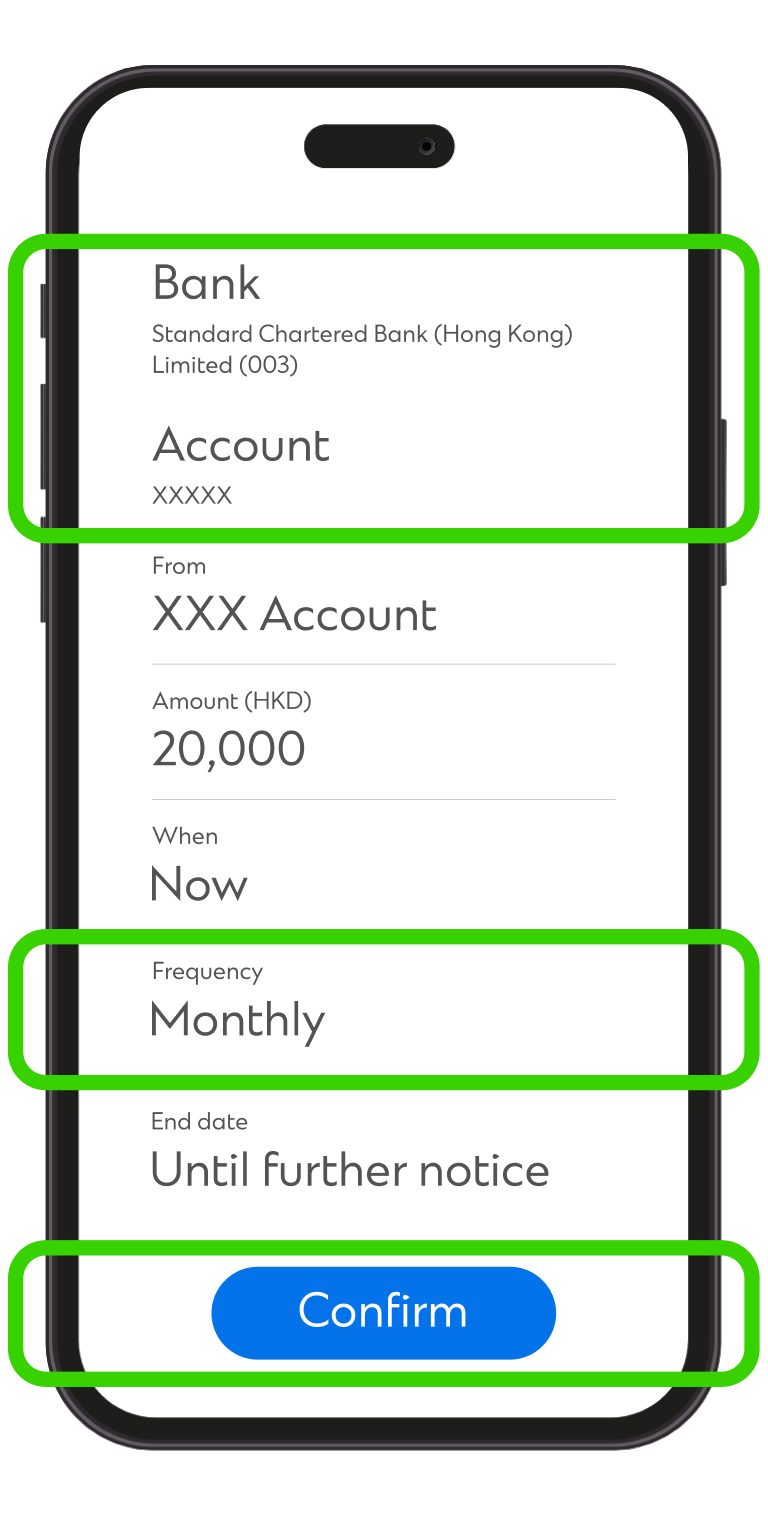

- Standing Instructions

- Change Your Payroll Account

Set up Standing Instructions to transfer funds to your Standard Chartered Payroll Account via other banks’ online banking.

Set up Standing Instructions to transfer funds to your Standard Chartered Payroll Account via other banks’ online banking.

Standing instruction setup completed!

*The above SI setup is for reference only and may vary among different banks. Some banks may not support setting up SI online and the final set-up method is subject to differences in other banks’ processes.

Simply notify your employer or Human Resources Department to change your Payroll Account

Fill out the Notification for the Change of Auto-Payroll Account

Notify your employer of the change of the Payroll account

Successfully conduct an automatic transfer to your Standard Chartered Payroll Account within 2 months after the opening date of the Payroll Account

New clients must first open an Integrated Deposits Account in advance and can apply for this offer via SC Mobile App or Online Banking one business day after successful account opening.

Payroll Account FAQs

A “Payroll Account” is a current deposit account used for your salary credit. Payroll Account Clients simply need to provide their employers with a payroll account, which will receive the salary deposit by auto-transfer; or set up Standing Instructions with transaction narrative containing “SALARY”, “SALARIES”, “WAGE”, “WAGES”, “PAYROLL” from other local banks (other than the Bank)

A ‘Savings Account’ is also a deposit account, but it is generally used for storing day-to-day funds, making deposits, and paying bills. The difference between a ‘Payroll Account’ and a ‘Savings Account’ is that customers can receive salary through the ‘Payroll Account’ to earn payroll rewards. ‘Payroll Account’ generally offer exclusive rewards to their account holders. The Standard Chartered Payroll Account rewards include Cash Rebate and miles.

There is no minimum salary requirement to open a Standard Chartered Payroll Account. To redeem the Standard Chartered Payroll Account Bonus Saver Campaign offer, clients must commence receiving Monthly Salary of HKD20,000 or above via the Payroll Account every month through the Auto-Payroll Service within the first 2 calendar months from the date of signing up for the Payroll Account, and continue using the Auto-Payroll Service until the relevant rewards under the Welcome Offers are rewarded;

For more details on Standard Chartered Payroll Account welcome offers, please click here.

No. Clients must first open an HKD statement savings account, HKD Sustainable Savings Account, or HKD savings account with an Integrated Deposits Account to apply for Standard Chartered Payroll Account services. They then must notify their employer to change their salary account / payroll account, or set up their own Standing Instructions to transfer their salary into the Payroll Account.

- New Payroll Account Clients refer to clients who have not used the Bank’s auto-payroll services in the past 12 months and have opened a Payroll Account during the promotion period.

- Offer of “Up to 3,000 miles quarterly” is applicable to clients with Bonus Payroll Account, HKD Sustainable Savings Account, HKD statement savings account, HKD savings account with an Integrated Deposits Account and other account with payroll services. Terms and Conditions for Asia Miles Payroll Offer apply.

- All principal cardholders (“Cardholders”) of Standard Chartered Cathay Mastercard (“Card”) issued by Standard Chartered Bank (Hong Kong) Limited (the “Bank”) will enjoy an annual fee waiver on their Cards for a year (beginning from the respective anniversary of the issuance date of their Cards) if they are payroll account clients. Cardholders are entitled to the above stated annual fee waiver so long as Cardholders meet the above stated criteria in the annual fee billing month. For details, please refer to relevant terms and conditions.

Risk Disclosure Statement of Foreign Exchange:

- Foreign exchange involves risks. Fluctuation in the exchange rate of a foreign currency may result in gains or significant losses in the event that the client converts deposit from the foreign currency to another currency (including Hong Kong Dollar).

Risk Disclosure Statement for Securities Services:

- Investment involves risks. The prices of securities fluctuate, sometimes dramatically and the worst case may result in loss of your entire investment amount.

- Past performance of any securities is no guide to its future performance. Investors should consider their own investment objectives, investment experience, financial situation, risk tolerance level and carefully read the Terms and Conditions of relevant Securities Services before making any investment decision.

- This website does not constitute any prediction of likely future price movements.

- Investors should not make investment decisions based on this website alone.

- This website has not been reviewed by the Securities and Futures Commission or any regulatory authority in Hong Kong.